Oil prices are a significant factor in the global economy, directly affecting gasoline prices and indirectly influencing the cost of goods and services. Additionally, oil prices have been a key determinant in shaping global market trends and inflation over recent years. The interplay between oil prices and economic health is reciprocal: low or stable oil prices can boost economic activity, while economic growth can lead to higher oil demand, and the reverse is also true.

Oil is sensitive to geopolitics and economic growth.

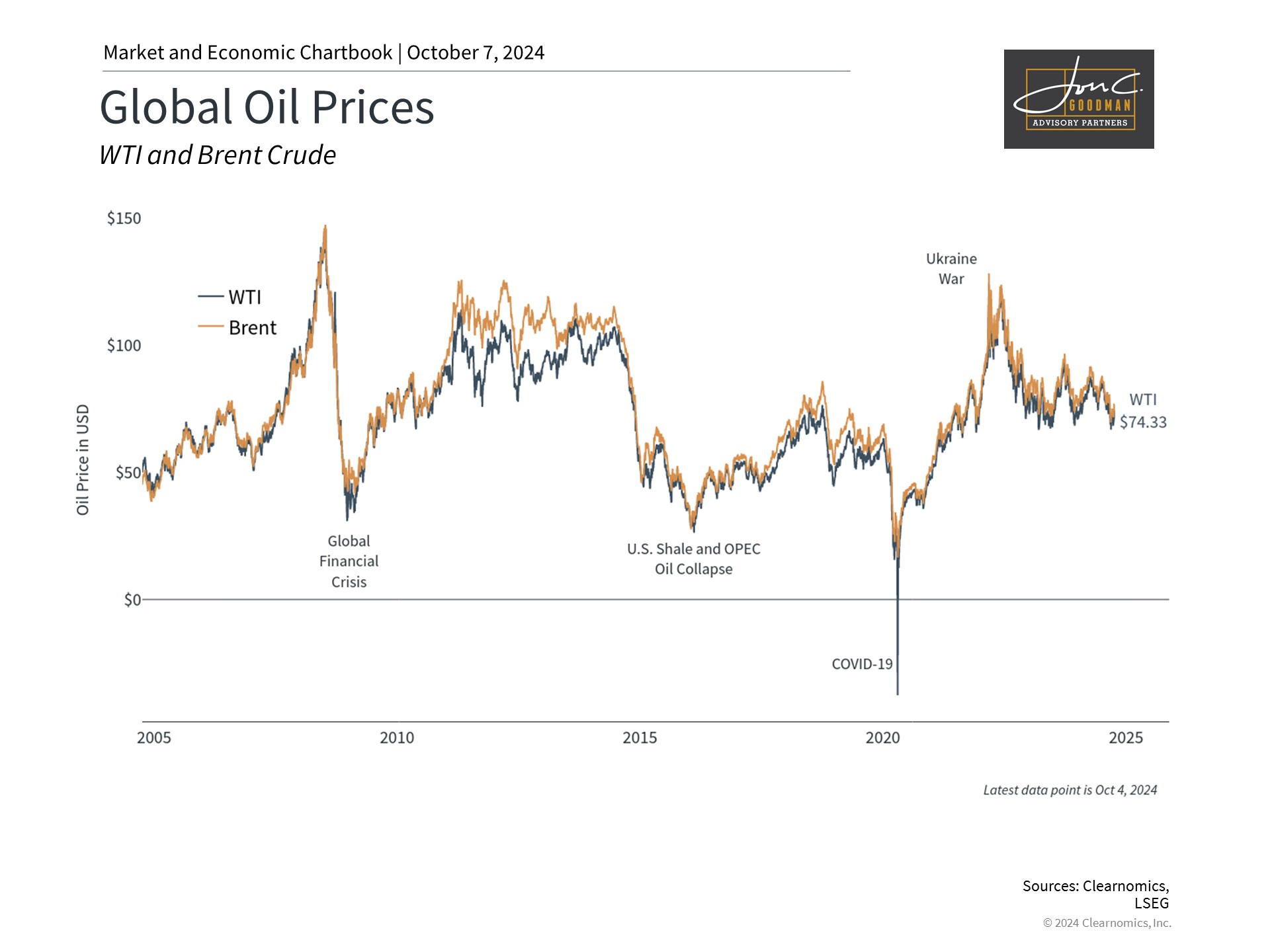

While oil prices have decreased from their peak in 2022, they have recently risen due to increased geopolitical tensions and potential risks to the oil supply. The intensifying conflict in the Middle East, which escalated a year ago with an attack by Hamas on Israel on October 7, raises concerns and has significant humanitarian implications. Investors, while recognizing the human aspect of the conflict, might be curious about how oil price trends could affect their portfolios and the broader economy in the upcoming months.

