Greetings!

First off, thanks for reading.

For what it’s worth, our Open Rate has skyrocketed to an all-time high of 65.5%.

So, thank you!

Per today’s dispatch, in your Wealth Advisory we will be taking a look at the bond market and the implication (and opportunity) that volatility has for your portfolio.

To clarify things, I will be adding commentary in italics beneath the charts again.

And your Wellness Navigator, Christine Despres, will expound upon the distinction between healthspan and lifespan, plus offer five practical tips that will help improve both.

Finally, in the Etcetera section, we’ll explore some tidbits you might have missed this week. (Also, if you come across any that might be of interest to other readers, please forward them along for consideration.)

With that, let’s go.

Wealth Advisory: How Policy Uncertainty Is Driving Bond Market Fluctuations

Similar to equity markets, increased uncertainty has triggered movements in the bond sector. These fluctuations, influenced by tariff policies and tensions between the White House and the Federal Reserve, have driven interest rates and bond yields upward. While temporary volatility often yields unpredictable outcomes, it’s essential to recognize that such periods emerge regularly, albeit with different triggers each time. For fixed income investors, particularly those depending on their portfolios for regular income, the current climate offers both difficulties and possibilities for their financial strategies.

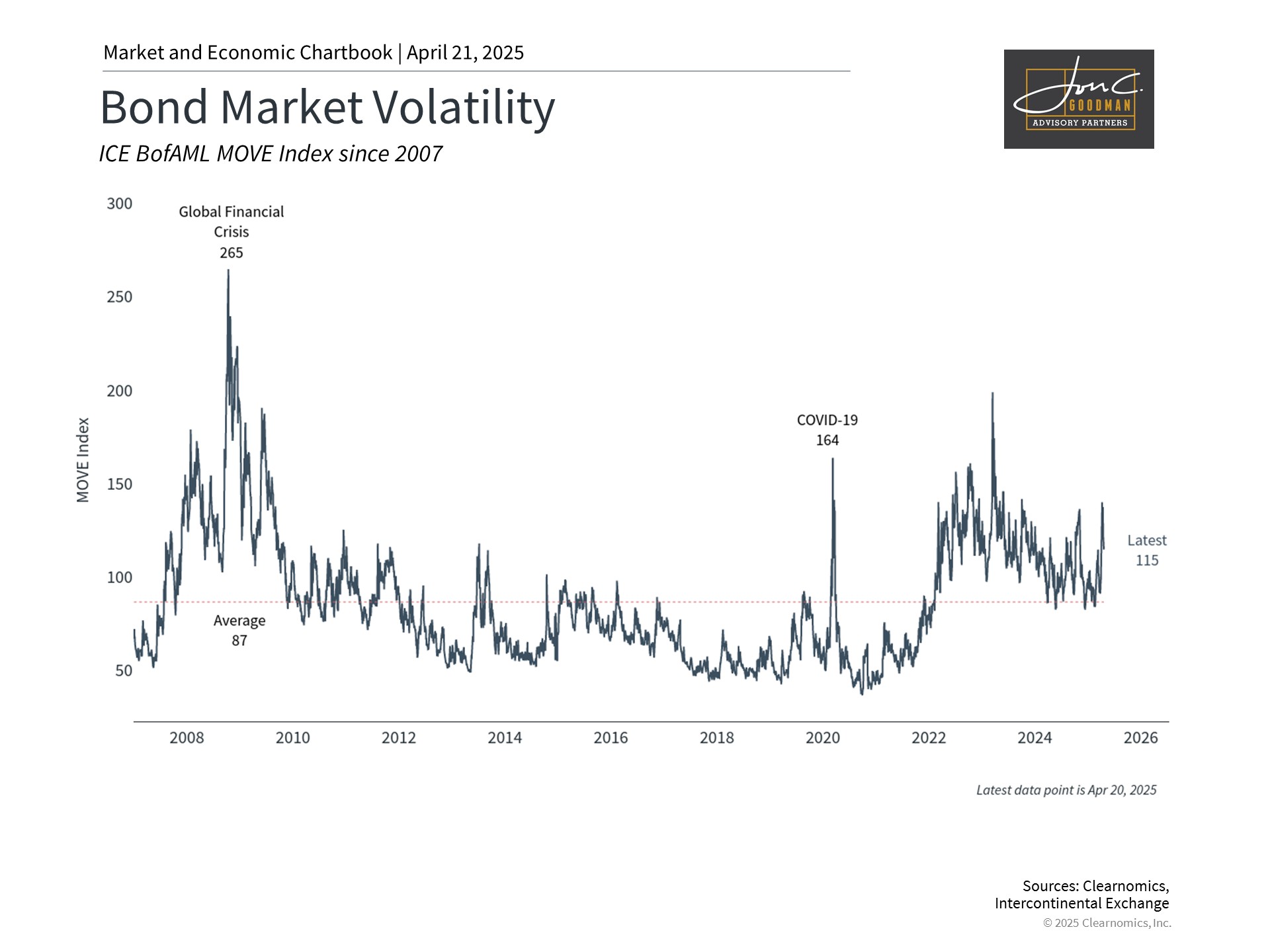

Bond market fluctuations have increased.

This chart shows the ICE BofA MOVE Index which measures the implied volatility of U.S. Treasurys. It tracks options on Treasury securities across maturities, using a weighted average of normalized implied volatilities across the yield curve. Bond market volatility spiked during the global financial crisis, the pandemic, and as rates have remained high.

This chart shows the ICE BofA MOVE Index which measures the implied volatility of U.S. Treasurys. It tracks options on Treasury securities across maturities, using a weighted average of normalized implied volatilities across the yield curve. Bond market volatility spiked during the global financial crisis, the pandemic, and as rates have remained high.

Date Range: 2007 to present

