Greetings!

Welcome to today’s Wealth Advisory.

We begin with a special market briefing—an in-depth look at current trade dynamics, the forces shaping today’s investment landscape, emerging risks and opportunities, and strategic recommendations to help you recalibrate your financial approach.

Then, in your Wellness Navigator segment, Christine Despres shares reflections on the transformative power of gratitude—how it uplifts not just our own outlook, but the lives of those around us.

Finally, in the Etcetera section, we’ll round things out with a few wealth and wellness tidbits that are sure to interest you.

With that, let’s go.

Special Briefing: Understanding the Impact of U.S.-China Trade Developments on Investment Strategy

The latest trade arrangement between the United States and China has significantly reduced many of the tariffs that caused market turbulence beginning in April. This 90-day agreement reduces U.S. tariff rates on Chinese goods from 145% to 30%, while China’s rates on U.S. products drop to 10%. Coupled with tariff suspensions affecting other trading partners and a newly established trade agreement with the United Kingdom, investors are increasingly confident that a prolonged trade conflict may be avoided. How should long-term investors interpret this evolving market narrative?

Financial markets typically respond most negatively to uncertainty and unexpected developments. This occurs because markets often price in worst-case scenarios immediately before adjusting as clarity emerges. While the unexpected magnitude and breadth of the April 2 tariffs triggered a sharp market decline, we’ve witnessed an equally rapid recovery over recent weeks.

Market indices are now hovering near their year-beginning values and slightly above pre-April 2 tariff announcement levels. This pattern mirrors numerous historical examples where recoveries materialize once greater certainty appears. These recent events provide another demonstration of why maintaining a long-term investment perspective remains crucial during periods of market uncertainty.

The U.S.-China trade arrangement signals potential for comprehensive agreement.

