Greetings,

Happy tax day.

(I know.)

In today’s Wealth Advisory, we will be taking a deep dive into our complicated relationship with China.

To clarify things, I will be adding commentary to your customary charts.

As a reward for your efforts, your Wellness Navigator, Christine Despres, will be sharing a healthy but tasty recipe for a green drink that could serve you well, quite literally, for the remainder of the week.

And in the Etcetera section, we’ll explore the some tidbits you might have missed this week.

With that, let’s go.

Wealth Advisory: Understanding the Global Impact of U.S.-China Trade Relations

Recent weeks have witnessed an escalation in trade disputes between the United States and China, with both nations implementing record-high tariff measures. Currently, the U.S. has imposed tariffs of 145% on Chinese imports, while China has responded with 125% tariffs on American goods. This rapidly changing situation continues to influence financial markets worldwide. Although international tensions often generate market uncertainty, historical patterns demonstrate that markets have successfully navigated similar challenges before. For investors with long-term horizons, comprehending the economic interdependence between these two major powers can provide valuable perspective beyond the headlines.

The spotlight has shifted to U.S.-China trade relations.

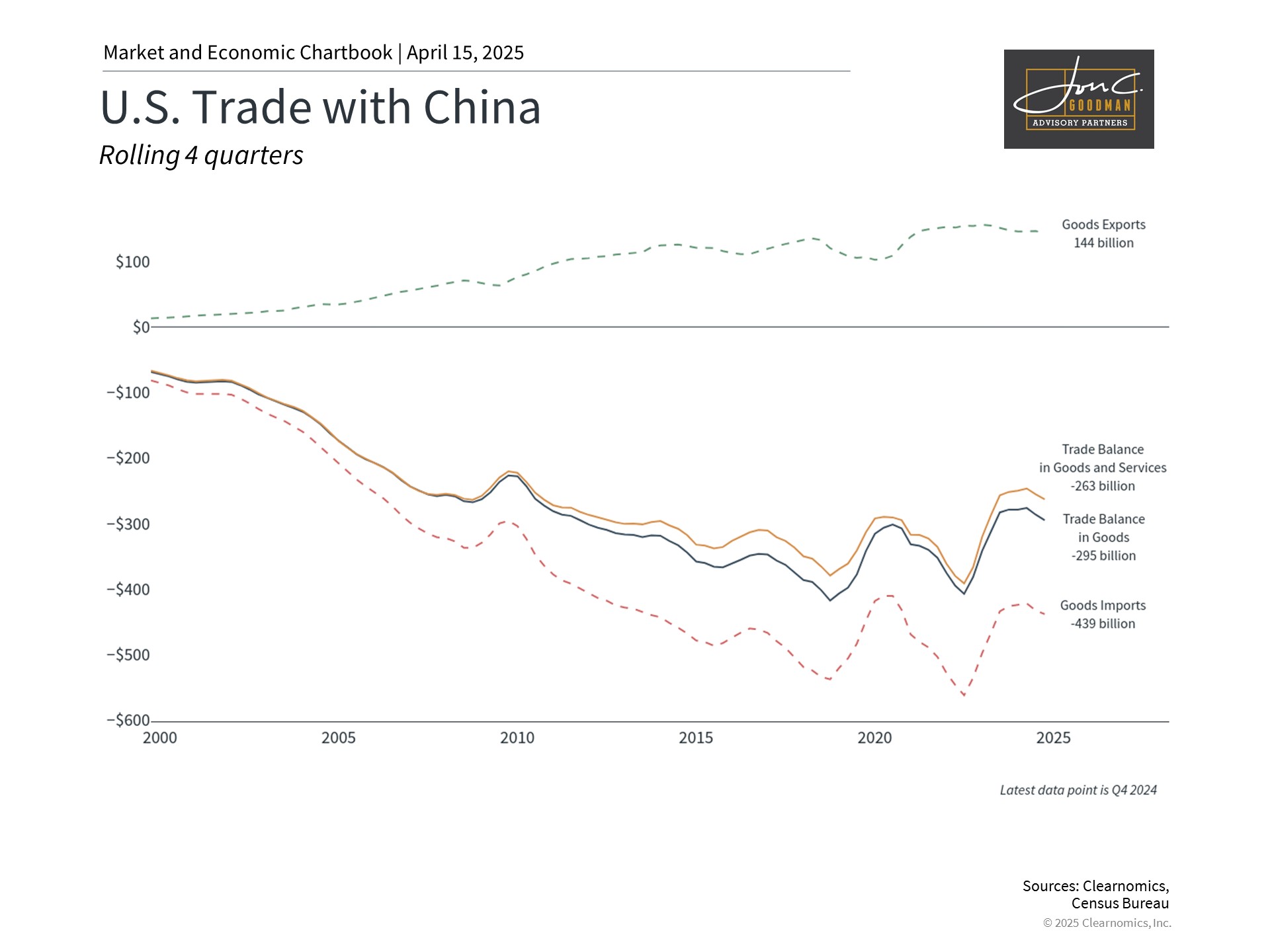

This chart shows various measures of U.S. trade with China including the trade balance in goods, goods imports, goods exports, and the trade balance in goods and services. Trade measures for goods are measured on a visible alongside basis. All datapoints are quarterly and calculated on a four-quarter rolling basis.

Date Range: 2000 to present

Source: Clearnomics, Census Bureau

Market discussions have been dominated by tariffs against various trading partners, but the recent 90-day pause has refocused attention on the U.S.-China relationship. These tensions extend beyond simple trade policy considerations. They reflect a fundamental shift to a “multipolar” global order where both the United States and China function as major economic powers with substantial international influence. This represents a significant change from the “unipolar” world that emerged after the Cold War, when the U.S. stood as the sole superpower. This transition naturally creates both new challenges and opportunities for each nation.

While predicting the trade conflict’s trajectory over coming months remains difficult, maintaining proper perspective has become essential for long-term investors. The economies of the U.S. and China remain deeply interconnected through trade relationships, financial systems, and global supply networks.

