The federal debt has reached unprecedented levels, nearing $36 trillion according to Treasury data, sparking widespread discussion among market participants and economic experts. This represents a fourfold increase since the 2008 financial crisis, with continuous growth observed since 2001. These developments have intensified ongoing discussions about fiscal policy, including debates over deficit spending, debt limits, and government funding.

Following the recent election cycle, public discourse has moved toward cabinet selections and upcoming policy initiatives. Understanding the implications of this expanding debt burden and its complex economic effects has become increasingly vital for market participants.

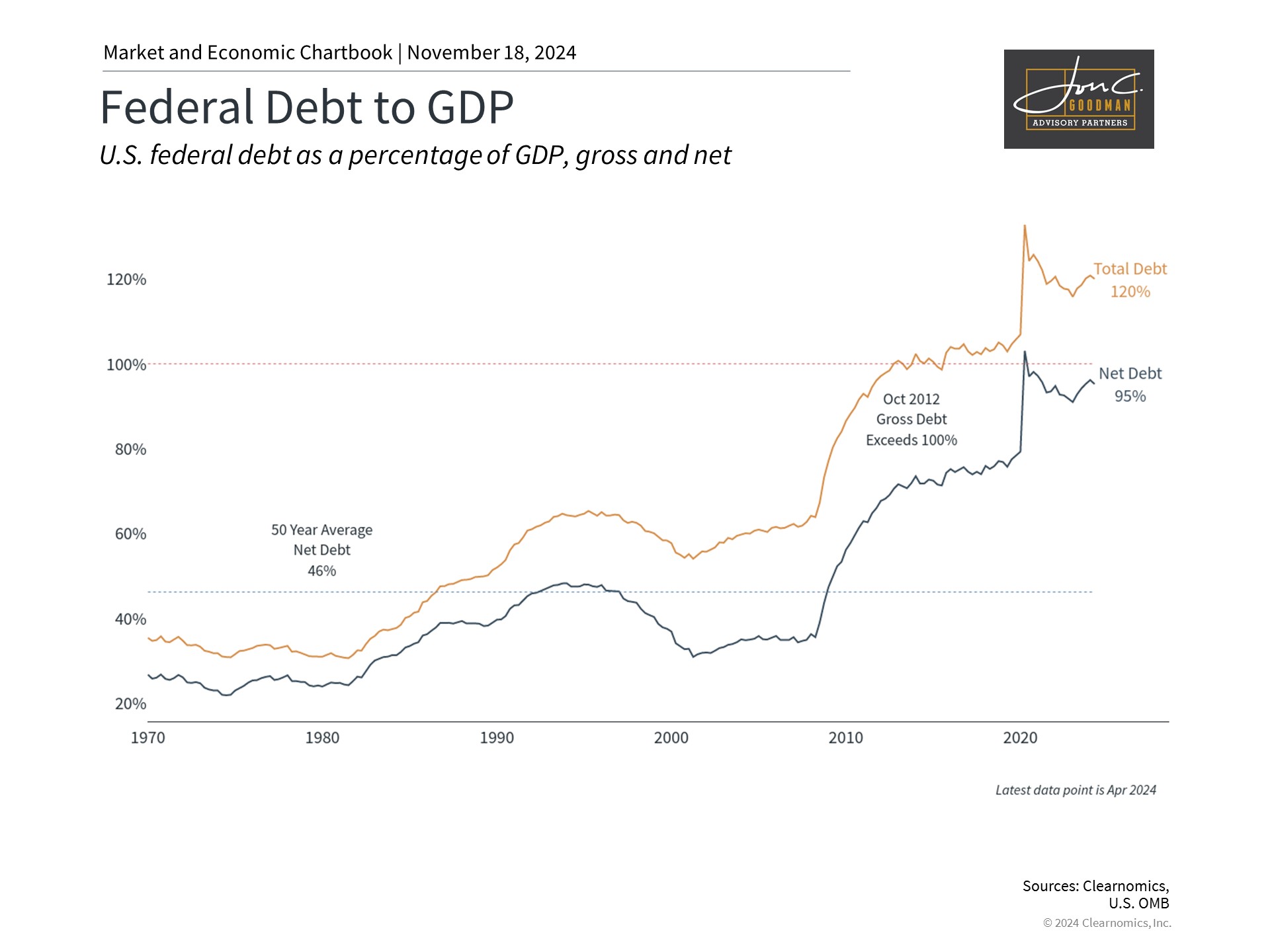

Federal debt expansion has accelerated since the financial crisis.

When analyzing the federal debt situation, it’s essential to separate our roles as citizens and investors. While many hold strong views about fiscal policies and their generational implications, these considerations differ from market-related concerns. The debt ceiling discussion will likely resurface as a critical issue when limitations are reinstated in January 2025.

The relationship between federal debt and market performance requires careful analysis. Despite debt concerns, financial markets have demonstrated resilience across multiple economic cycles. Long-term investment strategies shouldn’t be derailed by reactions to fiscal developments.

