Greetings!

In today’s Wealth Advisory, we will explore how debt, deficits, and Moody’s credit rating ding to the U.S. impacts investors.

Next, your Wellness Navigator, Christine Despres, makes a compelling argument for the need to move and ways even the busiest among us can do it.

And in the Etcetera section, we’ll depart from the norm and yield the floor to Dr. Peter Schmieding to tell us about an organization my wife, Ceci, and I have supported for years called Tsering’s Fund. And, lucky us, he even provided the link to his award-winning documentary on the why behind it.

With that, let’s go.

Wealth Advisory: What Debt, Deficits, and the Moody’s Downgrade Means for Investors

The U.S. has now lost its perfect credit rating from all major rating agencies with Moody’s recent downgrade from Aaa to Aa1. This follows similar moves by Fitch in 2023 and Standard & Poor’s in 2011, reflecting escalating worries about America’s fiscal health. The timing is particularly notable as Congress considers legislation that could potentially increase budget deficits, highlighting the tension between extending tax cuts and maintaining fiscal responsibility. Many investors are now questioning how these developments might affect their investment strategies and financial futures.

Market volatility has followed past budget debates and fiscal standoffs.

This chart tracks the total and net federal debt as a percentage of GDP. Net federal debt excludes federal debt that is held within the government. The blue dotted line denotes the 50-year average net debt. The red dotted line denotes the 100% of GDP mark.

Date Range: Q1 1970 to present

Source: Clearnomics, U.S. OMB

Looking back over the past fifteen years, budget negotiations and debt ceiling confrontations have consistently generated market turbulence. Notable examples include Standard & Poor’s 2011 downgrade of U.S. debt, the 2013 fiscal cliff scenario, and government shutdowns in 2018 and 2019. Yet in each instance, eventual agreements were reached, allowing markets to regain stability and continue their upward trajectory.

Interestingly, even after the unprecedented 2011 downgrade that triggered a market correction, the S&P 500 fully recovered within months. Despite these credit rating actions, U.S. Treasury securities continue to maintain their status as safe-haven assets during periods of market uncertainty, remaining fundamental to global financial markets.

When considering national debt and congressional budget conflicts, maintaining perspective is crucial. As citizens and voters, concerns about the nation’s unsustainable fiscal direction are legitimate. The reality remains that straightforward solutions are elusive, with numerous commissions and proposals failing to meaningfully reduce annual budget shortfalls.

While these fiscal challenges are significant, making reactive changes to investment portfolios based on these developments is inadvisable. Historical patterns show that markets have typically recovered from fiscal uncertainties and credit downgrades over time. Adhering to a disciplined investment approach centered on long-term objectives, diversification, and sound investment principles—rather than reacting to Washington headlines or expecting Congress to resolve deficit problems—remains the most effective strategy for achieving financial goals.

Moody’s downgrade arrives at a pivotal moment when investor focus is shifting from tariffs to Washington’s budget proposals. While markets rallied after last year’s presidential election partly due to anticipated pro-growth policies and extensions of the Tax Cuts and Jobs Act of 2017 (TCJA), the Moody’s announcement highlights the other side of fiscal reality.

In their statement, Moody’s emphasized that “successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs,” adding that they “do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

Congress working to extend or make permanent Tax Cuts and Jobs Act provisions.

