What a week it has been.

Today alone saw something not seen in decades, in which a strong early rally in U.S. stocks gave way to a sharp late-day selloff, as hopes for progress in trade negotiations quickly unraveled.

In fact, the S&P 500 experienced a rare and dramatic reversal—climbing more than 4% intraday before closing down over 1%. It marked the first time since at least 1978 that such a swing occurred. The Nasdaq Composite, heavy in tech stocks, also saw its largest intraday gain since 1982 vanish by the close.

The reason?

104% tariffs on all Chinese imports, effective tonight at midnight.

Meanwhile, Canada’s 25% tariff on U.S.-made vehicles that fail to meet North American trade agreement standards will begin tomorrow.

While some dip-buyers are stepping in amid the chaos, volatility remains high—and the bond market hasn’t offered much of a safe haven either.

Question is, might there be opportunity in the chaos? That’s the meat of today’s dispatch that will be discussed momentarily in our Wealth Advisory.

We’ll also spend a little time getting to know the Wellness Navigator, Christine Despres, a little better.

Finally, in our Etcetera section, we’ll take a break from all things wealth and wellness and have a look at meaningful things worth watching, reading, and listening to.

With that, let’s dive in!

Your Wealth Advisory: The Importance of Offense and Defense in Challenging Markets

Global markets have been rattled by escalating trade tensions and recession fears. As nations implement retaliatory tariffs, with China’s counter-measures heightening concerns about a potential trade war, investors worldwide have witnessed market declines. This uncertainty has triggered a move toward safer assets, driving bond prices higher and yields lower.

Market conditions highlight the need for strategic portfolio positioning.

Success in both athletics and investing requires effective offensive and defensive strategies. A defensive investment approach means constructing portfolios that can withstand various market conditions. Given the inevitability of market fluctuations and unexpected events, maintaining strong defensive positions is crucial.

Conversely, offensive strategies involve capitalizing on market opportunities during periods of change. While market uncertainty can be disconcerting, these periods often present attractive investment opportunities through more favorable asset prices. Creating portfolios aligned with financial objectives requires balancing both offensive and defensive elements. How should investors approach the current market environment to both protect their assets and seize opportunities?