Source: Clearnomics, Intercontinental Exchange

A fundamental concept in portfolio diversification is the traditional lack of correlation between stocks and bonds. Typically, when one moves in a particular direction, the other tends to move oppositely. This isn’t coincidental – equities generally thrive during economic strength while bonds have traditionally performed well during economic uncertainty. This relationship explains why blending stocks, bonds, and additional asset categories can create a more balanced portfolio than holding just one asset type, enhancing the likelihood of meeting financial objectives.

What’s currently occurring in the bond market and why is it significant? Occasionally, market volatility creates exceptions to these historical patterns for brief intervals. For example, bond volatility emerges when markets adapt to major economic or policy shifts, such as current developments regarding tariffs and disputes over Federal Reserve independence. Regarding tariffs, bond investors are evaluating two potentially contradictory scenarios: trade restrictions could increase prices, which would typically be inflationary (generally negative for bonds), and/or they might dampen economic growth (generally positive for bonds).

Furthermore, concerns about liquidity, possible movement away from U.S. assets, and technical factors have influenced recent developments. The U.S. dollar has declined alongside bonds, which is unusual since higher bond yields normally attract foreign capital. The accompanying chart illustrates how bond market volatility has been elevated not just in recent weeks but throughout the past three years.

While these factors contribute to bond market movements, they ultimately reflect increased policy uncertainty. Bond prices depend heavily not just on the direction of interest rates and the economy, but also on how uncertain this trajectory might be. Just as recent government trade policies have complicated planning for households and businesses, forecasting economic variables for the coming months or year has become more challenging. This includes Federal Reserve policy direction, further complicated by headlines about President Trump and Fed Chair Powell. Consequently, it’s unsurprising that bond prices have fluctuated along with stocks.

