Greetings!

I hope you had a meaningful Memorial Day weekend and took a moment to honor those who have served, reminding us that, as the saying goes, “Freedom isn’t free.”

In fact, there’s a lot more that comes with a cost. In today’s Wealth Advisory, we’ll delve into a topic that is also far from free—the rising costs of healthcare in the United States. We’ll explore how incorporating a Health Savings Account (HSA) strategy into your financial plan can assist you and your family in preparing for and potentially alleviating these expenses.

Next, our Wellness Navigator, Christine Despres, will offer insights into managing various types of stress, providing valuable tools to help us cope.

Lastly, in the Etcetera section, we’ll have a bit of fun as we explore some delightful tidbits beyond wealth and wellness that are sure to brighten your day.

So, let’s dive in!

Wealth Advisory: Planning for Rising Healthcare Costs and the Role of HSAs

Healthcare expenses present one of retirement’s most daunting financial challenges, with costs continuing their relentless upward trajectory. Current projections suggest that a 65-year-old individual entering retirement today may face approximately $165,000 in healthcare expenditures over their retirement years, with couples

potentially seeing costs nearly double that amount.^1 Given increased longevity among Americans, addressing these future expenses has become a critical element of sound financial planning.

Multiple strategies exist for tackling future healthcare expenditures, including specialized tax-advantaged accounts, supplemental Medicare coverage, long-term care protection, and thoughtful retirement income structuring. Each strategy brings distinct benefits based on individual health circumstances, financial resources, and retirement goals. A comprehensive approach that weaves together multiple strategies typically delivers the strongest defense against rising healthcare costs.

Among these options, Health Savings Accounts (HSAs) emerge as a particularly powerful but often overlooked resource for qualified participants. Since their debut in 2004, HSAs have transformed from an obscure option into one of the most tax-efficient tools available for financial planning. While HSAs require enrollment in high-deductible health plans, they can significantly enhance both immediate tax benefits and long-term financial resilience.

Healthcare expenditures demonstrate persistent upward pressure.