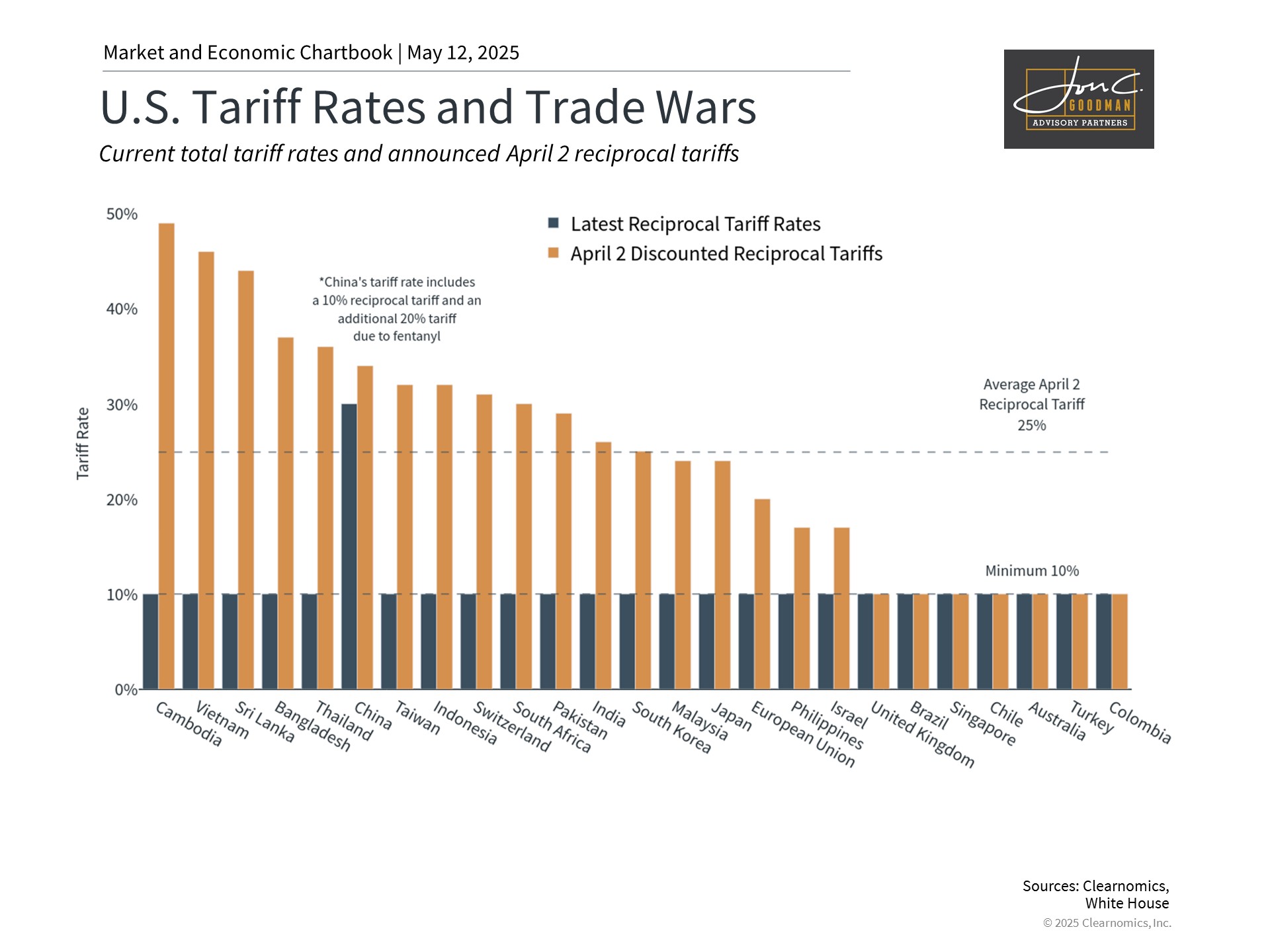

This chart shows reciprocal tariff rates announced by the White House on April 2, 2025. These reciprocal tariffs are on top of previously announced tariffs. This chart also shows the current level of total tariffs set by the U.S. on each country.

Date Range: April 2, 2025 to present

Source: Clearnomics, White House

The recent tariff arrangement between the United States and China represents positive progress by eliminating a major source of market uncertainty. It establishes a reciprocal U.S. tariff on Chinese imports at 10% while preserving the 20% tariff related to the fentanyl crisis implemented earlier this year. Although circumstances continue to evolve, this arrangement creates a foundation for a more extensive trade agreement between the world’s two largest economies and reduces tensions. Therefore, while tariff rates remain elevated compared to historical levels, the probability of worst-case outcomes has diminished significantly.

In retrospect, current developments reflect similarities to the trade tensions experienced during 2018 and 2019 in the first Trump administration. In both instances, the administration has leveraged tariffs as negotiation tools to secure new trade agreements, with the declared objective of reducing the U.S. trade deficit with major partners. Five years ago, these efforts culminated in the “Phase One” trade agreement with China, the USMCA (United States-Mexico-Canada Agreement), and several other arrangements.

These trade policies encompass multiple interconnected objectives, including manufacturing job creation, intellectual property protection, immigration control, and various other aims. Currently, the key distinction is that the administration has escalated tariff threats beyond what many investors and economists had projected. Nevertheless, the recently announced trade agreement between the U.S. and U.K. suggests similar patterns may be emerging again. This arrangement establishes a baseline 10% tariff rate on British goods, including specific provisions allowing importation of up to 100,000 vehicles at this rate and exemptions for steel and aluminum products.

Economic fundamentals remain strong despite trade uncertainties.

This chart shows quarterly GDP growth on a seasonally adjusted annual rate (SAAR) for the last four quarters. Growth is broken down into its percentage point contributions.

Date Range: Last several quarters as denoted on chart

Source: Clearnomics, U.S. BEA

Undoubtedly, comprehensive trade agreements with China and numerous other nations remain pending, and daily headlines could continue driving market volatility, particularly if existing tariff suspensions expire. A primary reason markets have focused intensely on tariffs stems from their potential impact on inflation and economic growth. This concern manifested in first quarter GDP figures showing a slight economic contraction as businesses accumulated imported inventory ahead of tariff implementation dates. Increased clarity will likely benefit both consumer and business confidence.

Within this environment, several positive factors deserve attention. Firstly, many economic indicators continue showing resilience. The most recent employment report revealed the economy added 177,000 positions in April, exceeding expectations of 138,000. The unemployment rate remained steady at 4.2%, continuing a period of stability beginning last May. This robust labor market helps counterbalance concerns about tariffs and uncertainty affecting consumer spending patterns.

Concurrently, inflation continues its gradual decline toward the Federal Reserve’s 2% target, with the latest Consumer Price Index registering at 2.4% year-over-year. This deceleration has been supported by declining oil prices, which recently reached four-year lows. Lower oil prices, partly influenced by tariff-related volatility, reduce consumer costs and potentially stimulate economic activity, all other factors being equal.