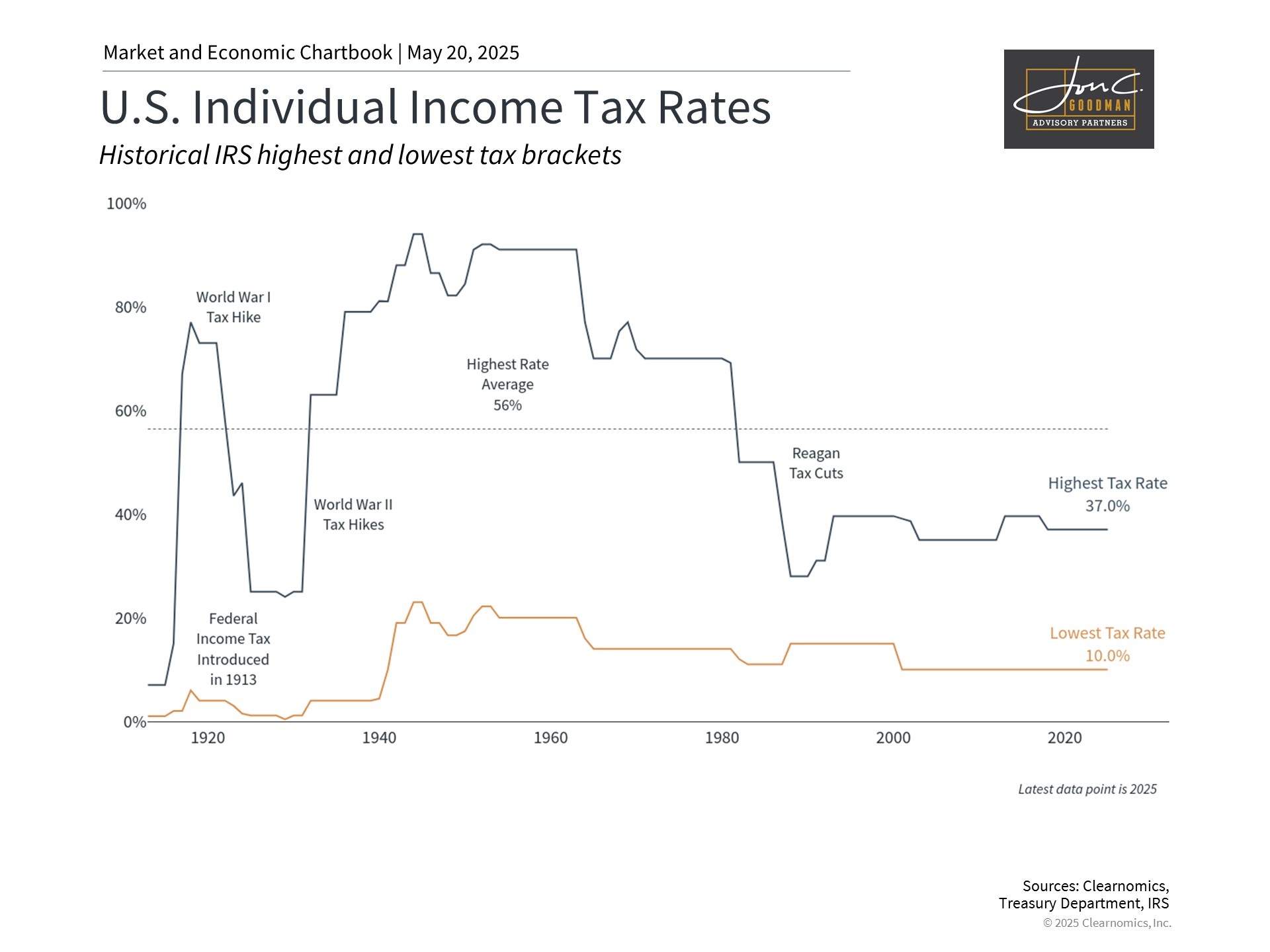

This chart tracks the highest and lowest federal income tax rate. The blue dotted line denotes the highest rate average over the period.

Date Range: 2013 to present

Source: Clearnomics, Treasury Department, IRS

Congress is currently developing a new budget bill with provisions still in flux. The proposal aims to provide certainty by extending individual tax cuts from the TCJA that would otherwise expire after 2025. This would prevent a potential “tax cliff” where rates would revert to pre-TCJA levels, possibly causing economic disruption. By addressing these issues well ahead of expiration, policymakers hope to create stability for households and businesses alike.

This extensive tax package contains numerous provisions affecting both individuals and businesses. Key components, which remain subject to modification, include:

For Individuals:

* Permanent establishment of TCJA individual tax rates, maintaining the top rate at 37%

* Child tax credit increase from $2,000 to $2,500 through 2028

* State and local tax (SALT) deduction cap remains contentious, with proposals to raise it to $30,000 from the current $10,000

* Income tax exemption for tips and overtime pay through 2028

* Auto loan interest becoming tax-deductible through 2028

* Introduction of “money account for growth and advancement” (“MAGA accounts”) for children under 8, designated for education, small business investments, and first-home purchases

For Businesses:

* Pass-through business deduction increase from 20% to 23% and made permanent

* Reinstatement of 100% bonus depreciation for qualified business assets acquired between January 2025 and 2029

* Restoration of research and development tax deductions

Notably, the proposal does not include provisions for a “millionaire tax” or changes to carried interest taxation that some had expected. The proposal could also raise the debt ceiling—the maximum amount the country can borrow—by $4 trillion.

