With markets navigating various challenges in early 2024, trade policy has emerged as a key focus for investors. As President Trump’s administration implements new tariff measures affecting relationships with major trading partners including China, Canada, Mexico, and the European Union, many wonder about the implications for their portfolios.

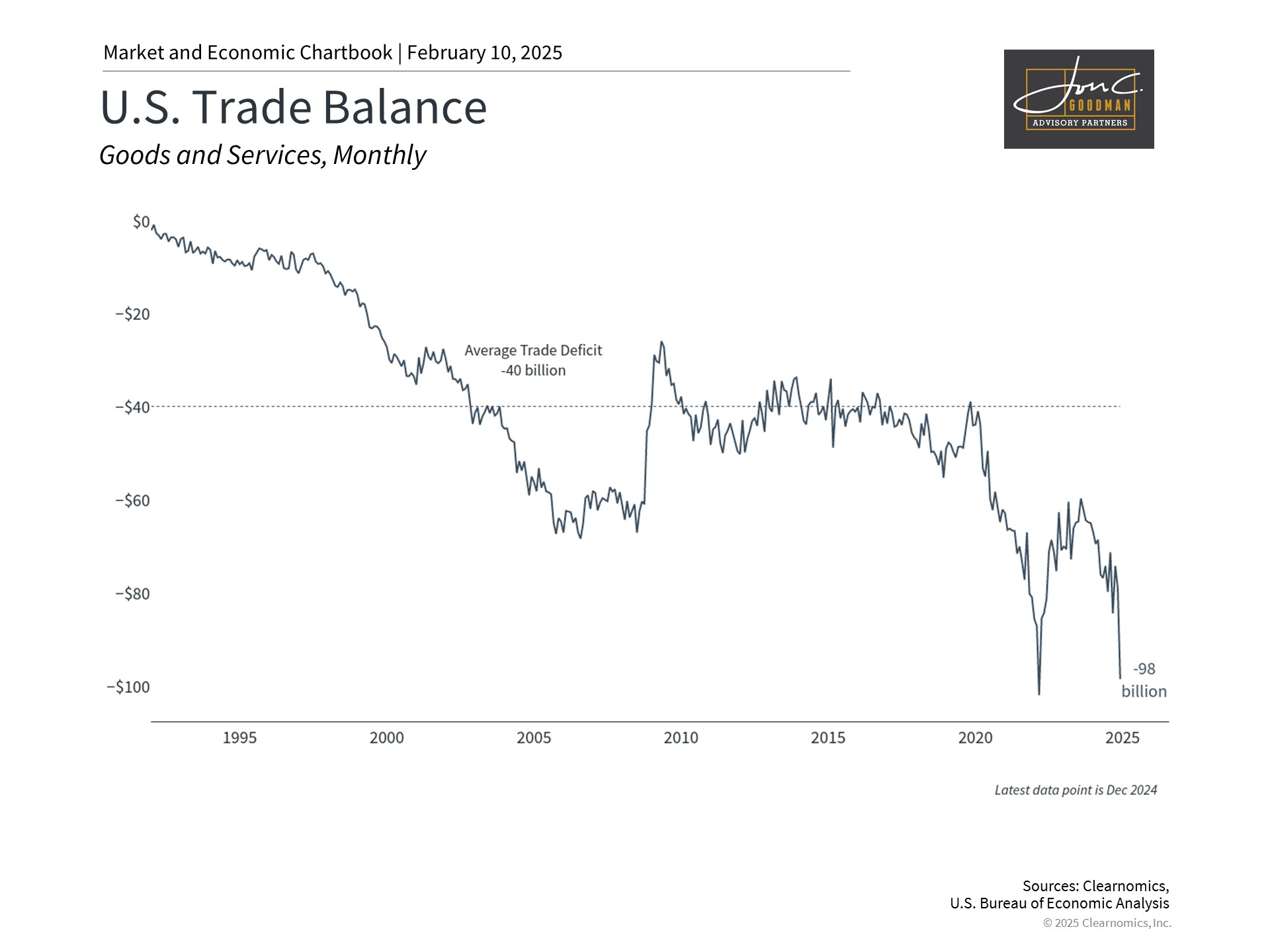

Trade imbalances remain a central policy focus.

