Recent market activity has shown increased volatility, with the S&P 500 declining 4.3% from its December 6 peak while the 10-year Treasury yield has moved up from 4.15% to 4.76%. This shift reflects evolving market sentiment around several key factors including interest rates, valuations, and economic indicators.

The December employment report exceeded expectations, suggesting continued economic resilience. This has led investors to revise their expectations regarding Federal Reserve policy, with markets now anticipating just one rate cut in 2025 as potentially the final adjustment in this cycle. However, as demonstrated throughout 2024, these projections remain subject to rapid changes based on new economic data.

Recent market movements reflect typical patterns following periods of strong performance.

Context is crucial when evaluating current market conditions. While early 2025 has experienced some downward pressure, it’s worth noting that we’re only a few trading sessions into the year. Similar patterns emerged at the start of 2024 before giving way to sustained market advances. Although past performance doesn’t guarantee future results, these short-term fluctuations shouldn’t derail long-term investment strategies.

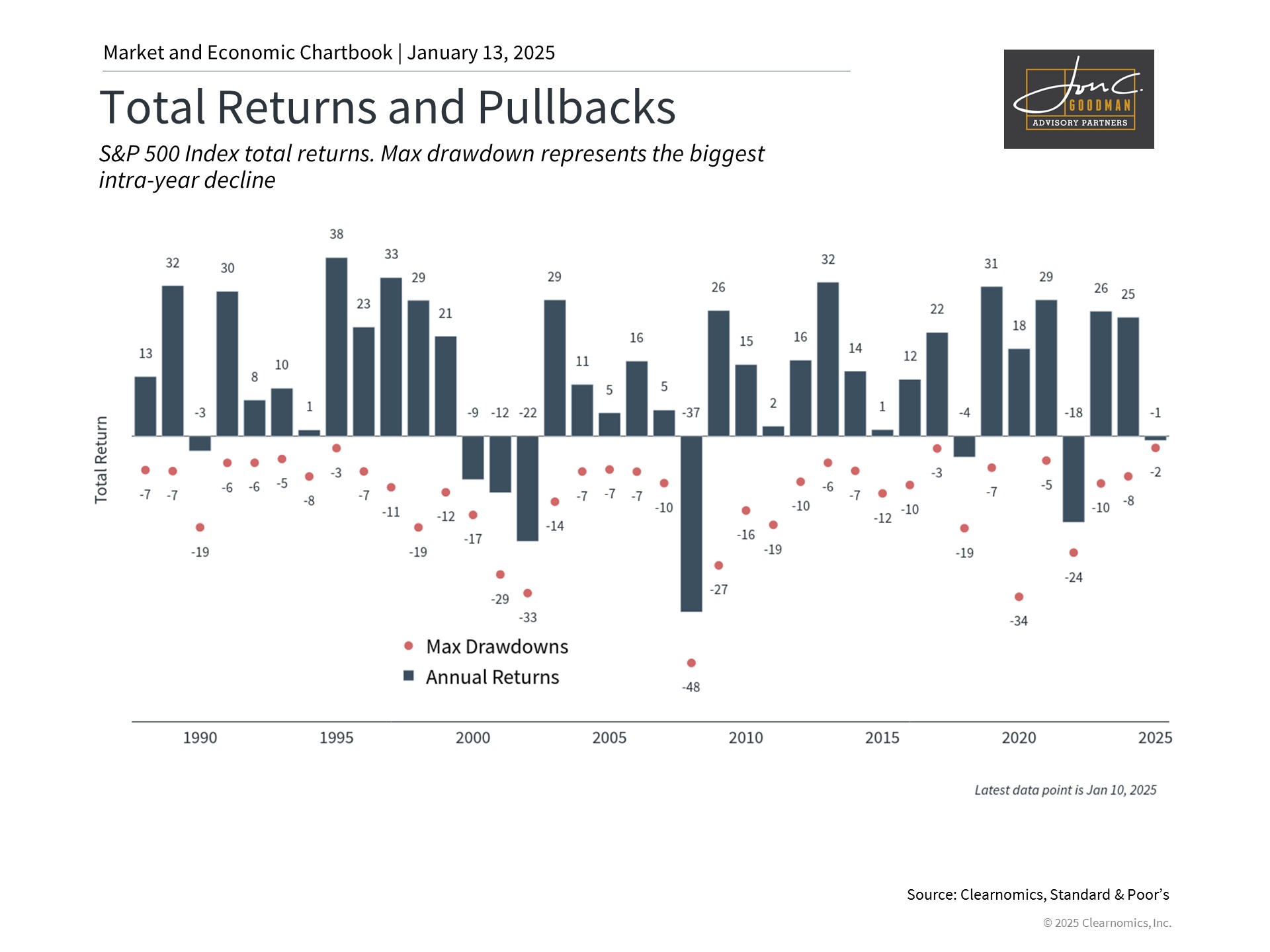

The previous two years have been characterized by relatively subdued volatility as major market indices reached historic levels. The data illustrates this stability, with the S&P 500’s largest decline in the previous year limited to just 8%–a notably modest pullback by historical measures.

