The financial markets began 2025 with mixed performance as investors navigated significant policy changes and technological disruption. The month saw President Trump’s return to office, major developments in artificial intelligence from China, and the Federal Reserve maintaining its current policy stance. These events occurred against a backdrop of renewed focus on international trade relationships and persistent inflation concerns.

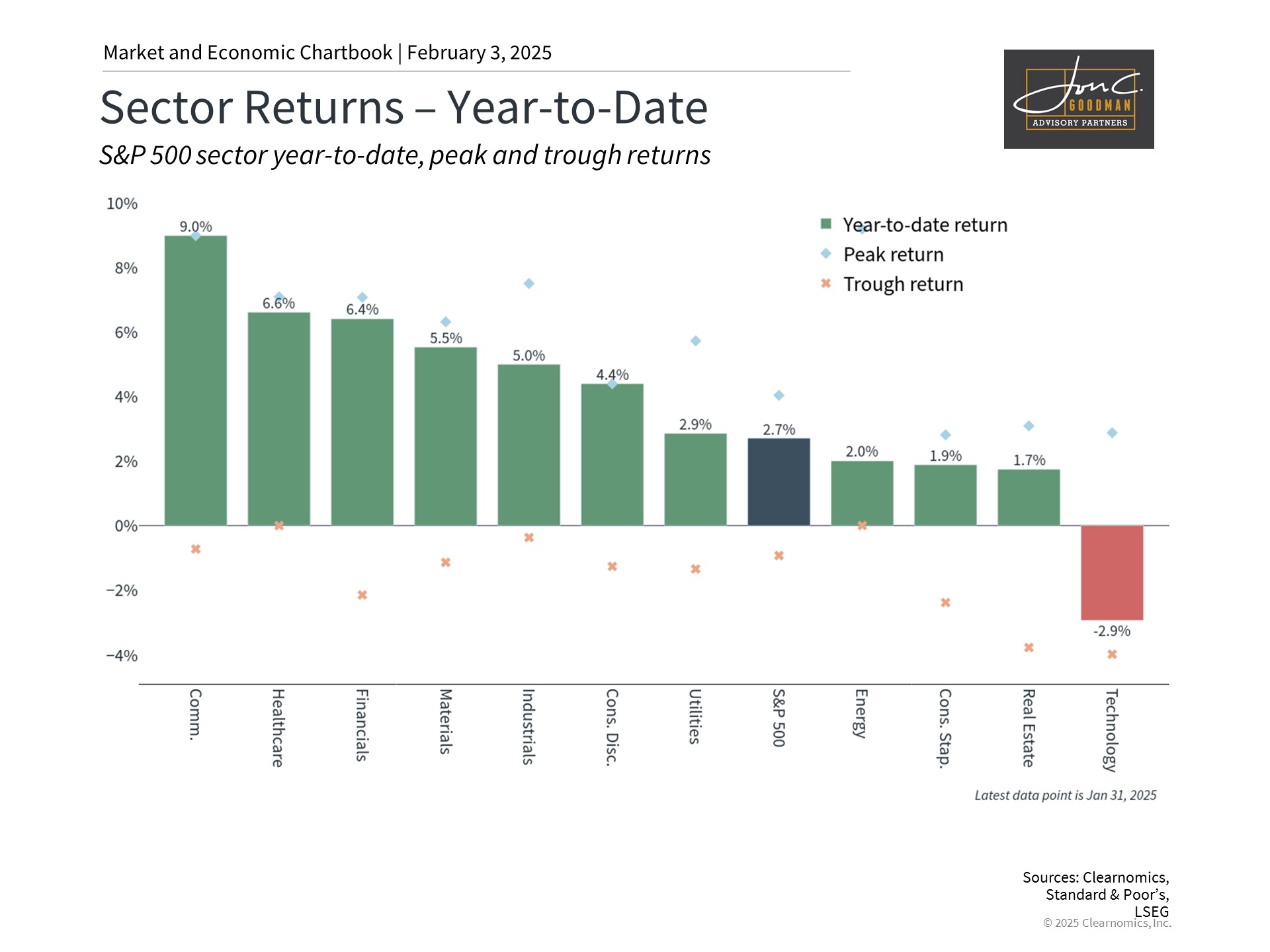

Major indices showed positive returns for January, with the Dow Jones Industrial Average leading at 4.7%, followed by the S&P 500 at 2.7%, and the Nasdaq at 1.6%. Economic indicators remained robust, with Q4 GDP growth at 2.3% and full-year 2024 growth reaching 2.8%. However, inflation measures continued to show resistance, with CPI at 2.9% and PCE at 2.6% year-over-year. The 10-year Treasury yield fluctuated throughout the month, peaking at 4.8% before settling at 4.5%.

Technology sector responds to transformative AI developments.

The technology landscape experienced a significant shift as Chinese firm DeepSeek announced a potential breakthrough in AI efficiency. Their claimed ability to train models with 95-97% fewer resources has sparked industry-wide discussions and market reactions, though competitors like OpenAI have questioned the innovation’s originality.

These technological developments carry broader market implications given the increasing integration of tech and AI across all economic sectors. The growing prominence of technology in major market indices means these developments affect portfolios beyond just tech-focused investments.

Trade policy changes create new market dynamics.

The Trump administration’s implementation of new tariffs has introduced fresh market considerations. The measures include a 10% tariff on Chinese goods, 25% on Canadian imports, and a temporarily suspended 25% tariff on Mexican products. These policies aim to increase government revenue, address border security, and protect domestic industries.

The Trump administration’s implementation of new tariffs has introduced fresh market considerations. The measures include a 10% tariff on Chinese goods, 25% on Canadian imports, and a temporarily suspended 25% tariff on Mexican products. These policies aim to increase government revenue, address border security, and protect domestic industries.

While Canada has already responded with retaliatory measures, the full economic impact remains uncertain. History suggests that markets can adapt to such changes, as demonstrated during the 2017-2019 trade tensions which ultimately led to new agreements like the USMCA.

The Federal Reserve’s decision to maintain rates at 4.25-4.50% following three consecutive cuts reflects ongoing economic strength and inflation concerns. Market projections now indicate fewer rate cuts for 2025 than previously anticipated, though these expectations remain fluid.

Rising inflation data and elevated long-term interest rates support the Fed’s cautious stance. The combination of steady economic growth and persistent price pressures suggests monetary policy may need to remain restrictive longer than initially expected.

The bottom line? January’s market performance demonstrates the importance of maintaining a long-term investment perspective amid policy shifts and technological changes. A well-structured portfolio remains the best approach for navigating market volatility and achieving investment objectives.

To schedule a 15 minute call, click here.