Greetings!

Here in the Last Best Place, the temperatures are on the rise and the rivers are swelling—signs that summer is just around the corner, which has me, for one, smiling.

In today’s Wealth Advisory I broach the why behind the impressive market recovery we’ve witnessed, even amidst ongoing concerns surrounding credit ratings.

Following that, the Wellness Navigator, Christine Despres, will guide us on a journey into the realm of brain health.

Lastly, in the Etcetera section, we’ll gaze at the stars and share a variety of wealth and wellness nuggets that are sure to pique your interest.

So let’s dive in!

Wealth Advisory: Recovery Continues Amid Credit Ratings Concerns

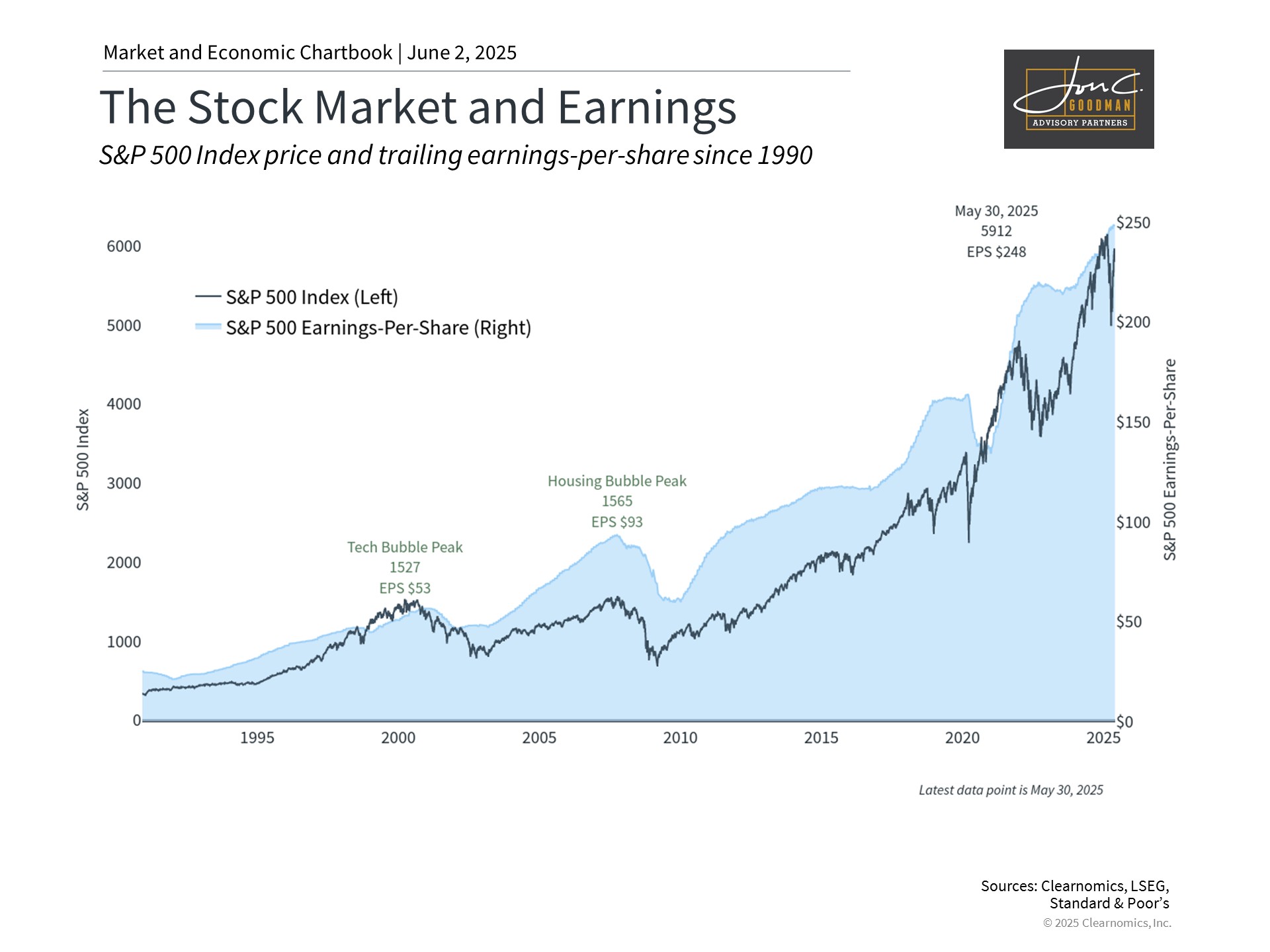

May brought renewed strength to financial markets as the S&P 500 climbed back into positive territory for the year. The month’s gains unfolded alongside developing trade negotiations, varied economic indicators, and persistent questions about America’s fiscal position.

