The stock market has grown increasingly volatile, with the S&P 500 seeing its first 5% pullback of the year. Factors such as the potential postponement of the Federal Reserve’s initial rate cut, downturns in technology and artificial intelligence stocks, and Middle Eastern tensions have all played a role in the market’s downturn. In such unpredictable market conditions, it’s crucial for investors to recall that short-term market dips are an inherent aspect of investing. Instead of tracking daily market fluctuations, investors should consider which perspectives will help them remain focused on the long-term objectives.

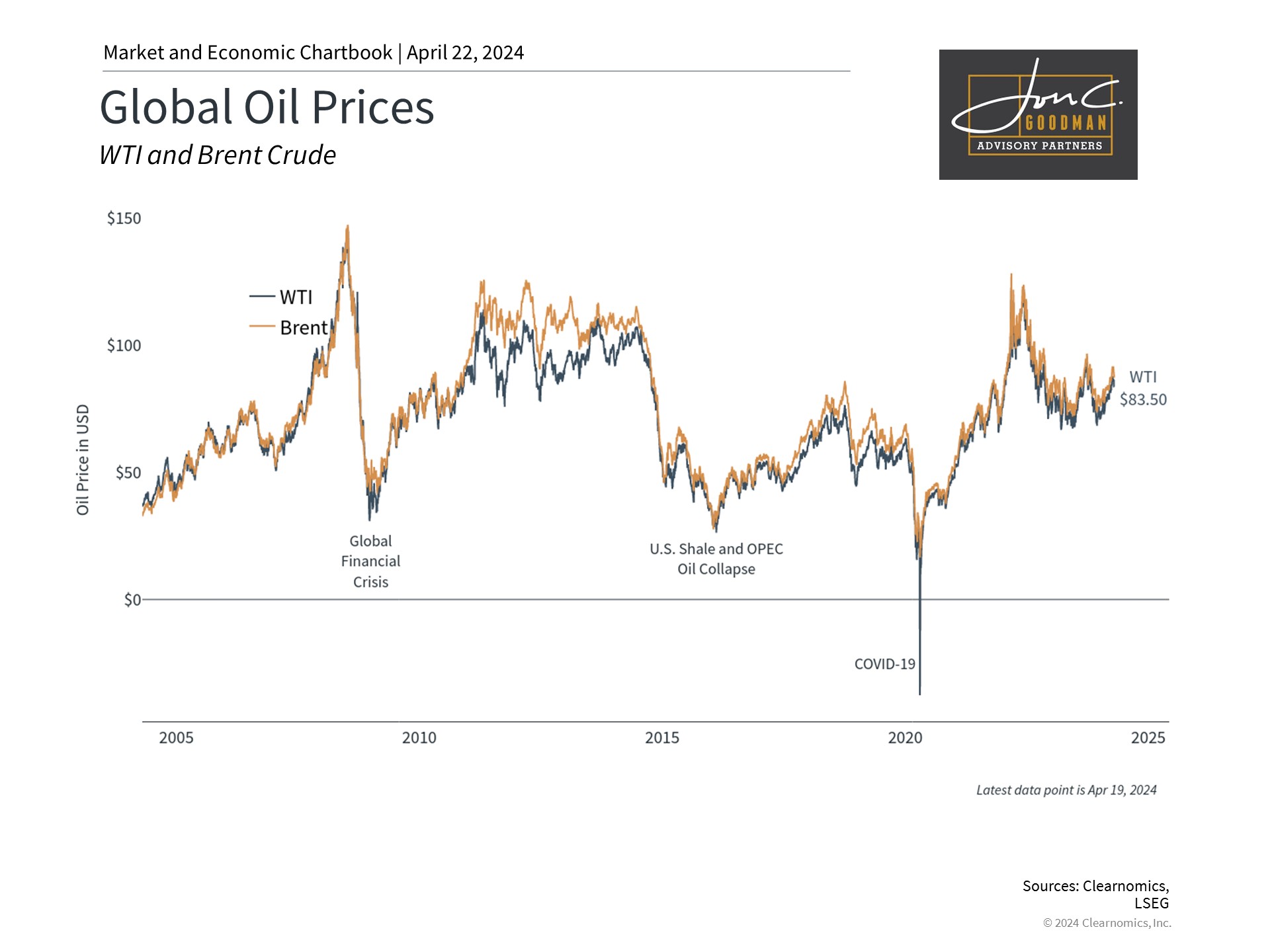

Oil prices have risen but remain below their historic peaks.

