The question of retirement security weighs heavily on many Americans’ minds, especially as we navigate through evolving economic and political landscapes in 2025. With retirement numbers reaching historical highs this year, understanding sustainable withdrawal rates from retirement savings has become increasingly crucial.

Two critical questions face both current and future retirees: determining the adequate amount for retirement savings and establishing a sustainable annual withdrawal rate that prevents premature depletion of those savings.

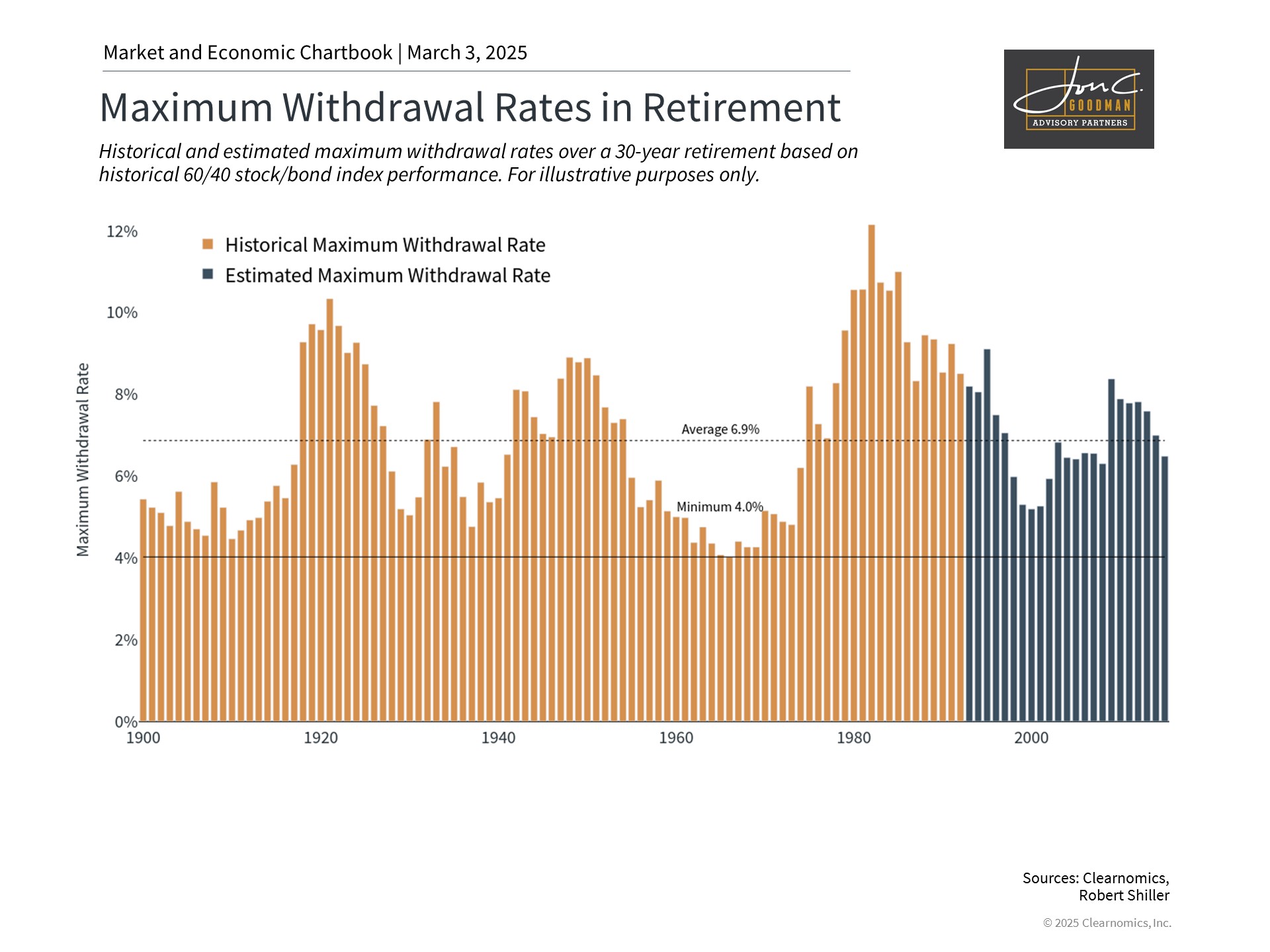

Historical data shows fluctuating sustainable withdrawal levels.

These retirement planning decisions are inherently personal and rest on three key variables: portfolio performance, expenditure patterns, and retirement duration. Understanding how these elements interact forms the foundation of effective retirement planning.

While market volatility remains beyond our control, historical data demonstrates the market’s capacity for long-term growth despite temporary setbacks. The key lies in maintaining investment discipline and appropriate portfolio allocation aligned with retirement objectives.

Retirement spending typically follows a “retirement smile” curve – higher initial spending during active early retirement years, followed by reduced spending in middle retirement, before potentially increasing due to healthcare costs in later years. Understanding after-tax spending patterns is crucial for optimal distribution planning.

Longevity risk–the possibility of outliving one’s savings–presents a unique planning challenge. With today’s retirees generally living longer than previous generations, conservative planning becomes essential since depleting retirement funds typically poses greater concerns than leaving excess wealth to beneficiaries.

Key considerations for determining retirement savings targets.

After evaluating these factors, you can better estimate your target retirement savings. Many start with the well-known “4% rule” as a baseline.

