A notable disconnect has emerged between investor sentiment and market performance. The timeless wisdom of Warren Buffett to be “fearful when others are greedy and greedy when others are fearful” remains particularly relevant today. Despite numerous economic and political uncertainties creating market turbulence, historical evidence consistently shows that maintaining investment discipline ultimately rewards patient investors.

Despite widespread concerns about economic conditions, trade policies, and monetary policy, many fundamental market indicators remain robust. The key to navigating market volatility isn’t about reacting to short-term fluctuations, but rather maintaining a strategically diversified portfolio aligned with your investment timeline and risk preferences. What insights can we gain from current market dynamics and investor psychology?

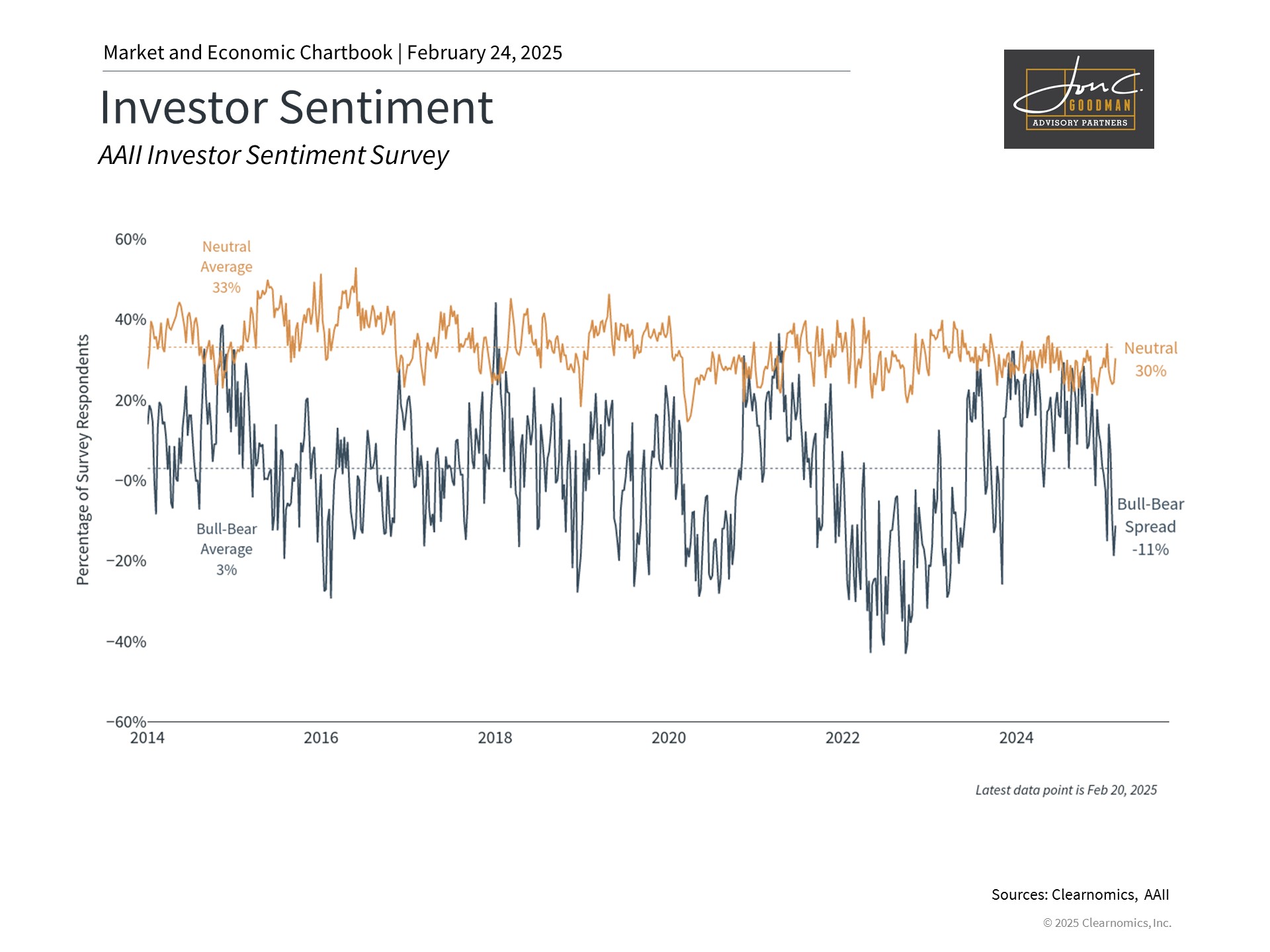

Market sentiment reaches notably bearish levels.

Recent data from the AAII Investor Sentiment Survey reveals a significant 19% gap favoring bearish over bullish sentiment, reaching levels not seen since recession fears peaked in late 2023. The chart clearly demonstrates how rapidly these sentiment indicators can shift.

A noticeable divergence exists between market perception and actual performance. While investor confidence has declined and daily volatility persists, major market indices have delivered positive returns in recent months. This pattern reinforces the notion that sentiment often serves as a contrarian signal, supporting Warren Buffett’s perspective that the best opportunities typically arise when investor anxiety peaks.

