Tuesday is news day.

Hopefully, news you can use.

In today’s Wealth Advisory, we’ll explore how rising consumer debt affects the economic outlook for the foreseeable future in the United States.

To clarify things, I again will add commentary to your customary charts.

Next, your Wellness Navigator, Christine Despres, will be sharing about the occasion for her trip home to Maine (including to her favorite beach, Fortune Rocks). More specifically, she will address an all-too-common topic for Gen X-ers, aka, the Sandwich Generation, namely how we can remain healthy and sufficiently energized for the tasks at hand.

And in the Etcetera section, we’ll cover several tidbits that you might have missed this week.

With that, andiamo!

Wealth Advisory: Consumer Debt Trends in a Bifurcated Economic Landscape

Consumer financial health serves as a crucial barometer for broader economic conditions. With consumer expenditures accounting for approximately 70% of total economic activity, consistent spending patterns have contributed significantly to economic performance exceeding forecasts in recent years. However, indications of consumer weakness have emerged, raising concerns among investors about potential recessionary risks.

Headlines recently highlight escalating debt levels and increasing payment delinquencies amid persistent inflation worries and growth deceleration. Simultaneously, other economic indicators reveal robust consumer balance sheets, unprecedented household wealth levels, and sustainable monthly payment obligations. This apparent paradox has created confusion among investors regarding which narrative accurately reflects current conditions, and whether underlying vulnerabilities are developing.

This contradiction can be understood through the framework economists refer to as a “two-speed economy,” wherein financial circumstances differ substantially across consumer segments based on factors including income brackets, wealth distribution, credit ratings, and additional variables.

While acknowledging the genuine financial challenges facing significant portions of the population, it’s essential to distinguish between impacts on individual households versus implications for financial markets and investment portfolios. Consumer health metrics should be evaluated as components within a comprehensive assessment that incorporates savings patterns, debt service proportions, and aggregate net worth. This more holistic perspective helps explain why financial markets have demonstrated considerable resilience despite these challenges.

Delinquency rates are trending upward.

