Greetings and Happy May!

In today’s Wealth Advisory, we will honor and glean wisdom from Warren Buffett’s illustrious career at the helm of Berkshire Hathaway and recall some of his best quotes–pearls, all.

Then your Wellness Navigator, Christine Despres, will touch upon the significance of the month of May for women and offer five ways in which we can honor them–especially Mothers this weekend–as they deserve.

And, finally, in the Etcetera section, we’ll survey the fascinating history of the piggy bank and ponder where that historical savings tool might go from here.

With that, let’s dive in.

Wealth Advisory: Lessons from Warren Buffett for Today’s Market

Investing success is fundamentally built on patience, discipline, and a long-term perspective. No one embodies these principles more effectively than Warren Buffett throughout his remarkable five-decade tenure as Berkshire Hathaway’s CEO. As Buffett steps into retirement, we have an opportunity to examine investment strategies that have consistently delivered results through various market cycles and remain particularly relevant in our current environment.

“Be fearful when others are greedy, and greedy when others are fearful” stands among Buffett’s most referenced wisdom. While stable markets provide comfort, genuine opportunities often emerge during turbulent periods. The market volatility witnessed in April—driven by concerns about tariffs, inflation, interest rates, and other factors—illustrates this principle perfectly. Investors who maintained focus on their overall portfolio strategy rather than reacting to short-term news cycles likely positioned themselves better for future growth.

Though the market has recovered most of its early-year declines, valuations remain more favorable than they were in January. These conditions create potential advantages for patient investors who can capitalize on more reasonable entry points and enduring market trends. Historical evidence supports that disciplined approaches to volatility—much like Buffett’s own strategy—reward those who maintain their investment objectives despite temporary market fluctuations. Below are several Buffett principles particularly applicable to current market conditions.

Valuation improvements through market volatility.

