Behavioral finance has shown that our emotional and psychological tendencies often lead to suboptimal investment decisions. Understanding these inherent biases is crucial as we navigate the financial markets, particularly following the substantial gains across multiple asset classes through 2024. By recognizing these patterns, investors can develop more effective strategies to manage their portfolios for the long term.

As markets reach record levels after a strong two-year rally, it’s more critical than ever to examine how our behavioral tendencies affect financial decision-making. Let’s explore several key psychological biases that can impact investment outcomes and discuss methods to address them.

Understanding how recent events shape our decisions.

One of the most prevalent behavioral patterns is the tendency to overemphasize recent events when making investment decisions. The market’s performance in 2024 demonstrates this concept well—despite widespread concerns about economic conditions, political uncertainty, and global conflicts, equity markets delivered impressive returns of approximately 30% including dividends. This shows how markets can perform well even in the face of numerous challenges.

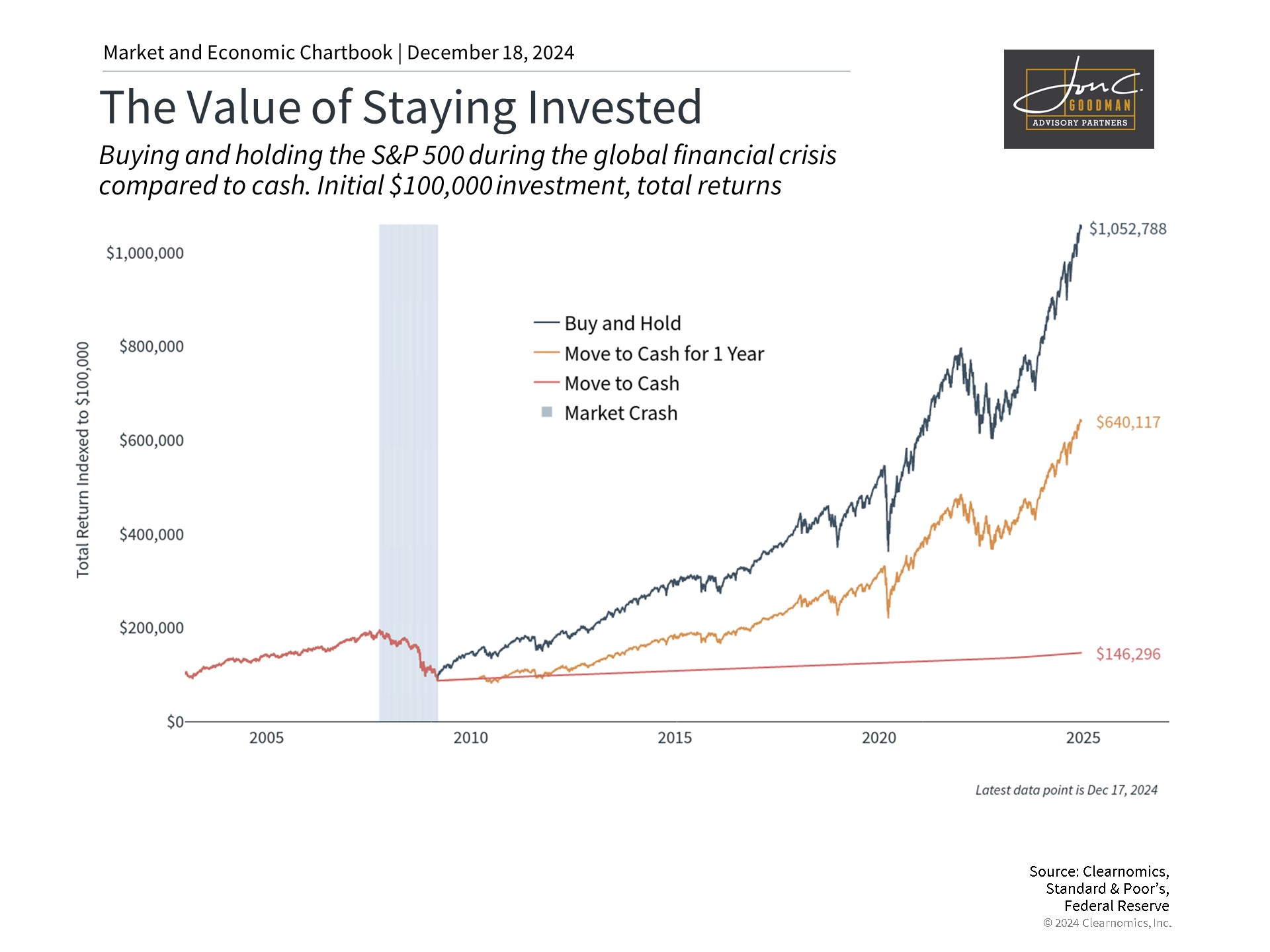