Brent crude oil prices, the international benchmark, surged to $78 per barrel because of the conflict between Israel and Hezbollah/Iran. This is a 13% increase from the recent low of $69 per barrel a month earlier, yet oil prices remain approximately stable year-on-year and are significantly lower than the 2022 high of nearly $128. Oil prices are known for their volatility and unpredictability, and although there were concerns that the Middle East conflict might cause prices to soar above $100 per barrel, this has not happened yet.

Traditionally, oil prices are swayed by geopolitics and economic growth. Conflicts can lead to price surges, as seen when Russia invaded Ukraine, but persistent rises in oil prices are usually due to increased demand from strong economic growth. For example, the high oil prices in the mid-2000s were driven by rapid global expansion before the 2008 housing crash and the subsequent global financial crisis. Therefore, geopolitics and economic growth typically influence supply and demand, respectively, which in turn affects the duration of high prices and their consequent impact.

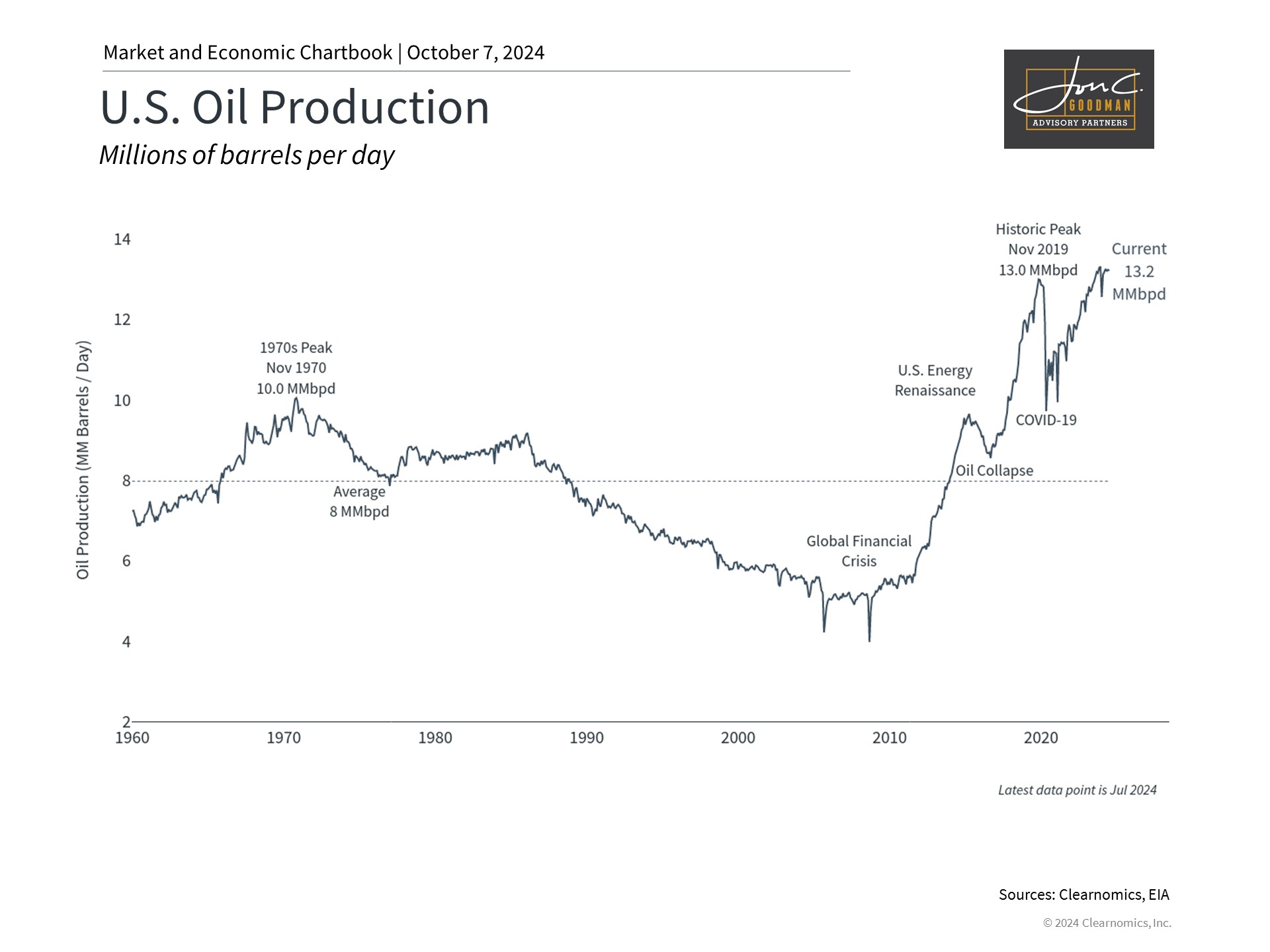

The U.S. is the world’s largest producer of oil and gas.

The distinction between supply- and demand-driven shocks is significant because oil producers can adjust to fluctuating prices. The U.S., unlike in the mid-2000s, has become the world’s top crude oil producer. Technological advancements in exploration and drilling have boosted output, enabling the industry to sustain high productivity levels. The Energy Information Administration notes that these advancements are crucial for the continued growth of U.S. oil production, which now surpasses 13.2 million barrels per day.

Theoretically, this positions the U.S. as a “swing producer,” capable of increasing supply when oil prices rise. However, this view is somewhat simplistic, considering the U.S. still depends on foreign imports due to the specific types of crude oil required by refineries and the influence of various energy policies. Nevertheless, this capacity provides some protection for the U.S. against geopolitical issues and may lessen the effects of oil shocks.

Looking ahead, the International Energy Agency forecasts that global oil production will exceed demand in the coming years. This projection is partly based on U.S. production, but also on the evolving dynamics within OPEC+. The consortium has prolonged production cuts until 2025 to support higher oil prices, despite strong incentives for member countries to break these agreements in pursuit of greater market share. This tendency has diminished the cartel’s influence over the last ten years.

Despite the increasing adoption of renewable energy sources, the world’s dependence on oil persists, making it a conduit for geopolitical tensions to impact the global economy. A significant rise in oil prices could pose a challenge to economic growth and the Federal Reserve’s desired “soft landing.” However, various factors may reduce the likelihood of this compared to previous times.