This phenomenon occurs because emotional responses can shift rapidly and may not accurately reflect future market drivers. Markets have repeatedly demonstrated their ability to climb despite widespread pessimism, as seen during the post-2008 recovery, the 2017 trade tensions, the 2020 pandemic recovery, the 2022 market bottom, and numerous other instances. Conversely, periods of extreme optimism often warrant greater caution.

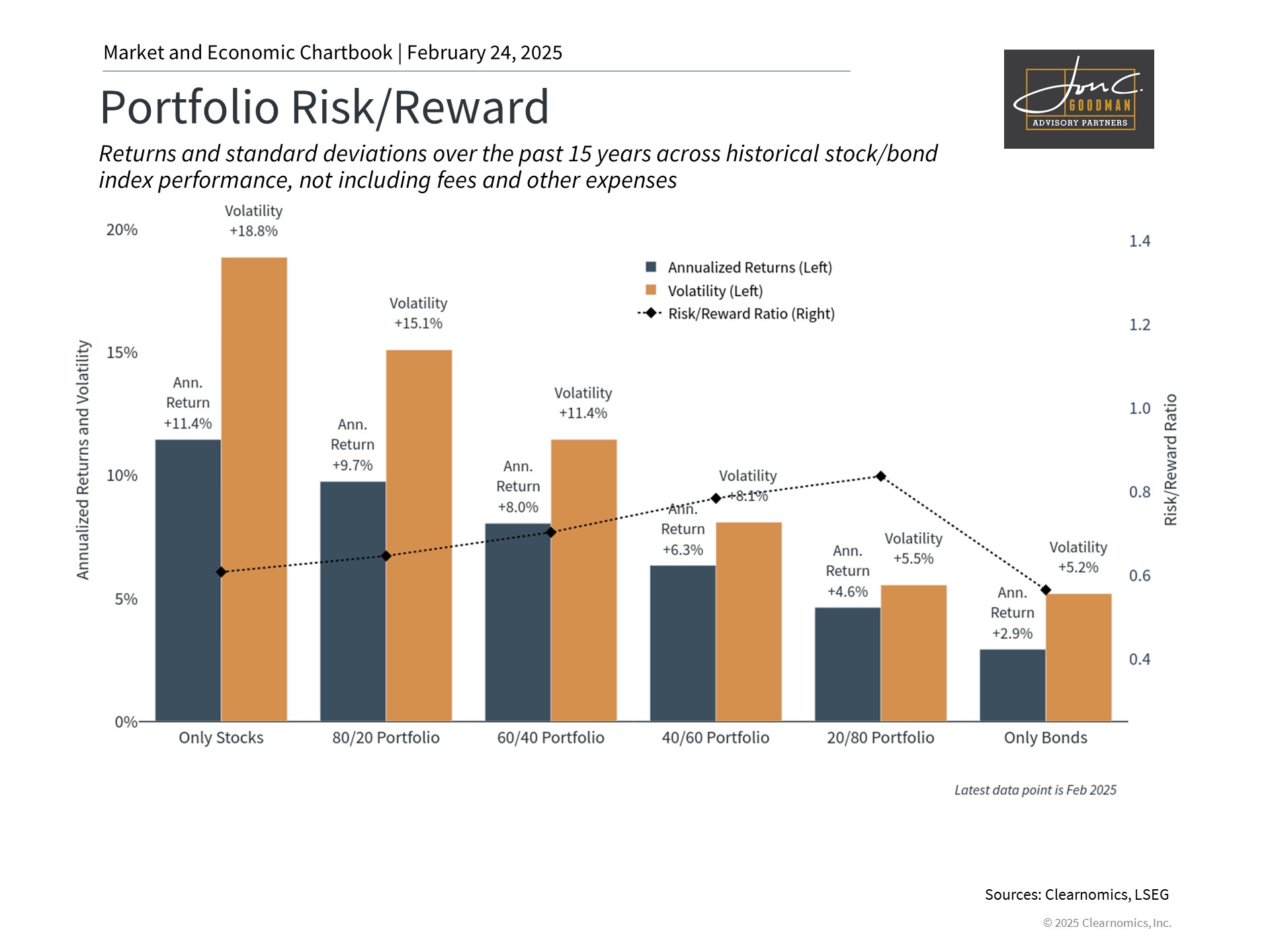

Strategic portfolio design optimizes the risk-return relationship.

When interpreting sentiment indicators, historical context is essential. Similarly, our investment strategies should provide confidence that our financial plans can withstand various market conditions while supporting our long-term objectives, regardless of short-term market movements.

Current economic indicators show considerable strength: unemployment remains near historic lows, the manufacturing sector is showing its first signs of recovery since 2022, business leadership expresses optimism, and productivity metrics have improved year-over-year. However, stock valuations are approaching historic highs, suggesting potential headwinds for broad market returns over time.

The solution to navigating mixed market signals and pessimistic sentiment isn’t market timing or complete withdrawal. Instead, these conditions emphasize the importance of thoughtful portfolio construction. The chart illustrates the fundamental relationship between risk and reward, highlighting the need to manage both aspects simultaneously. When valuations suggest elevated risks in certain areas, strategic allocation adjustments may be warranted.