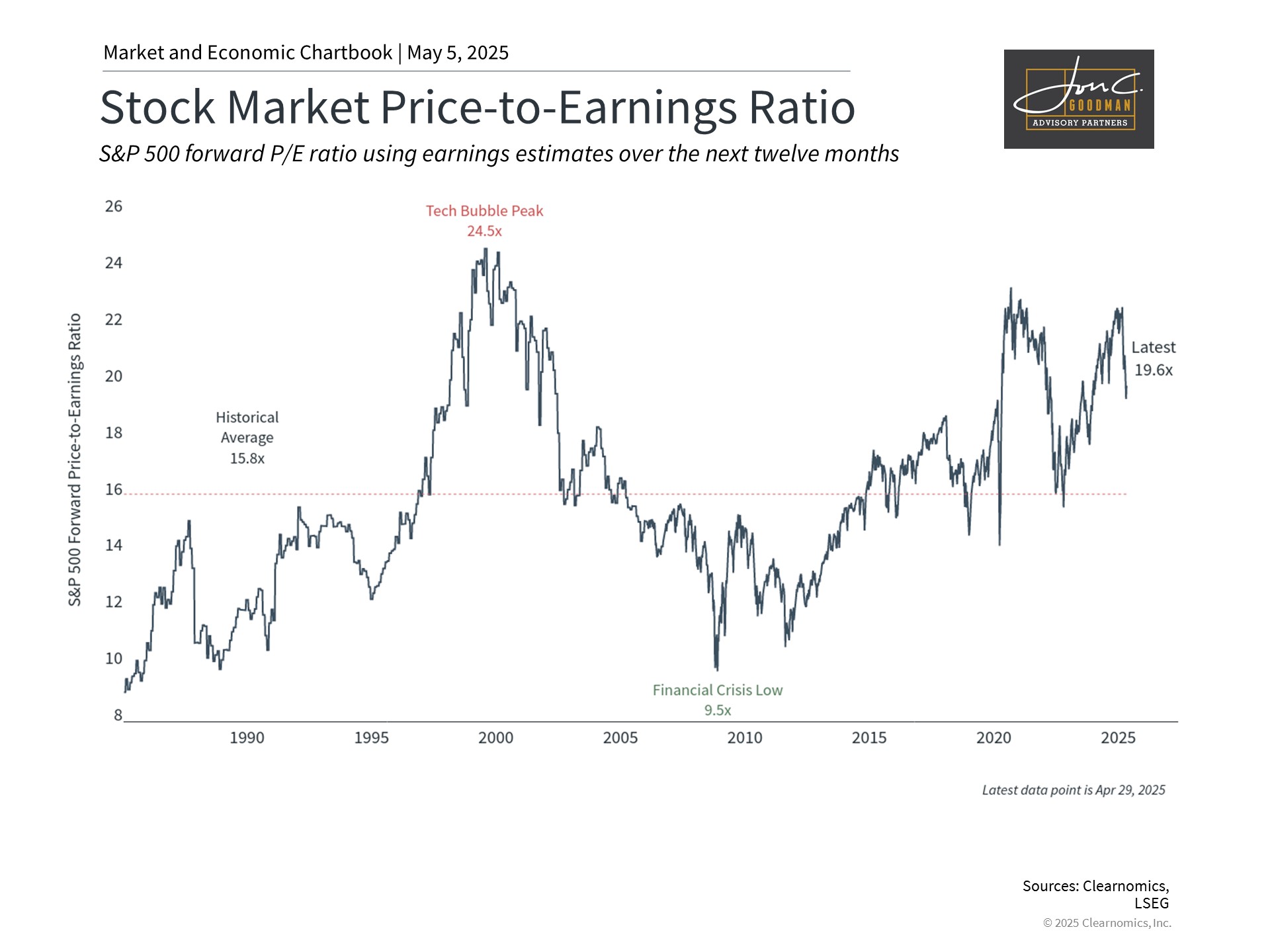

This chart tracks the S&P 500 price to earnings ratio. Earnings estimates are forward estimates over the next twelve months. The dotted line denotes the average over the full period. This data is calculated weekly.

Date Range: January 22, 1985 to present

Source: Clearnomics, LSEG

“Whether we’re talking about stocks or socks, I like buying quality merchandise when it is marked down.”

–Warren Buffett, 2018 Berkshire Hathaway annual letter

A cornerstone of Buffett’s investment philosophy involves purchasing undervalued companies. While broader market valuations approached historic peaks earlier this year, the recent market pullback combined with continued earnings growth has brought valuation metrics to more reasonable levels. Currently, the S&P 500’s price-to-earnings ratio sits just below 20x, aligning with its ten-year average. This valuation adjustment stems from short-term concerns regarding tariffs and economic uncertainty but may represent new opportunities for investors.

Over extended time horizons, valuation metrics remain the most reliable indicator of market attractiveness. Daily and monthly market movements typically respond to headlines, company announcements, and geopolitical developments—factors that generally diminish in importance over time. When considering investment periods spanning years or decades, the critical elements become underlying growth trends and whether initial purchase prices were reasonable.

Valuations provide a framework for assessing investment reasonableness. Rather than fixating solely on price movements, valuation metrics reveal what investors receive for their investment—earnings potential, book value, cash flow generation, dividend yield, and additional factors. Acquiring assets at attractive valuations historically improves the probability of stronger future returns, while investments made at premium valuations often yield more modest long-term results. This relationship explains the strong historical correlation between entry valuations and subsequent portfolio performance.

It’s worth noting that valuations should not be used as market timing tools for making binary investment decisions. Instead, they serve as valuable inputs for constructing appropriate portfolios. Understanding current valuation contexts helps identify potential opportunities and establish realistic expectations throughout different market phases.

Steady growth in corporate profits.