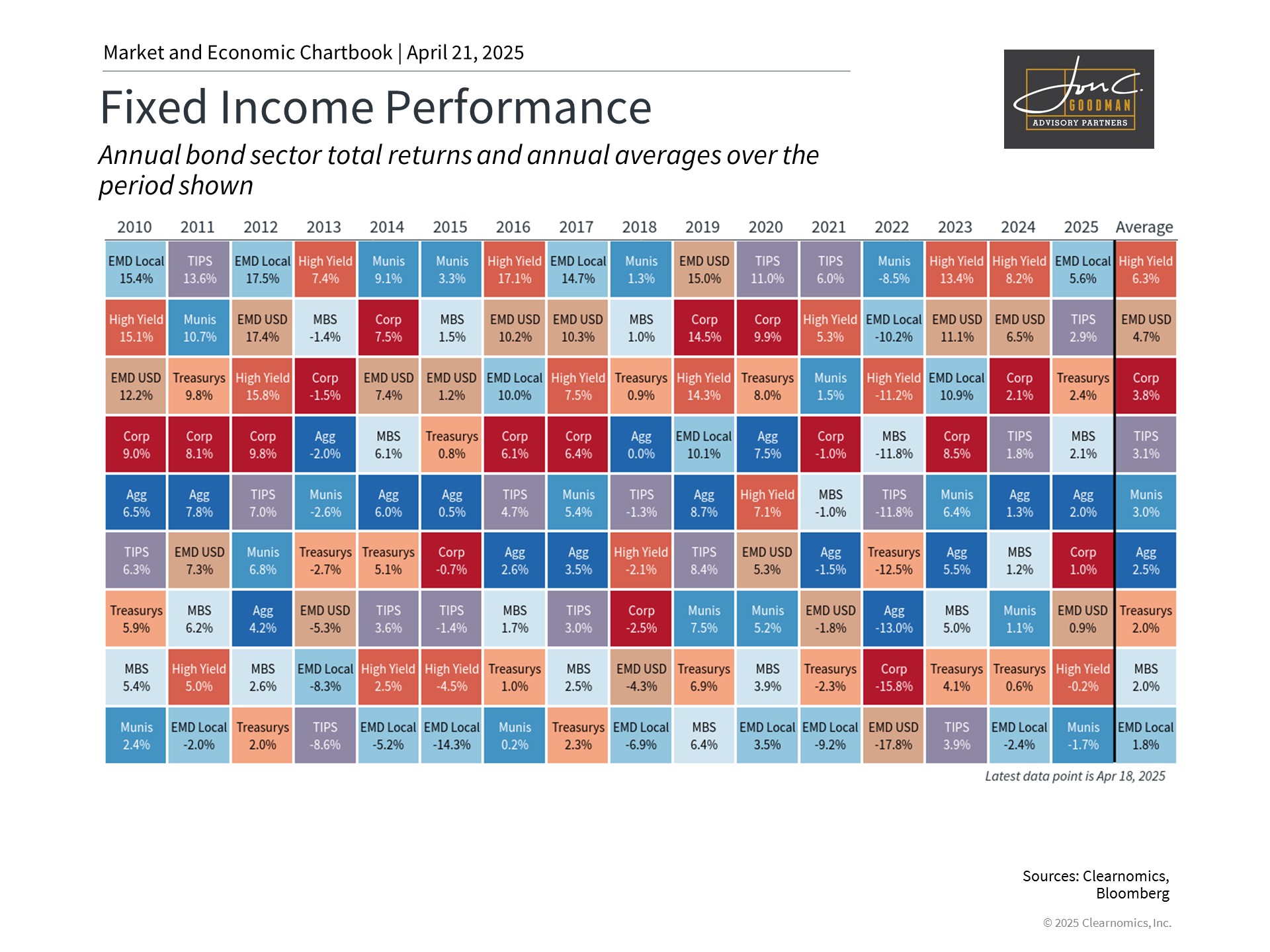

Bonds have continued to provide portfolio stability this year.

This chart shows sector total returns sorted from best to worst each year. Fixed income sectors included are Bloomberg U.S. Aggregate Bond Index, Bloomberg EM USD Aggregate Index, Bloomberg U.S. Corporate High Yield Index, Bloomberg Municipal Bond Index, Bloomberg U.S. Treasury Inflation Notes Index, Bloomberg U.S. Corporate Index, Bloomberg U.S. Treasury Index, Bloomberg U.S. Treasury, Bloomberg U.S. Mortgage-Backed Securities Index, and Bloomberg EM Local Currency Government Index. Diversifying properly across a variety of fixed income sectors can help investors to weather market volatility. By design, the aggregate bond portfolio performs steadily through both good and bad markets. It is difficult if not impossible to predict which sector will outperform from year to year.

Source: Clearnomics, Bloomberg

Naturally, some perspective is necessary. The 10-year Treasury yield currently hovers around 4.3% – well within its range over the previous two years. Generally, interest rates are higher than many anticipated at the beginning of the year.

Despite this, most bond sectors still display positive year-to-date returns including the U.S. Aggregate Bond Index, Treasurys, and investment grade corporate bonds. High yield bonds, which correlate strongly with the equity market, show only slight negative performance.

As these returns demonstrate, corporate bond investors are distinguishing between higher and lower quality issuers amid persistent economic uncertainty. Corporate bond spreads, which indicate how much additional yield these bonds generate compared to Treasurys, illustrate this phenomenon. Investment-grade spreads have remained relatively narrow, while high-yield spreads have expanded considerably. Nevertheless, spreads remain significantly tighter than during previous crises such as 2008, 2020, and 2022.

