As we embark on a new year, it’s crucial to consider our financial health alongside our personal well-being. Following two years of robust market performance and evolving economic conditions, now is an opportune time to evaluate and strengthen our financial foundations.

Make investing a priority for future wealth creation.

Creating a financial strategy is similar to developing a fitness routine – it requires dedication, consistency, and regular assessment. A comprehensive approach includes evaluating your current financial position, establishing attainable savings objectives, and implementing an appropriate investment strategy. Properly aligning your asset allocation with your specific goals and risk tolerance will help navigate whatever market conditions 2025 may bring.

Whether you’re focused on enhancing your investment strategy, establishing a safety net, minimizing debt, or building retirement savings, breaking down these objectives into smaller, actionable steps makes them more manageable.

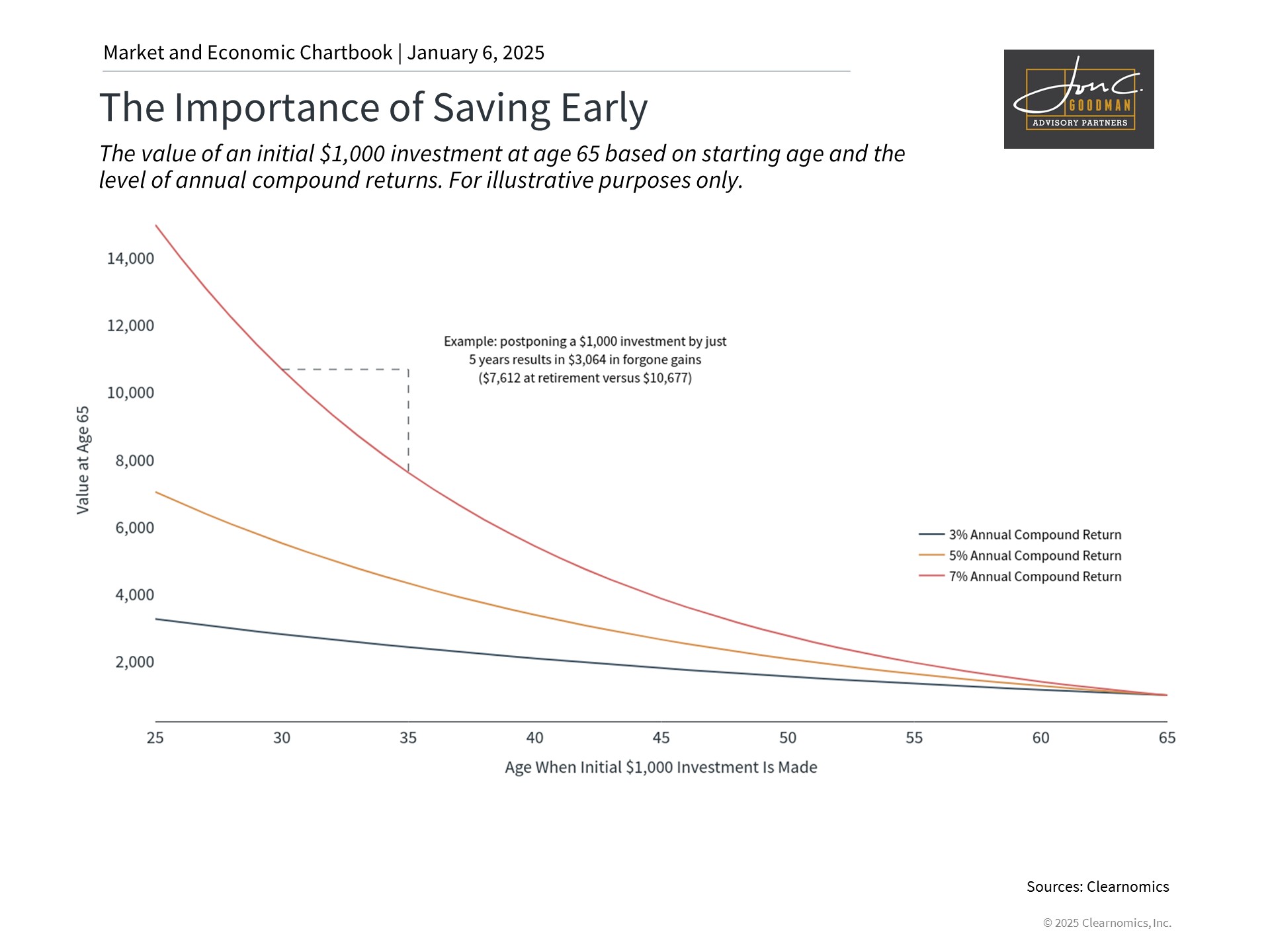

Consider the wisdom in the saying “the best time to plant a tree was 20 years ago. The second best time is now.” This perfectly illustrates how time in the market maximizes wealth through compound returns. When earnings are reinvested, they generate additional returns, creating a multiplier effect that transforms modest savings into substantial wealth over time.

The chart demonstrates how delaying investment, even briefly, can significantly impact outcomes. An investor achieving 7% average returns who starts at age 35 instead of 30 will see their initial $1,000 grow to $7,612 rather than $10,677 by retirement. This pattern holds true across various return rates. These differences compound substantially over an investment lifetime.

Market volatility, particularly when indices are at peak levels, can deter some from investing. However, the very challenge of maintaining investments during uncertain times is what creates opportunities for disciplined investors. Those who remain invested during market fluctuations often benefit from attractive buying opportunities that can lead to enhanced future returns.

Take time to evaluate retirement planning.