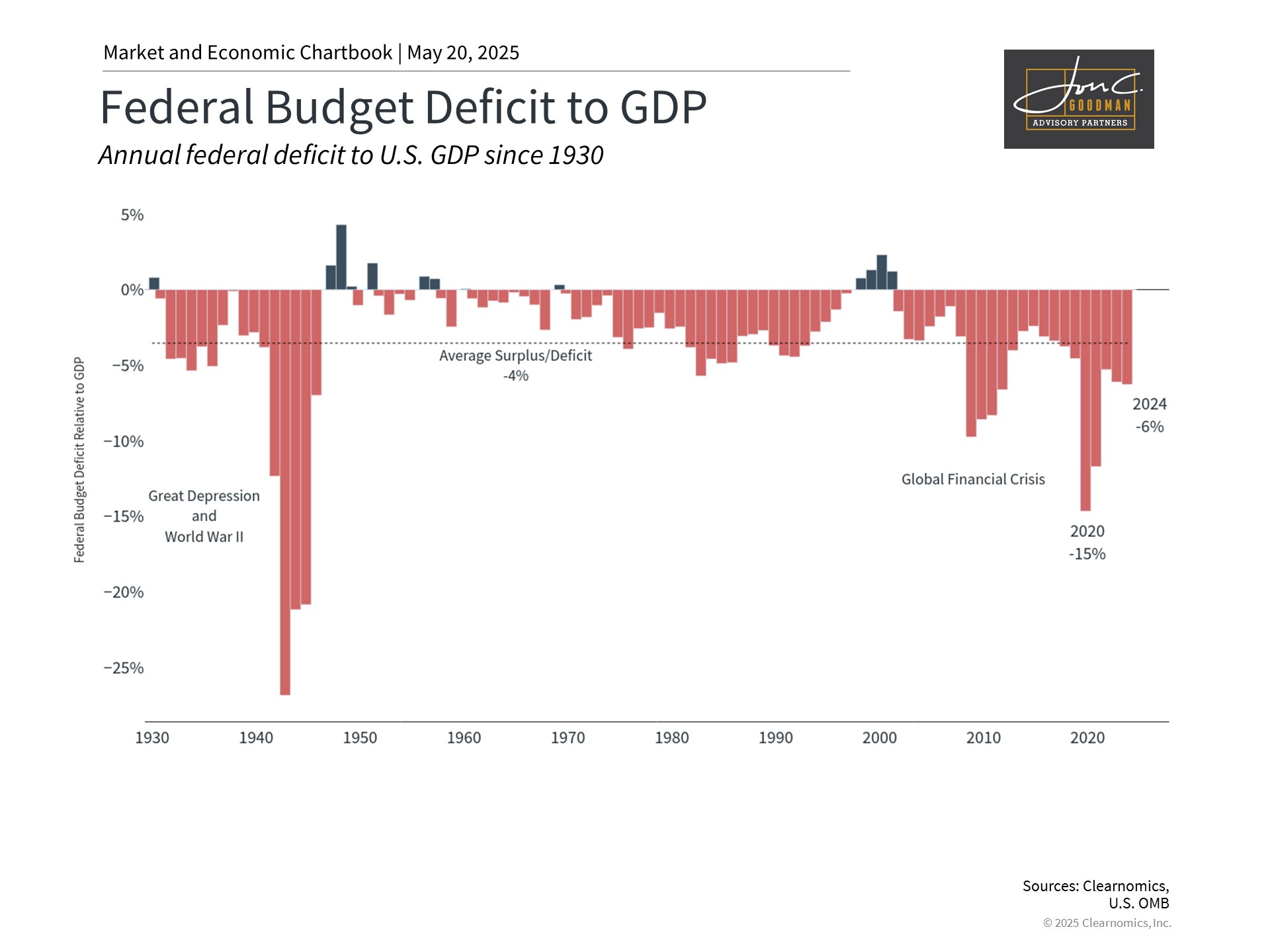

Continuing deficits may further increase national debt.

This chart shows the federal budget deficit as a percentage of GDP. The red bars show deficits and the blue bars show surpluses. The blue dotted line denotes the average surplus/deficit.

Date Range: 1930 to present

Source: Clearnomics, U.S. OMB

While the current proposal incorporates approximately $1.6 trillion in spending reductions through modifications to programs like Medicaid and nutrition assistance, these cuts are overshadowed by tax reductions and spending increases elsewhere.