Market history demonstrates that multiple pullbacks occur in virtually every calendar year. Since these temporary declines typically resolve relatively quickly, attempting to time them often proves counterproductive. Long-term investors who maintained their positions through various challenges – including the pandemic, inflationary pressures, monetary policy shifts, and global conflicts – have generally been rewarded for their patience.

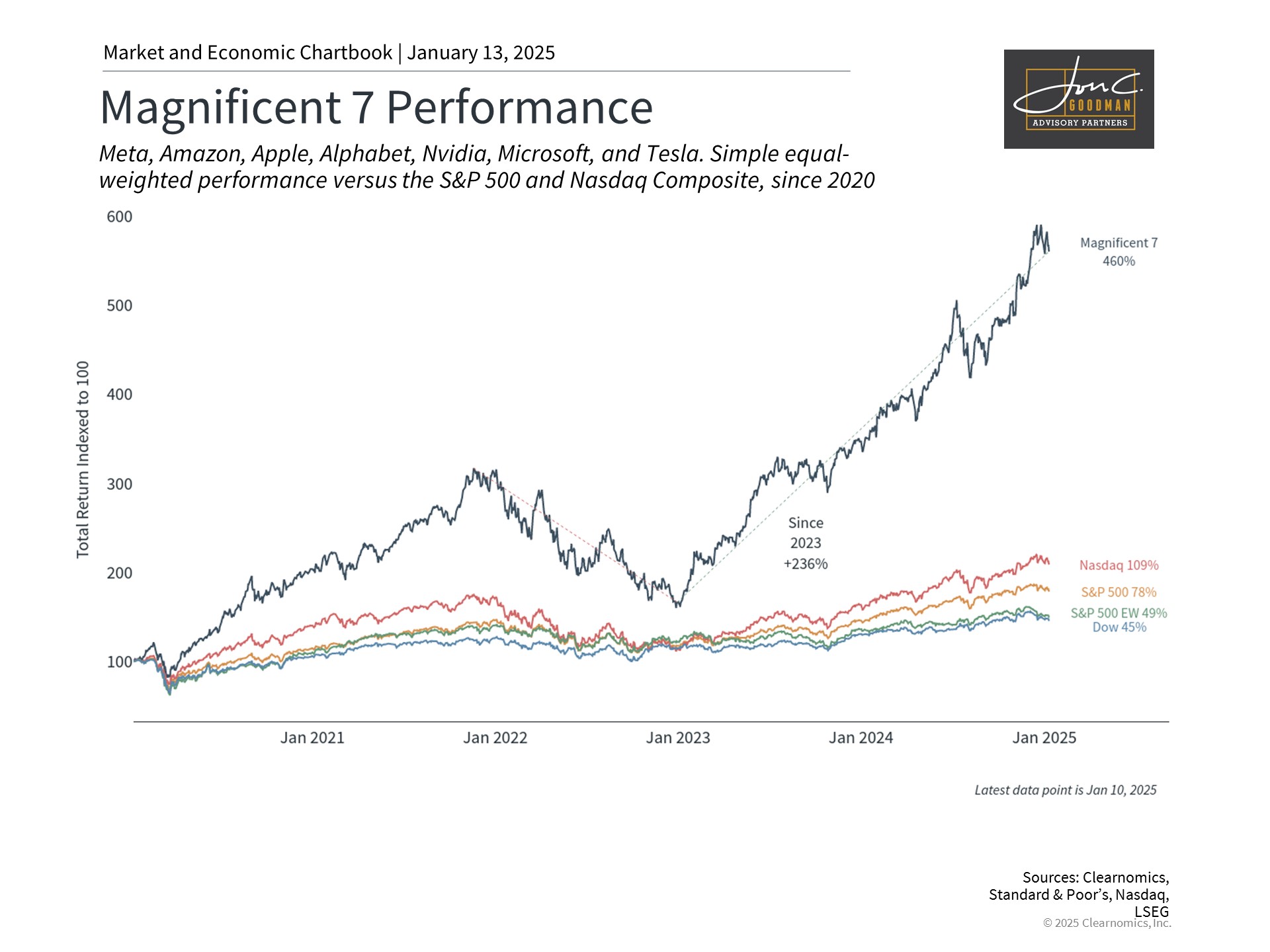

Technology leaders continue to drive market performance.

The sustainability of the technology sector’s rally, particularly among the Magnificent 7 stocks, remains a focal point for market observers. These seven technology companies have demonstrated remarkable performance, achieving gains of 250% since early 2023 and approximately 500% from 2020 levels.

Despite this impressive trajectory, it’s important to maintain perspective on technology investments. The 2022 market environment, characterized by rising rates and economic uncertainty, demonstrated how these stocks can face significant pressure. Their valuations are particularly sensitive to interest rate changes due to their reliance on projected future earnings.

The market-cap weighted structure of the S&P 500 means that strongly performing stocks can become disproportionately represented in index-based portfolios. This may result in unintended concentration risk and increased portfolio sensitivity to individual stock movements.

Rather than speculating on the future performance of any particular group of stocks, investors should focus on building well-diversified portfolios aligned with their personal financial objectives, preferably with professional guidance.