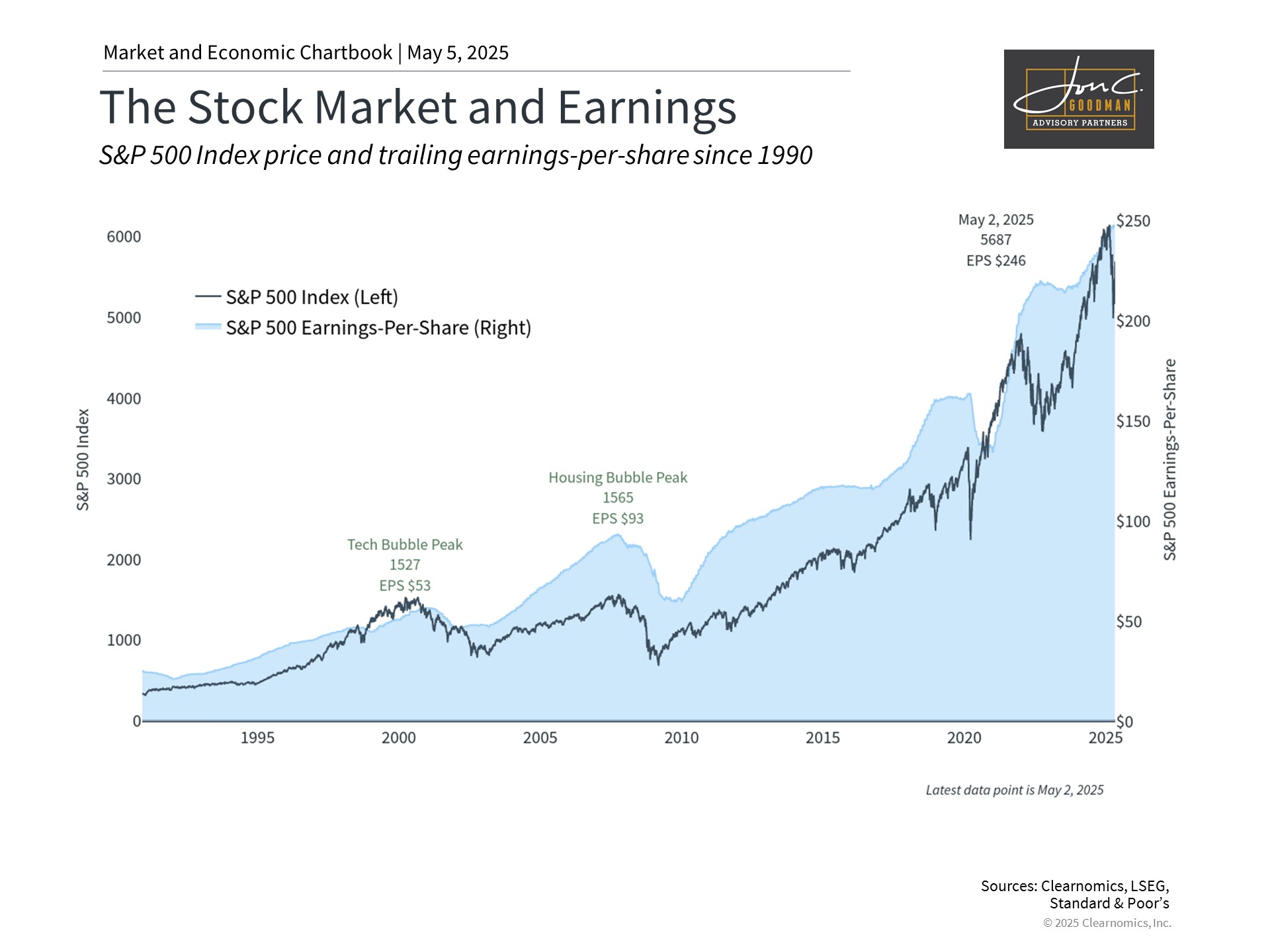

This chart shows the S&P 500 index alongside its trailing 12 months earnings-per-share. Over the long run, the stock market tends to follow earnings. If earnings are rising, investors are willing to pay more per share. Earnings, in turn, tend to track economic growth. Thus, a healthy economy tends to result in a rising stock market.

Date Range: January 2, 1990 to present

Source: Clearnomics, Standard & Poor’s, LSEG

“Concentrate on the potential future productivity of the asset you’re evaluating. If you’re not comfortable making a rough estimate of its future earnings, it’s best to move on.”

–Warren Buffett, 2013 Berkshire Hathaway Annual Letter

In addition to more favorable pricing, a significant factor contributing to improved valuations is the steady increase in corporate earnings. With over 75% of S&P 500 companies having reported their first-quarter results, earnings have soared by an impressive 12.8%, as noted by FactSet. This figure notably surpasses the initial expectation of 7.2% growth at the start of the earnings season. This positive outcome has been particularly driven by sectors such as Communication Services, Financials, Healthcare, and Information Technology, all of which continue to expand their profit margins.

