As we reflect on 2024, the wisdom of the 19th century author Balzac rings true: “our worst misfortunes never happen, and most miseries lie in anticipation.” Despite widespread fears of economic downturns, market corrections, and electoral uncertainty, many predicted challenges never materialized.

Instead, the financial markets have demonstrated remarkable resilience. The S&P 500 has reached historic highs, inflation continues to moderate, economic growth remains robust, and the Federal Reserve has initiated its rate-cutting cycle. These developments underscore how excessive caution can potentially compromise long-term investment success.

After experiencing market extremes in recent years–from the sharp declines of 2020 and 2022 to the robust recoveries of 2021, 2023, and 2024 – 2025 presents an opportunity to restore equilibrium. This balance applies both to investment strategies and investor psychology.

Looking ahead, several factors warrant attention: elevated market valuations, uncertain interest rate trajectories, emerging questions about artificial intelligence, and increasing geopolitical tensions. However, the lessons from recent market experiences offer valuable guidance for navigating these challenges.

Here are five crucial insights to help investors maintain perspective as they approach 2025, even when market sentiment turns cautious and uncertainty prevails.

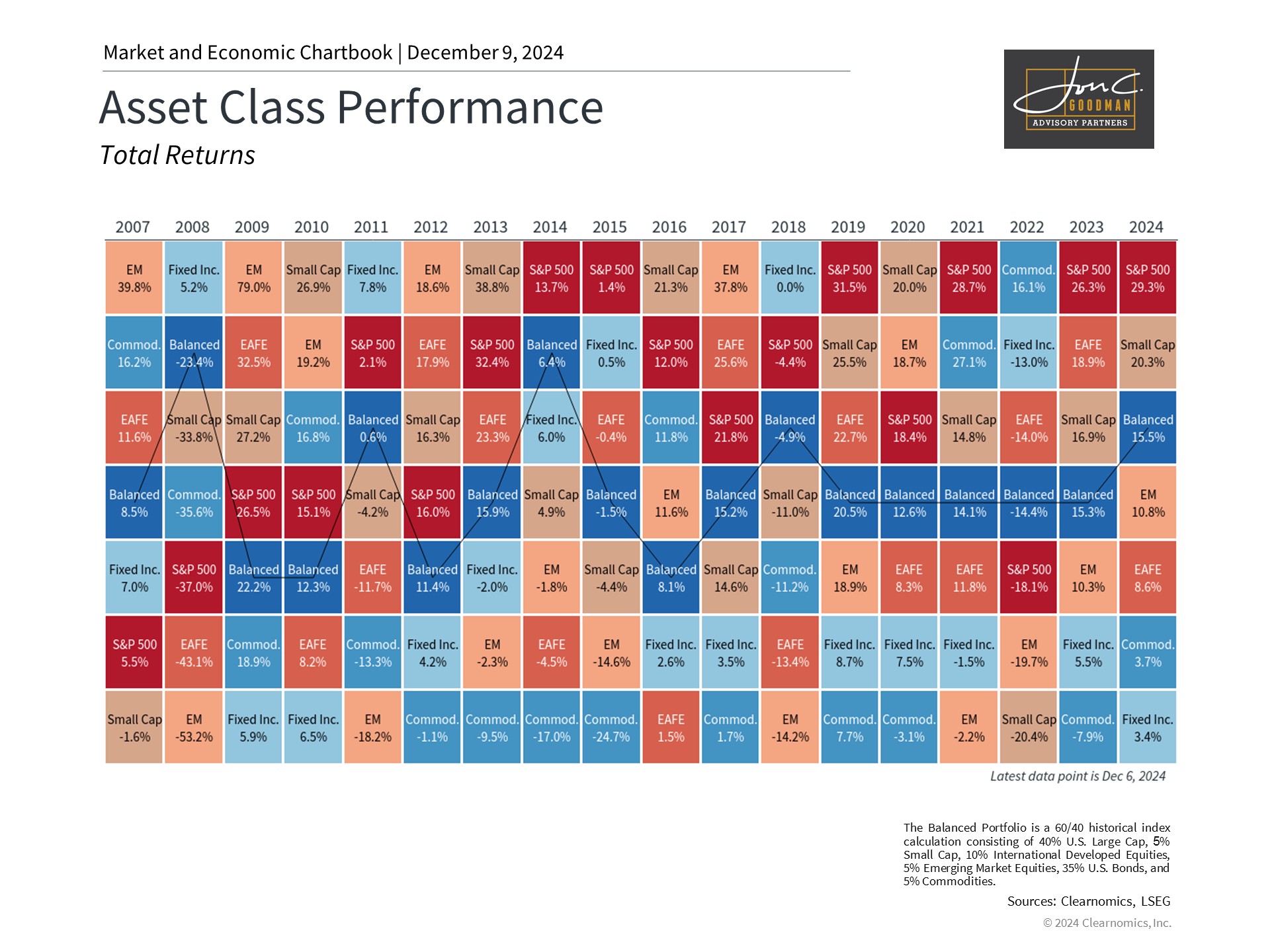

1. Economic resilience has bolstered diverse asset performance.

Contrary to widespread concerns about a severe economic downturn amid high interest rates, the economy has demonstrated remarkable strength. Inflation has moderated toward pre-pandemic levels, employment remains robust, and economic expansion has exceeded expectations.

Recent data shows inflation at 2.6% year-over-year, while unemployment holds steady at 4.2%. The economy has added 2.3 million jobs in the past year, with GDP growing at 2.8% in the third quarter.

This economic vitality has supported broad-based asset appreciation. Domestic and international equity markets have reached new highs, bond performance has improved as rates stabilize, and alternative assets like gold and Bitcoin have achieved record levels.

However, challenges persist. Consumer spending may decline as savings decrease and debt levels remain elevated. Assets that have experienced substantial appreciation may face increased volatility. In this environment, emphasis on fundamental analysis becomes crucial.