While trade headlines can be concerning, maintaining a broader perspective is crucial for investors focused on long-term success. It’s worth noting that announced tariffs don’t always translate into implemented policy. The administration often uses tariff threats as leverage to achieve multiple objectives beyond industrial protection, including border security enhancement, drug trafficking prevention, and revenue generation.

Protectionist policies have deep roots in American history, dating back to the Industrial Revolution when tariffs helped nurture domestic manufacturing. Notable examples include the McKinley Tariff of 1890, which pushed import duties to nearly 50% on numerous goods. The Smoot-Hawley Tariffs of 1930 stand as a particularly cautionary example, as they contributed to reduced global trade and potentially deepened the Great Depression.

These experiences led to a prolonged period of trade liberalization and the creation of international trade organizations. The theory behind free trade suggests that when nations specialize in their strengths and trade freely, all benefit. However, this shift also resulted in domestic manufacturing job losses as production moved to countries with lower labor costs.

The pendulum has now swung back toward protectionist measures, with President Trump returning to his first-term strategy of using tariffs as a central policy instrument. As illustrated above, the United States continues to maintain a substantial trade deficit, importing significantly more than it exports.

Current trade measures include new 25% tariffs on steel and aluminum potentially affecting all trading partners, reciprocal duties on nations taxing American goods, temporary suspensions for Canada and Mexico, and additional measures targeting China. Beijing’s response includes 15% tariffs on energy imports and 10% duties on various U.S. products, reminiscent of the 2018-2019 trade tensions. This escalating pattern has renewed concerns about potential trade conflicts.

