College decisions often mark a celebratory milestone for many families. Yet, they also signify one of the most significant financial commitments, comparable to retirement or home ownership. The current economic climate, characterized by high interest rates, uncertain Federal Reserve rate cuts, persistent inflation, and stock market fluctuations, exacerbates these financial pressures. Such economic conditions inevitably lead to concerns regarding college planning. Investors and their families must contemplate long-term perspectives as they navigate these crucial financial and life choices.

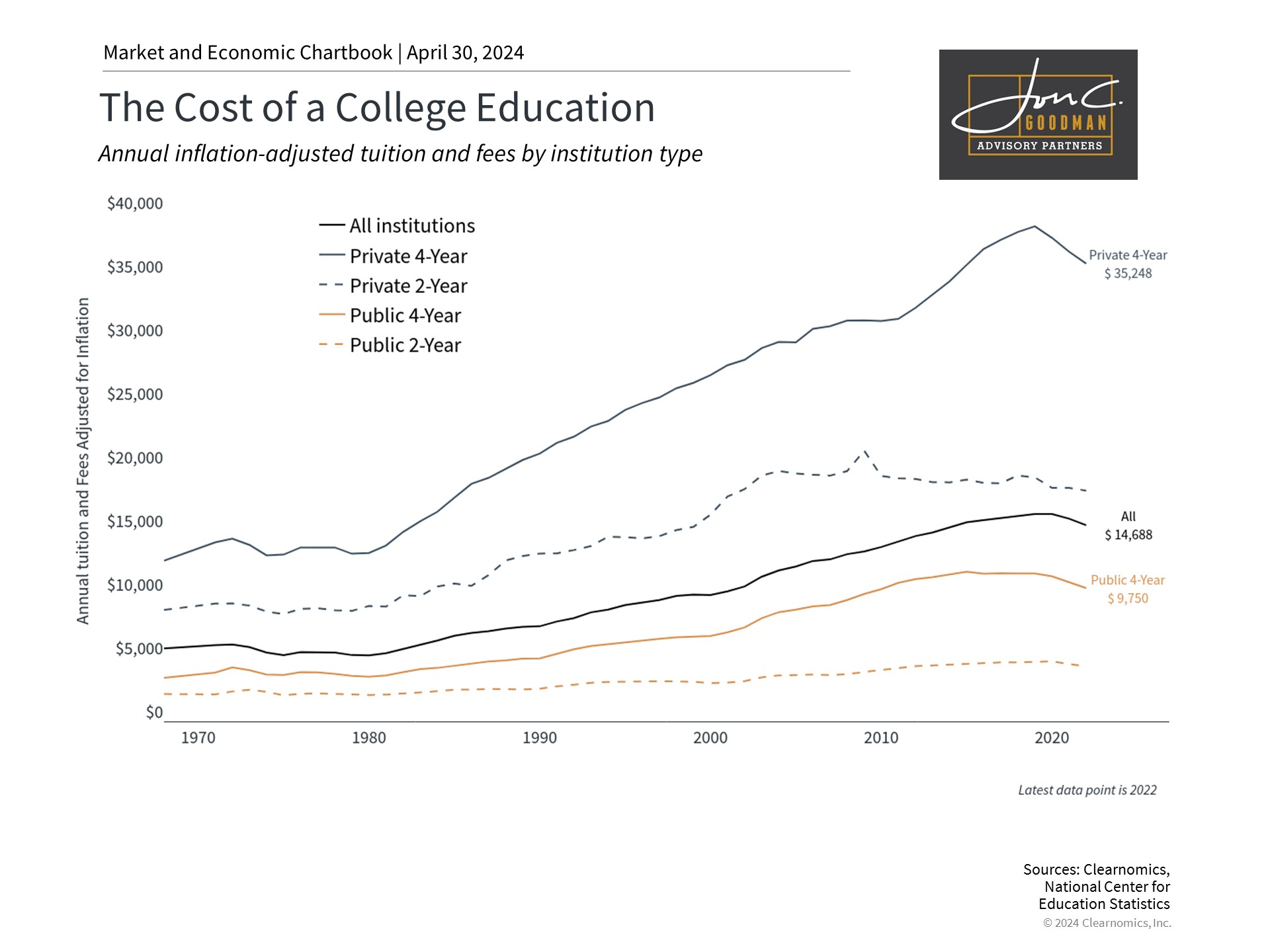

College costs have outpaced inflation.

