Markets are adjusting to the political landscape as President Trump begins his second term following the 2024 election. While the S&P index showed initial enthusiasm with a 5.3% gain including dividends after the November vote, markets have since retraced about half those gains early in 2025.

As 2025 unfolds, investors face multiple considerations including sustained economic expansion, potential shifts in Federal Reserve policy, and elevated market valuations. These factors may increase market sensitivity to policy decisions. Though numerous executive orders have already been signed, many key policy details remain undefined. The administration’s agenda spanning taxes, government spending, international trade, energy policy and immigration reform could significantly influence economic conditions.

Let’s examine seven key areas that may affect investment markets:

1. Tax policy continuity appears likely.

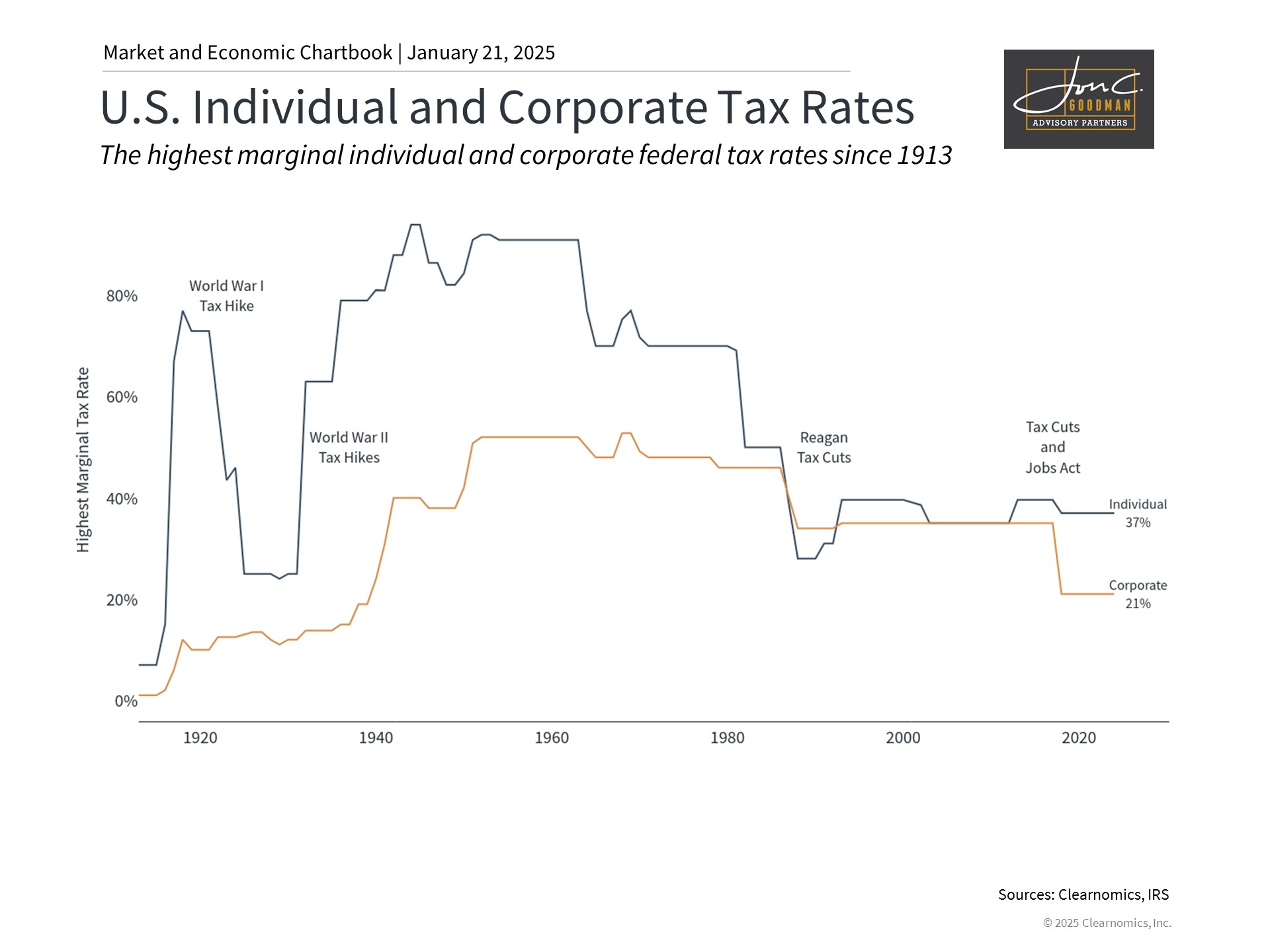

With Republican control of both the executive and legislative branches, an extension of the Tax Cuts and Jobs Act beyond 2025 seems probable. While specific legislative details are still being negotiated, this suggests continuation of the 37% top marginal rate for individuals, 21% or lower corporate rates, and expanded estate tax exemptions.

However, the relationship between tax policy and broader economic and market performance is complex. Tax rates represent just one of many factors influencing growth, with various provisions affecting effective rates.

Current tax levels remain below historical norms. Given the trajectory of national debt, prudent planning should account for potential future rate adjustments.

2. Federal deficit trajectory continues upward.

Fiscal forecasts anticipate ongoing federal debt expansion. The 2024 federal spending of $6.75 trillion resulted in a $1.83 trillion deficit, pushing total national debt beyond $36 trillion.

Recent years have seen limited appetite for deficit reduction from either party, particularly given various economic challenges. The administration has established the Department of Government Efficiency (DOGE) to identify potential spending reductions.

While balanced budgets remain popular with voters, their last occurrence in the 1990s appears increasingly distant despite new efficiency initiatives.