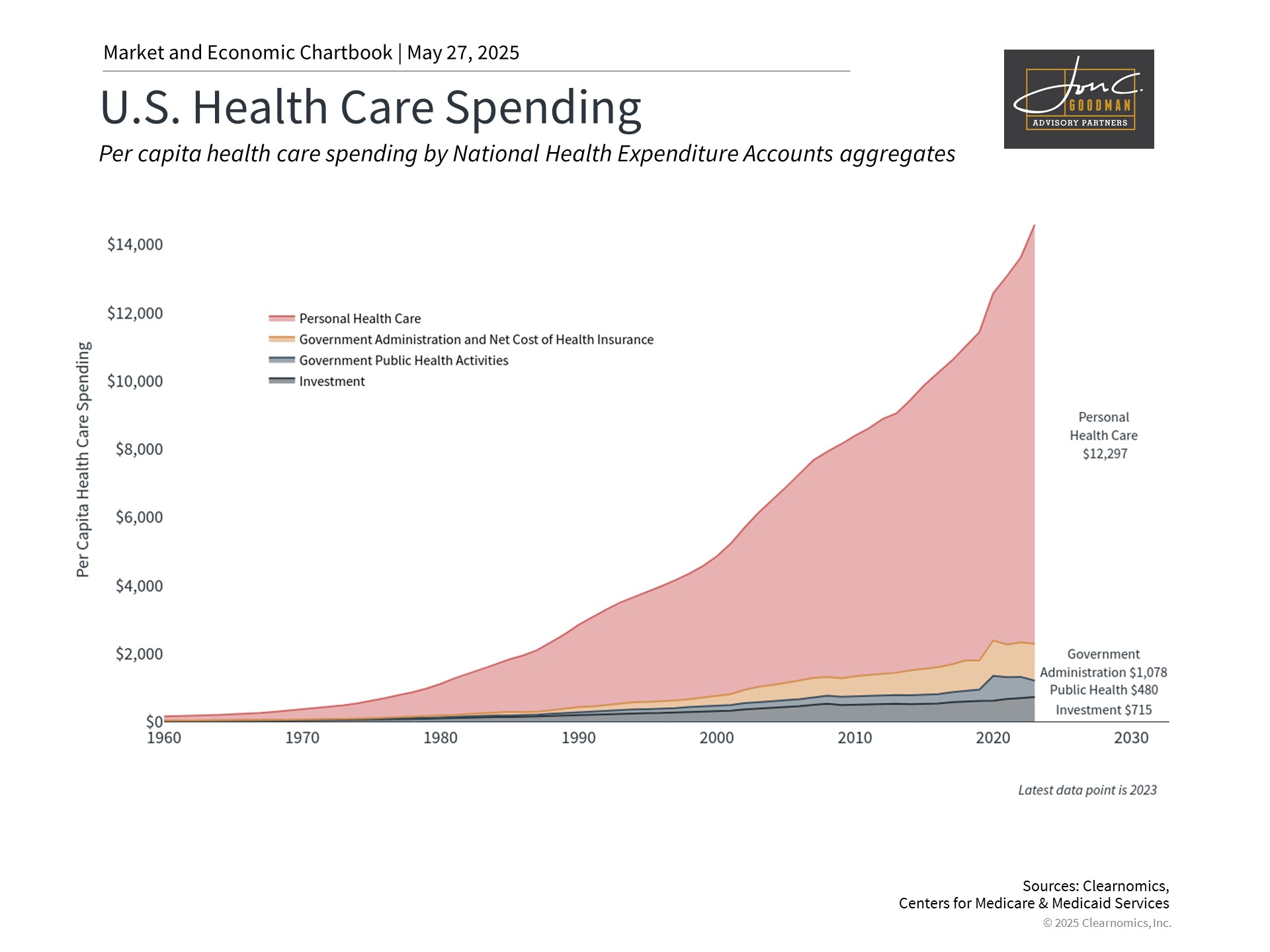

The Centers for Medicare & Medicaid Services (CMS) compiles the National Health Expenditure Accounts (NHEA), the official estimates of total health care spending in the United States. These are broken out into aggregate levels across Health Care Expenditures and Investment. Health Care Expenditures are further broken out into Personal Health Care spending and government spending.

Date Range: 2023

Source: Clearnomics, Centers for Medicare & Medicaid Services

Healthcare spending across the United States has experienced extraordinary expansion over recent decades. By 2023, national healthcare expenditures reached $4.9 trillion – translating to roughly $12,297 annually per individual and consuming nearly 18% of GDP.^2 This represents a substantial jump from the modest 5% of GDP recorded in 1962.

This sustained expansion stems from several interconnected factors, including demographic aging, increasing chronic disease prevalence, medical technology advancement, expanded insurance accessibility, and general healthcare price inflation.

What financial strategies can address this challenge? Consider these three key areas:

* Tax optimization: Exploring methods to finance healthcare costs through tax-advantaged approaches, particularly HSAs, while evaluating whether to allow these accounts to compound tax-free.

* Retirement preparation: Anticipating future healthcare requirements and identifying optimal funding mechanisms, with HSAs playing a central role.

* Estate considerations: Should healthcare allocations remain unused, evaluating how various vehicles like HSAs will be handled becomes an important planning element.

HSAs provide exceptional tax benefits with expanding contribution thresholds.

For eligible participants, HSAs represent an invaluable financial planning resource. HSA eligibility requires enrollment in high-deductible health plans (HDHPs), which for 2026 means coverage with minimum deductibles of $1,700 for individual plans or $3,400 for family plans.^3

HSAs possess a unique characteristic in their tax structure. They stand alone as the only financial instrument providing triple tax benefits:

1. Deductible contributions: HSA contributions lower your taxable income during the contribution year, delivering immediate tax relief.