What distinguishes current tensions from previous trade disputes is both the unprecedented scale of the tariffs and the wider geopolitical environment. As illustrated in the accompanying chart, the U.S. maintains a considerable trade deficit with China. Tariffs exceeding 100% effectively more than double the price of cross-border goods, assuming other factors remain constant. This results in higher consumer prices, increased business expenses, and potential economic slowdowns. Recent weeks have seen market volatility driven by concerns about elevated inflation and deteriorating corporate profit margins, reflected in shifting consumer survey data and revised earnings forecasts.

Investors have also been concerned about the White House’s willingness to intensify trade confrontations with China. Since tariffs at these elevated levels likely cannot be maintained over the long term, they probably represent a negotiating stance for the administration. Evidence supporting this view includes the 90-day suspension of tariffs above 10% (with China being the exception) and the exclusion of technology products, suggesting the administration’s primary goal remains achieving negotiated agreements.

The tariffs implemented during 2018 and 2019 provide helpful context for anticipating market and corporate responses as the situation develops. During that period, many companies demonstrated adaptability by modifying supply chains, identifying alternative suppliers, or internally absorbing portions of the increased costs. While markets experienced difficulties in 2018, they performed strongly in 2019 and again during the recovery following the pandemic. Though the broader application of current tariffs presents greater challenges for companies, the significant market rally following the announcement of the 90-day pause demonstrates that markets can rebound when conditions improve.

For investors focusing on longer time horizons, challenging market environments can present favorable opportunities. Valuations have become considerably more attractive compared to just a few months ago, both across broad market indices and in specific sectors like Information Technology and Communication Services that drove recent bull market gains. While interest rate increases have contributed to bond market volatility, they also create more opportunities for investors to generate income within their portfolios.

Economic headwinds facing China’s economy.

