The financial markets are experiencing significant interest rate movements as market participants process economic data, Federal Reserve decisions, and new policies from the Trump administration. Treasury yields have shown notable volatility, with the 10-year recently reaching 4.8% before dropping below 4.6%. Meanwhile, the 2-year yield stands near 4.2%, and 30-year mortgage rates continue above 7%.

Market volatility has been further influenced by developments in the artificial intelligence sector. Recent price movements in major tech companies and concerns about AI semiconductor supply have created ripples across both equity and fixed income markets. While interest rates represent just one component of portfolio management, their current levels offer important context for investment planning.

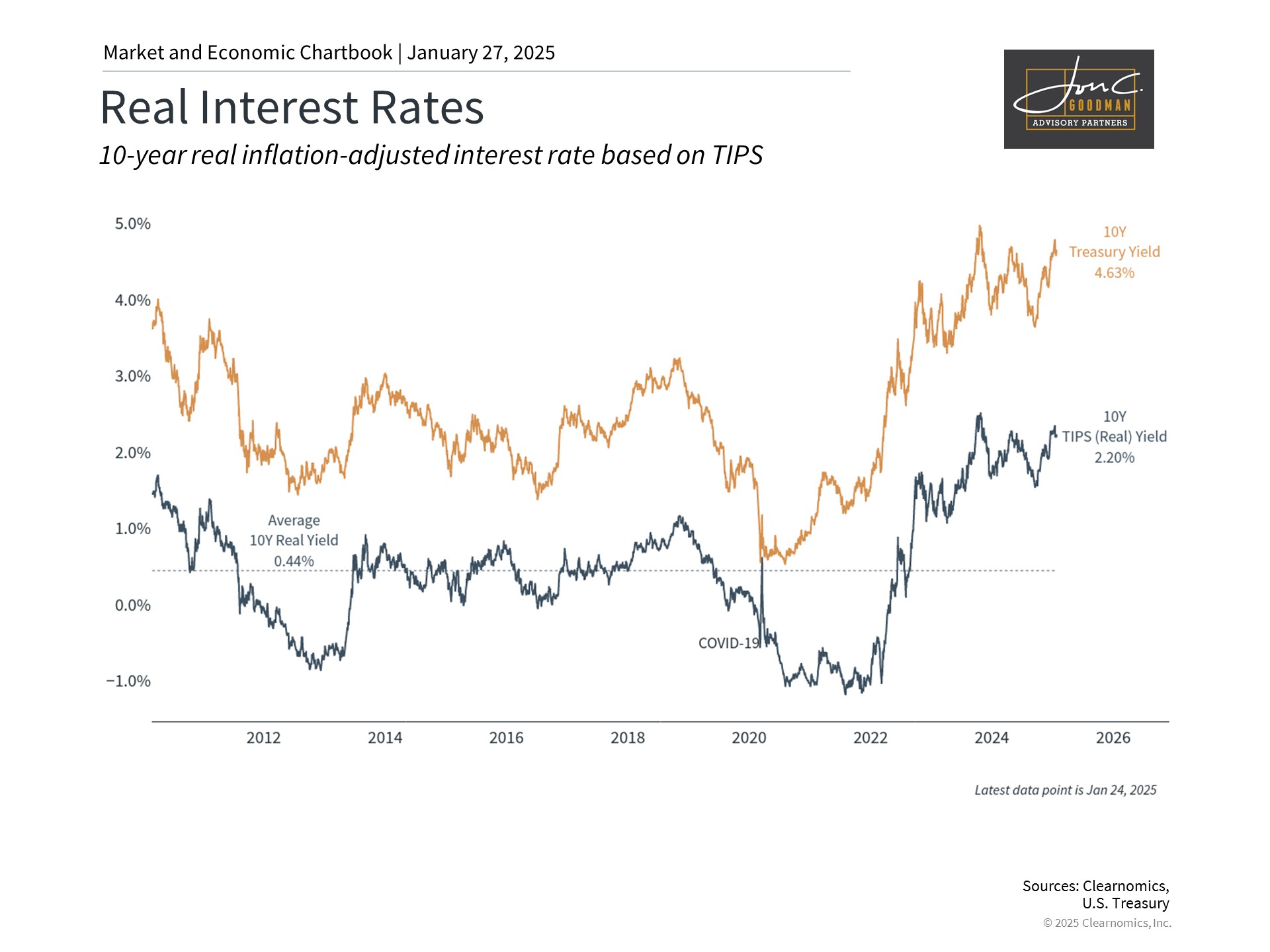

Bond yields offer compelling returns after inflation adjustment.

The level of interest rates plays a crucial role in determining the relative attractiveness of different asset classes. Higher rates increase the potential returns from conservative investments like government securities. This shift affects the equity risk premium–the additional return investors require for choosing stocks over less volatile investments. These changing dynamics influence how investors structure their portfolios across various asset types.

Currently, real yields have reached their highest point in more than ten years. Bond yields experienced a significant increase following the presidential election in November, as markets anticipated economic growth initiatives and tax reductions, despite potential inflationary pressures from trade policies.