Municipal bonds have also experienced greater volatility recently. The muni ratio, which compares municipal bond yields to Treasury yields, increased following the tariff announcement and continues to be elevated. This higher ratio indicates that munis are currently more appealing compared to Treasurys, especially for investors in higher tax brackets and high-tax states.

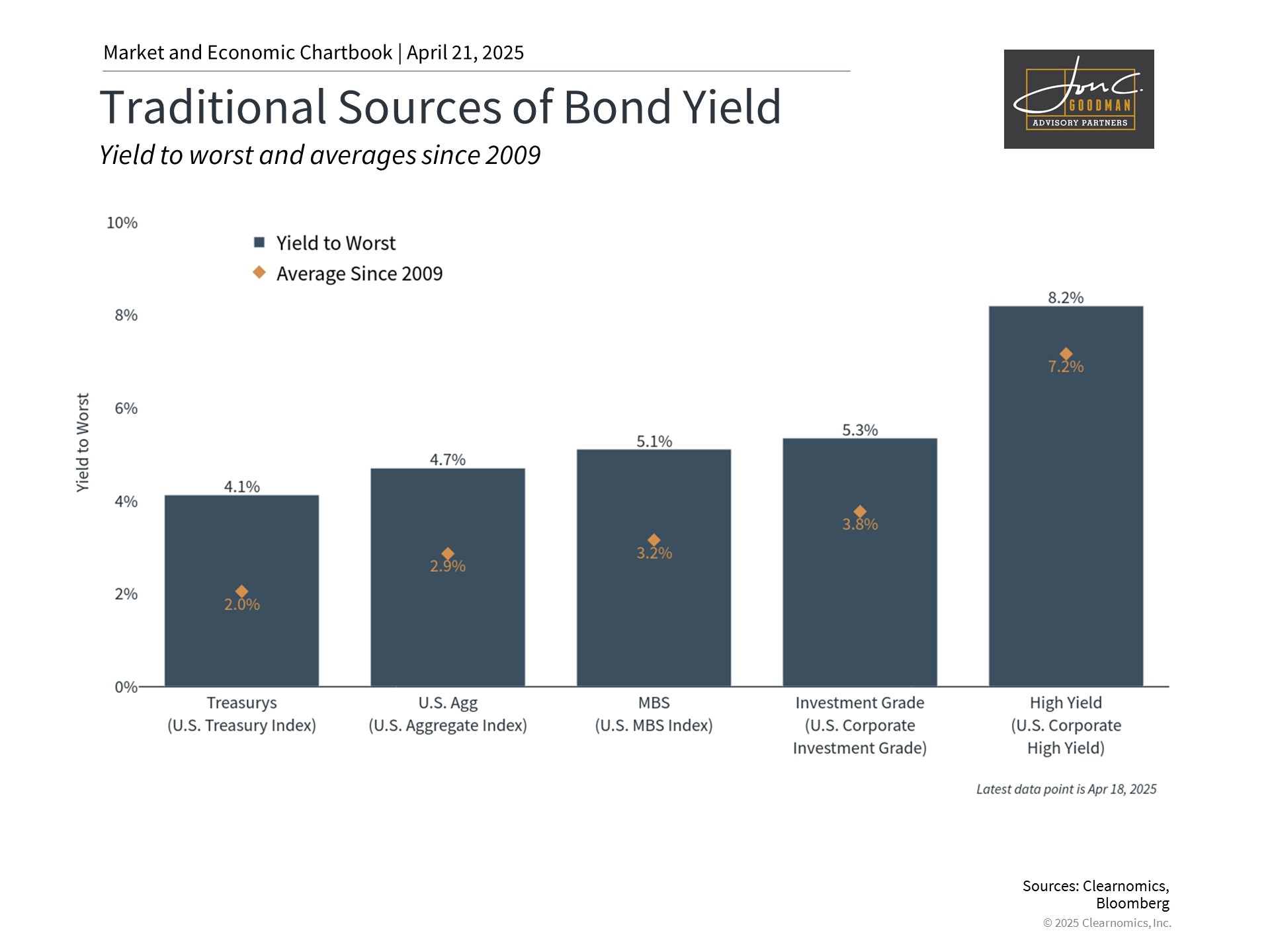

Bond yields remain at appealing levels.