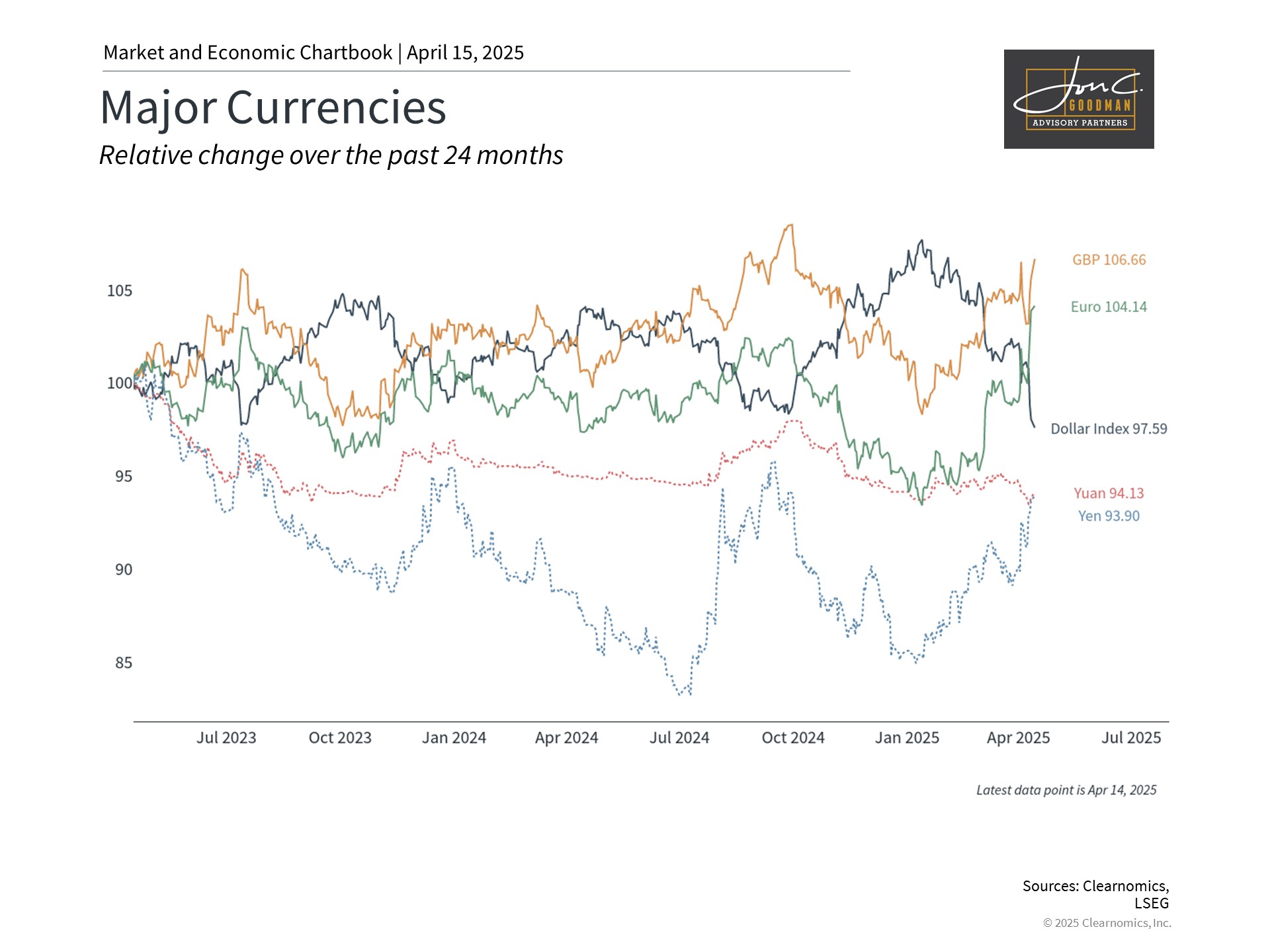

This chart tracks the performance of several major currencies over the past 24 months. The value of each currency is reindexed to 100 at the start of the period. The number at the end of the series shows the value, not reindexed.

Date Range: Two years ago to present

Source: Clearnomics, LSEG

While considerable attention has focused on America’s response to trade tensions, China confronts its own economic difficulties. These include ongoing worries about real estate market instability and financial system vulnerabilities that could limit its capacity to withstand trade pressures. China’s economic recovery since the pandemic has been inconsistent, with GDP growth decelerating to 5.4% year-over-year in late 2024, according to official statistics from the Chinese government. Many economic analysts have already lowered their growth projections for 2025 below the government’s 5% target.

Reports indicate Chinese leadership is evaluating additional economic stimulus measures. These would supplement significant initiatives implemented last year, including a 5-year, 10 trillion-yuan stimulus package supporting local government debt issuance, commitments to increase budget deficits, interest rate reductions, lower bank reserve requirements, and various measures supporting the real estate sector.

Recently, the People’s Bank of China has permitted the yuan to depreciate as a potential counterbalance to tariff impacts, setting its currency peg at the weakest level since September 2023. Currency devaluation can enhance export competitiveness by making goods less expensive for international buyers. However, this approach carries risks, particularly the potential for capital outflows, which could further destabilize China’s financial system. It may also be interpreted by the White House as an attempt to circumvent tariff measures.

The chart above, which indexes major currencies to a value of 100 two years ago, illustrates recent currency market volatility. Beyond the yuan’s movements, the U.S. dollar index has declined to the lower boundary of its three-year range. This trend contradicts some analysts’ expectations, as conventional economic theory suggests tariffs typically reduce imports, decreasing demand for foreign currencies and subsequently strengthening the domestic currency.

U.S. government debt remains predominantly domestically owned.