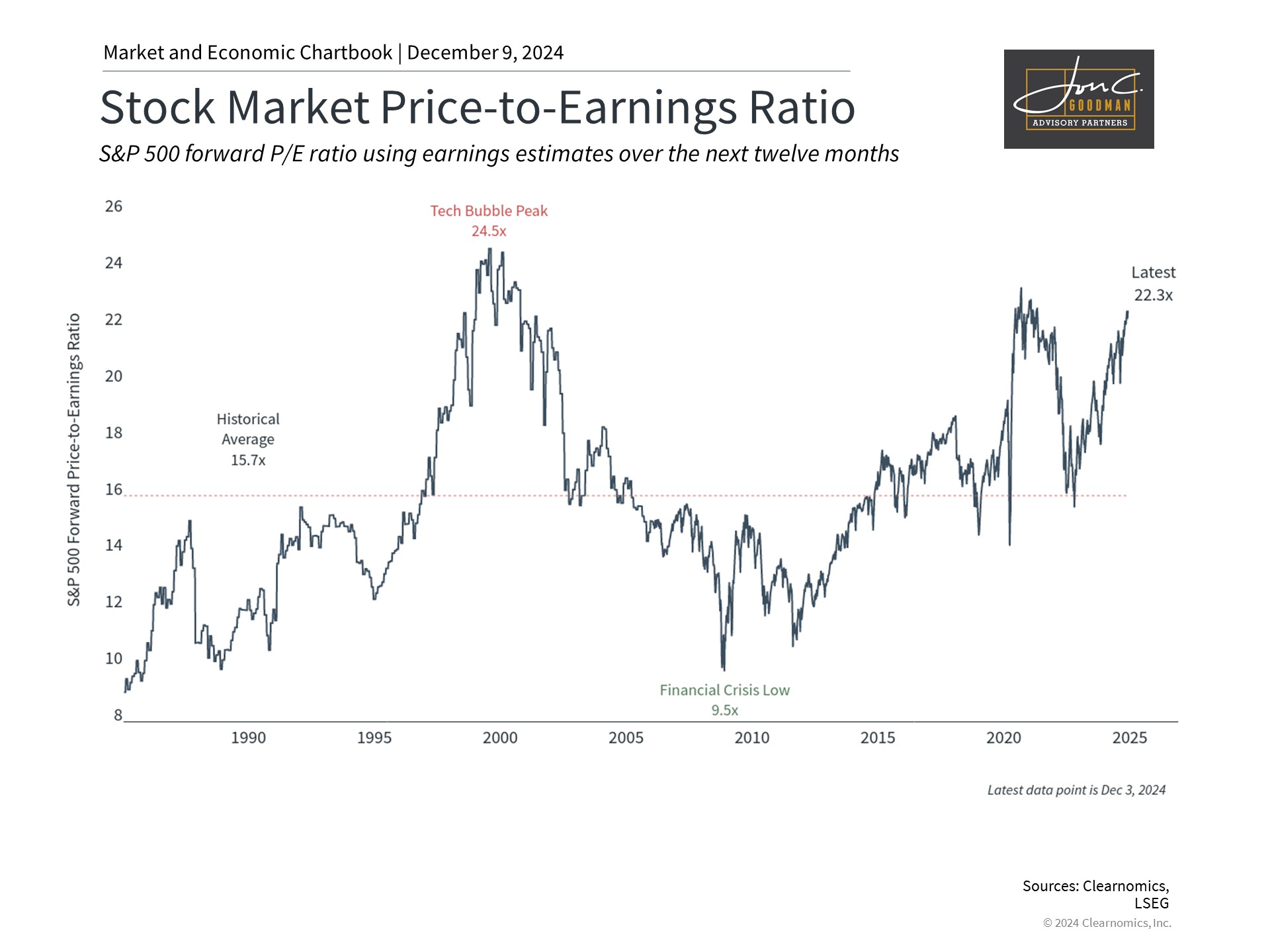

2. Current valuations highlight diversification importance.

Corporate America’s strength has driven market performance, with earnings growing 8.6% over twelve months to $236 per share for the S&P 500.

However, market gains have outpaced earnings growth, pushing valuations higher. The current price-to-earnings ratio of 22.3 significantly exceeds the historical average of 15.7, approaching the 24.5 peak seen during the dot-com era.

These elevated valuations suggest potentially lower future returns. This environment emphasizes two key strategies: balancing equity exposure with bonds and international investments, and identifying market segments offering better value.

While artificial intelligence stocks have led recent gains, market breadth has improved with all eleven sectors showing positive returns year-to-date. Given the difficulty in predicting sector leadership, broad diversification can help enhance portfolio stability.