2. Tax-sheltered growth: Interest, dividends, and capital appreciation within HSAs accumulate entirely tax-free.

3. Tax-exempt distributions: Withdrawals for qualified medical costs remain completely tax-free, regardless of timing.

This triple tax advantage makes HSAs mathematically more attractive than both traditional and Roth retirement vehicles when funds support qualifying healthcare expenses.

HSA contribution thresholds have consistently expanded over time. For 2026, IRS guidelines permit contributions up to $4,400 annually for individual coverage and $8,750 for family coverage, marking a 2.3% increase from prior year limits. Participants aged 55 and above may contribute an additional $1,000 annually as catch-up contributions. These contributions may originate from personal funds, employer contributions, or combinations thereof, but must not exceed annual maximums.

HSAs can revolutionize retirement preparation strategies.

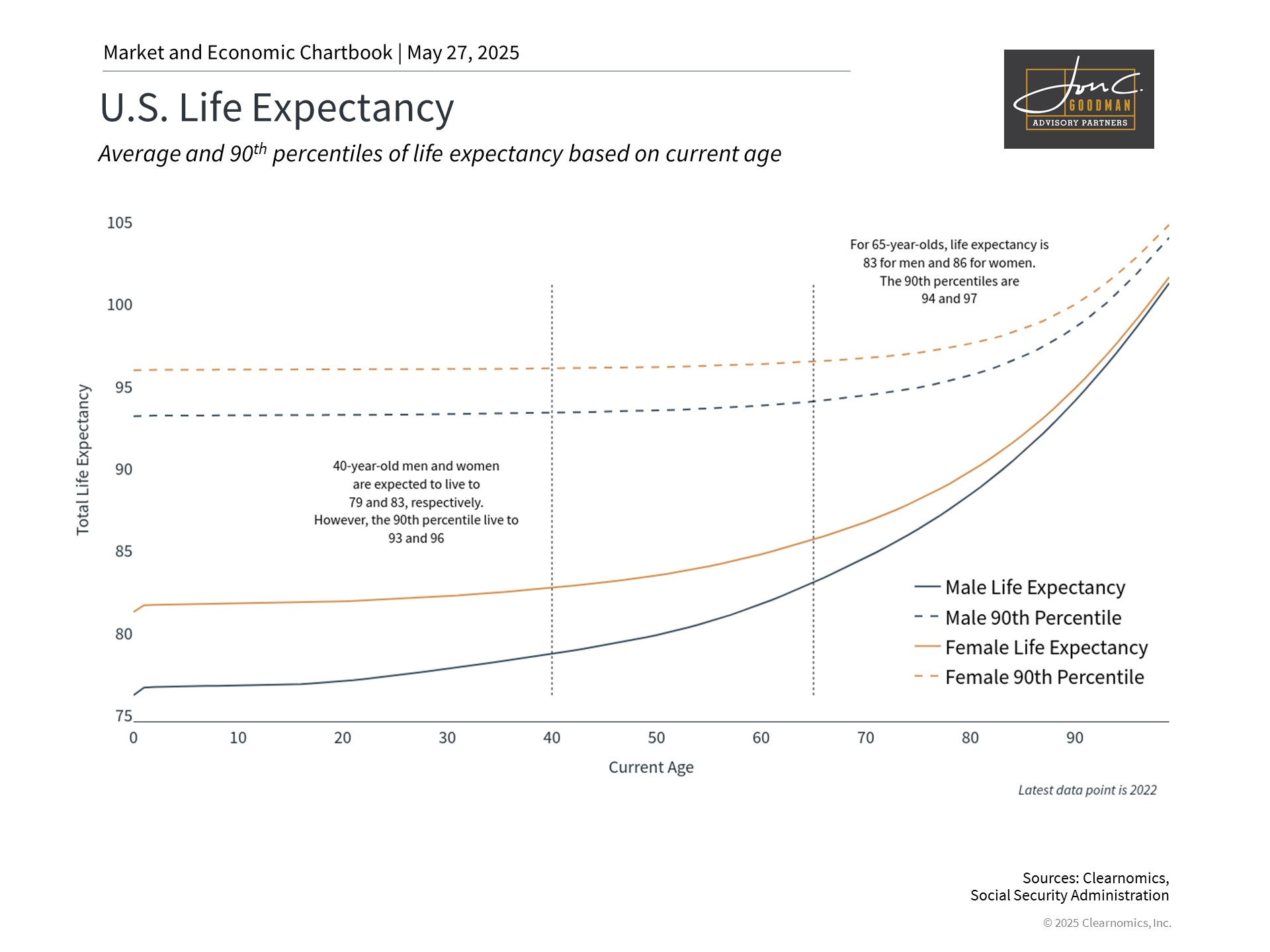

This chart shows life expectancy for males and females as reported in the most recent Social Security Trustees Report. Average life expectancies are displayed as reported. 90th percentiles of life expectancy are calculated from mortality probabilities. Life expectancies are calculated using the most recent mortality rates over the course of his or her remaining life.

Date Range: 2022

Source: Clearnomics, Social Security Administration

With typical life expectancy for those over 65 now reaching well into the 80s, the financial impact of extended retirement periods has grown substantially more significant, particularly regarding healthcare expenses.

A highly effective HSA approach – yet frequently overlooked by account holders – involves utilizing your HSA as a dedicated retirement vehicle specifically earmarked for healthcare costs. This strategy requires maximizing annual HSA contributions while potentially covering current medical expenses through other means. Under this approach, maintaining documentation for qualified medical expenses paid out-of-pocket proves valuable, as HSA reimbursements for these costs can occur at any future point – even many years later – without time restrictions.

Healthcare expenses peak during retirement years.