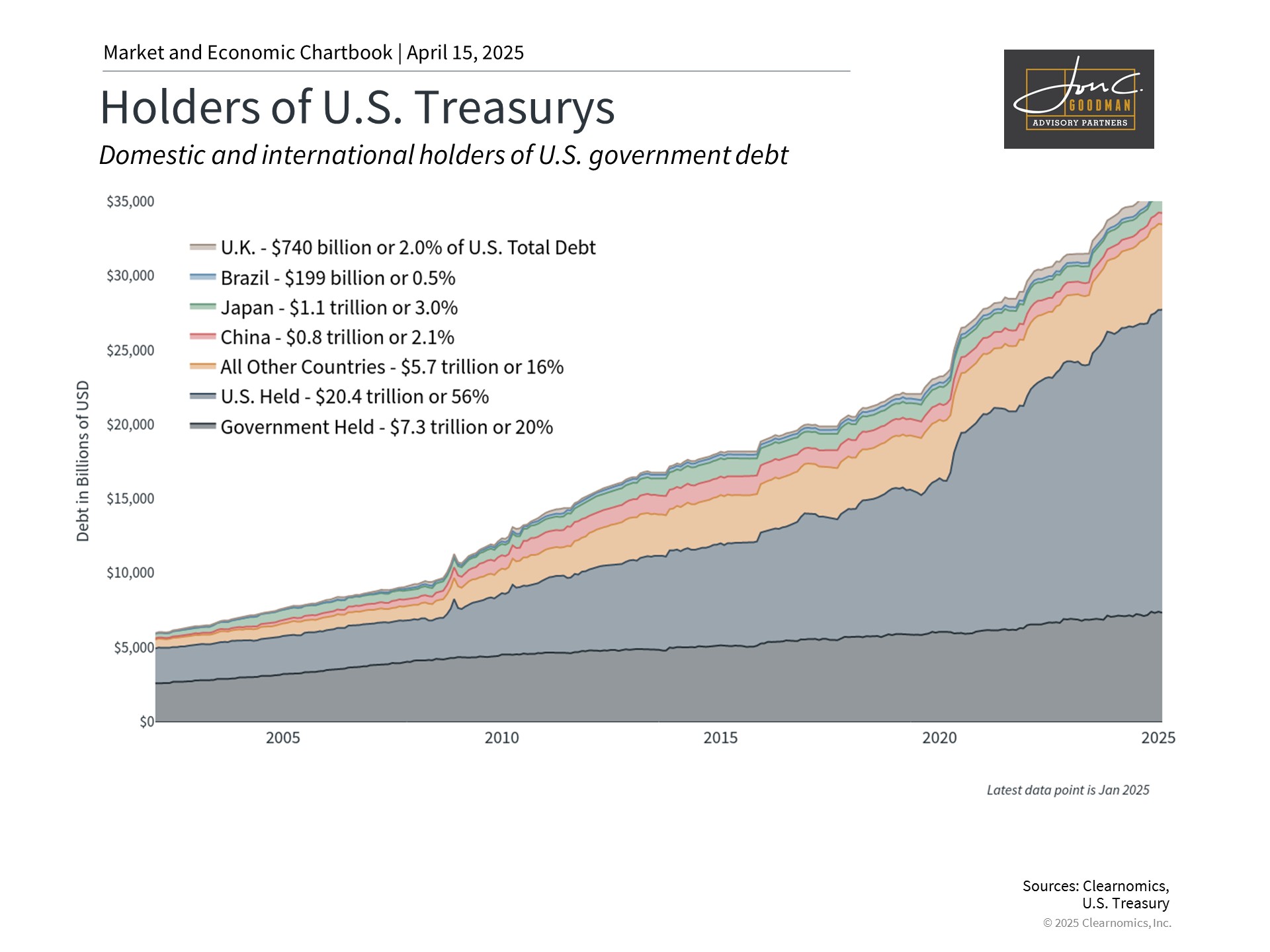

This chart shows the ownership of U.S. Treasurys and how it has evolved as the level of U.S. debt has increased over time. A large portion of U.S. debt is held by the government itself. Excluding this gives us a better sense of the debt picture. Over half of U.S. debt is held domestically by non-government entities. The rest is held by various countries.

Source: Clearrnomics, U.S. Treasury

Some investors express concern that China’s holdings of U.S. Treasury securities provide excessive leverage over the American economy. Questions have emerged about whether recent bond market movements reflect selling by countries like China. While difficult to confirm definitively, government data shows China’s Treasury holdings represent approximately 2.1% of total U.S. government debt. Significantly, most Treasury securities remain under domestic ownership, held by U.S. individuals, corporations, and various federal, state, and local government entities.