Among the numerous factors influencing markets today, the potential impact of geopolitical conflicts on oil prices stands out as particularly uncertain. The world remains heavily reliant on oil, with an estimated global demand of 102 million barrels per day in 2023, as reported by the International Energy Agency. Consequently, oil serves as a conduit for geopolitical instability to affect the global economy, as conflicts can interrupt oil production and supply chains, resulting in increased prices. Notably, in the current economic climate, escalating oil prices contribute to rising inflation, which affects consumers, influences the Federal Reserve’s decision-making, and alters interest rates.

For example, Russia’s invasion of Ukraine in early 2022 led to a spike in oil prices to over $127 a barrel. This is an important reason headline inflation, including the Consumer Price Index (CPI), jumped to four-decade highs a few months later. Gasoline prices at the pump rose to $5 on average across the country, hurting consumer sentiment and leading to fears of a recession. Oil prices did eventually settle and have been relatively calm in recent weeks amid rising tensions between Israel and Iran as well as shipping disruptions in the Red Sea.

Still, oil prices are about 8% higher this year with Brent crude and WTI recently trading around $87 and $83 per barrel, respectively. This pushed the energy component of CPI higher in February and March, propping up overall inflation. While economists tend to focus on core CPI which excludes food and energy prices, it’s impossible to ignore the impact higher oil prices have on consumers and economic growth. Thus, oil remains a wildcard when it comes to monetary policy and the timing of the Fed’s first rate cut.

The U.S. is the largest producer of crude oil in the world.

Second, an important difference between today’s inflationary environment and that of the 1970s and early 1980s is that the U.S. is now the largest producer of both oil and gas in the world. The U.S. has produced more crude oil than any other nation over the past few years. Domestic oil production has fully rebounded from the pandemic and now exceeds 13 million barrels per day, more than Saudi Arabia, Russia, and other members of OPEC+. There have also been hopes that the U.S. would play the role of a “swing producer” to raise production when required by global supply and demand. In theory, greater energy independence is one reason the U.S. may be more insulated from global events than in the past.

That said, the U.S. is still dependent on oil imports for a variety of reasons, including the type and quality of crude oil. Although the U.S. theoretically produces enough oil to meet its energy needs, overseas oil is often cheaper than domestically-produced crude due to a variety of other factors. In recent years, Canada, Mexico, and Saudi Arabia have been the largest sources of U.S. imports of foreign oil. U.S. imports from OPEC countries have declined to just 15% from a peak of over 70% of U.S. crude oil and petroleum imports in the late 1970s. However, since oil is a global commodity, price swings still impact U.S. producers and consumers despite strong U.S. oil production and strong trading partners.

