From President Biden’s announcement that he will not be seeking re-election, to a rotation out of tech stocks and into small caps, recent events have added to market uncertainty. The S&P 500 recently declined 2.9% from its all-time high, while the Nasdaq pulled back nearly 5%. It’s natural for investors to be concerned about where the market is headed, especially as the presidential election season heats up and the Fed prepares for its first rate cut this cycle. However, history shows that it’s important for investors to stay focused on the long run and not overreact to every news headline. More than ever, staying levelheaded is the best way to achieve long-term financial goals.

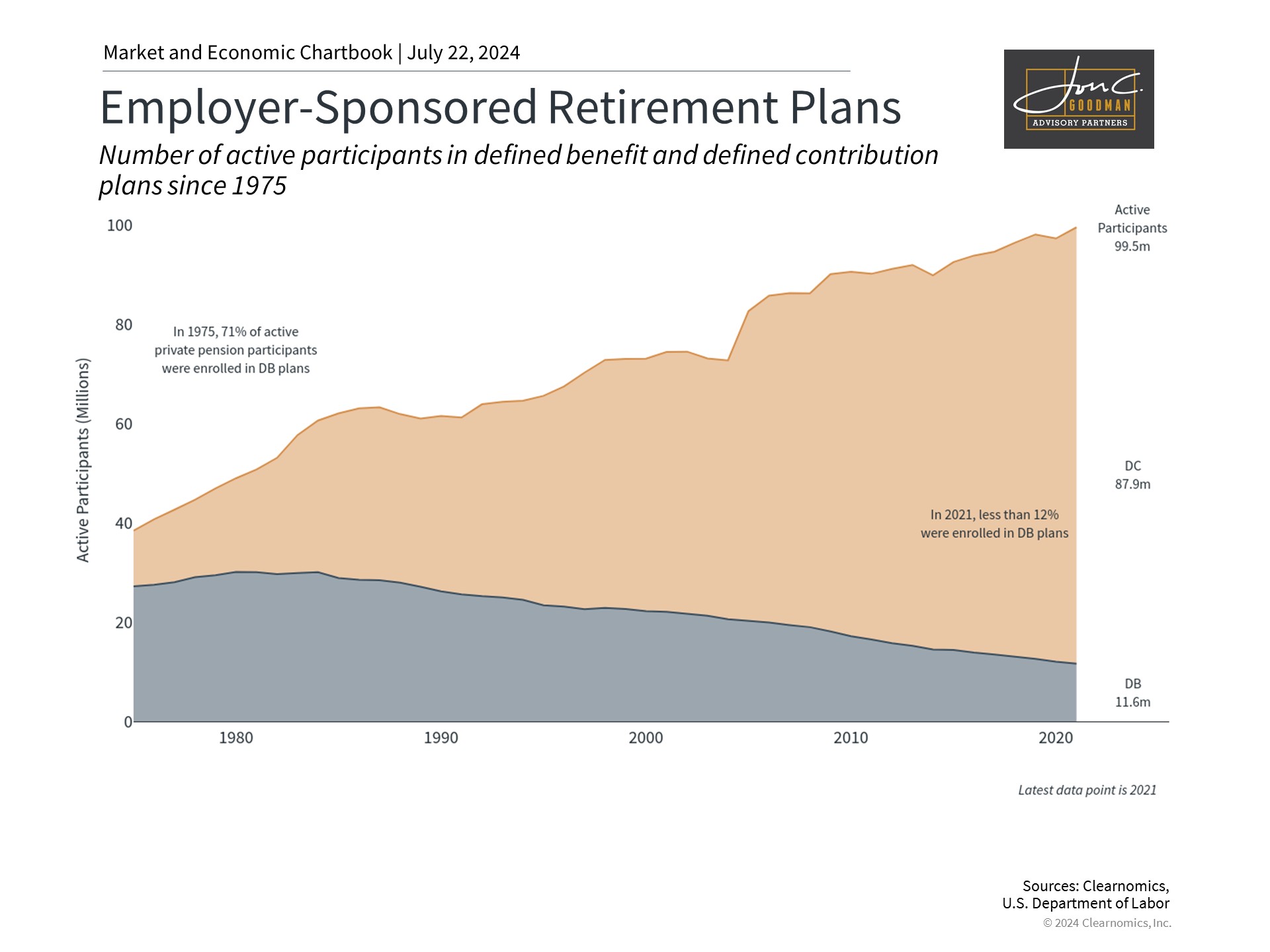

Investors are increasingly responsible for their own retirements.