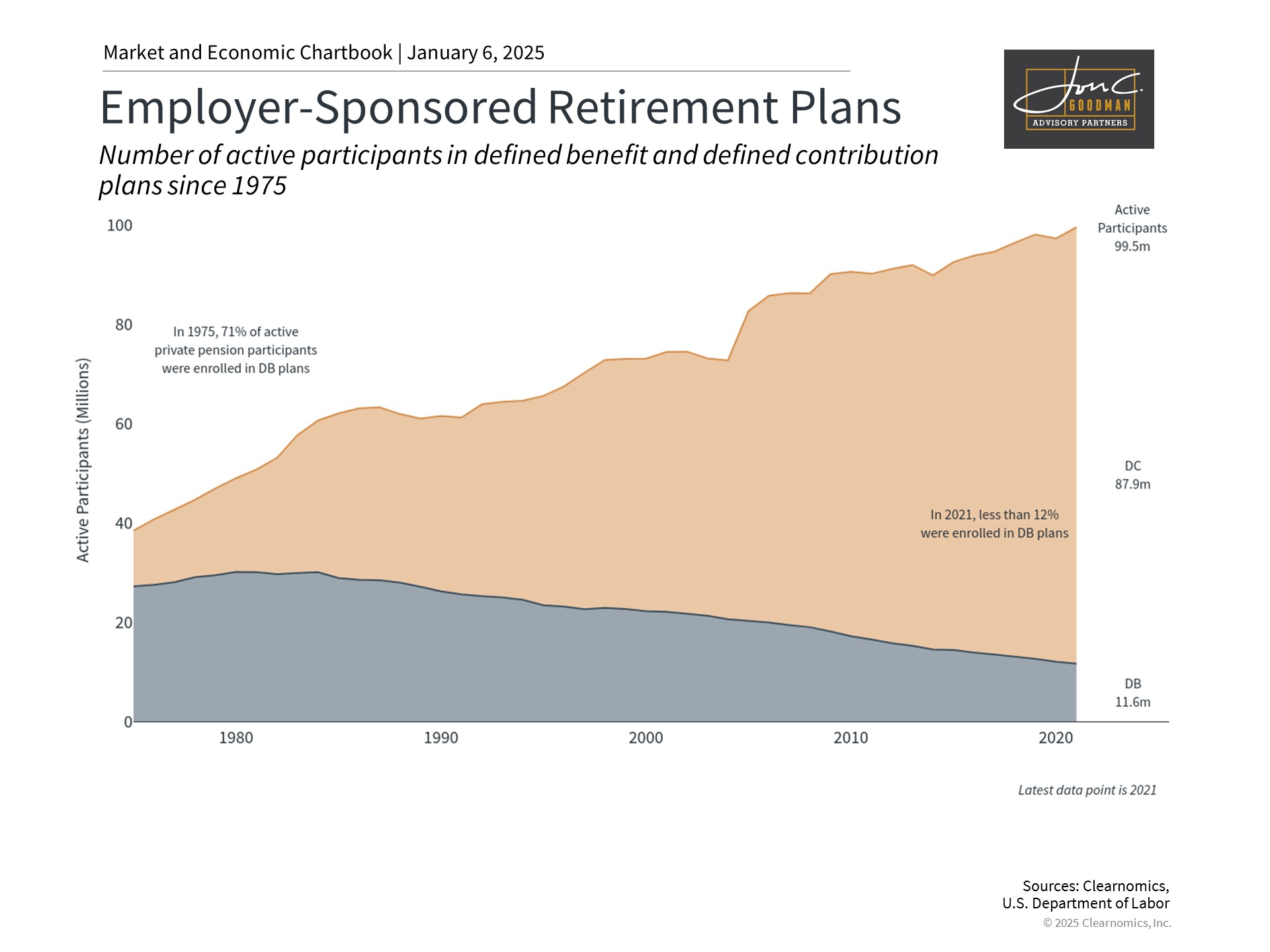

The retirement landscape has undergone significant transformation in recent decades, shifting from traditional pension plans to defined contribution programs. Previously, companies typically provided defined benefit plans with guaranteed retirement payments. Today’s workplace retirement landscape is dominated by defined contribution plans such as 401(k)s and 403(b)s, as illustrated in the chart.

This shift has transferred retirement planning responsibility to individual workers. Modern retirement planning requires personal decisions about account selection, tax planning, contribution levels, investment choices, and distribution methods.

Key retirement planning considerations for 2025 include selecting appropriate account types, maximizing employer matching opportunities, and optimizing tax efficiency through strategic investment placement. For instance, considering tax implications, it may be advantageous to hold certain fixed-income investments in tax-advantaged accounts.

While increased individual responsibility for retirement planning presents challenges, it also offers flexibility in customizing financial strategies. Given uncertainty around future social programs, taking control of your retirement planning becomes increasingly important.

Plan for extended retirement years.