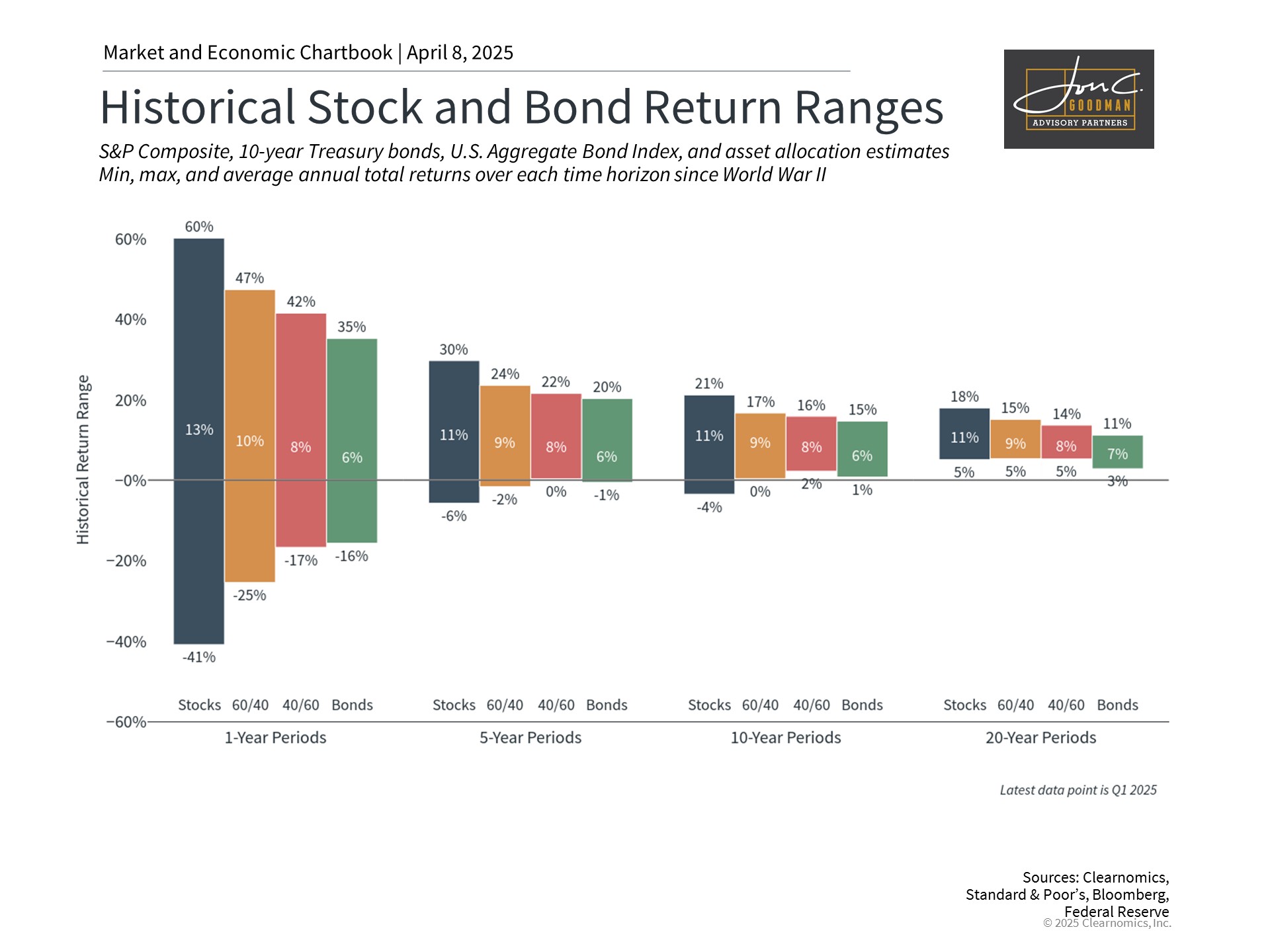

Diversification and long-term perspective represent fundamental principles of successful investing. The accompanying chart illustrates these concepts by showing historical performance ranges across various asset types and time periods. For example, single-year stock market returns have ranged dramatically, from a 60% gain in 1983 following stagflation concerns to a 41% decline during the 2008 financial crisis.

Examining longer time periods and diversified portfolios demonstrates the power of these investment principles. While diversification may limit maximum potential returns, it also reduces risk exposure. This is demonstrated by the balanced 60% stocks/40% bonds portfolio. While the S&P 500 has declined 13% this year, a 60/40 portfolio has only fallen 4.6%.

The primary objective isn’t maximizing returns at any cost, but rather achieving financial goals with the highest probability of success. Diversified portfolios historically show more consistent outcomes, enabling better financial planning.

Time horizon extension significantly impacts potential outcomes. Since World War II, no 20-year period has shown average annual declines for these asset types and portfolios. Many diversified allocations show similar results over 10-year periods. While past performance doesn’t guarantee future results, this demonstrates the importance of long-term thinking.

Market volatility can present investment opportunities.