Annual budget deficits contribute directly to the national debt, which now exceeds $36 trillion—roughly $106,000 per American. Reports indicate the proposed budget could add an estimated $3 trillion or more to the debt over the next decade. The Joint Committee on Taxation, a nonpartisan congressional committee, recently estimated the debt could increase by $3.7 trillion during this period.

The national debt has grown substantially in recent decades, with interest payments continuing to climb. Since most federal spending is directed toward mandatory programs like Social Security and Medicare, achieving meaningful spending reductions presents political challenges. This leads some to believe that tax rates may eventually need to increase despite near-term extensions or permanent implementation of TCJA provisions.

While deficit and debt levels are important for the economy’s long-term health, their immediate impact should be considered in context. Historically, markets have performed well across various levels of government debt and deficit spending. Paradoxically, some of the strongest market returns over the past two decades occurred following the largest deficits, as these typically coincided with economic crises when markets were at their lowest. In essence, basing investment decisions on government spending and deficits would have been counterproductive.

The bottom line? The U.S. credit rating downgrade reflects growing concerns about the nation’s fiscal sustainability. The ongoing budget negotiations may exacerbate these issues. However, historical evidence suggests investors are best served by maintaining their long-term investment strategies rather than reacting to these fiscal developments.

Your Wellness Navigator and Holistic Health Guide: Christine Despres, RN, NBC-HWC, CDP

Move It or Lose It: Why Sitting is the New Smoking

Research increasingly shows that excessive sitting may be just as harmful as smoking—and for good reason. A sedentary lifestyle is often linked to obesity, metabolic disorders, and chronic diseases. Movement isn’t just good for you—it’s essential. Our bodies were not designed for sitting 80% of the time. Life has changed dramatically in the last hundred years and we aren’t naturally as active as we once were. Cars, busy lifestyles, desk jobs, smart phones, computers and a culture of convenience have all contributed to an overload of sitting. We must make a conscious effort to get up and move. Not just to exercise for one hour but as a lifestyle, continually throughout our day.

While exercise has always played a vital role in overall wellness, it has now taken center stage as America’s health continues to decline. According to a recent study published in The Lancet, nearly 75% of U.S. adults are overweight or obese. The Physical Activity Guidelines for Americans (2nd edition) from the Department of Health & Human Services reveal even more shocking stats:

* Nearly 117 million American adults have at least one preventable chronic disease.

* 7 out of the 10 most common chronic diseases are positively impacted by regular physical activity.

* Yet, 80% of adults fail to meet both aerobic and muscle-strengthening guidelines.

How Much Exercise Do Adults Need?

According to the Physical Activity Guidelines for Americans, adults should aim for:

✅ At least 150 minutes of moderate-intensity aerobic activity OR 75 minutes of vigorous aerobic activity per week (or a mix of both), spread throughout the week.

✅ Muscle-strengthening activities (weights, resistance bands) at least 2 days per week.

✅ Less sitting. Even light activity can help counteract the risks of being sedentary.

✅ For even greater benefits: Aim for 300+ minutes per week of activity.

✅ Increase gradually—start where you are and build up over time.

The Benefits of Moving More

Staying active isn’t just about losing weight—it’s about longevity, mental clarity, and quality of life. It helps balance all aspects of wellness. Movement improves your health span and quality of life at all ages.

Regular exercise can:

✔ Reduce stress & improve mood

✔ Boost energy & combat fatigue

✔ Improve sleep quality

✔ Lower the risk of chronic diseases (including heart disease, diabetes, and dementia)

✔ Support brain health & reduce depression risk

✔ Build a sense of community & connection

The best part? You should enjoy moving your body, it should feel good! Find an activity that you like, works for your lifestyle, and your schedule. Consistency beats perfection. You just have to do it. The beauty of exercise is you can feel the difference as soon as you start. Joseph Pilates says, “In 10 sessions you’ll feel the difference. In 20, you’ll see it. In 30, you’ll have a whole new body.” Don’t be a part of the 25% of Americans that are inactive. You’ve got to move it, move it!

6 Simple Ways to Get Moving Today:

1️⃣ Track your activity – Use a fitness app, smartwatch, phone, whoop or Oura ring to monitor your progress.

2️⃣ Start walking – Aim for 30 minutes per day, increasing by 10 minutes per week or walking twice a day.

3️⃣ Pick up the pace – Pump your arms, increase your speed, and work toward 10,000 steps per day.

4️⃣ Add resistance – A weighted vest (rucking) increases intensity and calorie burn by 2-3x.

5️⃣ Make it enjoyable – Listen to audiobooks or podcasts while you walk. Call friends or family.