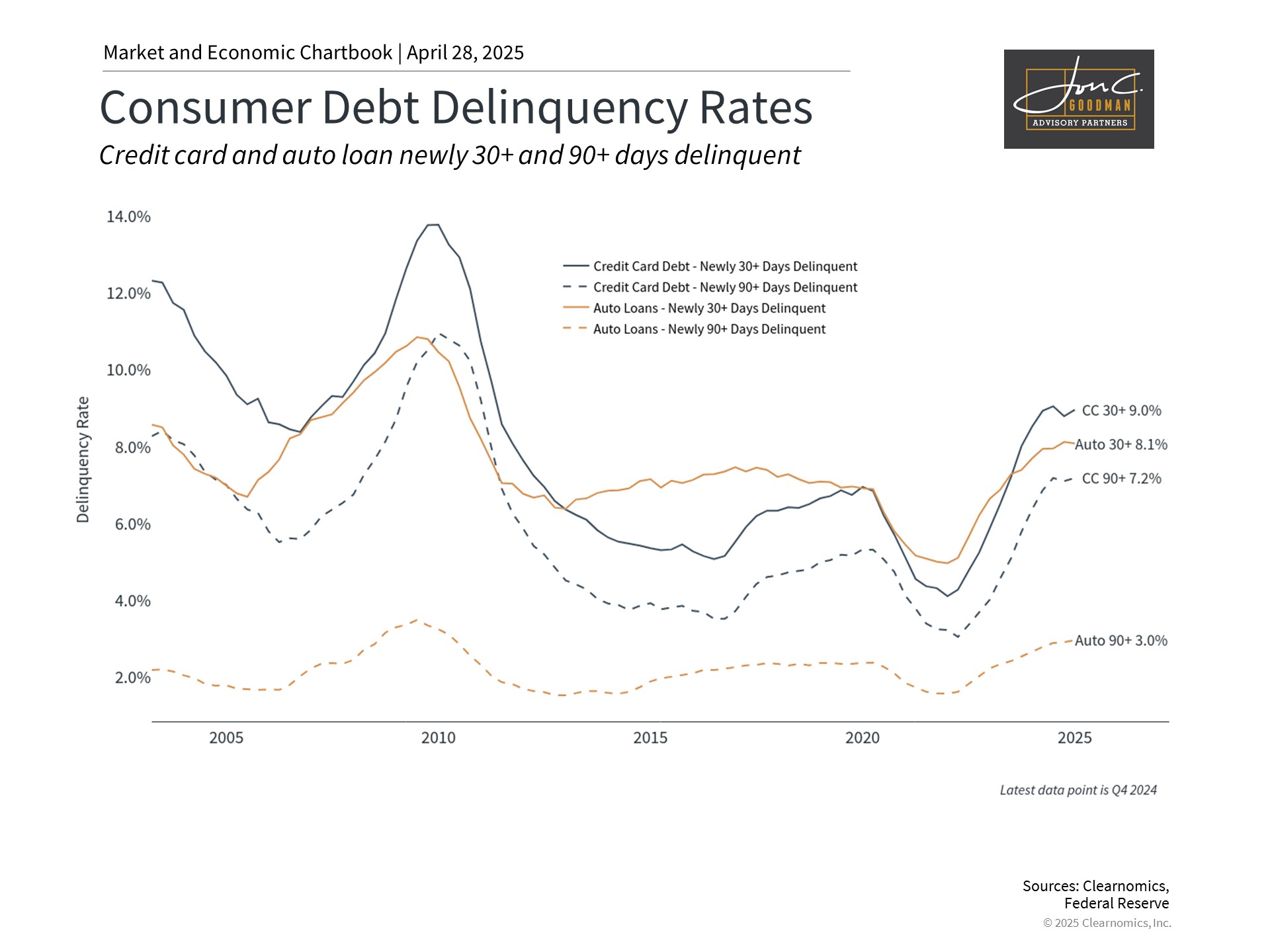

This chart shows the percentage of accounts that are newly 30+ and 90+ days delinquent for credit cards and auto loans. This data is compiled by the Federal Reserve Bank of New York based on its Consumer Credit Panel and data from Equifax.

Date Range: 2003 to present

Source: Clearnomics, Federal Reserve

Among the most scrutinized indicators of consumer financial pressure are delinquency statistics across various loan categories. Delinquencies occur when borrowers miss payment deadlines, which may happen for numerous reasons. During the past two years, delinquencies in both credit card and automobile financing have increased notably, as illustrated in the chart above.

Delinquencies are categorized according to payment lateness duration. Initial delinquency begins at 30 days past due, with escalating severity at 60 and 90+ day thresholds. The emergence of new delinquencies deserves particular attention as it identifies consumers recently experiencing payment difficulties. The upward trajectory of 90+ day credit card delinquencies indicates persistent financial challenges for certain consumer segments.

Auto loan delinquencies provide particularly valuable insights because consumers typically prioritize these payments even during financial hardship. This prioritization reflects the critical nature of vehicle ownership for employment commuting and essential daily activities. This prioritization pattern was notably evident during the housing crisis when many homeowners faced negative equity situations with their mortgages.

Credit quality significantly influences delinquency patterns.