On the other hand, the Consumer Discretionary and Consumer Staples sectors have displayed relative weakness, posting sales results that fall short of targets at a lower rate. This trend aligns with survey results indicating that consumers are becoming increasingly cautious with their spending as they focus on essentials amid rising inflation.

Beyond the numbers, earnings calls have shed light on how companies are navigating the current landscape. Three prominent themes have surfaced. First, many companies have opted for a “wait-and-see” strategy regarding the tariff landscape. With limited visibility, some have chosen to withdraw guidance, while others have included preliminary tariff assessments in their forecasts. Second, despite the uncertainty in the near term, there remains a robust commitment to capital investments, particularly in the technology sector. Major tech firms are either maintaining or increasing their capital expenditure plans for 2025, particularly concerning artificial intelligence infrastructure. This indicates that management teams are confident about their long-term growth prospects. And third, companies across various sectors are undergoing transformations to adapt to technological innovations, evolving consumer preferences, and economic changes. These strategic shifts, while sometimes difficult in the

short term, are positioning companies to better navigate uncertainty and seize emerging opportunities.

Dividends continue to provide solid support for investment portfolios.

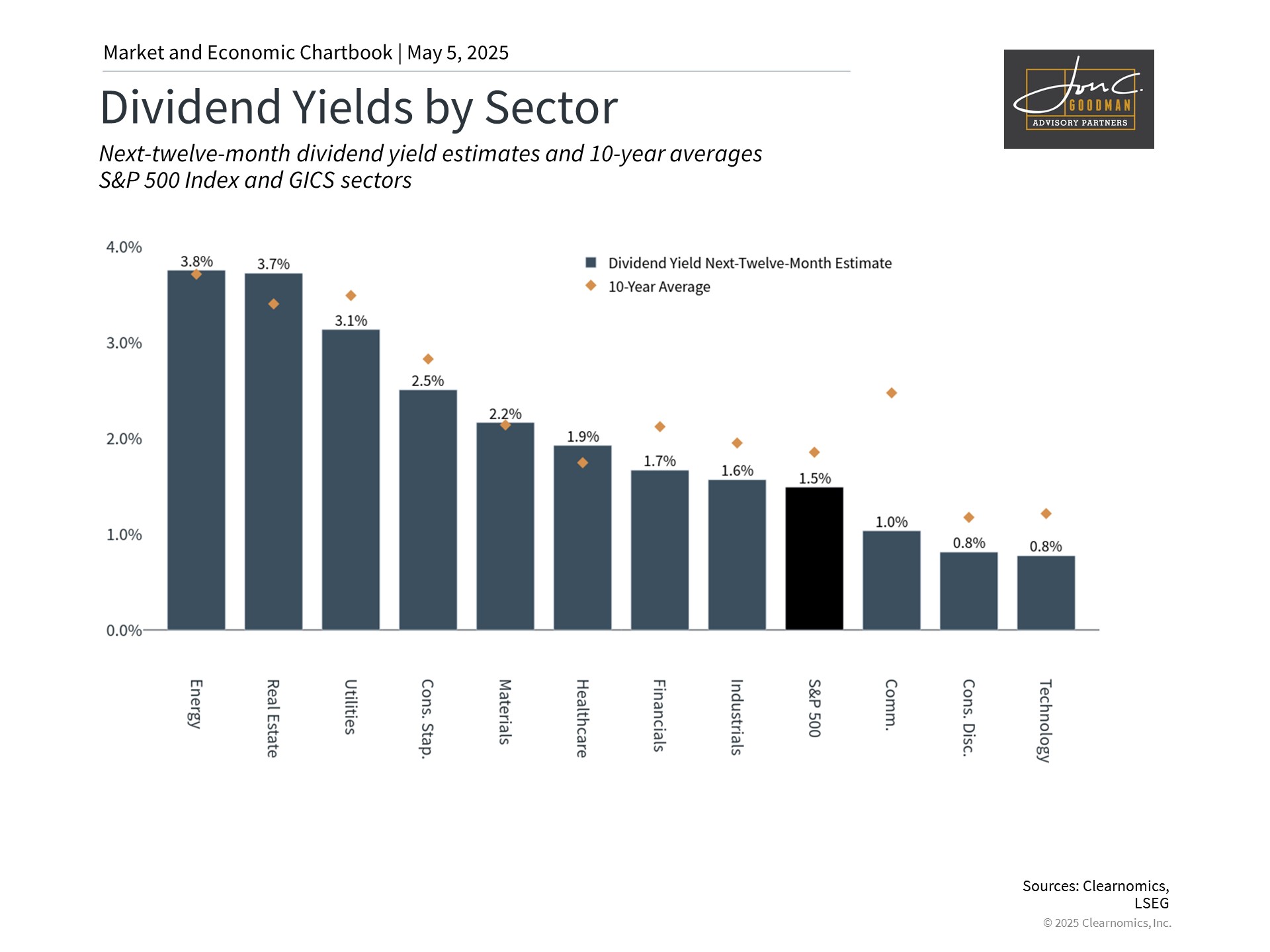

This chart shows dividend yield estimates over the next twelve months based on consensus analyst estimates. Sectors are based on GICS sector classifications for S&P 500 companies. Averages are calculated over the prior ten years.

Date Range: Latest available data

Source: Clearnomics, LSEG

“It’s not good news when any company cuts its dividend dramatically”

–Warren Buffett, 2023 Berkshire Hathaway annual meeting

Even though Berkshire Hathaway has rarely paid dividends, Buffett has benefited from the earnings and dividend-generating ability of his portfolio companies. His mentor, Benjamin Graham, focused heavily on the importance of dividends as an indicator of corporate financial health in the book “The Intelligent Investor.” While investors typically focus on stock prices, dividends have historically been a major contributor to long run returns.