This chart shows several traditional sources of bond yield. Blue bars denote the latest yield to worst and gold diamonds indicate the yield to worst average daily average since 2009. Treasuries are represented by the Bloomberg U.S. Treasury Index, U.S. Agg by the Bloomberg U.S. Aggregate Index, MBS by the U.S. MBS Index, Investment Grade by the U.S. Corporate Investment Grade Index, and High Yield by the U.S. Corporate High Yield Index. Bond yields can act as a necessary balance to volatile equities in portfolios. Yield-to-worst shows the lowest possible yield of a bond operating within its contract if the bond does not default. Yields across bond indices are attractive compared to their averages since 2009.

Date Range: January 2009 to present

Source: Clearnomics, Bloomberg

Regardless of bond price movements in the upcoming weeks, bond yields remain attractive compared to the past two decades, creating opportunities across fixed income markets for those seeking portfolio income. Investment grade corporate bonds, for instance, currently offer an average yield of 5.3%, compared to a 3.8% average since 2009.

The outlook for bonds may also be favorable as the Fed is expected to implement additional rate cuts later this year, regardless of how the disagreement with the White House unfolds. For income-focused investors, current yields appear attractive across numerous fixed income sectors and can help sustain portfolios during ongoing uncertainty.

The bottom line? Policy developments continue to unsettle financial markets. While bonds have experienced volatility in recent weeks, compelling yields and generally healthy returns can support long-term investors in achieving their financial objectives.

Your Wellness Navigator and Holistic Health Guide: Christine Despres, RN, NBC-HWC, CDP

I am thrilled that conversations on health and wellness are shifting to focus on quality over quantity. As a nurse who has worked extensively with the elderly, I can tell you firsthand there is a huge difference. Of course, we can learn so much from places like the Blue Zones (areas that are characterized by lower rates of chronic diseases and a longer average lifespan compared to the rest of the world.) but living longer may not seem like a gift if the last 20 years are spent battling heart disease, dementia, diabetes or severe pain and debilitation.

Healthspan is the number of years that someone lives or can expect to live in reasonably good health whereas lifespan refers to the total number of years a person lives, from birth to death. Focusing on healthspan means making intentional, sustainable choices today so that your future self can thrive—not just survive. And then here we are again…back to holistic health habits and lifestyle choices that prevent or lessen 80% of chronic illness and disease and 45% of dementia cases.

Nathan LeBrasseur, Ph.D, Director of the Robert and Arlene Kogod Center on Aging, Mayo Clinic, Rochester, Minnesota put it best: “As much as we’re searching for the ‘magic pill,’ our studies show that lifestyle factors such as physical activity, healthy nutritional habits, social connectedness and sleep profoundly affect how well we age and extend our healthspan. What we’ve shown in our studies is that higher levels of physical activity and reduced calories while maintaining adequate nutrition have the potential to reduce the number and burden of the cells. Taking care of your body and incorporating some of these fundamental activities can improve your lifespan and build a foundation for healthy aging.”

Here are my Top 5 Wellness TIPS:

1. HYDRATE 💦- drink lots of quality H2O, herbal teas, bone broth, coconut H20, green juice

2. MOVE YOUR BODY – ⛹️♀️🚴🏼♀️🏌🏽🤾🏻🏄🏽⛷️in ways you enjoy and that create strength

3. DON’T SMOKE CIGARETTES – or anything else 🚭

4. THE 80/20 RULE – everything in moderation ⚖️

5. EAT WHOLE FOODS, REALFOOD, SUPERFOODS & COCONUT EVERYTHING🥥

Remember…

“It is not enough for a great nation merely to have added new years to life—our objective must also be to add new life to those years.” John F. Kennedy

You can reach Christine directly through her email at christine@thewellnessnavigator.com or www.thewellnessnavigator.com.

To test:

How to Pick a Wine by the Animal on the Bottle

To watch:

How to Curb a Destructive Mindset

To read:

San Francisco Unveils a Great Big Naked Statue

That’s all for today.

Thanks again for reading. I’m glad you’re enjoying the new format.

As ever, if you found anything herein of value, please share with your friends and family.

Until next week,

All my best,

To schedule a 15 minute call, click here.