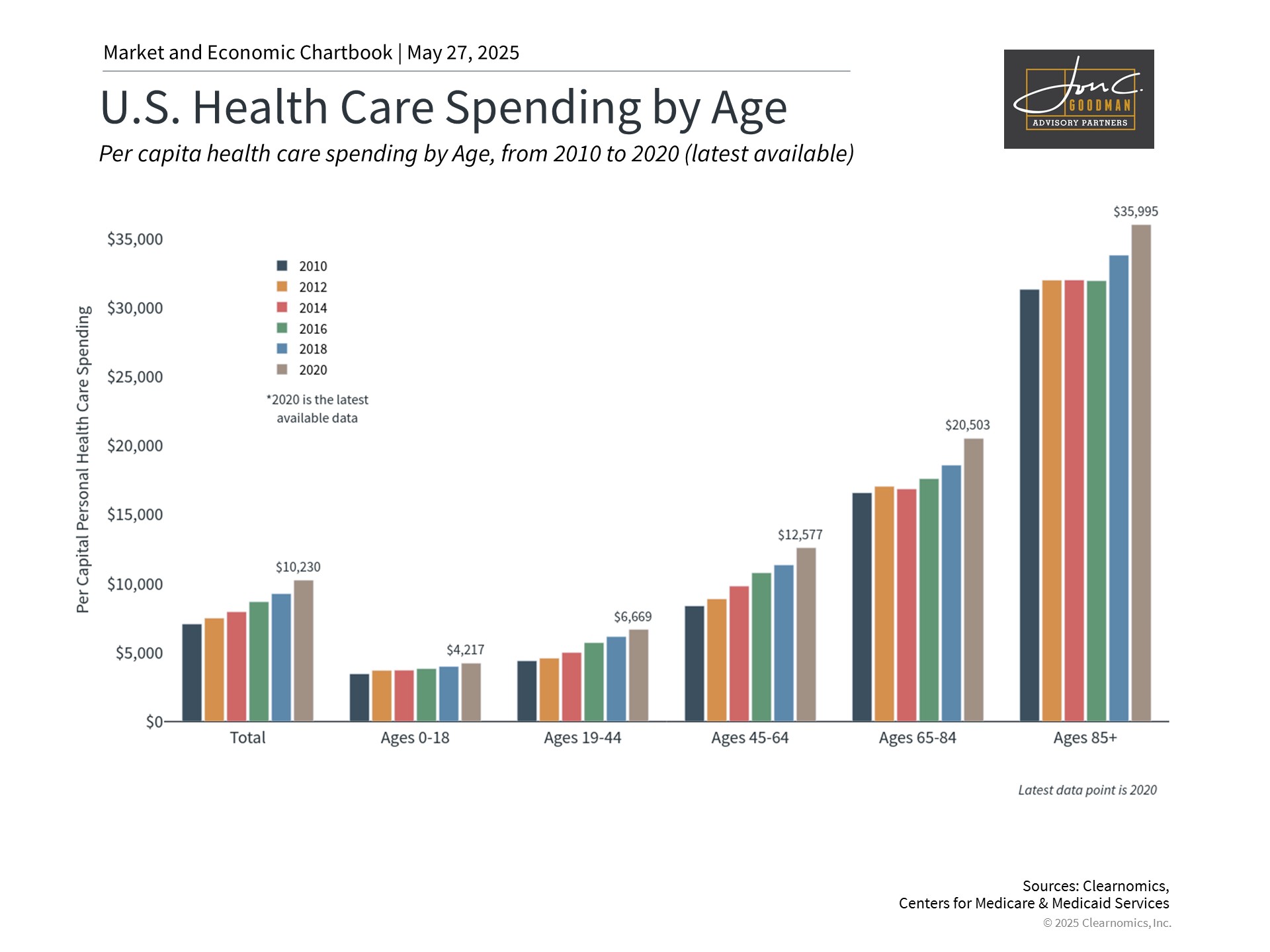

The Centers for Medicare & Medicaid Services (CMS) maintains personal health care spending data by age category and sex. These data are not as timely as other CMS health care spending data.

Date Range: 2020

Source: Clearnomics, Centers for Medicare & Medicaid Services

Successfully executing this strategy requires investing HSA funds for long-term appreciation – enabling HSA investments to compound tax-free over extended periods. This represents a crucial component that many account holders overlook, despite most HSA providers offering diverse investment alternatives. Over lengthy timeframes, this approach can establish a tax-advantaged fund specifically reserved for retirement healthcare requirements.

Unlike most retirement accounts, HSAs impose no required minimum distributions throughout your lifetime, maximizing tax-advantaged growth opportunities. Furthermore, after reaching age 65, HSAs gain additional flexibility as the 20% penalty for non-healthcare withdrawals disappears. While non-qualified distributions would remain subject to ordinary income taxation (similar to traditional IRAs or 401(k)s), this increased flexibility enhances HSAs’ value for retirement planning.

HSAs serve important functions in estate planning.

Beyond retirement considerations, estate planning deserves attention within your comprehensive financial approach. HSA fund treatment upon death varies by designated beneficiary and can effectively preserve tax advantages for surviving spouses.

When your spouse serves as the named beneficiary, the HSA transfers to them with all tax benefits preserved. They may continue utilizing the account as their personal HSA, retaining all triple tax advantages.

For non-spouse beneficiaries including children or other parties, the treatment becomes less advantageous and may generate substantial tax liabilities, particularly for sizeable HSAs. In certain circumstances, designating your estate as beneficiary might prove more tax-efficient.

These estate planning factors underscore the importance of incorporating your healthcare funding approach within your broader financial blueprint, preferably with guidance from qualified financial advisors who comprehend both tax consequences and your individual situation.

The bottom line? Escalating healthcare costs represent a major financial planning challenge and opportunity. HSAs provide unparalleled tax benefits for addressing one of life’s most substantial expenses. For qualified individuals, integrating HSAs into your financial planning approach is highly recommended.