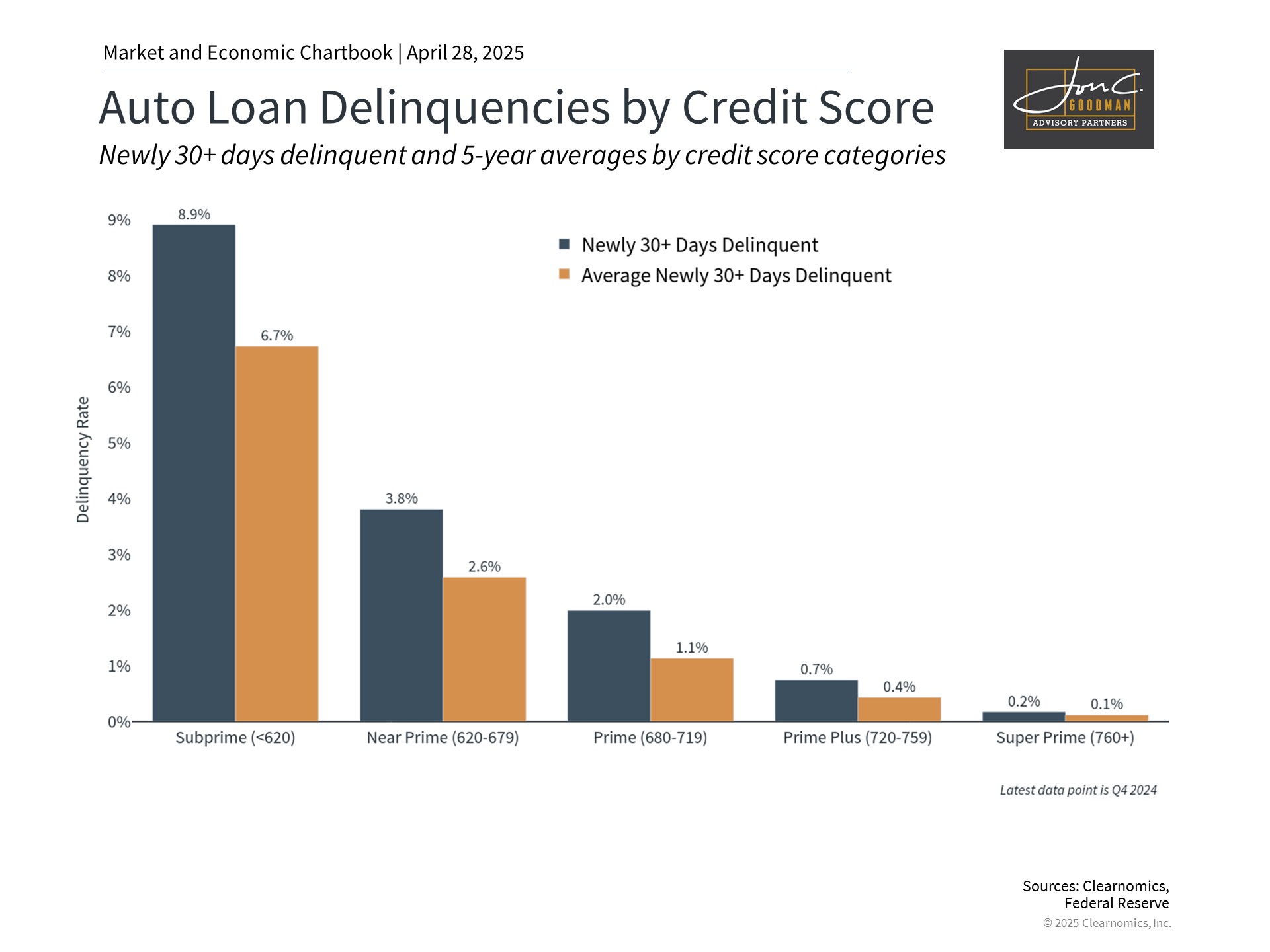

This chart shows the percentage of auto loan accounts that are newly 30+ days delinquent, compared to the historical average over this time period. This data is based on analysis conducted by the Federal Reserve Bank of New York.

Date Range: 5 years ago to present

Source: Clearnomics, Federal Reserve

What accounts for increasing delinquencies and the disparities among loan categories? Recent analysis indicates these trends are primarily driven by credit quality variations. Credit profiles typically range from subprime (individuals with weaker credit histories) to prime (those with stronger credit backgrounds). Prime borrowers generally present reduced default risk to lenders, while subprime loans frequently carry higher interest rates reflecting elevated repayment uncertainty.

Current data suggests the overall increase in automobile loan delinquencies is disproportionately concentrated among borrowers with lower credit scores. As demonstrated in the accompanying visualization, the delinquency rate differential between subprime and prime borrowers is substantial both in absolute terms and relative to historical norms. Comparable patterns appear evident in credit card delinquency statistics.

This distribution pattern also explains why major financial institutions haven’t expressed broader concerns regarding consumer financial stability. During recent earnings discussions, banking executives emphasized the continued durability of their consumer portfolios. This resilience persists despite concerns about tariffs, diminished consumer confidence, heightened inflation anxieties, and various other economic uncertainties.

Debt service ratios remain within sustainable parameters.