6️⃣ Find accountability – Walk with a friend, join a group or schedule movement breaks together.

“The secret to getting ahead is getting started.” – Mark Twain

If interested in working with Christine directly, you can reach her through her email at christine@thewellnessnavigator.com or www.thewellnessnavigator.com.

Tsering’s Fund

by Dr. Peter Schmieding

Tsering’s Fund is a Montana based nonprofit with a primary focus of preventing the early marriage and outright trafficking of young girls from the rural parts of Nepal. For twenty years we have been helping children in many areas of the country, but in the last decade have focused on the Helambu Region of northern Nepal. We identify young, at risk girls, sponsor them in English medium boarding schools through college, and thereby educate, protect and empower them so as to break the cycle of poverty and exploitation that has plagued the region for generations. We match specific sponsors to each student who support them long term and often provide personal support during their journey.

The trafficking of humans, and in Nepal especially of young girls, is a worldwide problem. Historically the Helambu Region of Nepal, with its indigenous Hyolmo and Tamang ethnic groups, has been especially hard hit with early marriage and outright trafficking of young girls an endemic problem. In order to end this scourge we feel that education, especially of young girls, is the key. For generations young girls have had limited opportunity and, being a very poor, primarily subsistence farming region, if girls were educated at all it would be through primary school (Class 5) only. At that point, when faced with the prospect of boarding their daughters in a secondary school, families would choose to marry them off or send their daughters away to “work”…….often overseas. We have found that taking an interest and supporting these young girls at this vulnerable point in their lives is critical to changing their future as well as that of their families, villages and the entire region.

Our work has focused on the Helambu Region for a number of reasons. First, as Tsering’s Fund’s founder and president, I wanted our work to make a significant and palpable change in a specific region of Nepal during my lifetime. Second, my wife and I have six adopted Nepali children (four Sherpa, two Hyolmo) and our relationship with the Hyolmo people in Helambu is very personal indeed. Third, my relationship with Mr. Purna Gautam and the Melamchi Ghyang School has become very close and this outstanding school presented us with the opportunity to sponsor girls in Helambu at one of the finest schools in all of Nepal. Tsering’s Fund has grown and over the years we have worked to raise awareness about the issues as well as locate donors and sponsors for our work.

Tsering’s Fund’s first use of film to spread our message was the short film “Namaste Ramila” in 2017. Three years ago, because of our work in Helambu and our personal relationship with our two children Maya and Karsang Hyolmo, I set out to produce a new documentary film to raise awareness of the issues of trafficking in Helambu and how education was the key to bringing about change. My head cinematographer Wes Overvold asked me early on what I wanted to accomplish and my response was that I wanted to personalize the trafficking issue, especially as it related to this particular region. People worldwide read about human trafficking in articles and books but often these victims are reduced to mere statistics…….numbers. I told Wes I wanted to put a face on the issue, a real human being with hopes, dreams and the same potential as other more affluent people worldwide. As I learned about our daughter Maya’s life growing up I knew she was that person.

Maya represents the trafficked girl from Nepal. As I began work on the Helambu film three years ago in Kathmandu I was sitting with Maya and she began to cry. I asked her what was wrong and she replied “Dad……I am the only one left”. When asked she explained that of all the girls she grew up with in primary school she was the ONLY one not married off at 13 or trafficked away. I knew then she was our story. Maya represents several things; first the face, the human being, of who these girls are. But she also represents the goal of Tsering’s Fund……..to create more Mayas. Given a chance and an opportunity they can become amazing, empowered young women that will change their villages, region and Nepal itself.

Helambu began its journey as a finalist at the Bamff Mountain Film Festival and then went on to being a finalist in Vancouver, New Zealand, New York, Torillo, Spain as well as in Milan, Italy. Last March we were named Best Mountain Film at the London Mountain Film Festival in England. The film has brought awareness as well as inspiration to many people as our model of providing sponsored, English medium boarding school education to vulnerable girls has proven to be so effective. We are literally a grass roots women’s empowerment charity that changes lives on a most basic level. How human is that.

Maya’s story, as well as the story of Tsering’s Fund and its success changing thousands of lives, is so amazing and human. I pray you can find a way for us to expand our reach. Here is the link to Helambu. Feel free to pass it on cautiously as it remains private until our film festival circuit is completed. I would be happy to provide more information to anyone interested. It’s an amazing story.

Have a great week,

To schedule a 15 minute call, click here.