3. Trade policy shifts signal economic changes.

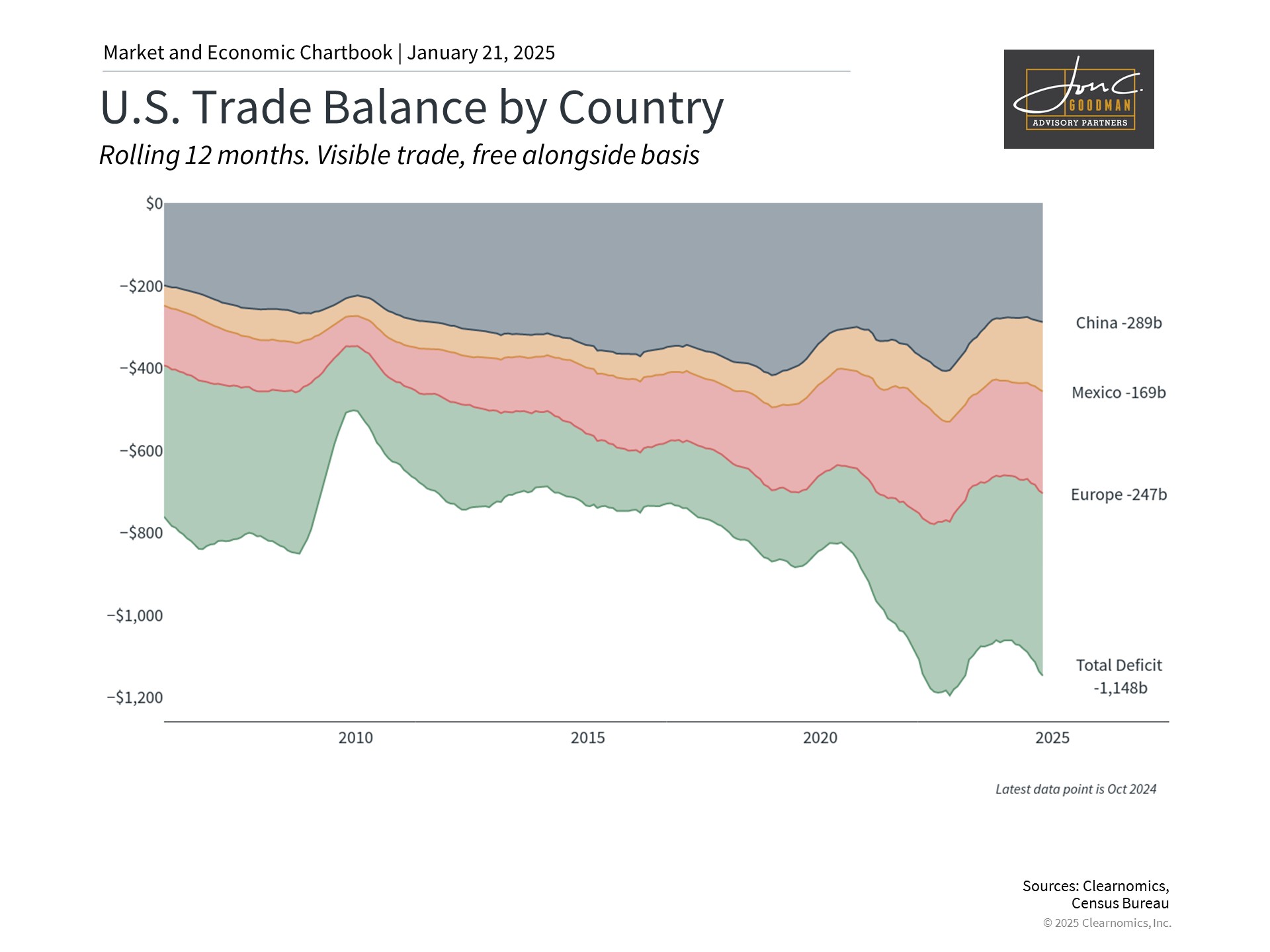

Campaign positions often differ from implemented policies, particularly regarding international trade. The president has proposed broad 10-20% import tariffs, with 60% rates on Chinese goods specifically. Recent statements indicate planned 25% tariffs on Canadian and Mexican imports starting February 1, alongside creation of an “External Revenue Service.”

The previous Trump administration increased various tariffs, leading to new trade agreements including USMCA and the China “Phase One” deal. Many of these policies continued under President Biden.

America maintains the world’s largest trade deficit, importing $78.2 billion more than it exported in November 2024. This reflects both dollar strength and robust consumer demand, though it does increase international borrowing.

While tariffs contribute minimally to federal revenue at under 2%, they may influence inflation through import costs. Policymakers must balance these effects against intellectual property protection and domestic manufacturing priorities.

4. Energy expansion takes center stage.

Energy independence features prominently in the administration’s agenda, with a declared national energy emergency and planned National Energy Council to expand drilling access.

U.S. energy production leads globally, maintaining top positions in crude oil output and natural gas exports over recent years.

Prior drilling restrictions under President Biden are facing reversal, with potential implications for energy markets and inflation. Expanded domestic production could help stabilize prices amid ongoing global conflicts.

5. Labor market implications of immigration policy

Beyond border security measures, immigration policy changes may affect skilled worker programs and overall labor availability. With job openings exceeding unemployed workers by 1.2 million, workforce access remains crucial for economic growth.

Republican debate continues over skilled visa programs like H1B, highlighting tensions between workforce needs and immigration controls.

6. Market response to policy shifts.

Initial market enthusiasm for “Trump trade” sectors has moderated since the election. These areas typically benefit from reduced regulation, lower taxes, and infrastructure spending.

Technology and cryptocurrency markets have shown strength, with Bitcoin exceeding $100,000 amid expectations of supportive policies from a new “AI and crypto czar.”

Historical patterns suggest maintaining balanced portfolios remains prudent despite policy-driven market movements.