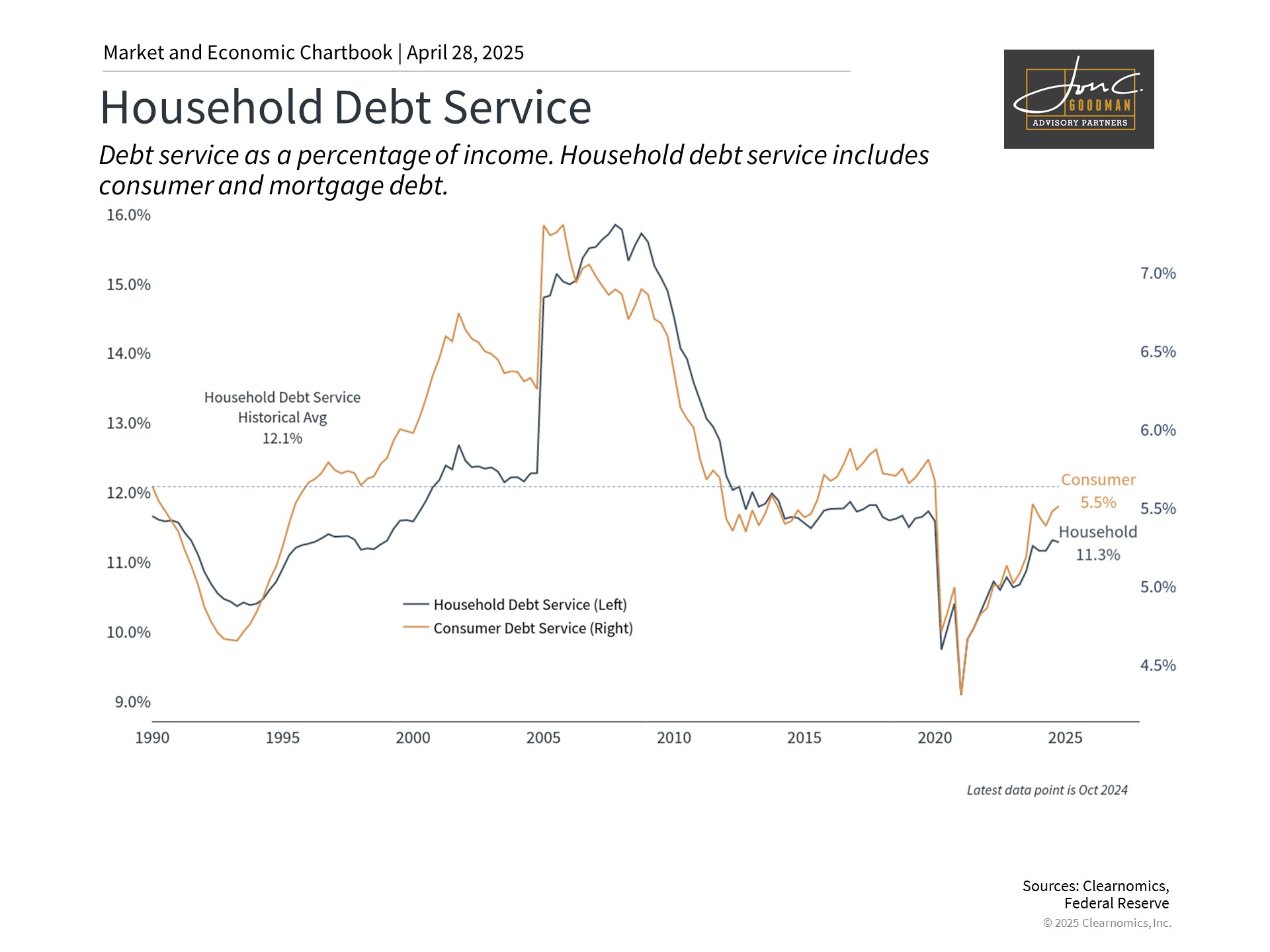

This chart shows the household and consumer debt service payments as a percent of disposable personal income. The household debt service is on the left axis and consumer debt service is on the right axis. The dotted blue line denotes the average household debt service percentage.

Date Range: Q1 1990 to present

Source: Clearnomics, Federal Reserve

It’s important to recognize that debt levels naturally expand alongside economic growth. Properly evaluating consumer financial health requires contextualizing debt relative to income and savings. Currently, consumer debt payment obligations represent approximately 5.5% of household income. While this ratio is approaching its long-term average, it remains comparatively low by historical standards. This suggests the typical consumer maintains a relatively healthy position regarding monthly financial obligations.

Concurrently, household savings rates have stabilized recently, with Americans currently preserving roughly 4.6% of their earnings, though this falls below the historical average of 6.2%. Additionally, American household net worth continues near peak levels despite market fluctuations and economic uncertainties of recent years. These factors collectively establish a solid foundation for many consumers’ financial wellbeing.

It’s crucial to acknowledge that these aggregate measurements may obscure significant variations across demographic and economic segments. The difficulties confronting subprime borrowers within this “two-speed economy” represent genuine concerns. However, from macroeconomic and market perspectives, broader consumer financial indicators remain fundamentally healthy.

What implications does this present for investors? Despite tariffs and market volatility generating heightened inflation and recession concerns, overarching consumer trends remain predominantly positive. This bodes well for investors whose portfolios can withstand temporary market fluctuations while markets adjust to economic and policy uncertainties.