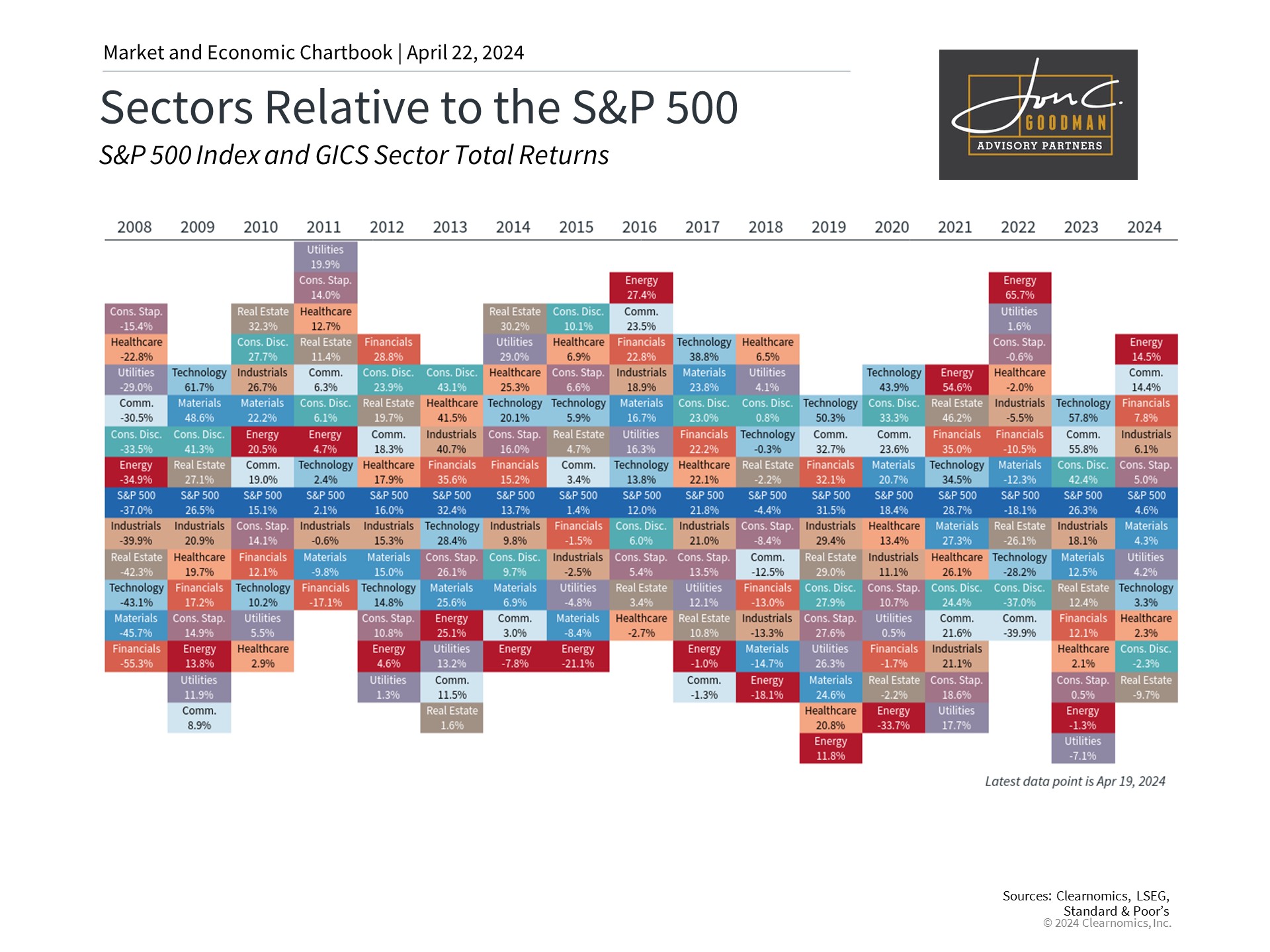

The energy sector has performed well this year.

Finally, from an investment perspective, the energy sector is a volatile but important component of a diversified portfolio. Interestingly, the sector has behaved quite differently from the rest of the market over the past several years. For example, during the 2022 bear market caused by inflation and recession fears, rising oil prices propelled the energy sector to a total return of 65.7%, adding to its significant gain in 2021. This was also a reversal of the trend that began in 2014 when the energy sector was among the worst performers most years due to overproduction and low oil prices.

This year, the energy sector has generated a total return of 14.5% and is now the best performing sector. While there is no guarantee that the energy sector will always perform well during periods of geopolitical uncertainty, it remains an important part of a balanced portfolio that can help investors to weather volatility and stay focused on long-term financial goals.

The bottom line? Geopolitical instability can drive up oil prices and spur inflation, muddying the economic and interest rate outlook. Investors should continue to stay invested and focused on long run trends.

To schedule a 15 minute call, click here.