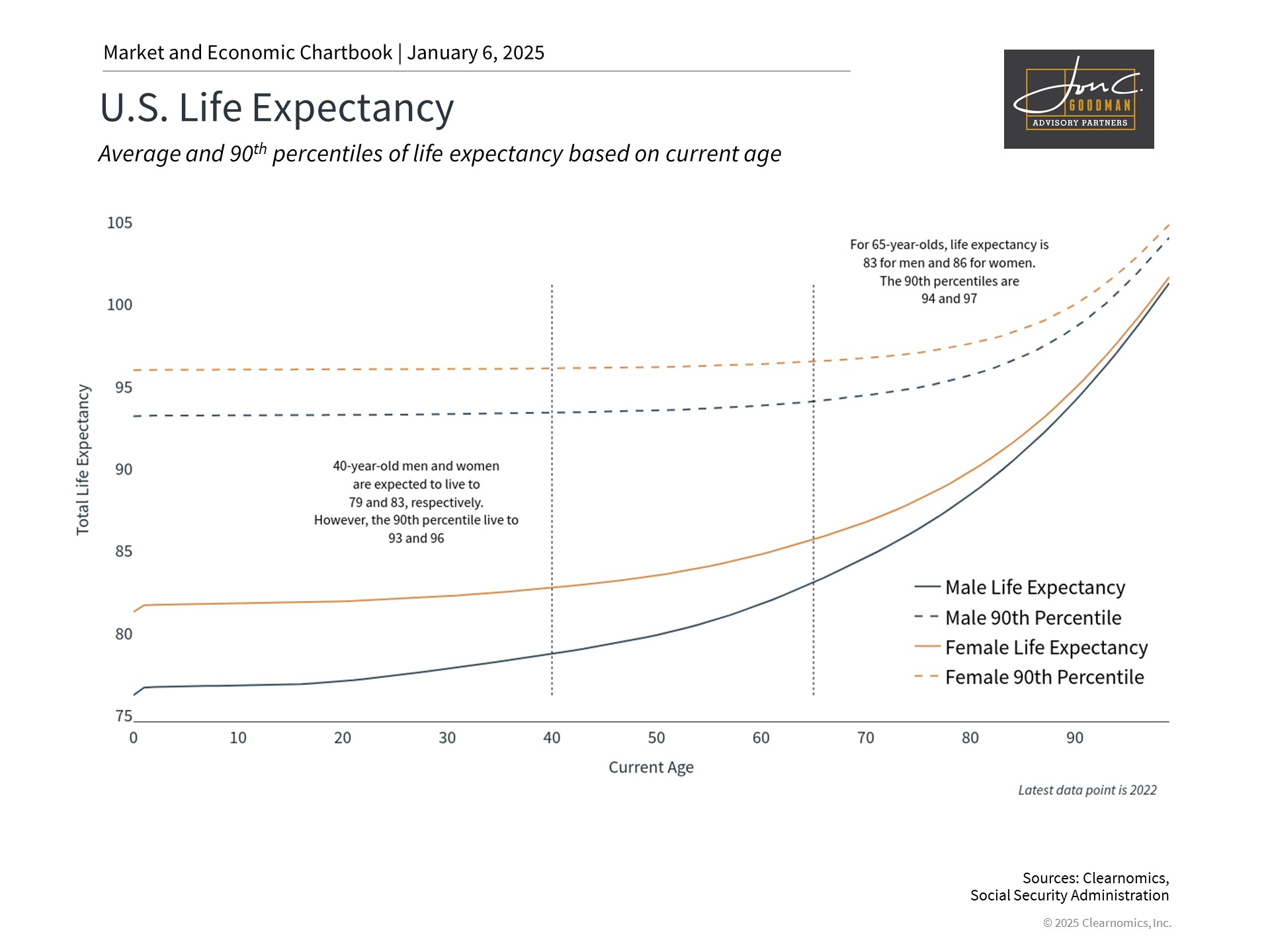

Increasing life expectancy is a positive development, but it introduces the challenge of longevity risk – the possibility of outliving one’s financial resources. Successful retirement planning must address this risk to ensure financial security throughout retirement.

Modern retirement planning must account for longer distribution periods and sustained income generation compared to previous generations. Many retirees now need to plan for three decades or more of retirement, with investments that continue growing to support extended lifespans and counter inflation.

According to Social Security Administration data shown in the chart, current 40-year-old men and women are expected to live to 79 and 83 respectively, with some reaching 93 and 96 or beyond. For current 65-year-olds, these projections are even higher, suggesting retirement planning should extend well beyond age 80.

Extended retirements require careful consideration of healthcare expenses, inflation impacts, and sustainable withdrawal strategies. Incorporating financial planning into your overall wellness goals can help ensure adequate funding for a longer retirement while maintaining peace of mind.

The bottom line? The new year presents an ideal opportunity to establish strong financial objectives. Building wealth early, maintaining retirement accounts, and preparing for extended longevity are fundamental to achieving long-term financial success.

To schedule a 15 minute call, click here.

.