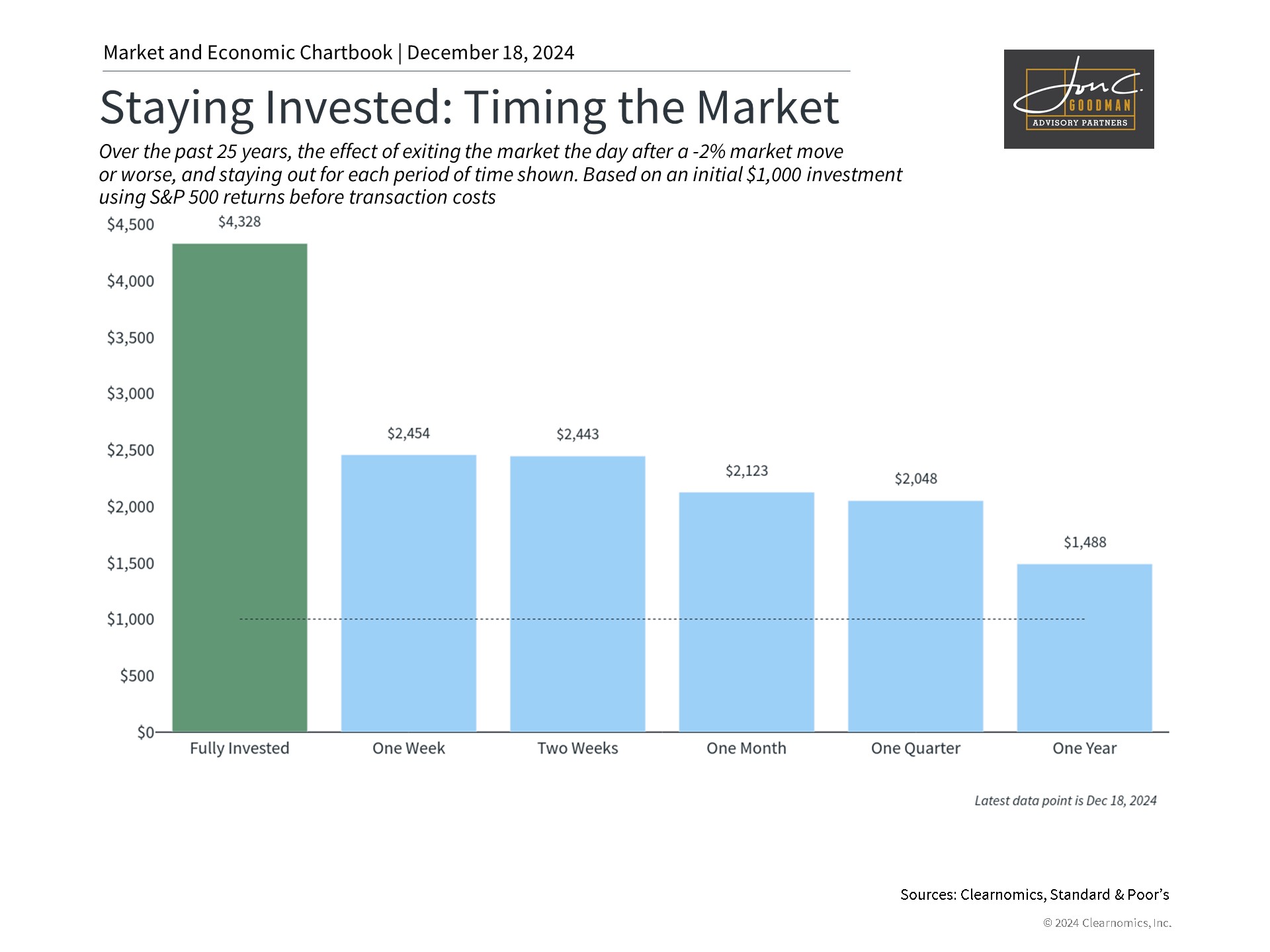

Historical analysis reveals that investors who abandoned their investment strategy during the 2008 financial crisis often compromised their long-term financial objectives. The impact was particularly severe for those who moved to cash positions, but even brief departures from the market, such as a one-year hiatus starting in March 2009, resulted in significantly reduced returns compared to those who maintained their investment positions.

This pattern of emotional decision-making has repeated during other market disruptions, including the technology bubble burst in 2000, the COVID-19 market decline in 2020, and the market correction in 2022.

When investors place too much weight on recent market movements, they may make portfolio adjustments that compromise their long-term investment strategy. This could involve reducing market exposure after downturns or increasing risk during bull markets, both of which can be detrimental to long-term performance.

Success in long-term investing typically comes from maintaining a consistent approach based on individual risk tolerance and investment timeframes, preferably with professional guidance. A well-constructed financial plan can provide valuable perspective during both market upturns and downturns.

Understanding our psychological response to losses.

Loss aversion, a concept developed by behavioral economists Daniel Kahneman and Amos Tversky, explains why people tend to feel losses more intensely than equivalent gains. This psychological principle applies to everyday situations – the disappointment of losing $10 typically feels more significant than the joy of finding $10.

In investment contexts, this aversion to losses can lead to excessive caution, potentially causing investors to maintain overly conservative positions and miss growth opportunities. This bias often manifests during market declines, when investors may sell investments at unfavorable times, converting temporary paper losses into permanent ones.

The market downturn of 2020 provides a clear illustration of this behavior, as many investors who sold during the decline missed the subsequent recovery. Historical data consistently shows that investors who maintain their positions through temporary market declines typically benefit from long-term market appreciation. Indeed, the psychological challenge of remaining invested during difficult periods is precisely why markets provide long-term rewards.

Exploring opportunities beyond familiar markets.