The relationship between bond prices and yields operates inversely–rising yields decrease existing bond prices, and vice versa. This price movement can affect returns for active bond traders.

For retirement-focused investors who maintain long-term bond positions, the current yield environment offers enhanced income potential. This increased income stream can support retirement spending and potentially reduce the need for asset liquidation to cover expenses. Furthermore, higher yields may enhance portfolio diversification benefits as bonds become more competitive with other investments. Individual circumstances vary, making professional financial guidance valuable.

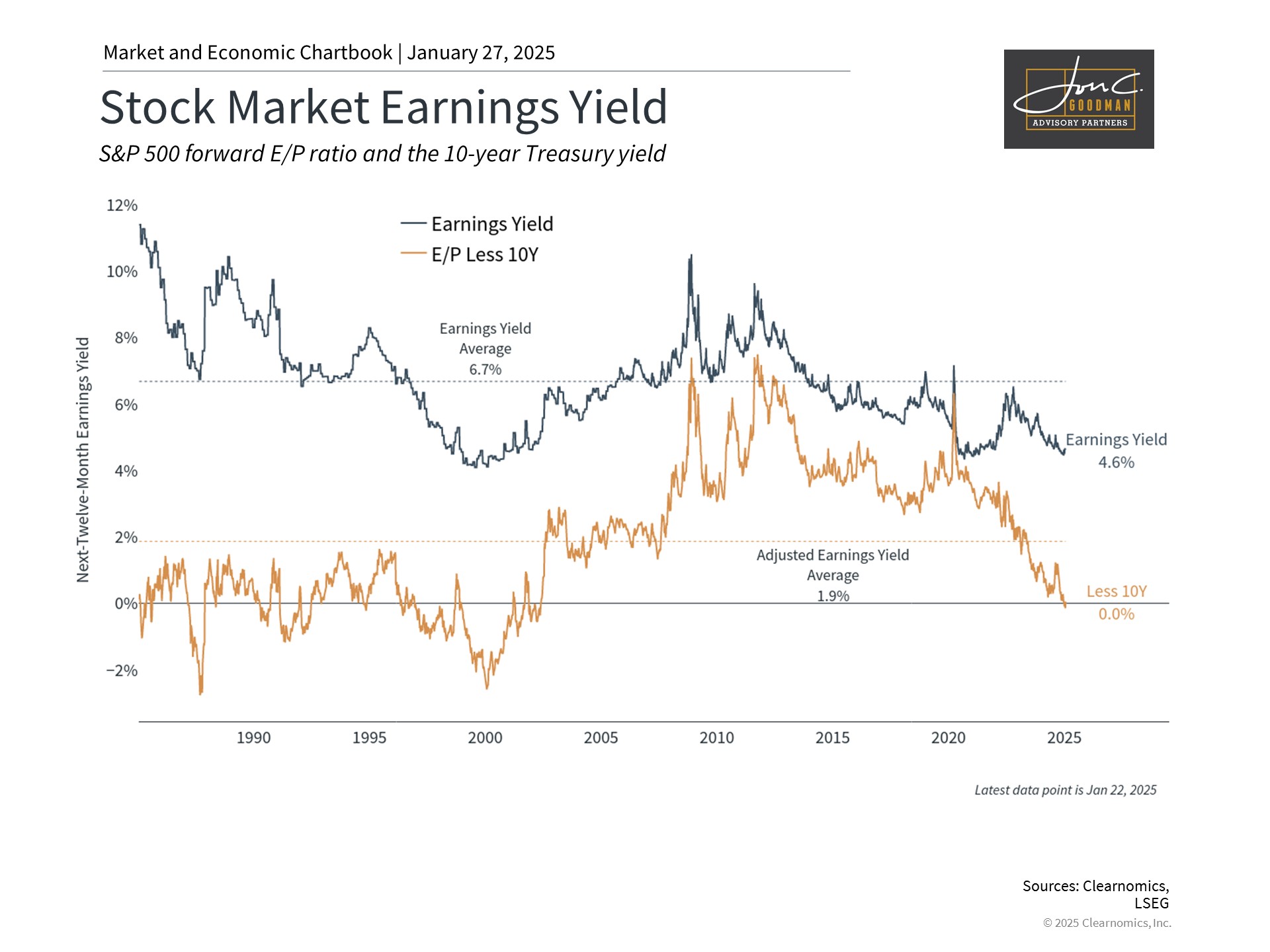

Stock valuations appear less compelling versus bonds.

The equity risk premium can be evaluated through the market’s earnings yield–calculated as earnings per share divided by price. This metric provides a useful comparison to bond yields as both measure return relative to price.

As illustrated in the chart, the S&P 500’s earnings yield has decreased steadily over 15 years. Current levels approximate the 10-year Treasury yield, suggesting reduced stock market attractiveness compared to historical norms. This reflects both higher interest rates and strong equity market performance. Historically, investors have demanded higher premiums for equity exposure given their greater risk profile.