The cost of college has significantly surpassed inflation rates over the past forty years. The chart, reflecting the average tuition and fees adjusted for inflation, shows that these increases exceed the general rate of inflation, according to the National Center for Education Statistics. For example, in the 2022-2023 academic year, the average tuition and fees were $35,248 at private four-year colleges and $9,750 at public universities.

Tuition costs vary widely between institutions. Beyond tuition and fees, students and their families must also consider other expenses like room and board, which typically exceed $13,000 per year. At the most expensive colleges, the total annual cost of attendance can approach $85,000, totaling over $340,000 across four years. While two-year colleges have not seen as steep an increase, their costs have still risen beyond the inflation rate. This steady rise in costs is fueling increasing disillusionment with the value of higher education.

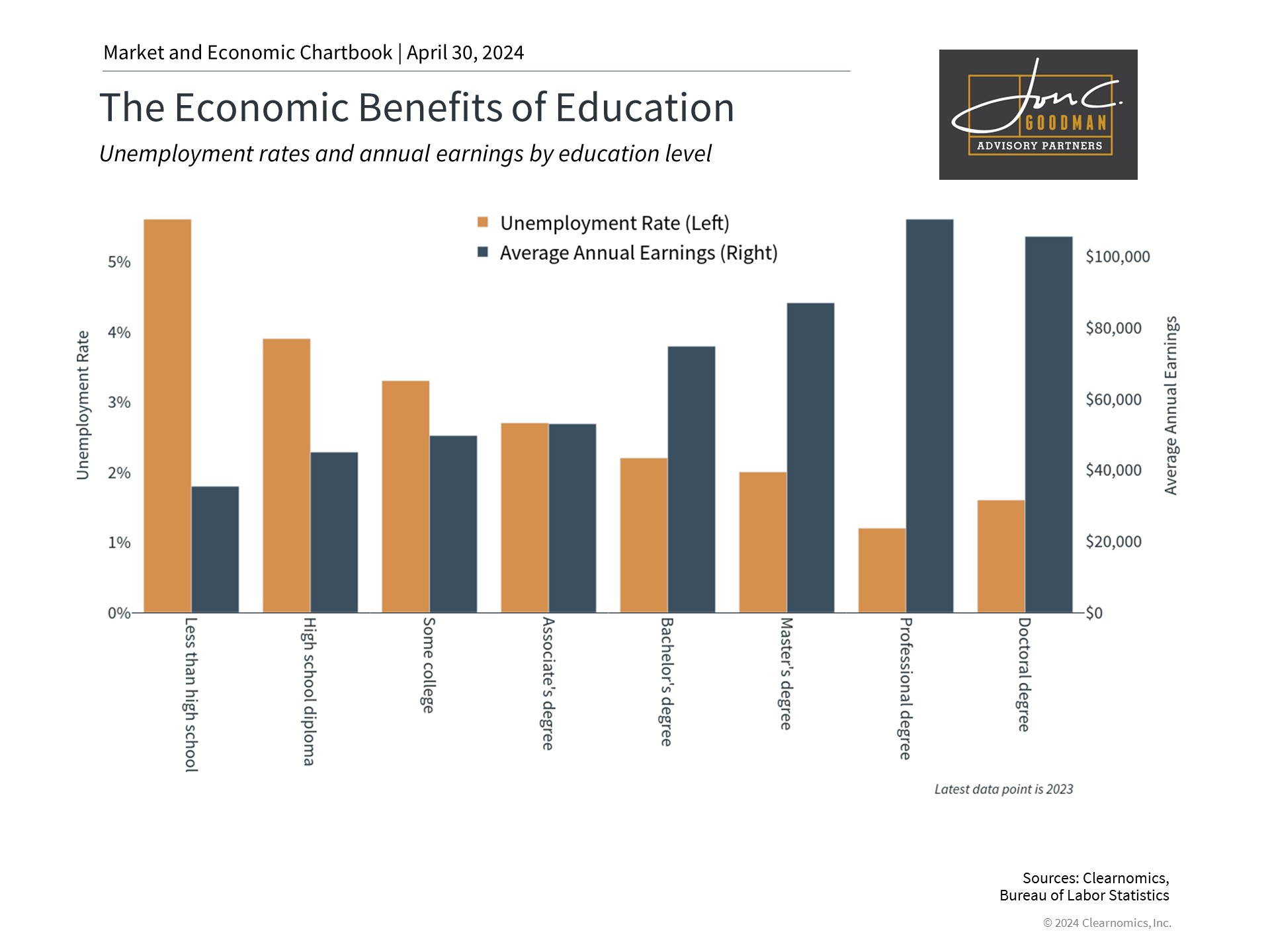

Higher education is still valuable.

Despite increasing expenses, it is evident that college graduates, on average, have higher earnings and greater employment prospects than individuals with less education. Data from the Bureau of Labor Statistics reveal that in 2023, the unemployment rate for individuals with a college degree stood at merely 2.2%, in contrast to 3.9% for those who only held a high school diploma. Furthermore, the median yearly income for college graduates was $74,650, which is considerably more than the $44,950 median for those with just a high school diploma.

The trend persists with higher levels of education, encompassing master’s, professional, and doctoral degrees. These statistics are a key factor in why many view college as the optimal route to financial prosperity. However, it’s important to note that these figures represent general trends and do not account for personal situations, such as opportunity costs and the selection of a college major.

For instance, economic theory posits that the current low unemployment rates and wage increases could render the opportunity cost of a four-year college degree less appealing in comparison to acquiring work experience, on-the-job training, or education from two-year colleges or trade schools. Conversely, during economic recessions, when opportunity costs diminish, there tends to be a rise in applications and enrollments in college and professional degree programs like business, medical, and law schools.

The aggregate student loan debt in the United States, now surpassing $1.6 trillion as reported by the NY Fed’s Consumer Credit Panel, remains a pressing concern for investors and economists. It has escalated into a contentious issue nationwide, including in Washington. The White House has recently unveiled a plan to absolve the student loan debt of 30 million Americans, with executive actions already sanctioning $146 billion in debt relief. Considering the magnitude of this predicament, the discourse surrounding higher education and student loans is poised to persist as a polarizing topic in politics.