In the last half-century, the responsibility of retirement planning has moved from corporations and governments to individuals. Navigating the complex array of investment options, tax implications, portfolio construction, and market volatility can be daunting, even for savvy investors. This complexity underscores the importance of seeking professional financial advice to stay on course toward achieving one’s financial objectives. Indeed, most firms employ financial advisors to establish and oversee their company-sponsored retirement programs.

The retirement landscape has undergone significant changes. Initially, the American Express Company set a precedent in 1875 by introducing the first pension plan, sparking a trend of employer-provided retirement benefits. For many years, these were predominantly “defined benefit” plans, where employers contributed to a pension fund, and employees received a predetermined amount upon retirement, ensuring a steady income for eligible retirees.

When considering retirement income, government programs like Social Security often come to mind. Established in 1935 during the Great Depression, Social Security provided income to workers at age 65, establishing the concept of a retirement age and offering a financial safety net for the elderly.

However, changing demographics and increased longevity have challenged the sustainability of Social Security. The Trustees of the Social Security and Medicare trust funds report that, without congressional action, Social Security reserves may run out by 2035, with only enough income to pay 83% of promised benefits. This underscores the longstanding reality that individuals cannot rely solely on Social Security for their retirement.

Investors must determine the most appropriate asset allocation for their goals.

Today, most individuals start their investment journey with their company’s defined contribution plans, like 401(k)s or 403(b)s. The main difference is that participants in defined contribution plans must choose and manage their investments themselves. Consequently, their retirement benefits come solely from their savings and investments, unlike with traditional defined benefit pension plans. This holds true for other self-opened retirement vehicles, such as IRAs.

With the significant shift over the last fifty years, individuals now carry the full responsibility of investing wisely. Hence, it’s crucial for everyone to grasp the fundamental principles of investing, particularly since these are not commonly taught in schools.

