Artificial intelligence stocks and the timing of the Federal Reserve’s initial rate reduction continue to propel markets. These factors not only influence daily market fluctuations but also signify broader trends in innovation, productivity, and economic health. Additionally, they stem from pandemic-era policies of easy money and fiscal stimuli that fueled tech sector booms and rapid price escalations. As we emerge from the inflationary period of recent years, investors must consider how to retain perspective within their portfolios.

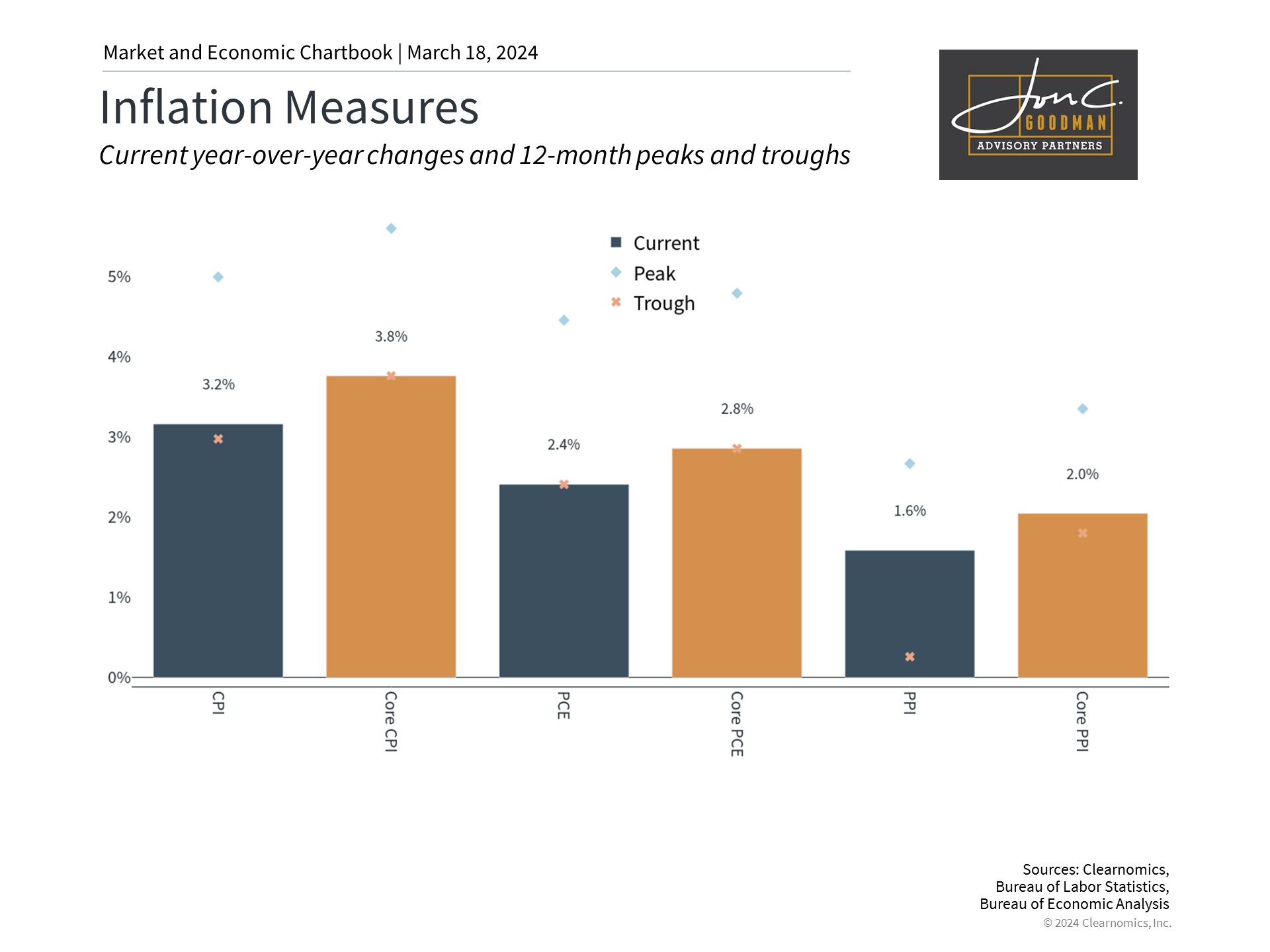

Inflation is improving, albeit at a slower pace.