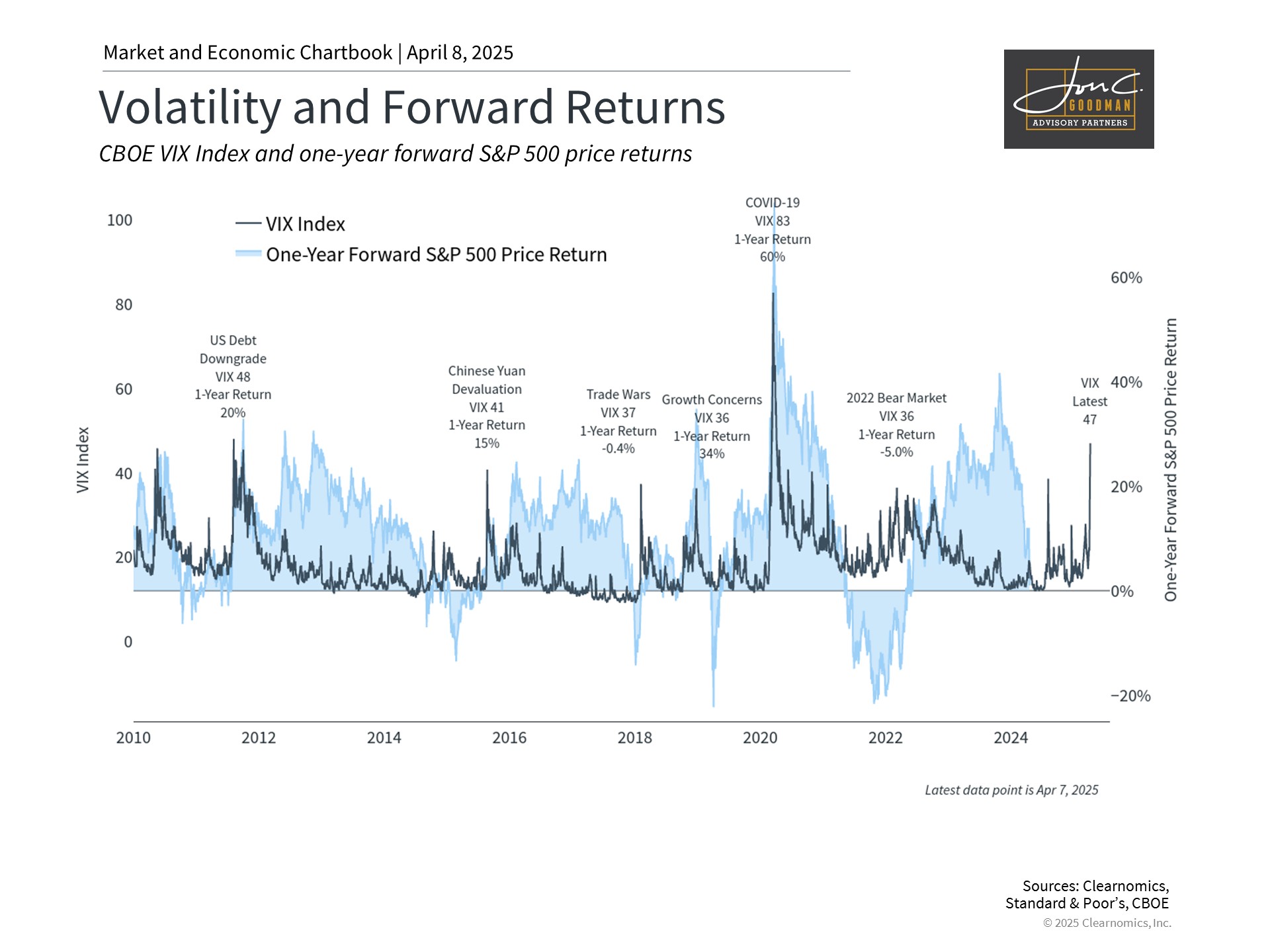

Examining market opportunities reveals that the VIX index, commonly known as the market’s “fear gauge,” experiences periodic spikes. These peaks coincide with significant market declines, as seen in 2008 and 2020. During these periods, market sentiment reaches extreme levels of nervousness, with many doubting the possibility of stabilization.

The chart also displays S&P 500 returns for the subsequent year. While no single-year returns are guaranteed, data suggests that significant opportunities often emerge during periods of peak investor concern. This aligns with Warren Buffett’s famous advice to “be fearful when others are greedy, and greedy when others are fearful.”

This pattern is particularly evident when markets face liquidity rather than solvency issues. Liquidity challenges arise when market declines force leveraged investors to sell assets. Such situations can create price declines even when fundamental asset values remain unchanged. These scenarios often present opportunities for patient investors as short-term market movements diverge from long-term prospects.

This analysis shouldn’t be interpreted as advocating market timing. High VIX levels don’t guarantee immediate market recoveries. Instead, investors should consider this within a broader portfolio context. Market downturns often coincide with attractive valuations, potentially warranting increased rather than decreased exposure to affected assets, depending on individual circumstances.