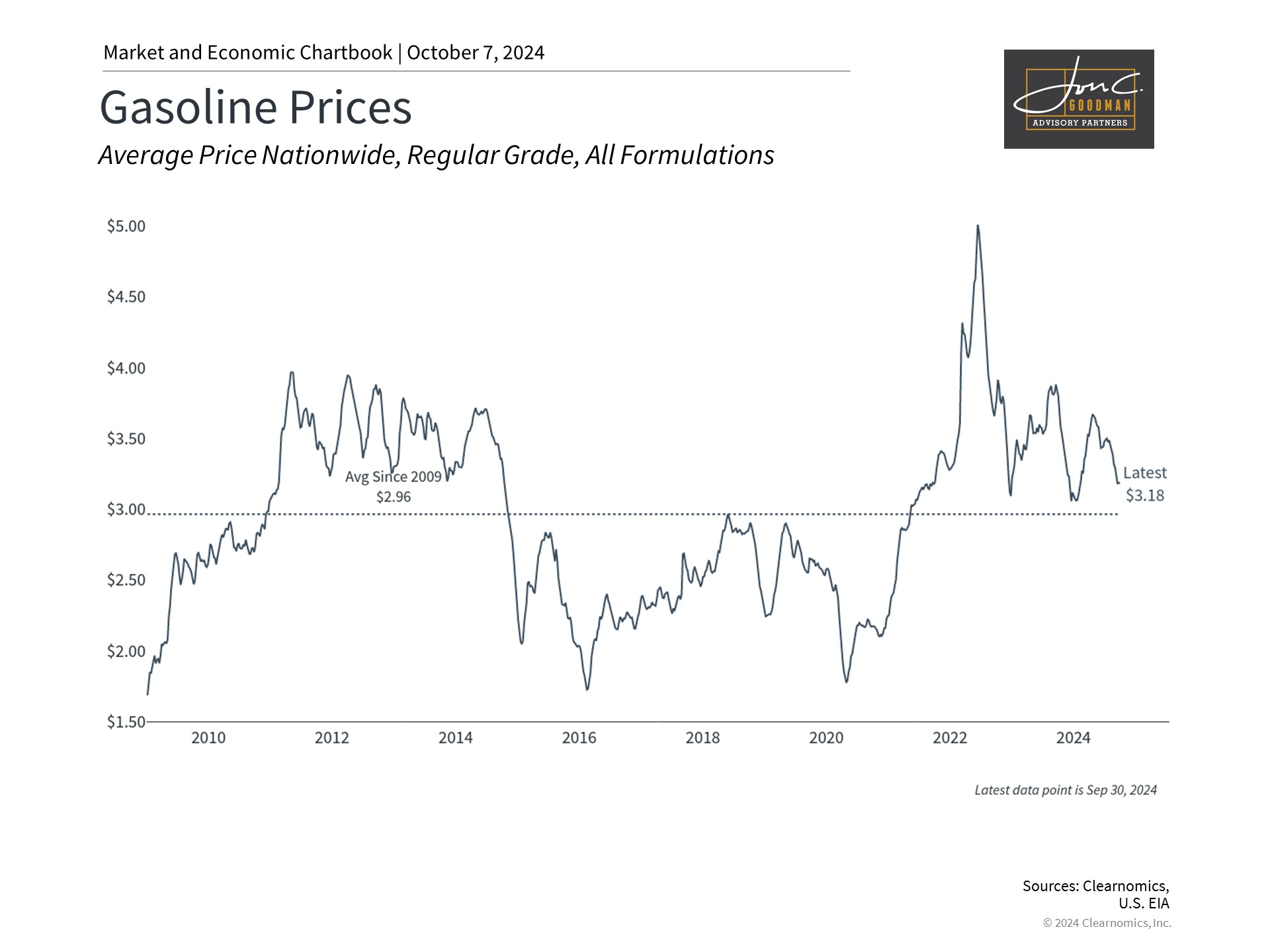

Gasoline prices remain relatively low.

The most significant impact of rising oil prices on consumers is often felt through increased gasoline prices at the pump. Thankfully, current gasoline prices are significantly lower than their peak in 2022, when the average price for a gallon of regular unleaded hit $5. This prompted the Department of Energy to release oil from the Strategic Petroleum Reserve (SPR), a government-maintained emergency crude supply. Since that time, the government has been replenishing the SPR at more favorable prices.

Elevated gasoline prices act as an informal tax on households and consumers, as commuting, schooling, and grocery shopping are essential activities. These higher prices also diminish disposable income for other expenditures, particularly larger discretionary purchases, potentially affecting retail sales and corporate profits.

From an investment standpoint, managing the volatility of oil prices is complex, particularly when driven by uncertain or concerning geopolitical events. The energy sector’s performance in times of market volatility is indicative: in 2022, while the broader S&P 500 index fell by 18% with most sectors in decline, the energy sector saw an impressive 66% gain, following a 55% increase in 2021 when the economy rebounded post-pandemic.

Although past performance is not indicative of future outcomes, a diversified portfolio encompassing various sectors, such as energy, can assist investors in mitigating the volatility associated with escalating oil prices. Over time, possessing a resilient portfolio capable of enduring market fluctuations enables investors to concentrate on their long-term financial objectives.

Ultimately, despite the increase in oil prices owing to tensions in the Middle East, they are still significantly lower than their previous highs. While oil prices can influence economic expansion, investors ought to maintain a wide-ranging sector exposure within their portfolios and refrain from making hasty decisions based on daily news.

To schedule a 15 minute call, click here.

.