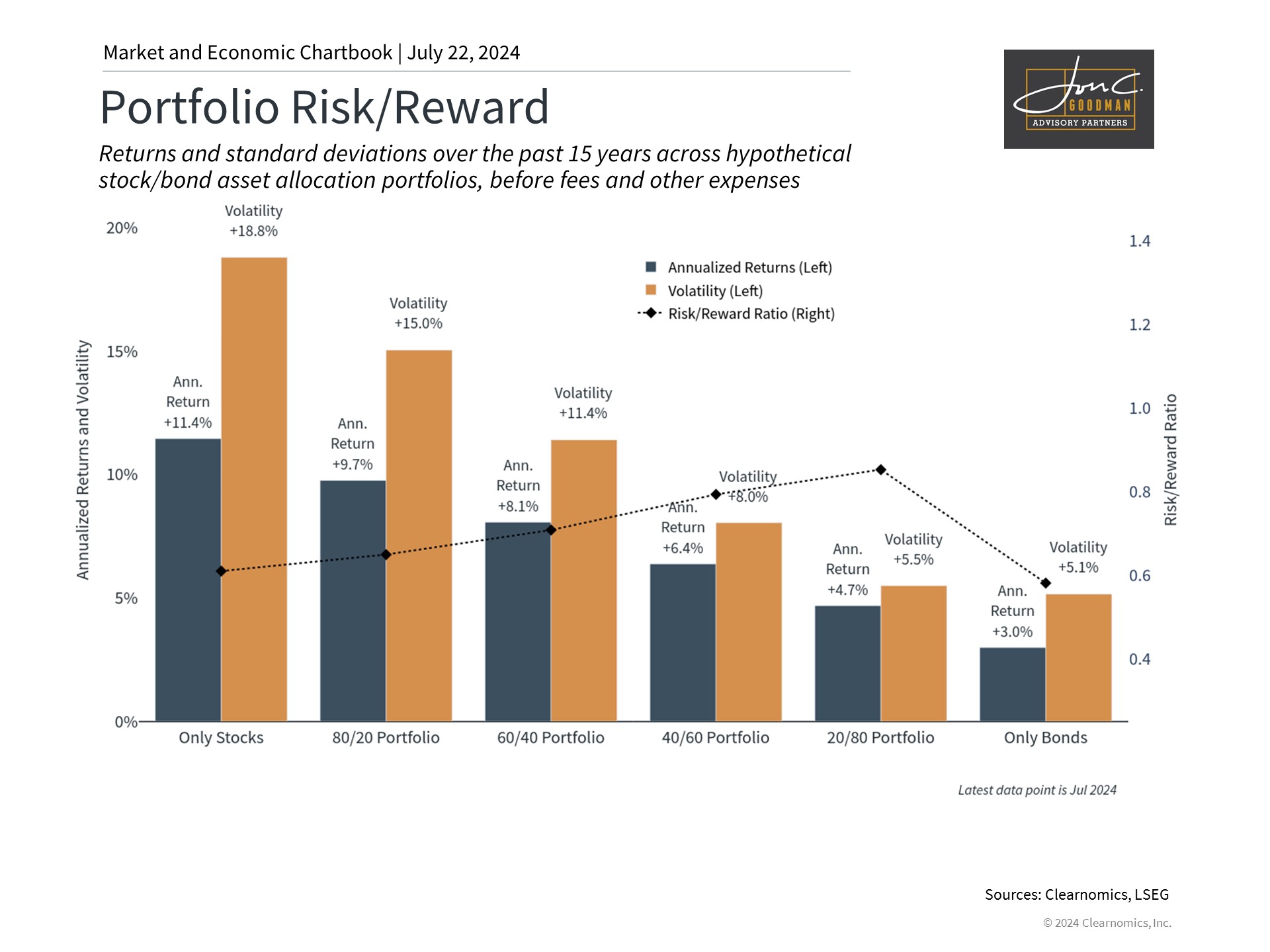

Firstly, investors should maintain a well-structured portfolio that aligns with their unique needs, factoring in their life stage, risk tolerance, and other considerations. In the short term, selecting the appropriate asset mix can assist investors in navigating the frequent market fluctuations, such as the pullbacks experienced this year.

For instance, stocks often yield higher returns but carry greater risk, as illustrated in the accompanying chart. Conversely, bonds are generally more stable but offer lower potential for growth. Proper asset allocation enables investors to benefit from the strengths of both asset classes, resulting in a portfolio that exceeds the sum of its parts. Investors can modify this allocation over their lifetime and as they near retirement, as well as make tactical and strategic adjustments in response to market conditions.

Starting early and staying invested are critical for retirement.