Comparing debt levels to economic output provides more meaningful context than absolute figures. While debt has grown considerably, the economy has also expanded twofold since 2008. The current debt-to-GDP ratio stands at 120%, though excluding intragovernmental holdings reduces this to 95%. The recent increase largely reflects pandemic-related stimulus measures.

The sustainable debt threshold remains uncertain. Japan’s experience with debt exceeding 250% of GDP offers limited comparative value due to its unique characteristics, including higher household savings rates. The U.S. maintains distinct advantages through its demographic profile, economic diversity, and the dollar’s global reserve status.

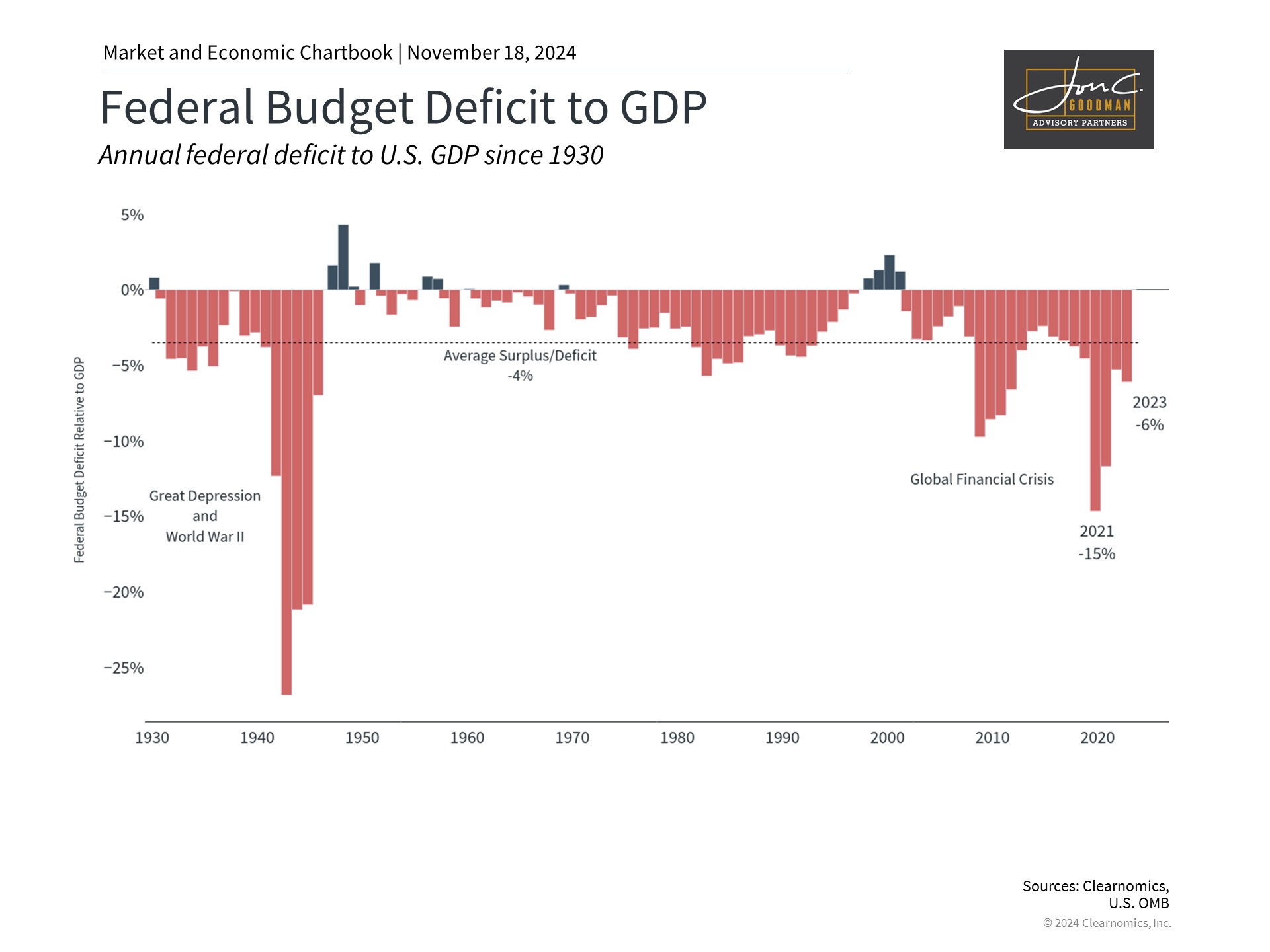

Annual budget shortfalls continue to expand total federal obligations.

The rapid debt accumulation stems from persistent budget imbalances. These deficits emerge when expenditures exceed tax revenues, including individual, corporate, and social insurance contributions. Additional revenue sources like tariffs represent minimal portions of total intake, typically below 2% annually.

Despite natural revenue growth from economic expansion, government spending has consistently outpaced income. Expenditure growth spans both mandatory programs and discretionary spending categories.

The government bridges funding gaps through Treasury security issuance, effectively borrowing from investors, institutions, and foreign entities.