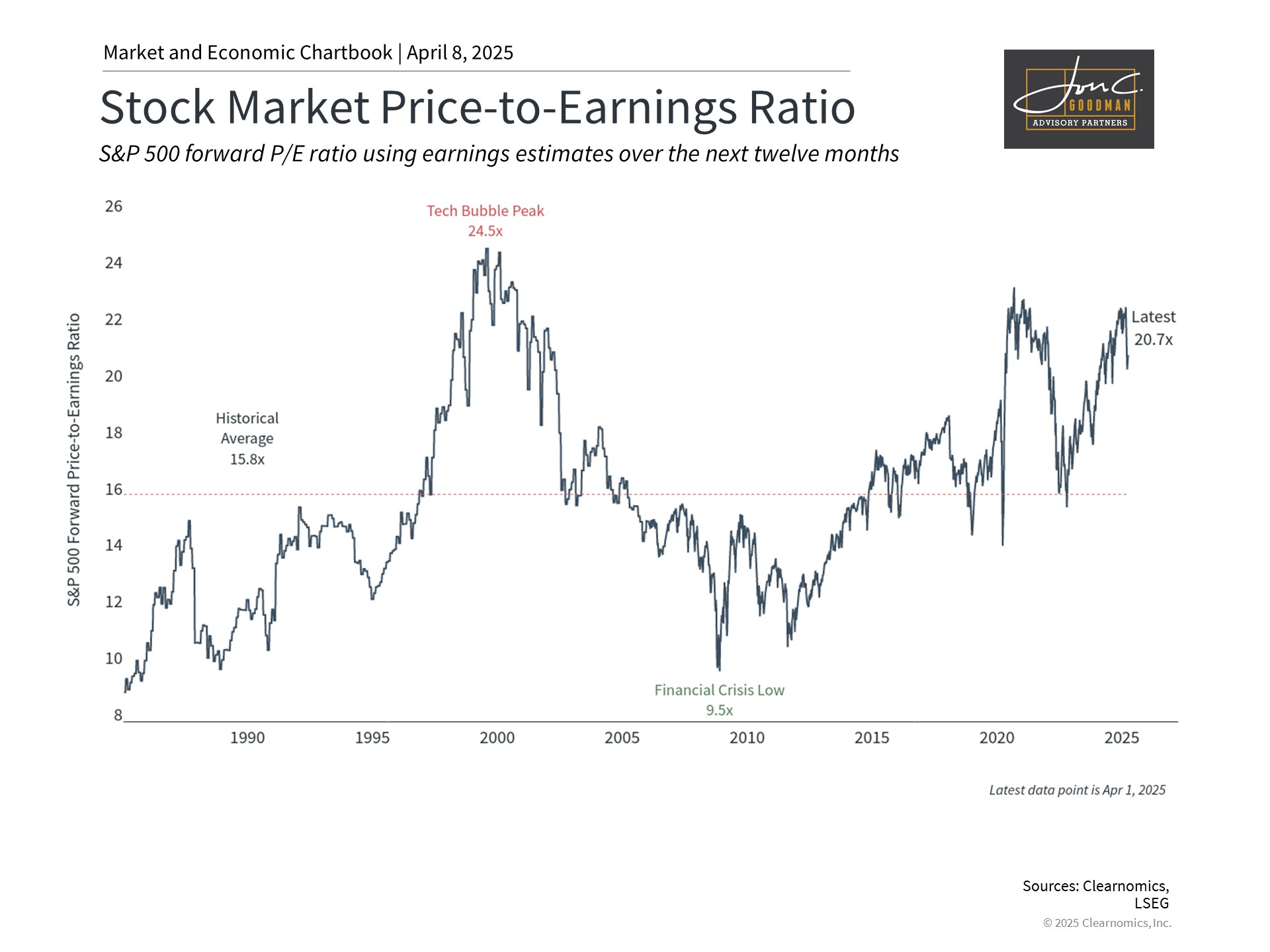

Current market conditions have created more appealing valuations.

Which assets have provided stability this year, and where do opportunities exist? Bonds have demonstrated their portfolio value as falling interest rates have helped offset declines in other asset classes. Bonds typically exhibit lower volatility than stocks and often move inversely, leading to the saying that “bonds zig when stocks zag.” Maintaining appropriate allocations to uncorrelated assets helps prepare portfolios for challenging periods.