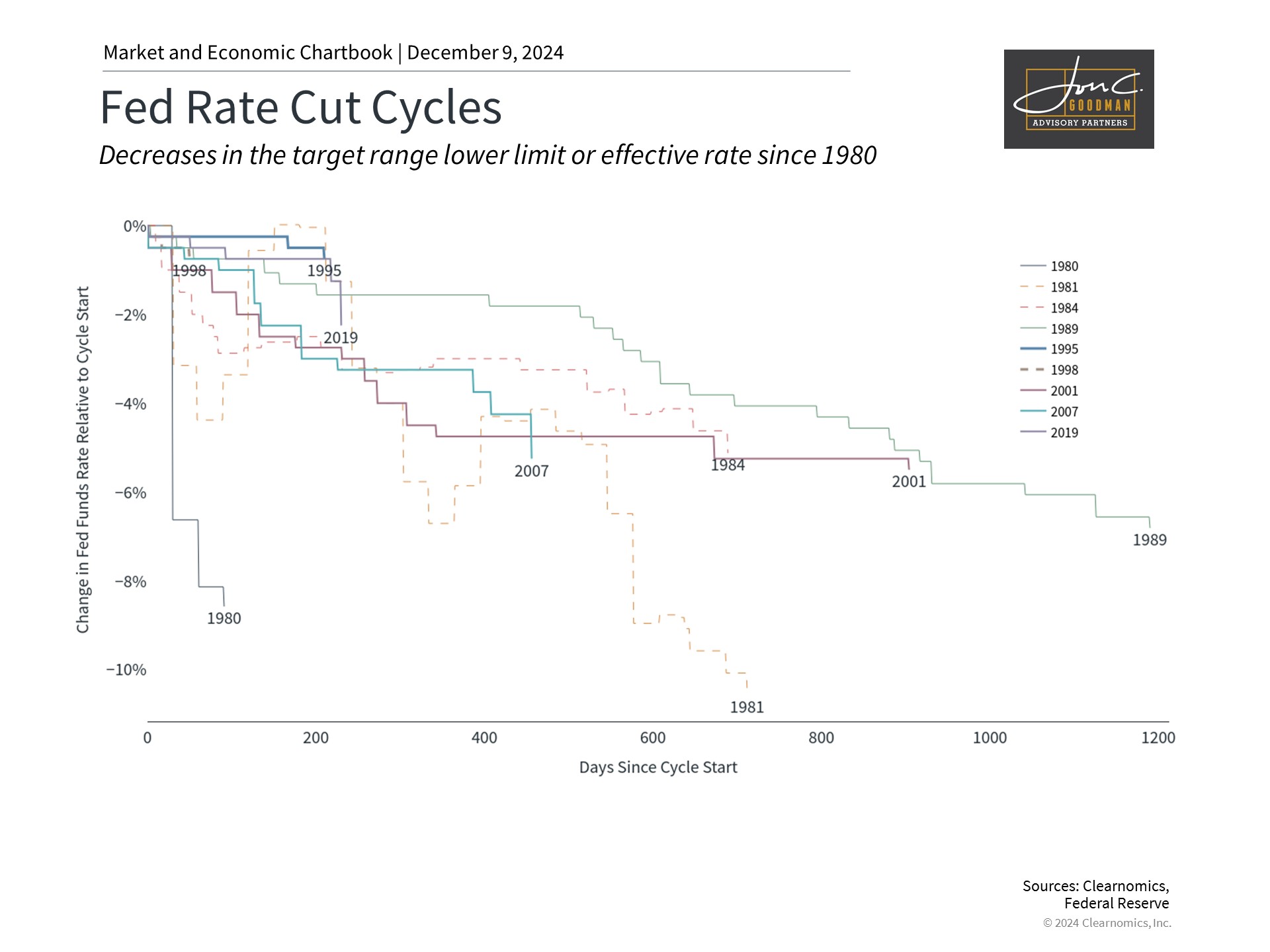

3. Monetary policy shifts toward accommodation.

Following months of anticipation, the Federal Reserve began reducing rates in September, implementing cuts totaling 0.75%. Markets anticipate three to four additional reductions through 2025.

While the precise timing and scale of future cuts remain uncertain, the shift from monetary tightening to easing marks a significant change. This transition could support economic growth and potentially benefit both corporate earnings and market returns over time.

The evolving rate environment may particularly benefit fixed income investments as inflation and growth stabilize. Lower short-term rates combined with steady longer-term rates could create opportunities for both income generation and price appreciation in diversified portfolios.

Rather than attempting to predict specific Fed actions, investors should focus on the broader policy trajectory and its implications for various asset classes.