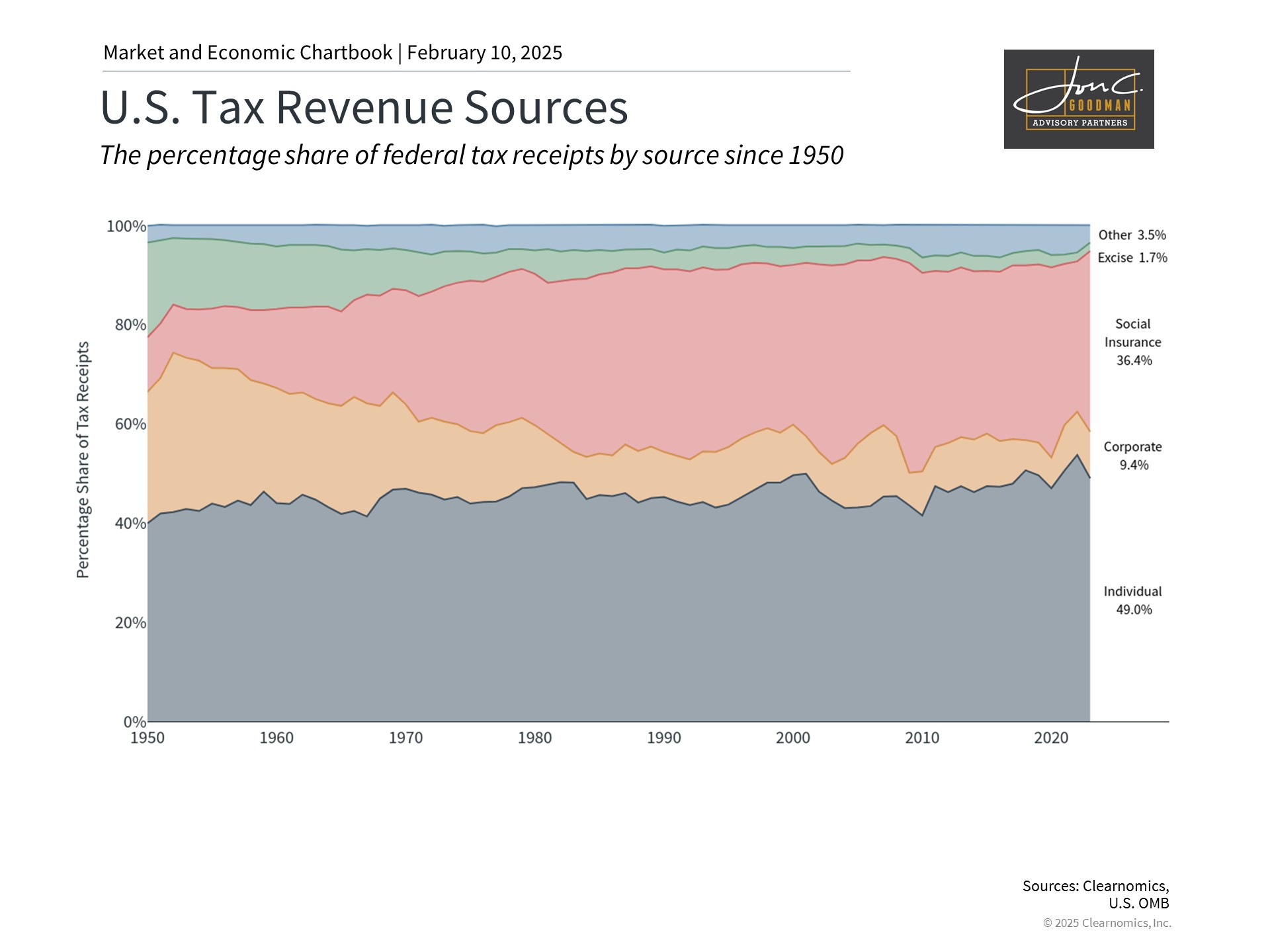

Modern tariffs play a different economic role than in the past.

Market responses to tariff announcements typically exceed their actual economic impact. Despite trade war concerns during Trump’s first term, markets performed well. The 2018-2019 trade disputes, while concerning at the time, didn’t result in the severe global consequences many predicted. Instead, tariffs served as negotiating tools, leading to agreements like USMCA and a China trade deal.

As shown above, tariffs, categorized under “Other,” represent only 1-2% of government revenue, demonstrating their limited fiscal significance. Nevertheless, many policymakers seek trade balance improvements to strengthen domestic manufacturing, boost export-related employment, and reduce foreign borrowing dependence.

Interestingly, the trade deficit partly reflects U.S. economic strength and consumer purchasing power. Higher disposable income naturally leads to increased imports. Additionally, foreign capital inflows into U.S. markets partially offset the deficit, as international investors seek American market opportunities, supporting domestic innovation and job creation.