1. https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

2. https://www.ama-assn.org/about/ama-research/trends-health-care-spending

3. https://www.irs.gov/government-entities/federal-state-local-governments/where-can-i-learn-more-about-health-savings-accounts-hsa-and-health-reimbursement-arrangements-hra

Your Wellness Navigator and Holistic Health Guide: Christine Despres, RN, NBC-HWC, CDP

Stress is a natural part of life—something we all experience. While we can’t always avoid stress, we can control how we respond to it. Developing healthy coping strategies is key to protecting our body, mind, and spirit from its negative effects. Stress is the body’s reaction to any demand or challenge, whether perceived or real. It can be classified into two main types:

Acute Stress (Short-Term): This is the body’s immediate reaction to a new or perceived threat—also known as the “fight or flight” response of the sympathetic nervous system. In dangerous situations, the body releases hormones like adrenaline and cortisol to help you react quickly.

These cause:

* Increased heart rate and blood pressure

* Release of glucose and fats

* Sweating and respiratory rate to go up

* Stress hormones to be be stimulated

* Pupils to dilate (improve vision)

* Airways to open ( increase oxygen)

* Digestion and other non essential body functions to shut down

Chronic Stress (Long-Term): Chronic stress occurs when this system is activated too often—such as through traffic, job pressures, caregiving or financial worries. While these aren’t life-threatening, the body still reacts as if they are. As you can imagine, over time, being constantly “on alert” depletes your energy and weakens your health.

Why does Stress Management matter?

When the body is in a prolonged stress state, it can lead to serious health consequences.

These may include:

* Heart disease and stroke

* Weakened immune system

* Sleep disturbances and insomnia

* Migraines and chronic pain

* Weight gain or loss

* Hormonal imbalances and decreased libido

* Irritable bowel syndrome (IBS)

* Depression, anxiety, and mood disorders

* Accelerated aging and bone density loss

* Hair loss and fatigue

Signs that you might be coping with stress in unhealthy ways…

Without the right tools, people often turn to poor coping mechanisms that bring immediate relief but have long term consequences and don’t get to the root cause of the issue.

Such as:

* Alcohol or drug use

* Smoking

* Emotional or disordered eating

* Anger or aggression

* Withdrawal or depression

* Toxic relationships

* Negative thinking patterns

Not All Stress Is Bad.

It’s important to note that not all stress is harmful. In fact, certain stressors can motivate us to grow stronger both physically and mentally. This is known as eustress, or positive stress.

Which can lead to:

* Increased energy and focus

* Improved motivation and performance

* A sense of accomplishment

* Greater resilience and confidence

* A feeling of purpose or excitement

How to Turn Off the “Fight or Flight” Response

The key to managing stress lies in activating the parasympathetic nervous system—also known as the “rest and digest” system. This system helps the body relax, recover, and conserve energy. Finding ways to regularly engage this relaxation response is vital to your overall well-being.

Tips for Activating the Relaxation Response:

* Deep breathing exercises like box breathing

* Meditation, gratitude and mindfulness practices

* Gentle movement like yoga, stretching, walking

* Time in nature, sunlight, grounding

* Laughter, smiling and connection to things you love ( like pets)

* Adequate sleep, rest and time to smell the roses

* Proper nutrition, hydration and exercise

* Creative activities or hobbies that bring pleasure or a sense of peace

* Adaptogens ( like Ashwagandha, maca, turmeric) and Nootropics ( like Lions mane, caffeine, L-theanine)

By understanding how stress is activated and taking proactive steps to manage it, you empower yourself to live a healthier, more balanced life. Check in, determine the cause of the stress and decide if it’s in your control to make changes and adjustments or it’s out of your control and you move to acceptance and coping skills. But most of all do not be afraid or ashamed to seek help if you are not making progress on your own, it takes courage and strength to acknowledge you need assistance. ( i.e. Functional Medicine Dr, therapist or a holistic health coach like myself.

SIGN UP FOR MY MONTHLY WELLNESS LETTER at www.thewellnessnavigator.com or email me for more information on my health coaching programs at christine@thewellnessnavigator.com.

Semi-colon use in decline, study finds.

The 30-second rule for conversations.

Science reveals how to cry less while cutting onions.

… and the physics behind making huge splashes in the pool.

That’s all for today.

Until next week,

All my best,

To schedule a 15 minute call, click here.