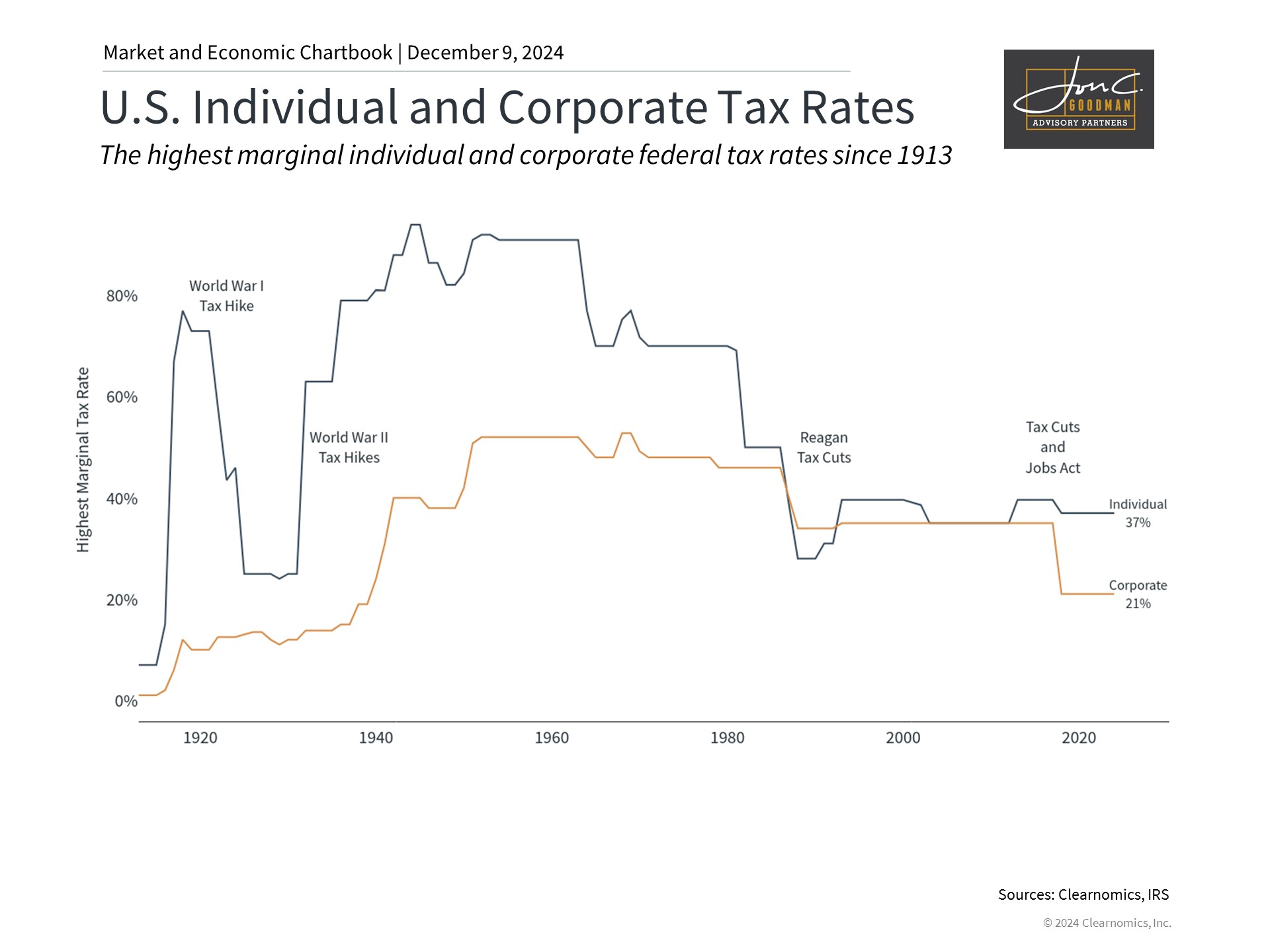

4. Investment focus shifts from electoral politics to policy implementation.

Markets have responded positively to reduced political uncertainty following the November election. However, national division persists, making it crucial to separate personal political views from investment decisions.

Historical data demonstrates that markets have performed well under both political parties. Economic cycles, which depend on numerous factors beyond politics, typically exert greater influence on market performance than presidential administrations.

Tax policy clarity following the election provides a framework for financial planning. Working with qualified advisors remains essential for optimizing investment strategies within this context.

While trade tensions and fiscal challenges warrant attention, historical perspective suggests that markets can perform well despite these ongoing concerns. The national debt has reached $36 trillion, requiring long-term solutions, but immediate market impacts may be limited.

5. Maintaining long-term perspective remains crucial.

The past year reinforces that markets can thrive despite prevalent concerns. Brief market declines in April and August proved temporary, as fundamental factors supported continued advancement across asset classes.