Although economic data generally reflected strength, consumer confidence remained subdued regarding future prospects. Bond yields experienced volatility throughout the period as investors weighed federal spending concerns and debt obligations. For investors with long-term horizons, May demonstrated markets’ capacity to navigate evolving circumstances, even amid substantial policy and economic uncertainty.

Primary Market and Economic Factors

* The S&P 500 advanced 6.2% during May, marking its strongest monthly performance since 2023, while the Dow Jones Industrial Average climbed 3.9% and the Nasdaq surged 9.6%. For the year, the S&P 500 stands at 0.5% gains, the Dow shows a 0.6% decline, and the Nasdaq remains down 1.0%.

* The Bloomberg U.S. Aggregate Bond index dropped 0.7% in May yet maintains a 2.4% year-to-date advance. The 10-year Treasury yield concluded the month at 4.4%.

* Global equities also delivered strong results, with both the MSCI EAFE index for developed markets and the MSCI EM index for emerging markets posting 4.0% gains.

* The U.S. dollar index continued its decline, finishing the month at 99.3, approaching three-year lows.

* Bitcoin reached a new peak of $111,092 before settling at $104,834 by month-end.

* Gold similarly achieved a record high of $3,422 before closing at $3,288, representing a 24% year-to-date increase.

* May’s Consumer Price Index data revealed that consumer prices increased 2.3% year-over-year in April, marking the smallest 12-month rise since February 2021.

* Employment growth continued with 177,000 new jobs added in April, while unemployment held steady at 4.2%.

Source: Standard & Poor’s, Nasdaq, Bloomberg. All month end figures are as of May 30, 2025.

Market resilience emerges despite fresh uncertainties

The May rally highlights the value of maintaining investment discipline during volatile periods. Following April’s setbacks, markets showed their adaptive capacity by recouping most losses and achieving positive momentum in May. This rapid shift in market dynamics reflects how quickly investor sentiment can improve when conditions begin to stabilize—a phenomenon witnessed repeatedly over recent years. However, past performance provides no assurance of future results, and markets will likely continue grappling with trade developments, debt concerns, and economic health in upcoming months.

Credit agency reduces U.S. rating.