The bottom line? The two-speed economy explains how overall consumer metrics can remain strong despite significant pockets of financial distress. For investors, maintaining focus on longer-term economic patterns remains essential for successful investment outcomes.

Your Wellness Navigator and Holistic Health Guide: Christine Despres, RN, NBC-HWC, CDP

I am writing from my hometown in Biddeford, Maine.

It’s always a nostalgic pleasure to be here. I love so many aspects about Maine from the smell of the pine trees, to driving down winding county roads, the Northeastern architecture, the taste of the delicious, fresh seafood, the joy of seeing old friends and family and most of all, EVERYTHING about the beach. But this trip is different for me. I’m here as a nurse to care for my father after orthopedic surgery. I’m pretty sure I heard him refer to me as Nurse Ratched to one of his doctors. (Not the first time I’ve heard that, ha-ha.) I do run a tight ship but obviously it’s a slight exaggeration.

This has me thinking about what’s called the sandwich generation and how my wellness business can be supportive of Baby Boomers and their adult children as they navigate healthy aging together. According to Pew Research (2022), about 23% of U.S. adults are part of this phenomenon.

The “sandwich generation” is a label for adults in their late 30’s to late 50’s (approximately) who are simultaneously responsible for:

1. Caring for their own dependent children (or financially supporting young adults) and,

2. Providing care or significant support to aging parents or other older relatives.

They’re “squeezed” between two sets of caregiving—and often financial—obligations.

Caring for our parents isn’t just a responsibility, it’s an opportunity. It honors the past, strengthens the present, and shapes the future. Most of us are here because of the sacrifices and support our parents gave us. (Especially my father, in my case.) Caring for them is often a natural extension of that bond. Maintaining a strong relationship in their later years nurtures both their emotional health and ours. It feels right to give back and sets an example for our own children. But it may be laden with complex histories, guilt and interfamily struggles. It can certainly be a meaningful time in our lives, but we must acknowledge it can be emotionally, mentally, physically and financially challenging depending on finances, distance, health status of both parties, career and your own family responsibilities. The bottom line is it is heartbreaking to watch your loved one’s decline. Stress, burnout and exhaustion are also common side effects among those with dual responsibilities.

Supporting two generations is an honorable and worthy cause—but caring for yourself is essential too! Use this checklist to protect your health while you care for others.

Self-Care Checklist for the Sandwich Generation

☑️ Prioritize Sleep

◻ Aim for 7-9 hours of sleep each night.

◻ Create a calming bedtime routine

☑️ Nourish Your Body with Brain-Boosting Foods

◻ Include leafy greens, berries, nuts, and healthy fats daily.

◻ Prep and pack simple, healthy snacks you can grab on busy days.

☑️ Set Healthy Emotional Boundaries

◻ Practice saying “no” kindly but firmly when needed.

◻ Ask for help or delegate tasks when feeling overwhelmed.

☑️ Manage Stress with Self Care

◻ Fit in at least 30-60 minutes of movement daily, practice meditation, breath work and find ways to take valuable time for yourself.

☑️ Make Mental Health Check-Ins Non-Negotiable

◻ Pause weekly to ask: “How am I really feeling?”

◻ Seek out support—therapist, coaches, or caregiver support groups.

☑️ Build a Trusted Healthcare Team

◻ Find doctors who listen to and support your family’s health journeys.

◻ Connect and communicate with trusted health professionals (nurse practitioners, therapists, nutritionists) for guidance and care. Preferably a Geriatrician for the elderly.

If interested in working with Christine directly, you can reach her through her email at christine@thewellnessnavigator.com or www.thewellnessnavigator.com.

The Science…

of how soap keeps you clean and what earwax says about your health

The Reason…

A duffel bag is called a duffel

The History…

of why boys traditionally wear blue and girls pink

The Anniversary…

of YouTube and the twentieth anniversary of its first-ever video: a grainy, 19-second clip of cofounder Jawed Karim at the San Diego Zoo.

…Also of…Jazz legend, Duke Ellington’s birth (1899); Singer-songwriter Willie Nelson’s birth (1933); Film director Alfred Hitchcock’s death (1980); the Los Angeles riots prompted by the acquittal of the policemen who physically beat Rodney King a year earlier; and Prince William and Kate Middleton’s televised wedding (2011).

That’s all for today.

If you enjoyed this week’s dispatch, please share with your friends, family, neighbors, or co-workers.

More importantly, if you discover anything interesting or thought provoking in the week ahead, please forward it to me for all to enjoy!

With that,

Until next week,

All my best,

To schedule a 15 minute call, click here.