Effective portfolio management involves balancing various asset classes to account for different market and economic scenarios, managing risk and return potential to maintain progress toward financial objectives. Market declines can create opportunities for rebalancing and acquiring quality investments at attractive valuations. This disciplined approach highlights the value of working with professional advisors in developing investment strategies.

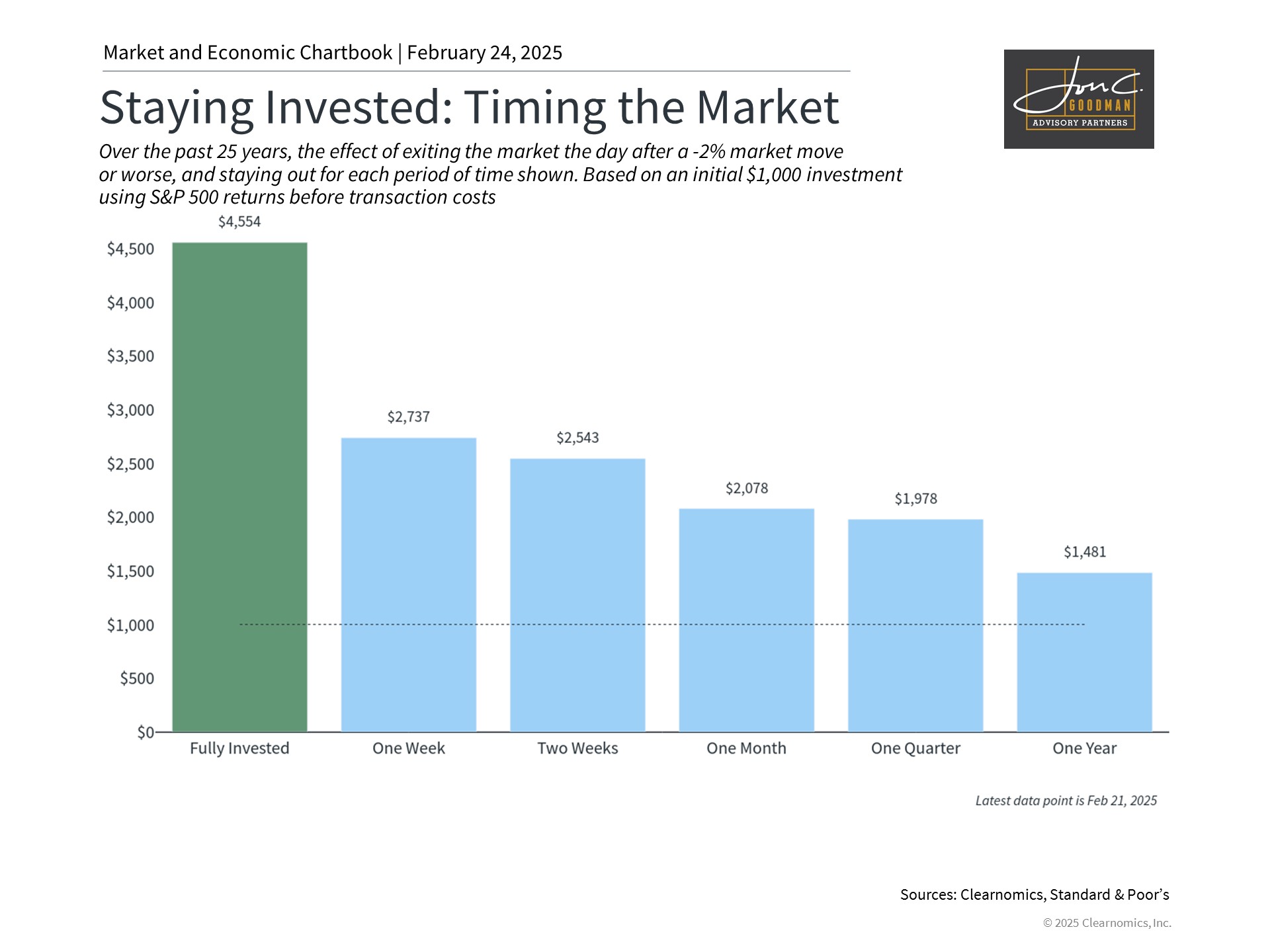

Long-term investment success requires staying the course.

Perhaps the most crucial principle for long-term investors is maintaining market exposure through various cycles. Historical evidence consistently demonstrates that remaining invested through market cycles is fundamental to building wealth over extended periods. Despite various sources of short-term uncertainty, attempts to time market entries and exits often prove counterproductive.

The chart demonstrates that over the past 25 years, maintaining investments through market downturns has consistently outperformed short-term market timing strategies. While past performance doesn’t guarantee future results, the rapid nature of sentiment shifts explains why disciplined investors often achieve superior outcomes.

The bottom line? While market volatility and negative headlines naturally create concern, historical evidence supports that investors with well-structured portfolios who maintain their long-term focus are best positioned for success. Those who remain disciplined through market cycles typically achieve better financial outcomes.