The recent U.S.-China arrangement also diminishes pressure for immediate Federal Reserve policy adjustments. Market-based projections still anticipate Fed rate reductions this year, though expectations have moderated to approximately two or three cuts, possibly commencing in July or September. The Fed, which recently maintained rates between 4.25% and 4.5%, appears to be adopting a cautious approach rather than reacting immediately to short-term trade developments, market fluctuations, and economic data.

Markets often recover when recovery seems least probable.

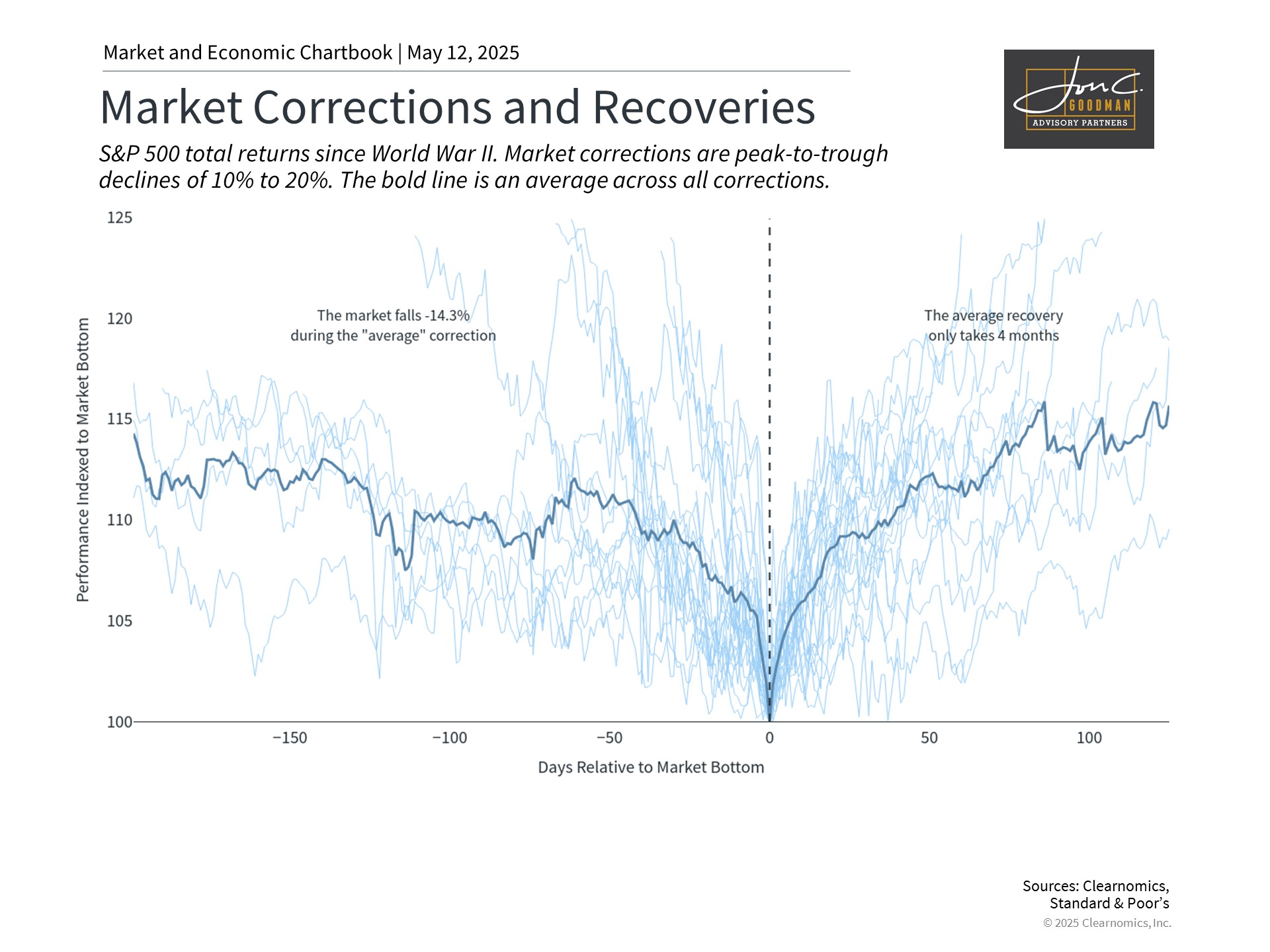

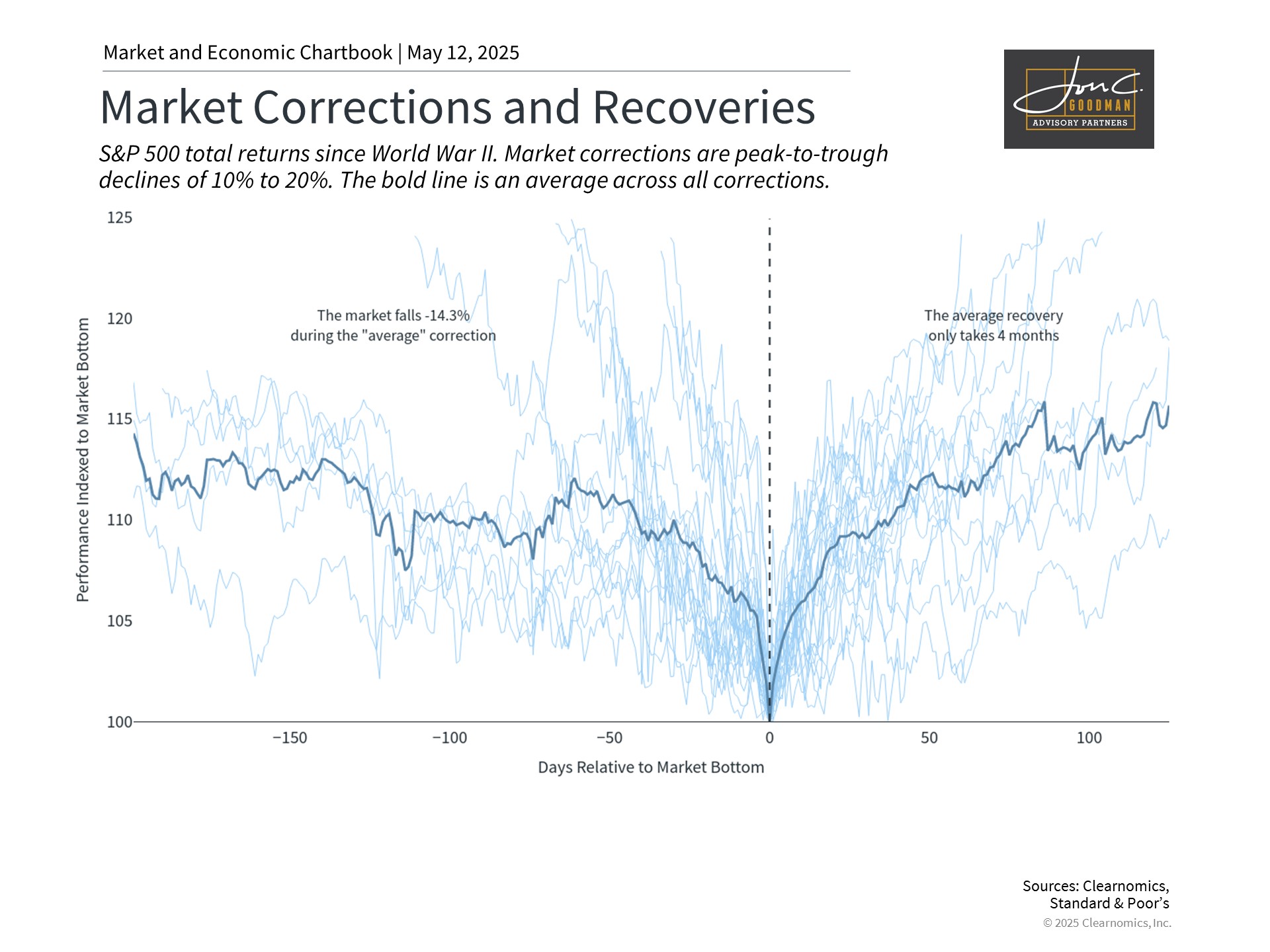

This chart shows every S&P 500 correction since World War II. Market corrections are defined as declines beyond 10% but less than 20% from the previous all time high. Declines of 20% or more are considered bear markets. The market bottom is reindexed to 100 and the x-axis measures days before and after the market bottom.