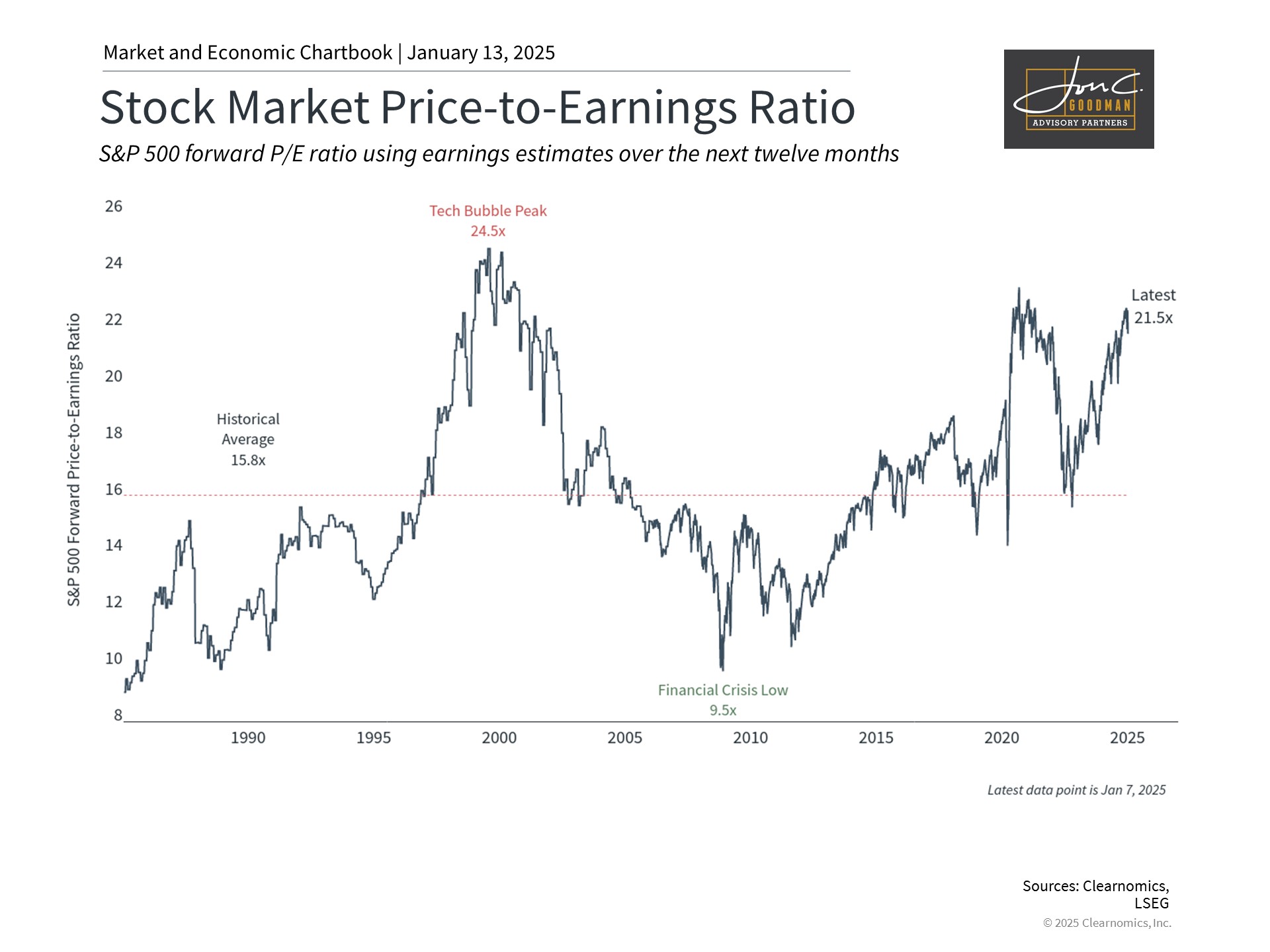

Current market valuations exceed historical averages.

A distinctive feature of the current market environment is elevated valuations. The S&P 500’s price-to-earnings ratio stands at 21.5x, approaching historic highs and not far from the 24.5x peak observed during the dot-com era. This has prompted discussions about potential market bubbles, particularly in AI-related securities.

The elevated price-to-earnings ratio indicates investors are paying a premium for corporate earnings compared to historical norms, which could impact future return potential. The critical consideration is whether fundamental economic and corporate conditions support these valuations, unlike the situations in 2000 or 2008. Current indicators show continued economic growth, robust employment, and strong earnings among market leaders.

High valuations suggest a strategic approach focused on diversification rather than market avoidance. This might include exposure across various market segments beyond technology, incorporating different investment styles and uncorrelated assets. The objective is to construct a portfolio that aligns with individual investment goals and risk tolerance.

The bottom line? While markets have experienced early-year volatility, maintaining a well-diversified, long-term focused investment approach remains prudent. A balanced portfolio strategy can help navigate short-term uncertainty while supporting enduring financial objectives.

To schedule a 15 minute call, click here.

.