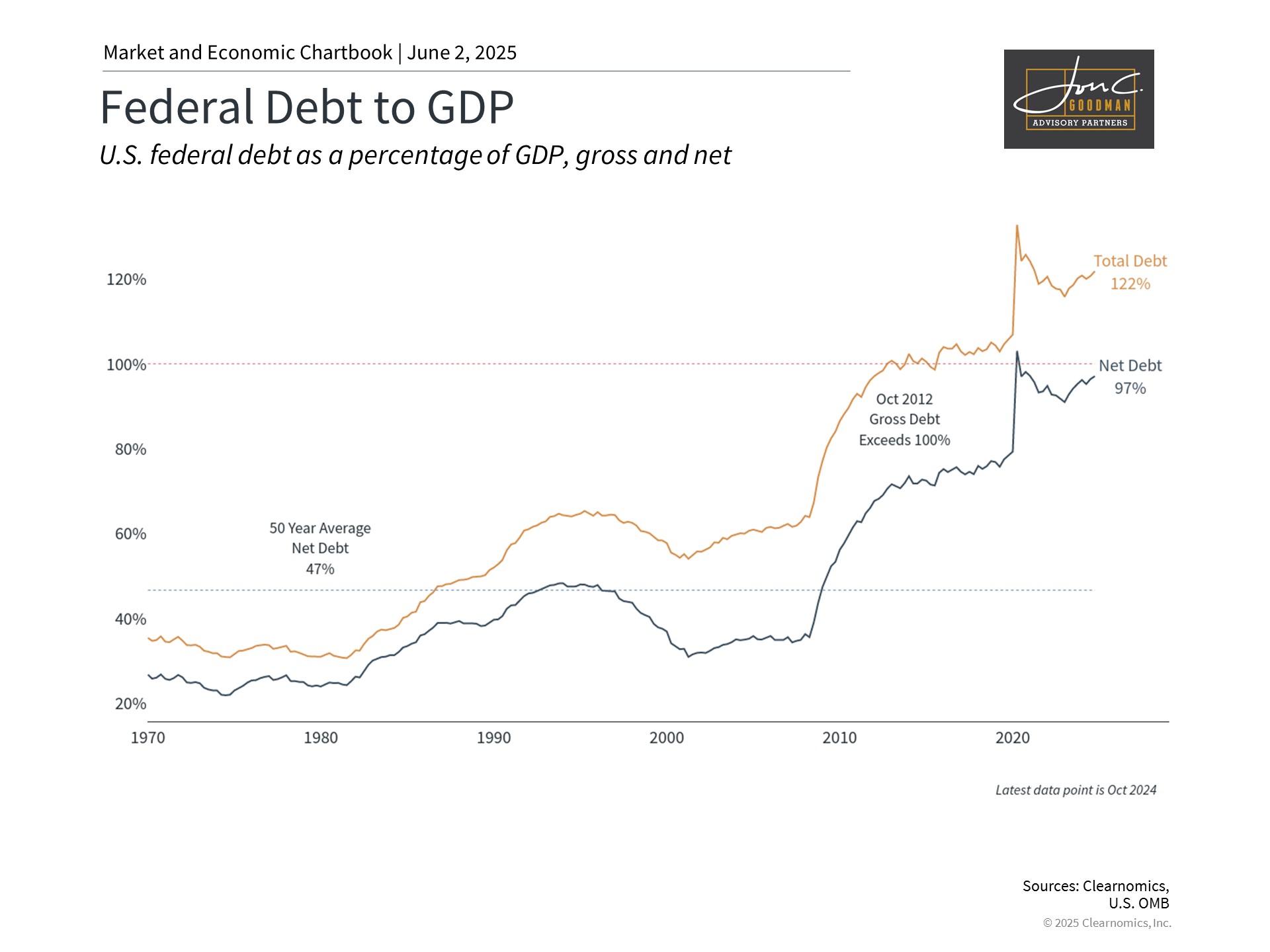

Among May’s most notable developments was Moody’s decision to lower the U.S. credit rating from Aaa to Aa1. This action followed earlier downgrades by Fitch in 2023 and Standard & Poor’s in 2011, all stemming from concerns regarding the country’s expanding debt burden and expenditures. The related chart illustrates how U.S. total debt reached 122% of GDP in 2024, while net debt, excluding intragovernmental holdings, climbed to 97%.

Despite the significant nature of this credit downgrade, market reaction remained subdued. This restrained response occurs because the downgrade largely reflects existing conditions that investors already understand regarding the nation’s fiscal situation. The limited market impact also draws from experience with the 2011 Standard & Poor’s downgrade, when Treasury securities maintained their status as preferred safe-haven investments.

The timing of this downgrade coincided with House passage of extensive tax and spending legislation. The approved measure would extend individual tax reductions from the Tax Cuts and Jobs Act, incorporating a 37% maximum rate, child tax benefits, expanded State and Local Tax deduction limits, and exemptions for tips and overtime compensation, among other provisions. The Penn Wharton Budget Model estimates this legislation could expand deficits by $2.8 trillion across the next decade. (https://budgetmodel.wharton.upenn.edu/issues/2025/5/23/house-reconciliation-bill-budget-economic-and-distributional-effects-may-22-2025) Senate consideration and potential modifications await.

While broad consensus exists that these fiscal challenges demand long-term remedies, the U.S. dollar maintains its position as the world’s leading reserve currency, ensuring continued Treasury demand in the foreseeable future.