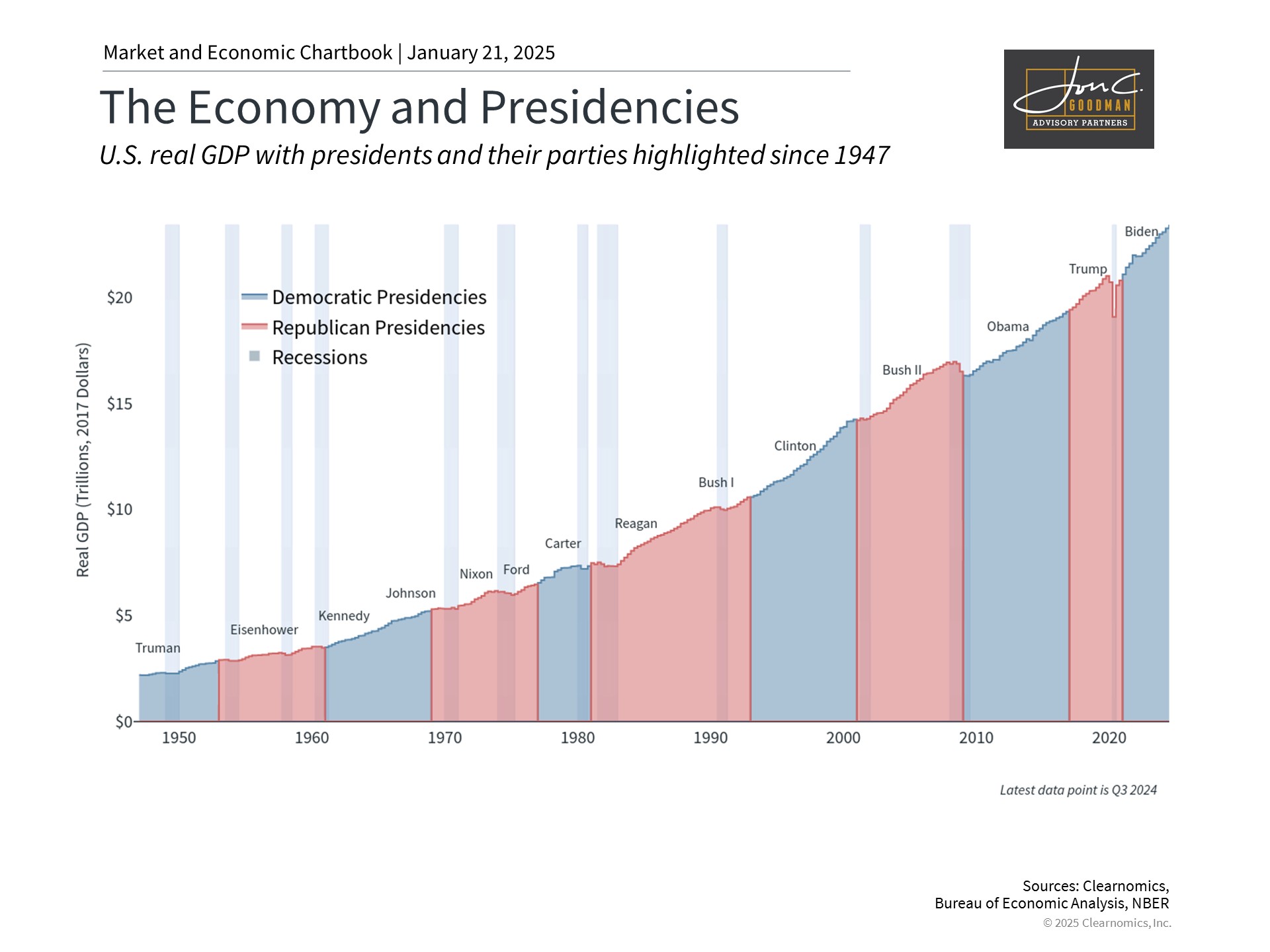

7. Economic growth transcends party lines.

Presidential influence on markets and the economy often receives disproportionate attention. Historical data shows growth periods across administrations of both parties, reflecting broader economic cycles beyond political control.

While policy decisions matter, fundamental economic factors typically drive long-term market performance more than political leadership.

The bottom line? The next four years will see markets processing various policy initiatives and their economic impacts. Successful investing requires focusing on long-term objectives while maintaining perspective beyond political developments.

To schedule a 15 minute call, click here.