If China were to substantially reduce its Treasury holdings, this could potentially trigger temporary market volatility and briefly elevate U.S. interest rates. However, China and other nations maintain U.S. Treasuries, dollar reserves, and other foreign assets for a fundamental reason: to preserve financial stability. U.S. dollar assets and Treasury securities have consistently maintained their “safe haven” status even during periods of uncertainty. This has remained true throughout recent years despite inflation concerns, budget challenges, U.S. debt downgrades, and various other issues.

The bottom line? Despite increasing U.S.-China trade tensions creating market uncertainty, historical evidence demonstrates financial markets’ long-term resilience. Maintaining a diversified portfolio aligned with your long-term financial objectives remains the most effective strategy for navigating the evolving global economic landscape.

Your Wellness Navigator and Holistic Health Guide: Christne Despres, RN, NBC-HWC, CDP

Hello and Happy Spring!

Hopefully there is some green coming into your life wherever you may live. Even if it’s The Masters!!! (Btw I am making pimento cheese and egg salad sandwiches for Sunday’s final round but I always “healthify” any fun recipe by using quality ingredients like local eggs, gluten free seed crackers and avocado oil mayonnaise.)

I love this time of year as it’s energizing, symbolic of growth, nature, fresh starts… all the things coming alive. Spring reminds us that healing is possible, and that growth starts quietly—often beneath the surface. It really is a perfect time of year to reboot and reset.

The power of greens in your diet is undeniable. 🥬 The most beneficial nutrient found in leafy greens is arguably folate (also known as vitamin B9), but leafy greens are truly powerhouses with multiple standout benefits. So when you eat your greens, you’re not just doing your body a favor—you’re literally nourishing your brain, protecting your heart, and boosting energy at the cellular level. Here are a few of my favorites:

🥗 Watercress – very high nutrient score per calorie

🌱 Swiss chard – high in potassium, vitamin K, and antioxidants

🥬 Collard greens – great calcium and fiber source

🥬 Spinach and kale – rich in iron, magnesium, folate, and antioxidants

I am including my Green Drink recipe. I like to use the blender so I can add as many superfoods into one glass as possible. It’s a vehicle to get the nutrients in. You honestly don’t have to love it, just drink it!

SUPERFOOD GREEN DRINK

Needs:

* high speed blender

* peeler

* spoon

* cutting board

* knife

* glass jars

Ingredients:

* 2 cup power greens (less spinach or kale)

* ½ cup watercress

* ½ cup mint or 2 -.5oz container

* 2 TBSP ginger (fresh or jar)

* 3 TBLS lime or lemon juice (fresh or jar)

* 1 ½ c coconut water or water

* 2 TBSP chia seeds

* 2 large cucumber washed, half peeled and quartered

* optional berries/apple or ½ avocado

* optional pinch of sea salt, option of ice

* optional add 2 TBSP green superfood power, bee pollan or other superfoods

Green juice can be an acquired taste so you may need to add a touch of fruit in the beginning.

It stays for 5 days if well sealed and refrigerated in a glass container.

Load the high powered blender with the coconut water and chia seeds to soak while prepping then add all ingredients and blend on high until a liquid. Add ice to taste and pulse again to chill if drinking right away. It’s a little pulpy but you aren’t wasting any of the good nutrients and fiber. Just shake, stir or add water to reconstitute or thin to desired level.

This recipe is flexible and should be altered for your taste and needs. Add a pinch of sea salt if looking for hydration, more or less of what you like. The coconut water is natural electrolytes but you can use water as well.

If interested in working with Christine directly, you can reach her through her email at christine@thewellnessnavigator.com or www.thewellnessnavigator.com.

How to Ask Great Questions

Clearer Thinking | Sara Ness

Curiosity isn’t just a trait—it’s a trainable skill. In this talk, Sara Ness breaks down the five types of questioners and shows how learning to ask better questions can lead to more meaningful conversations, deeper connections, and clearer thinking. Ready to elevate your curiosity into a superpower? Start here.

Record Number of Sandhill Cranes Flock to Nebraska

Curious about nature’s grandest gathering? This year, Nebraska saw a record-breaking number of sandhill cranes during their annual migration along the Platte River—an awe-inspiring sight that has captivated birdwatchers and scientists alike. The surge in crane numbers offers both a stunning visual and a chance to study environmental shifts affecting migratory behavior.

Gatsby Turns 100

The Great Gatsby marks its centennial today—once a flop, now an American classic with over 30 million copies sold. Set in Jazz Age New York, Fitzgerald’s tale of ambition, illusion, and lost love still resonates a century later. Celebrations include a Broadway toast and the Empire State Building glowing green in Gatsby’s honor.

That’s all for today.

I hope you’re enjoying the new format.

Until next week,

All my best,

To schedule a 15 minute call, click here.

.