Current deficits around 6% of GDP, while substantial, align with historical patterns during economic challenges and conflicts. Historical trends suggest deficit improvements during economic stability, though complete elimination remains rare.

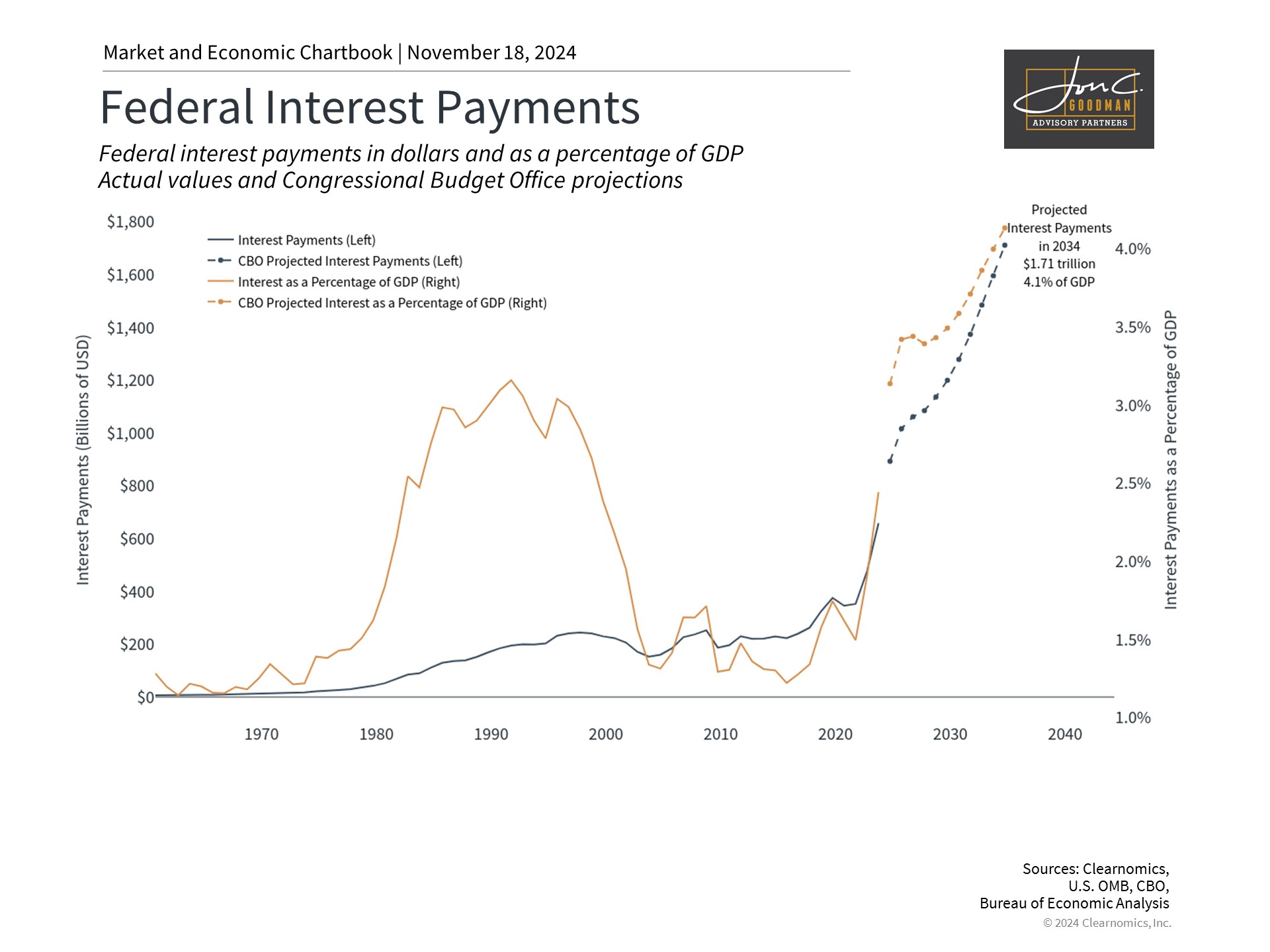

Interest expenses create growing pressure on federal finances.

Deficit spending persists without significant political attention from either major party. The last balanced budgets occurred during the Clinton era, following a previous instance under Nixon. Projections indicate annual interest payments could reach $1.71 trillion within a decade.

Approximately two-thirds of federal debt is domestically held, with China’s share declining to 2.2%. Some worry about future Treasury market dynamics and potential implications for interest rates and dollar dominance.

Despite these concerns, which have persisted for decades, global markets continue to view U.S. securities as premier safe-haven assets. This was evident during the 2011 debt downgrade when Treasury demand actually increased.

Markets have historically demonstrated resilience regardless of debt levels or tax policies. Paradoxically, periods of highest deficits have often presented attractive investment opportunities, coinciding with crisis-driven fiscal responses.

The bottom line? While federal debt remains a significant national issue, investors should maintain perspective and avoid letting fiscal concerns override sound investment principles.