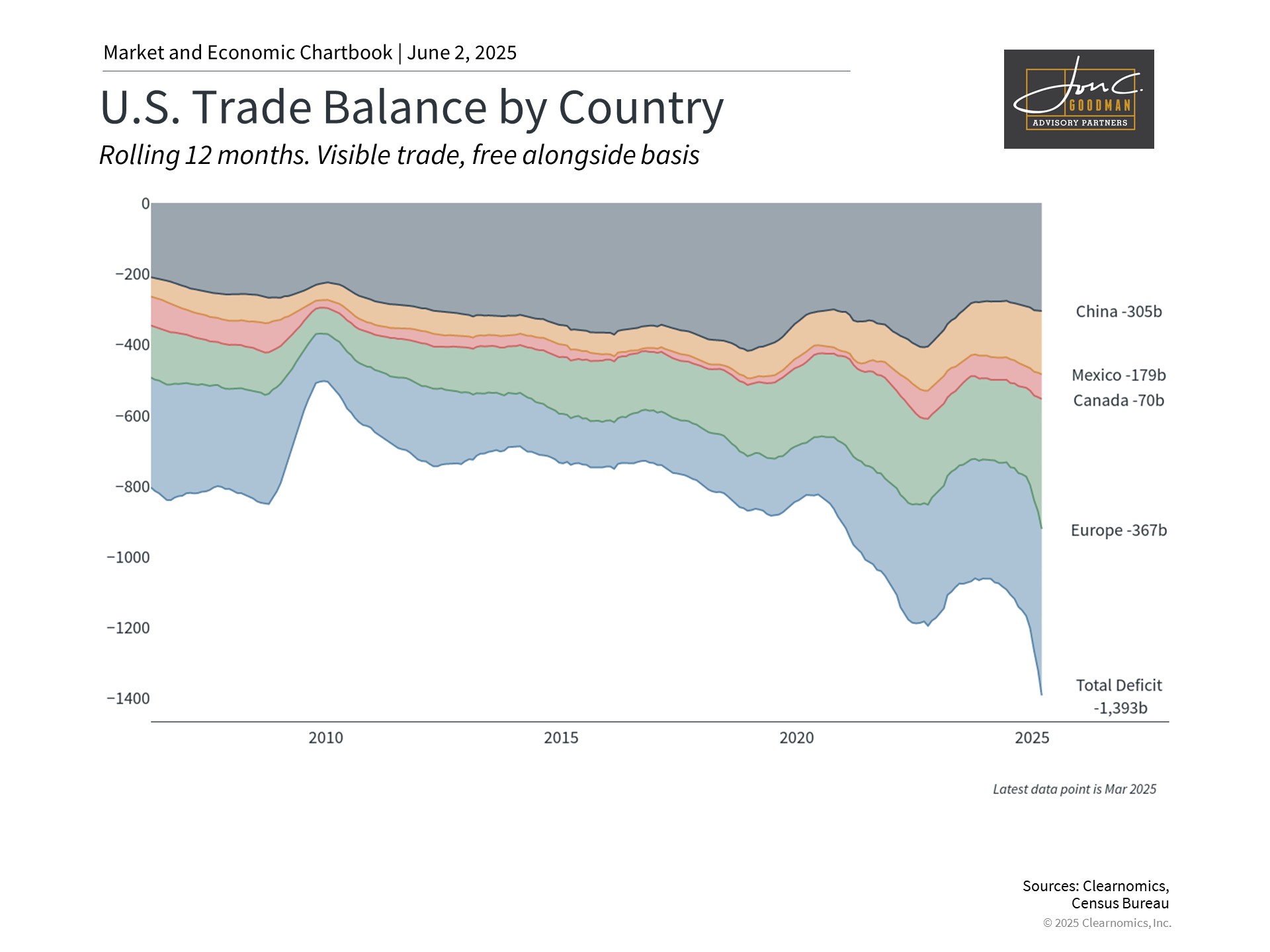

Commercial negotiations advance.

May also witnessed meaningful advancement in trade discussions, eliminating several concerning scenarios from consideration. The administration secured agreements with both the U.K. and China while maintaining dialogue with other significant trading partners. The U.S.-China arrangement established a 90-day window of reduced U.S. tariffs on Chinese products.

Notwithstanding these accords, trade uncertainty will probably persist. Recent developments have seen both China and the U.S. claim violations of the trade pause, while the administration seeks elevated tariffs on steel and aluminum products. Simultaneously, European Union negotiations generated optimism when the White House postponed its planned 50% EU tariff following constructive talks, indicating that diplomatic resolutions remain achievable even when initial stances seem incompatible.

The administration also confronts legal obstacles to its tariffs. During May, the U.S. Court of International Trade invalidated numerous recently implemented tariffs, determining they surpass presidential authority under the International Economic Emergency Powers Act. Although a federal appeals court suspended this ruling, permitting tariffs to continue temporarily, this legal challenge introduces additional uncertainty to the trade environment.

Trade policy developments typically evolve over extended periods rather than brief intervals. May’s recovery serves as a reminder that investors should avoid excessive reactions to trade-related news, particularly given that extreme scenarios now appear less probable.

Consistent earnings growth bolsters markets.

First quarter corporate earnings provided additional grounds for optimism. S&P 500 companies generated positive earnings per share surprises while 64% achieved positive revenue surprises, as reported by FactSet. (FactSet Earnings Insight May 30, 2025) This robust earnings performance demonstrated the fundamental strength of corporate profitability, with technology firms displaying resilience while managing trade-related uncertainties.