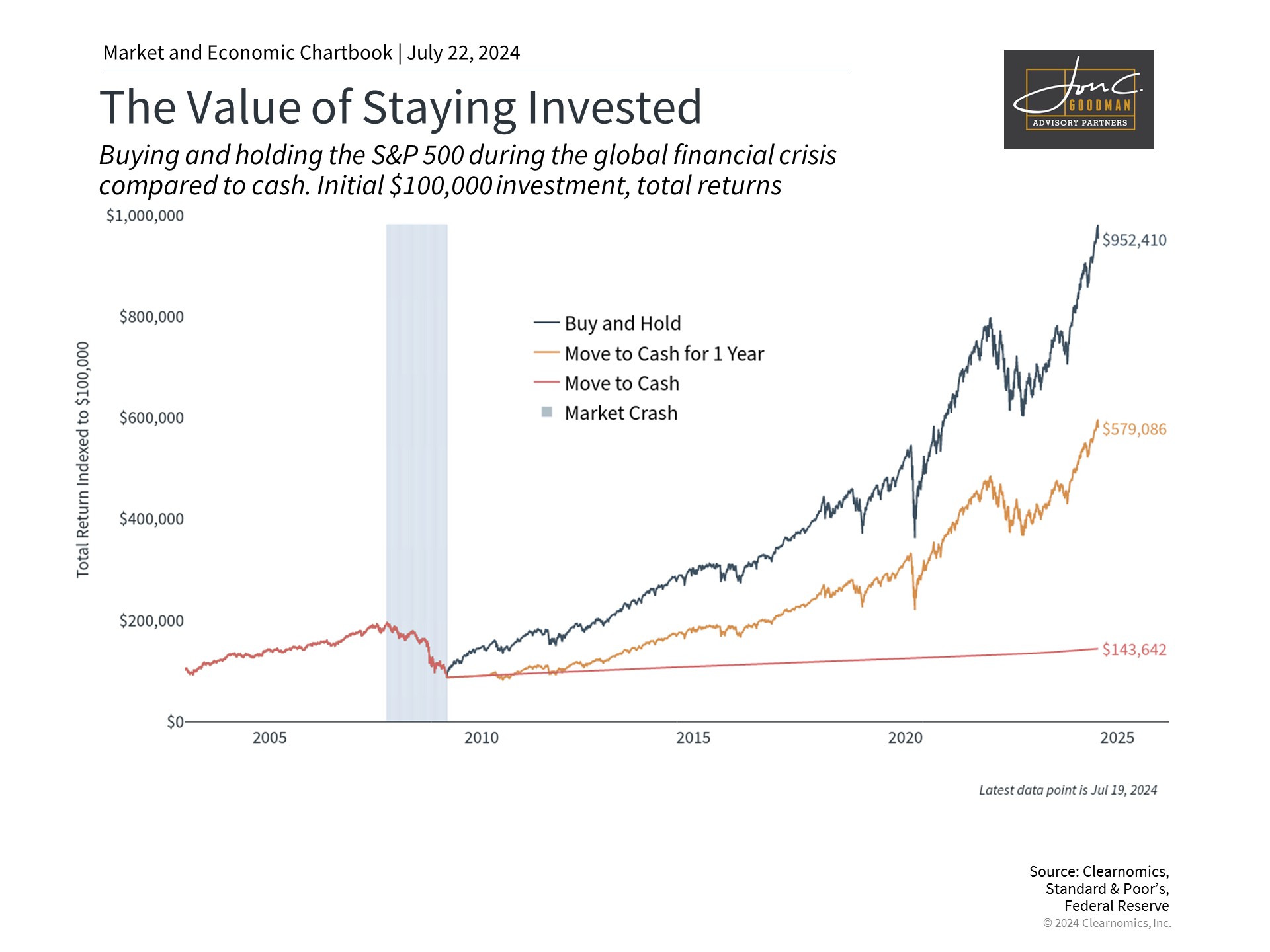

Secondly, starting to save early can assist investors in accumulating wealth through the power of compounding interest. The sooner one starts to invest, the longer their money has to grow before they need to make withdrawals. This holds true even in times of market volatility, as seen in recent years. Although avoiding the market or holding cash in a checking account might seem safer, the real cost is the missed potential earnings that could contribute to a more secure retirement.

Lastly, it is crucial to concentrate on the long-term perspective rather than short-term market movements. Beginning investments early and maintaining them throughout market cycles is the most effective strategy for reaching financial objectives. Attempting to predict market timing or making abrupt portfolio adjustments is not just challenging but also detrimental, as it can divert investors from their primary goals.

The bottom line is that the current retirement environment necessitates that individuals be proactive in managing their financial future. Despite the challenges, this also presents opportunities for investors to customize their retirement strategies to meet their unique needs.

To schedule a 15 minute call, click here.