Despite ongoing market uncertainty, dividends have continued their upward trajectory, adding to stock market total return for investors. The accompanying chart shows that many sectors have healthy dividend yields, many of which are still around their 10-year averages.

For investors who rely on their portfolios for income, dividends are an important source of yield. Companies are typically reluctant to cut dividends except during periods of financial stress. Dividends are also an important signal of the underlying financial health of corporations. This is because dividend payments are not just accounting figures, but require actual cash. The continued growth in dividends suggests confidence among corporate leaders despite near-term uncertainties.

The bottom line? As Warren Buffett’s career shows, the best way to navigate uncertainty is with a patient, long-term approach to investing. This remains relevant in today’s market environment, especially as investment fundamentals improve.

Your Wellness Navigator and Holistic Health Guide: Christine Despres, RN, NBC-HWC, CDP

Meaningful May

May is a big month! An important month honoring some of life’s most precious gifts, nurses and Mothers. Obviously, there are countless other worthy professions, I am just partial. 😉 So Happy Nurses Day to all the fabulous nurses and caregivers out there and most importantly—thank you! For the people you care for, for being a patient advocate and for the strength you provide to those around you, both personally and professionally. Just like being a mother, you’re always a nurse even when you aren’t “working.”

It’s not surprising that May is also Women’s Health month. What ties all these together is a deeper call: to nurture and nourish, not just others, but ourselves. In a world that often celebrates women for how much they give, I invite you to turn that care inward–to prioritize your health, to rest and replenish, and to appreciate the worthiness of who you are at your core. Gratitude begins here: in recognizing and honoring our own needs as necessary, right alongside the care we offer to others. When we prioritize ourselves, we can continue to give graciously to others.

This month, (and every month) we should honor and express gratitude for the caregivers during Nurses Month and to celebrate the unconditional love of mothers on Mother’s Day. We all deserve it!