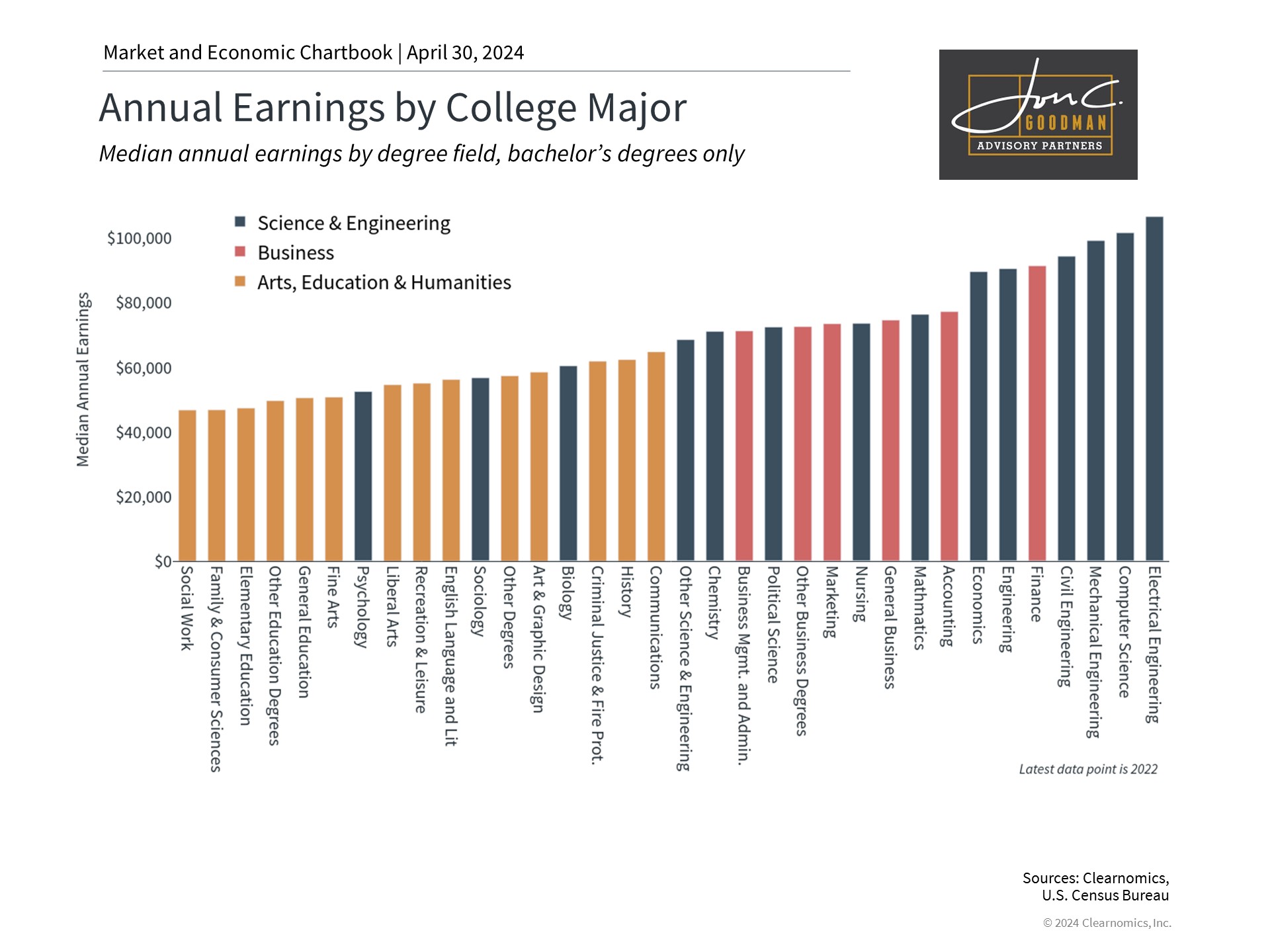

Earnings vary greatly by college major.

The capacity to repay student loans significantly differs among individuals, depending on their college major. The provided chart illustrates the average earnings for holders of a bachelor’s degree. As expected, degrees in science, engineering, and business typically yield the highest annual income, in contrast to those in the arts, education, and humanities. These statistics represent the average earnings of all professionals within each field, not solely recent graduates, reflecting the long-term earning prospects associated with each major.

For instance, a graduate with a degree in social work typically earns less than $50,000, whereas one with a degree in electrical engineering often earns above $100,000. Therefore, the choice of college major and subsequent job prospects should be key considerations when deciding to take out loans for higher education. Opting for a field with a higher earning potential throughout one’s career may alleviate the financial strain associated with student loans.

Indeed, while financial considerations are significant, they are not the sole factor in the pursuit of higher education. Engaging in one’s passions and attaining personal satisfaction are equally crucial, despite being more challenging to measure and quantify.

In conclusion, despite the significant increase in college costs over the past few decades, the financial advantages of higher education persist. Deciding whether to attend college, choosing a program type, and selecting a major are all personal decisions that require careful consideration.

To schedule a 15 minute call, click here.