This guideline, established by William Bengen, suggests that withdrawing 4% annually from a retirement portfolio, adjusted for inflation, historically provided sustainable income over a 30-year retirement period.

However, individual circumstances and market conditions make this rule more of a starting point than a definitive answer.

Interestingly, many retirees tend to withdraw too conservatively. Historical analysis suggests that average sustainable withdrawal rates could have reached 6.9% over the past hundred years. Only during the 1960s did maximum sustainable withdrawal rates approach the conservative 4% threshold.

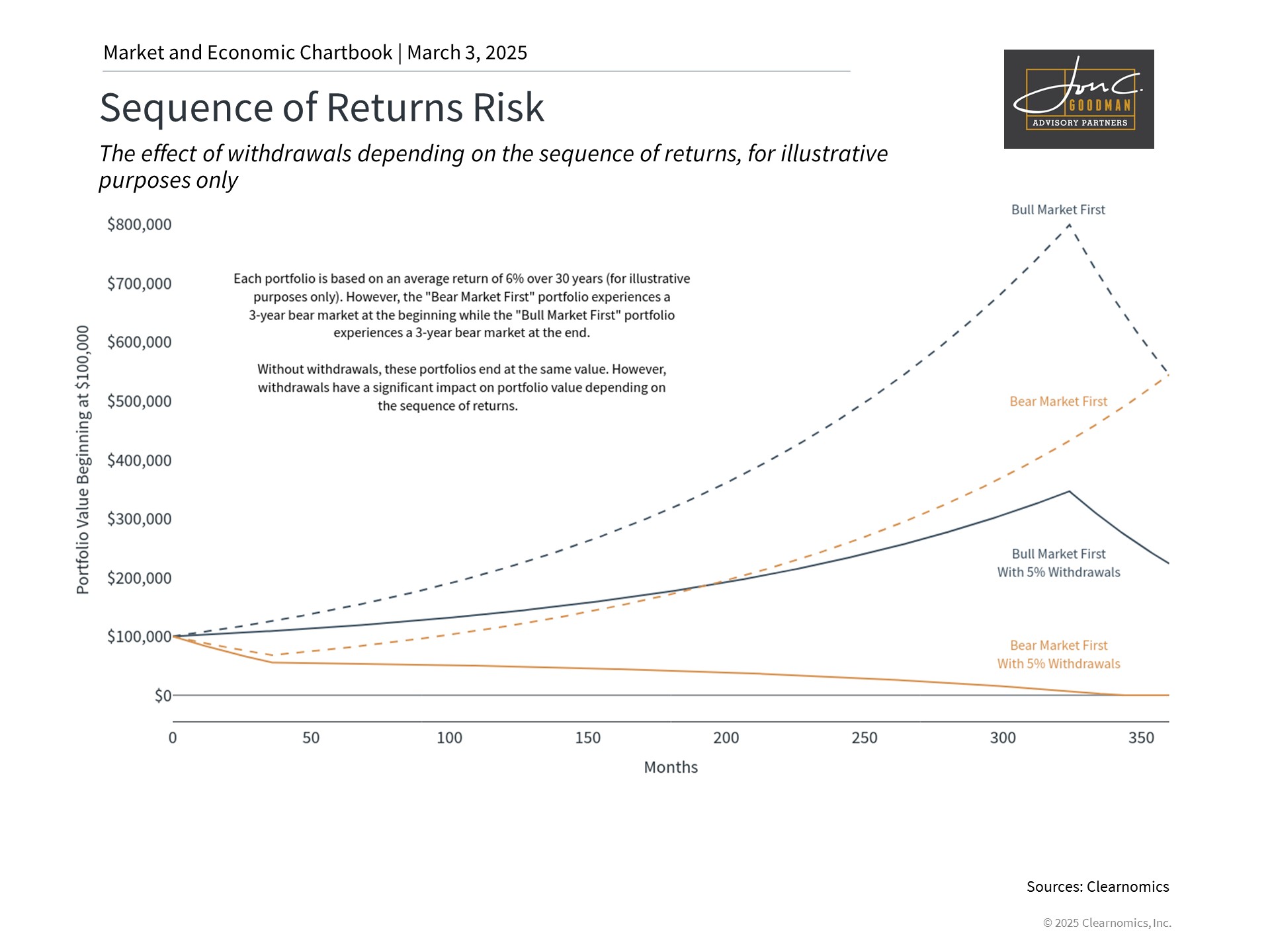

Market timing significantly affects retirement portfolio sustainability.

Safe withdrawal rates can vary significantly across market cycles. “Sequence of returns risk” – how the timing of market gains and losses affects portfolio value during withdrawal periods–becomes particularly relevant in today’s environment of high valuations and elevated inflation.

The 4% rule’s limitations become apparent when considering real-world factors. Its assumptions about portfolio allocation, taxes, and fees may not align with individual circumstances. Effective retirement planning requires a more comprehensive approach incorporating personal investment strategies, risk tolerance, and spending patterns.

Success in retirement planning ultimately depends on maintaining consistent investment discipline throughout retirement. Emotional reactions to market volatility can prevent participation in market recoveries, potentially compromising long-term withdrawal sustainability.

The bottom line? While the 4% rule provides a useful starting point, effective retirement planning requires personalized analysis of individual circumstances and needs. Professional guidance can help navigate these complexities and enhance the likelihood of a secure retirement.