Conversely, consumer attitudes have remained negative this year due to tariff and inflation worries. Nevertheless, recent sentiment measures began indicating improvement that better aligns with positive earnings and economic information. The University of Michigan’s latest May survey revealed slightly declining inflation expectations and stabilizing sentiment. While single-month data requires cautious interpretation, this improvement represents a promising development. A robust economy combined with improving sentiment could provide market support.

The bottom line? May delivered positive results for investors despite challenges. Although the U.S. credit downgrade and fiscal issues presented new obstacles, advancement in trade negotiations helped lift markets. For investors with long-term perspectives, these events emphasize the importance of maintaining broader viewpoints and concentrating on fundamental trends rather than temporary policy developments.

Your Wellness Navigator and Holistic Health Guide: Christine Despres, RN, NBC-HWC, CDP

Are You Afraid of Losing Your Marbles?

June is National Alzheimer’s & Brain Awareness Month—and I’m here for it all month.

Why? Because brain health is one of my favorite topics. Your brain controls everything—your thoughts, your body, your emotions, your personality. It’s what makes you you.

Yet we rarely give it the attention it deserves. You can’t see it. You usually can’t feel it. And it works on autopilot—until something goes wrong. Then the fear creeps in: “Am I losing my mind?”

If you’re middle-aged—especially a woman—the answer may feel like a hesitant yes. Hormonal shifts, chronic stress, poor sleep, lack of exercise, and a nutrient-poor diet can lead to a 30% decline in brain function.

Let that sink in: Thirty percent. Brain fog, inability to concentrate and forgetfulness are not normal signs of aging. Will they happen now and then, of course they will, but they should not be baseline during middle age.

We wouldn’t dream of driving our car without gas or oil, yet we often push our brains to the limit without giving it the fuel and maintenance it needs. Your brain performs literal miracles 24/7—it deserves the utmost care, love, and respect.

As a Registered Nurse and Certified Dementia Practitioner, I’ve worked in dementia, hospice, rehabilitation, and long-term care. I’ve seen what happens when the brain breaks down. It’s heartbreaking. My passion for brain health? It started with fear—and turned into a mission.

Cognitive decline is the #1 health concern as we age. But here’s the good news: ✨ You have more control than you think.

Research shows that cognitive decline begins 20–30 years before symptoms appear. That means your 40s, 50s, and 60s are the perfect time to start being proactive.

In fact, up to 40–60% of Alzheimer’s cases and 80% of chronic diseases like diabetes and heart disease are preventable with lifestyle changes. That’s not just inspiring—it’s empowering.

Neuroscientist and brain health expert Dr. Lisa Mosconi reminds us that less than 1% of Alzheimer’s cases are due to genes alone. For the other 99%, the biggest risk factor is how we live. Hormones, nutrition, sleep, stress, toxins, movement—they all shape the future of our brains.

Dr. Mosconi leads the Weill Cornell Women’s Brain Initiative—the first Alzheimer’s Prevention Clinic focused on women’s health. But not everyone has access to clinics like this.

That’s where people like me—nurses, health coaches, and educators—step in.

My job is to guide you, support you, and make it easier to take care of your brain, your body, and your future.

Let’s start now.

Here are the 10 most powerful ways to support your brain (and your body—because it’s all connected).

1- Keto Flex diet (per Dr. Brednesen)

* High phytonutrients

* High fiber

* High omega’s

* No grains or dairy

* No simple carbs

* Clean protein, low mercury fish

* Fermented veggie’s daily

* Cruciferous veggie’s daily

* Fasting 3 hours before bed & 12 hours per night

2. Exercise- aerobic and non aerobic= steps and strength

3. 7-9 hours of quality sleep, good sleep hygiene

4. Stress reduction, meditation, box breathing

5. Socialization, connection, feeling valued

6. Gut health- gut brain connection

7. Mouth health-oral care

8. Detoxification-sauna’s, hot cold/therapy, heavy metals, gut cleanses

9. Intentional brain training, games, hobbies

10. BHRT, NAD+, vitamins, supplements, nootropics, adaptogens

Stay tuned next week as we dive deeper into the top brain healthy foods to incorporate into your diet.

Please feel free to reach out with questions or interest in 1:1 health coaching programs. You can reach Christine directly through her email at christine@thewellnessnavigator.com (mailto:christine@thewellnessnavigator.com) or www.thewellnessnavigator.com.

Compliments of the newsletter, 1440:

See photos of this weekend’s aurora across the US .

…and May’s best science images.

Why billionaires are racing to space. (via YouTube)

Copenhagen is ranked the world’s happiest city.

Why people without diabetes are wearing glucose monitors.

That’s all for today.

Until next week,

All my best,

To schedule a 15 minute call, click here.