While it is certain that economists and historians will spend the coming decade chronicling the myriad causes and policy decisions that led to the most severe inflation in four decades, it is evident that the various supply and demand shocks are subsiding. Some prices, such as those in the crucial category of shelter (that is, the costs of rent and mortgages), remain intractable, but most indicators have shown significant improvement. This lays the groundwork for the much-anticipated Federal Reserve rate reductions later this year.

The most recent Consumer Price Index report indicated a 3.2% increase in prices year-over-year for February, marking a minor rise from the previous month, primarily due to heightened energy costs. Similarly, energy prices significantly influenced the Producer Price Index, yet both the overall and core indices remain at or under 2%. The Core CPI was reported at 3.8%, but removing the housing component yields an annual growth rate of just 2.2%.

These indicators align with a gradual reversion of consumer price inflation towards 2%, although this transition will require time. Nonetheless, these numbers reflect an optimal scenario that investors could have only envisioned less than two years prior. However, the Federal Reserve has prudently refrained from prematurely claiming success. This caution is justified, considering that headline inflation is closely tied to volatile energy prices, which can be drastically affected by unpredictable global incidents, such as the conflict in Ukraine or the twin OPEC oil crises of the 1970s.

Despite numerous comparisons to the inflationary surges of the 1970s and early 1980s, today’s policy reactions and economic consequences are distinctly dissimilar. In the ’70s, the Federal Reserve frequently altered its course as it contended with “stagflation” — the notion that inflation could escalate even amid weak demand. Fortunately, likely due to thorough analysis by contemporary policymakers of that era, stagflation has been successfully circumvented in our current context.

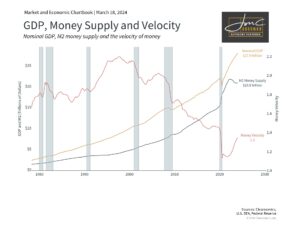

The money supply has stabilized.

For investors today, it is particularly relevant that the disinflationary period eventually gave rise to “the Great Moderation,” which began in the mid-1980s. This era was characterized by extended business cycles, controlled inflation, declining unemployment, and strong market performance. Although this is a singular historical instance, it implies that decreasing inflation and a shift towards normalized monetary policy will probably benefit both the economy and financial markets.

The money supply has been a point of concern for investors, echoing the renowned economist Milton Friedman’s assertion that “inflation is always and everywhere a monetary phenomenon,” meaning that it arises solely from a more rapid increase in money quantity than output. The validity of this perspective, known as “monetarism,” remains contested among economists. Nonetheless, the accompanying chart indicates a contraction in the money supply compared to its post-pandemic zenith. This contraction is indicative of the Federal Reserve’s monetary constriction efforts, which include reducing its balance sheet at an annual rate of approximately $1.1 trillion.

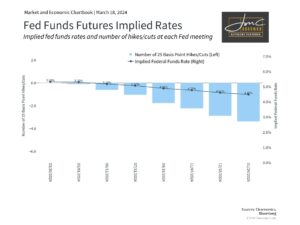

Market projections currently anticipate an initial rate reduction during the summer months.

Consequently, daily market fluctuations are influenced by evolving economic forecasts and expectations regarding Federal Reserve rate reductions. The recent market volatility stems from anticipations shifting towards an earlier rate cut in June or July, rather than March. For long-term investors, the exact timing of this cut—whether it happens now or in a few months—should be inconsequential within the larger historical framework. The essential factors are the ongoing improvement in inflation rates and consistent economic expansion. A reversion to standard monetary policy is also expected to aid in stabilizing interest rates, thereby fostering a more favorable financial market climate.

The essential takeaway is that investors ought to maintain their attention on overarching economic trends and historical context, rather than the daily fluctuations of individual stock performances.

To Schedule a 15 minute call, click here.