Date Range: January 1950 to present

Source: Clearnomics, Standard & Poor’s

While numerous market risks persist, recent weeks demonstrate how rapidly sentiment can transform. By their fundamental nature, markets anticipate worst-case scenarios. During periods of negative headlines and market declines, envisioning eventual recovery becomes challenging. While prudent risk assessment remains important, it should not compromise long-term portfolio positioning.

The accompanying chart illustrates how market corrections have behaved since World War II. Although the average correction involves a 14% decline, recovery typically occurs within approximately four months. Most significantly, markets frequently rebound when recovery seems least likely, as we’ve witnessed following recent trade negotiation progress. Investors who overreact to initial volatility signals may find themselves inappropriately positioned relative to their financial objectives.

The bottom line? The recent U.S.-China trade announcement has reduced market uncertainty and alleviated recession concerns. For long-term investors, this situation reinforces the importance of maintaining perspective during market turbulence rather than reacting to short-term volatility.

Your Wellness Navigator and Holistic Health Guide: Christine Despres, RN, NBC-HWC, CDP

An Attitude of Gratitude

I hope and trust you had a lovely weekend celebrating the important women in your life. Don’t ever wait for a holiday to tell those you care about how much you love and appreciate them. The time is always now to show and share your heartfelt gratitude. The benefits are endless.

Holidays can be loaded with mixed emotions, anxiety and pressure. I want to gently acknowledge that this can bring up tender emotions for many. If you’ve lost your mother, have a challenging relationship, or are facing other difficulties, please know my heart is with you. Personally, having lost my own mother when she was 57, I understand the sadness that can accompany times like these. Sending love and comfort to all who need it.

May is officially designated as National Mental Health Awareness Month. It is a jam-packed month with graduations, spring chores, sports, school release, college kids returning home and preparations for summer. I encourage you to keep your eyes open to how those around you may be affected by these life changing milestones. This month is a time to raise awareness about mental health, reduce stigma, and encourage open conversations about mental wellbeing. Most importantly, to be a good listener. I tend to want to solve every problem with an action step. Sometimes an empathetic ear is more valuable. “Just listen,” my daughter says.

Gratitude and the power of positive thinking can change your view of the world. Gratitude isn’t just a feel-good habit–it’s a powerful tool that can transform your own health and happiness as well as lift those around you. Positive psychology research shows that people who practice gratitude regularly experience more positivity in their lives which leads to improved health outcomes. Gratitude shifts the focus from what you don’t have to what you do have. This mindset grows over time and becomes second nature. Make gratitude part of your everyday routine and you will feel the brain health benefits. It increases dopamine and serotonin–two neurotransmitters that help regulate mood and make you feel happier and calmer. And the best part is, it’s free!! It can be done anywhere, by anyone. There is no right or wrong way to practice.

Top 5 Gratitude exercises:

1. Morning Gratitude Ritual

Start your day by listing what you’re thankful for and setting a positive intention–before you even get out of bed or 1st thing during your am routine.

2. Good Things Bedtime Habit

Write down 3 things that went well today before you fall asleep–big or small.

3. Gratitude Meditation

During meditation, focus on things you’re grateful for. Breathe in what you want more of, breathe out & release what is not serving you. (Click here for a demonstration of how I meditate.)

4. Prayer

If you’re spiritual, use prayer as a way to thank God and appreciate the blessings in your life.

5. Write Thank-You Notes

Everyone loves getting mail and it feels good to write it down.

In conclusion, incorporating gratitude into our daily lives can significantly enhance our well-being and strengthen our connections with others. While holidays prompt us to express appreciation, it’s vital to share our love and gratitude regularly. As we observe Mental Health Awareness Month this May, let’s be attentive to the emotions of those around us and offer support through listening and kindness. By making gratitude a habitual practice, we not only uplift ourselves but also foster a sense of community that nurtures mental health and happiness for all.

You can reach Christine directly through her email at christine@thewellnessnavigator.com or www.thewellnessnavigator.com.

In case you missed it…

The first American Pope.

A doctor’s science-backed advice for aging well.

Estimated consumer spending for Mother’s Day.

Uncovering the Buddha’s origins in his Nepali hometown.

Where US home prices are rising and falling the most.

That’s all for today.

I hope you’re enjoying the new format.

Until next week,

All my best,

To schedule a 15 minute call, click here.