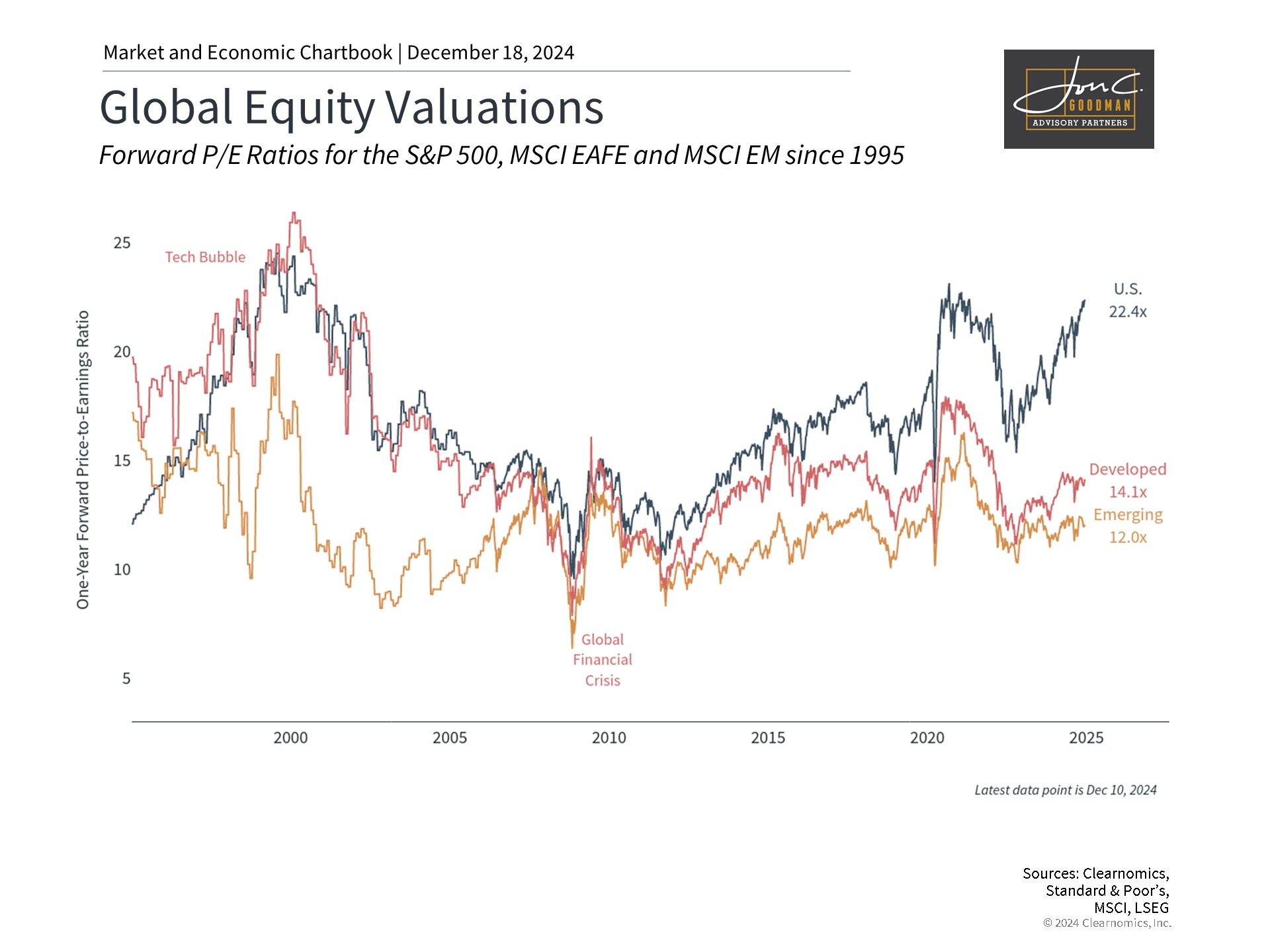

Another significant behavioral pattern is the preference for domestic investments over international opportunities. This bias often extends to favoring local companies or employers, which can result in concentrated portfolio positions. While familiarity with these investments may provide comfort, it can limit diversification benefits and growth potential.

Investors frequently cite concerns about foreign exchange risk, regulatory differences, and perceived higher risks in international markets as reasons to avoid overseas investments. The strong performance of U.S. markets over the past decade, supported by innovation, strong corporate governance, and market depth, has reinforced this domestic bias.

However, international markets continue to present valuable opportunities for portfolio diversification and potential returns, often at more attractive valuations. While emerging markets and other international investments may carry additional risks, they frequently compensate investors for this risk over extended periods. Current valuation metrics suggest international markets offer more favorable entry points compared to U.S. markets.

The bottom line? Recognizing and understanding behavioral biases is essential for making better investment decisions. Success in long-term investing comes from maintaining a disciplined approach rather than acting on emotional impulses.

To schedule a 15 minute call, click here.