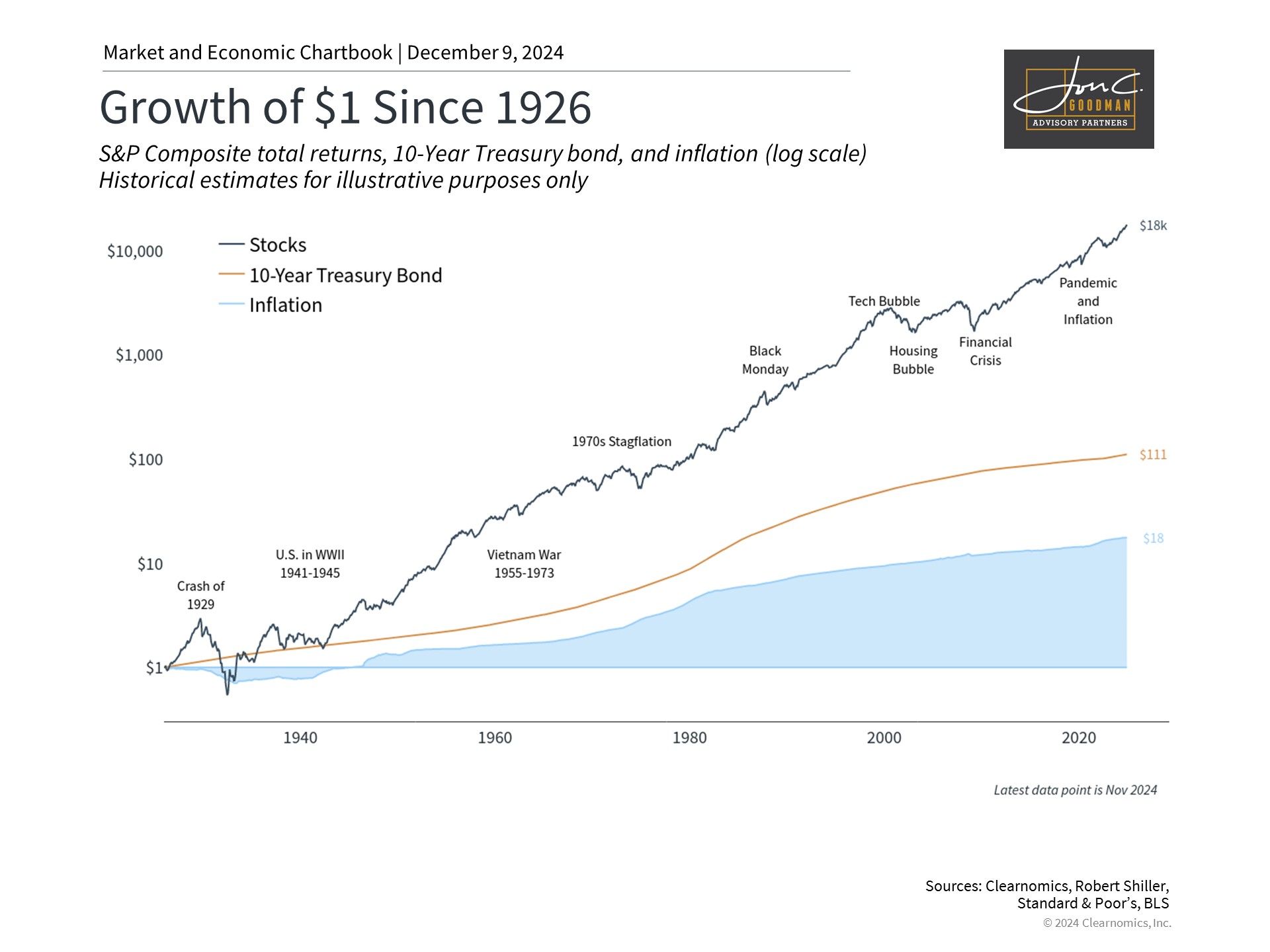

Looking at market history demonstrates that sustainable wealth creation occurs over extended periods. Even retirees benefit from maintaining a long-term outlook, which helps contextualize short-term market movements.

The bottom line? While we can celebrate strong market performance in 2024, investors should prioritize portfolio balance in 2025. Historical evidence suggests this approach best positions investors to handle uncertainty while pursuing long-term financial objectives.

To schedule a 15 minute call, click here.

.