A compressed equity risk premium doesn’t necessarily signal an imminent market correction. Historical bull markets have sustained periods of low earnings yields, particularly during low-rate environments. However, it does indicate relatively high equity valuations compared to alternatives.

Current market valuations are notably influenced by technology sector strength. Other market segments maintain more moderate valuations, emphasizing diversification’s importance. Success depends on maintaining appropriate asset allocation and risk levels aligned with personal investment goals and timeframes.

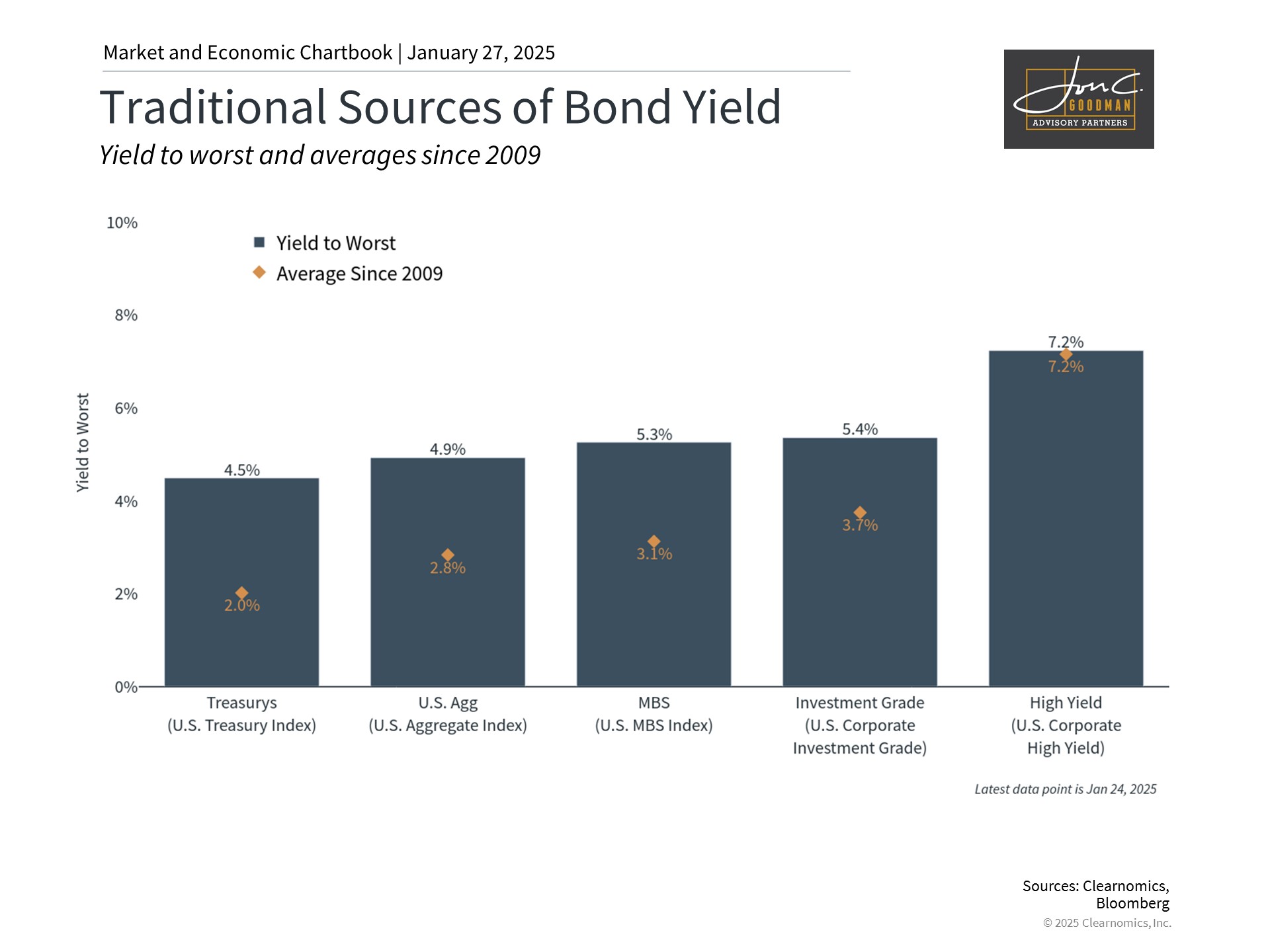

Fixed income provides essential portfolio balance.

Current bond yields offer some of the most attractive fixed income opportunities in recent years. This is particularly relevant as short-term rates are expected to decline with Fed policy shifts, affecting various cash instruments. During uncertain periods that push rates lower, rising bond prices can help offset equity market volatility.

Fixed income remains a crucial portfolio component regardless of rate trajectories. Bonds have historically demonstrated lower volatility than stocks and often move counter to equity prices. This relationship helps stabilize portfolio performance across market conditions, reducing overall risk and supporting long-term investment success.

The bottom line? The current rate environment presents compelling fixed income opportunities that can enhance portfolio yield and diversification benefits. Maintaining a long-term perspective while adhering to established investment strategies remains crucial.

To schedule a 15 minute call, click here.