Following several years of strong market performance, valuations have become more attractive. While earnings impacts from tariffs remain uncertain, the S&P 500’s price-to-earnings ratio has decreased to 20.7x. Information Technology, Communication Services, and Consumer Discretionary sectors have experienced particularly notable multiple contractions during the broader market retreat.

Traditional safe-haven assets like gold have recently faced challenges despite reaching new all-time highs earlier this year and delivering double-digit annual returns. While investors often seek gold for similar reasons as bonds – as a store of value during uncertainty – recent economic concerns have pressured all commodity prices. This underscores the importance of maintaining a comprehensive portfolio perspective rather than focusing on individual asset classes.

The bottom line? Successfully navigating market uncertainty requires both defensive positioning and offensive capability. This balanced approach helps manage risk while capitalizing on opportunities that emerge during periods of market fear. Long-term success ultimately depends on maintaining an appropriately structured portfolio aligned with financial goals.

Your Wellness Navigator: More About Christine Despres, RN, NBC-HWC, CDC (Plus, How to Reach Her)

Christine grew up in coastal Maine with a robust garden and a family that cooked seasonal, local food. Being an engaged consumer has always been a part of her lifestyle, whether foraging for fiddleheads or wild mushrooms, digging for clams or picking blueberries and apples. Food has always been a central point in her life as it brings people together, creates memories and traditions and feeds the soul. More importantly, food is medicine and the kitchen is part of your healthcare.

Christine’s own journey into wellness began during her nursing studies at the University of Massachusetts in Amherst, where a less-than-appetizing cafeteria menu and the infamous Freshman 15 sparked her commitment to a healthier lifestyle. Becoming a vegetarian for a decade felt like the right choice—until she moved to the icy mountains of Jackson Hole, Wyoming. Faced with freezing temperatures and a body begging for change, she begrudgingly added meat to her diet, marking the start of her deep connection to bio-individuality and the importance of truly listening to your body. There are countless dietary theories and finding what works best to optimize your health, wellness and vitality is the key. Not a “diet” or a fad but a holistic lifestyle that promotes aging well, preventing disease and feeling amazing.

For the past two decades, Christine has lived in the beauty of Montana. While the setting was idyllic, it led her serendipitously into work in rehabilitation, dementia, and hospice. Here, Christine developed a profound love for the elderly and witnessed the heartbreaking reality of preventable chronic illnesses, often marked by declining brain function and diminished quality of life. She was struck by a common question from her patients: “What happened to the golden years?” Christine realizes that aging doesn’t have to mean “rusting.” With 80% of chronic health conditions being preventable, she’s dedicated to empowering others to take control of their health early on. With a focus on optimal brain function and preventing cognitive decline she guides you to stack sustainable health habits that have a trickle down effect in all areas of wellness leading you to feel empowered, motivated and supported on your wellness journey.

Christine’s enthusiasm for wellness is contagious, and she loves sharing her knowledge with patients, coworkers, friends, family—and now, you. Stay tuned next week as she dives into science backed tips and healthy habits that will enhance your wellbeing and optimize your cognitive health.

You can reach Christine through her email at christine@thewellnessnavigator.com (mailto:christine@thewellnessnavigator.com) or her website www.thewellnessnavigator.com.

To watch: Yours truly on building the ideal 50/30/20 Spending Plan posted this week within the millionaireME Community on the Skool platform. To join and follow along daily, click here. This month, we’re covering everything you didn’t learn in High School, aka, “Foundations in Personal Finance.”

To read: The Top Five Regrets of the Dying by Bronnie Ware. (These include “I wish I had the courage to live a life true to myself, not the life others expected of me,” “I wish I hadn’t worked so hard,” “I wish I had let myself be happier,” and more. Not included in the list: “I wish I’d earned more” nor “I which I’d bought more things.”

To listen: David Brook’s speech, “How to Make a Person Feel Seen,” from the Welcome Conference at David Geffen Hall at Lincoln Center September 16th, 2024. (Also, an excellent example of how to deliver a humorous, self-effacing, honest speech.)

That’s all for today.

Until next week,

All my best,

To schedule a 15 minute call, click here.

P.S. To find or follow me online, click links in the footer.