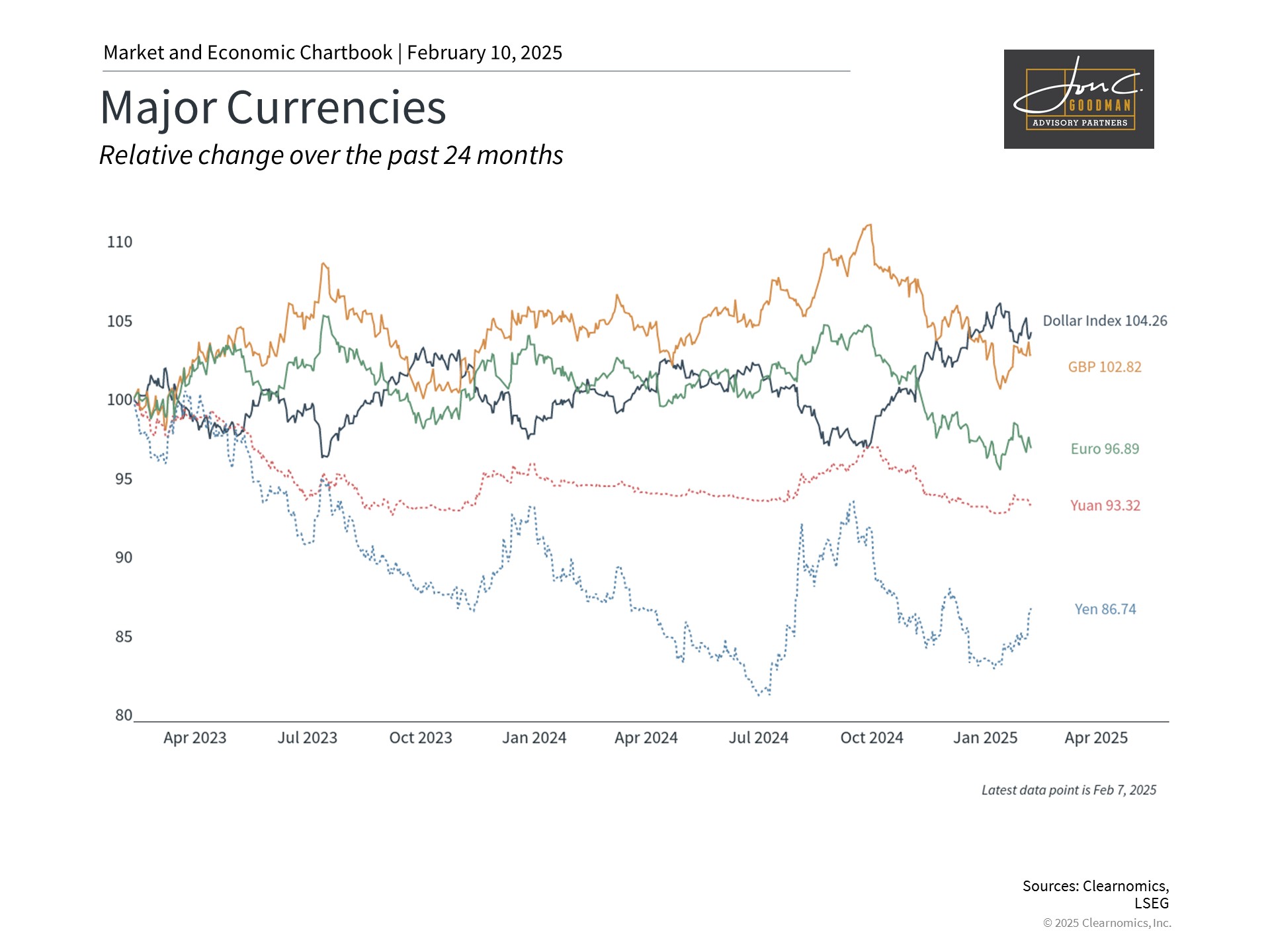

Currency markets reflect changing trade dynamics.

Trade policy developments have contributed to dollar appreciation since the 2024 election. This relationship exists because trade and currency values are interconnected – reducing imports typically strengthens the dollar, as shown in the chart above depicting dollar gains against major currencies.

Tariffs can impact consumer prices and inflation, as businesses often transfer additional costs to consumers. This effect is particularly evident in sectors with significant international trade exposure, such as consumer electronics, automobiles, and household goods.

However, these developments warrant measured consideration. Tariffs serve multiple purposes beyond their market impact. While they can create uncertainty, affect currency values, and influence consumer prices, historical evidence suggests markets can thrive despite these challenges.

The bottom line? Though trade policies and tariffs influence global economics, their market impact is often less significant than headlines suggest. Long-term investors should maintain focus on their financial objectives rather than reacting to short-term developments.

To schedule a 15 minute call, click here.