🌸 5 Ways to Honor the Women in Your Life 🌸

1️⃣ Say the words – A heartfelt message, a handwritten note, or even a simple “Thank you for all you do” can be the best gift. ❤️

2️⃣ Encourage healthy habits – Support her in making her well-being a priority, by providing opportunities for self-care and positive encouragement. Give healthy gifts like massage, spa days, fitness classes and health coaching. 🩺💪

3️⃣ Give her rest – Take something off her plate or gift her time to replenish. It’s ok to take this moment to put your feet up and relax, especially without guilt. 🌿✨

4️⃣ Celebrate her – Honor and respect her passions, dreams, and beautiful spirit. Let her be unique and to shine for who she truly is. Appreciate her wisdom, experiences and show gratitude for all she does.🌟

5️⃣ Pay it forward – Support, mentor, or uplift other women. Stick together and love one another. Gratitude grows when expressed and shared. The more you give the more you receive.💕

🌟 LAST CALL! 🌟6 week Spring Wellness Reboot

Your chance to hit the reset button and join the Wellness Reboot is here — but doors are closing SOON! 🚪✨Let’s make your wellness a priority again — together. 💪🌿

Join me May 6th 8pm-9pm ET for a 6-week group coaching experience where we’ll focus on six essential pillars of wellness to help you focus, get motivated and take control of your health again. Register here: Spots are almost gone. Don’t wait!👉 Sign up NOW! 💫

We’ll cover:

🍽 Nourishing food that fuels (no diets here)

💪 Movement that supports your body

🧘♀️ Mindfulness to manage stress

💃 Hormone harmony & balance

🧠 Brain health + clarity

🌿 Gentle detox + daily healing habits

You can reach Christine directly through her email at christine@thewellnessnavigator.com or www.thewellnessnavigator.com.

The surprisingly rich—and a bit quirky—history of the ubiquitous Piggy Bank: One that blends linguistics, frugality, folklore, and evolving cultural values around saving.

Here’s the Tale. (Pun intended.)

1. The Etymology: Not a Pig At First.

The word “piggy” in piggy bank doesn’t originate from the animal at all. In medieval Europe (circa 15th century), people stored coins in household containers made from a cheap orange clay called “pygg” (pronounced pug). This clay was widely used for making pots, jars, and dishes.

These “pygg jars” became common storage vessels for spare coins—early proto-savings accounts, if you will.

2. From Clay to Critter: The Great Linguistic Mix-Up

By the 18th century, the English language had evolved, and the word pygg had fallen out of everyday use—except in reference to these old coin jars. Enter the potters.

At some point, someone either misheard or made a clever pun and crafted a savings jar shaped like a pig, turning the homonym into literal design. The pig-as-a-bank stuck—likely because the visual visual was humorous, memorable, and ironically fitting: pigs symbolized both wealth and gluttony.

3. The Rise of the Ceramic Piggy.

In the 19th century, piggy banks became popular children’s gifts—especially in Europe and the U.S.—as a tool to teach thrift. Often made of ceramic, they weren’t easy to open. The only way to retrieve savings was to break the bank—a phrase that lives on today.

Fun fact: The oldest known piggy bank was found in Indonesia and dates to the 13th century, a terracotta pig discovered in Java. That means piggy banks may have global and parallel histories beyond Europe.

4. Symbolism and Culture.

In many cultures, pigs represent prosperity and good fortune. In Chinese culture, for instance, pigs are one of the 12 zodiac signs and are associated with abundance. The piggy bank, then, becomes a charming cross-cultural metaphor for growing wealth.

5. The Modern Reinvention.

Today’s piggy banks are less about destruction and more about financial education. They come with rubber stoppers, digital counters, and even app integrations. But the essence remains: a visible, often whimsical way to make saving fun—especially for kids.

Some financial educators (like millionaireME!) use piggy banks to teach not just savings, but budgeting—dividing deposits into digitized jars labeled Give, Save, Spend, and Invest.

Speaking of millionaireME: Where to from Here for the Vaunted Piggy Bank?

Glad you asked. 😉

millionaireME has a simple way to take your savings to new heights—one that connects your funding account (ideally, your personal savings) with a target account (like debt payoff, high-yield savings, or long-term investments).

Why?

So you can contribute more intentionally, more frequently, and reach the goals that matter most—faster.

But that’s not all.

To help ensure success, we are adding what we call the three C’s: community, coursework, and collaborative technology.

For time’s sake, though…whew…we’ll leave things at that for today.

Thanks for reading,

To schedule a 15 minute call, click here.