As we approach the end of a remarkable year in financial markets, there are significant positive developments worth highlighting. Markets have shown remarkable resilience in 2024, delivering strong returns despite various challenges including monetary policy shifts, electoral uncertainty, and global tensions. The S&P 500 has achieved gains of 26.7% including dividends, while the Dow and Nasdaq have advanced 19.5% and 27.4% respectively. The global market picture is also encouraging, with emerging markets rising 9.0% and developed markets up 4.8%. The economy has demonstrated unexpected strength, characterized by moderating inflation, sustained employment levels, and continued GDP expansion.

Markets have demonstrated remarkable resilience through 2024.

While the holiday season naturally prompts personal reflection and gratitude, it also presents an opportunity to acknowledge positive developments in the financial landscape. This perspective is particularly valuable given investors’ tendency to focus on potential risks. Even in the wake of two successful market years, concerns persist about market fundamentals, economic trajectories, fiscal challenges, and international stability.

Historical data consistently shows that maintaining a long-term perspective is crucial for achieving financial objectives. Markets can experience significant fluctuations over short periods, as evidenced by the volatility in April and August, or the movements in 2020 and 2022. However, longer time horizons typically reveal an upward trajectory driven by economic expansion. Let’s examine three key developments that merit recognition this season.

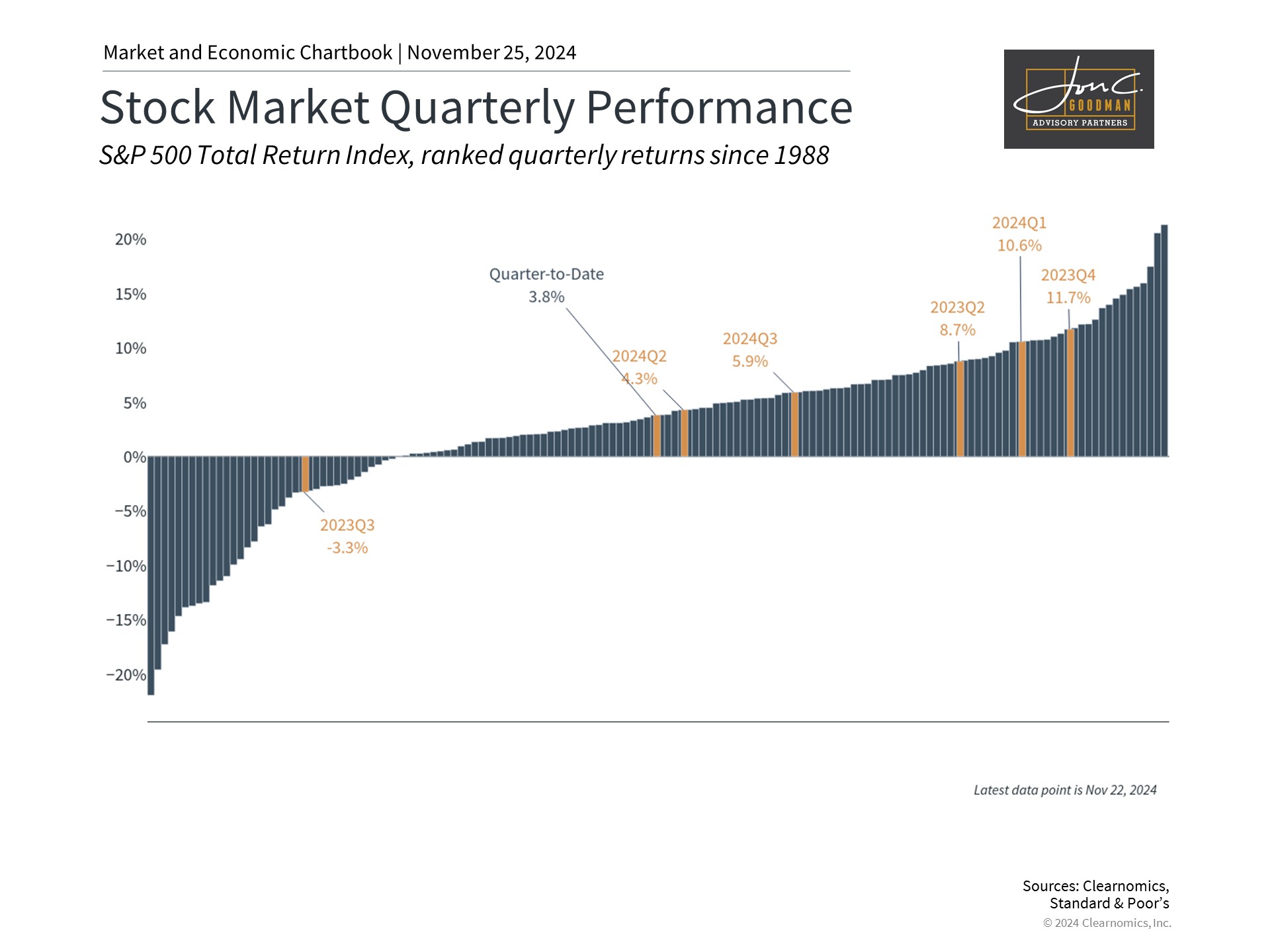

The first notable achievement is the robust performance of U.S. equities in 2024. This success stems from strong corporate performance, favorable economic conditions, and enhanced market sentiment. As illustrated in the chart, market returns have maintained steady momentum over the past two years, with only one quarter showing weakness. While technology and AI-related sectors have led the advance, the rally has been broad-based. Most market segments are in positive territory for the year, with eight of eleven S&P 500 sectors recording double-digit gains.

The sustained bull market since late 2022 has pushed valuations higher. The S&P 500’s price-to-earnings ratio currently stands at 22.3, approaching both recent peaks and the historical high of 24.5 from the dot-com era.

These elevated valuations underscore the importance of maintaining a well-balanced portfolio rather than suggesting market avoidance. Risk assets like stocks need to be complemented with other investments such as bonds to achieve desired portfolio outcomes. Year-end presents an ideal opportunity for portfolio rebalancing, particularly following this year’s significant market movements.

Price pressures have eased significantly across the economy.

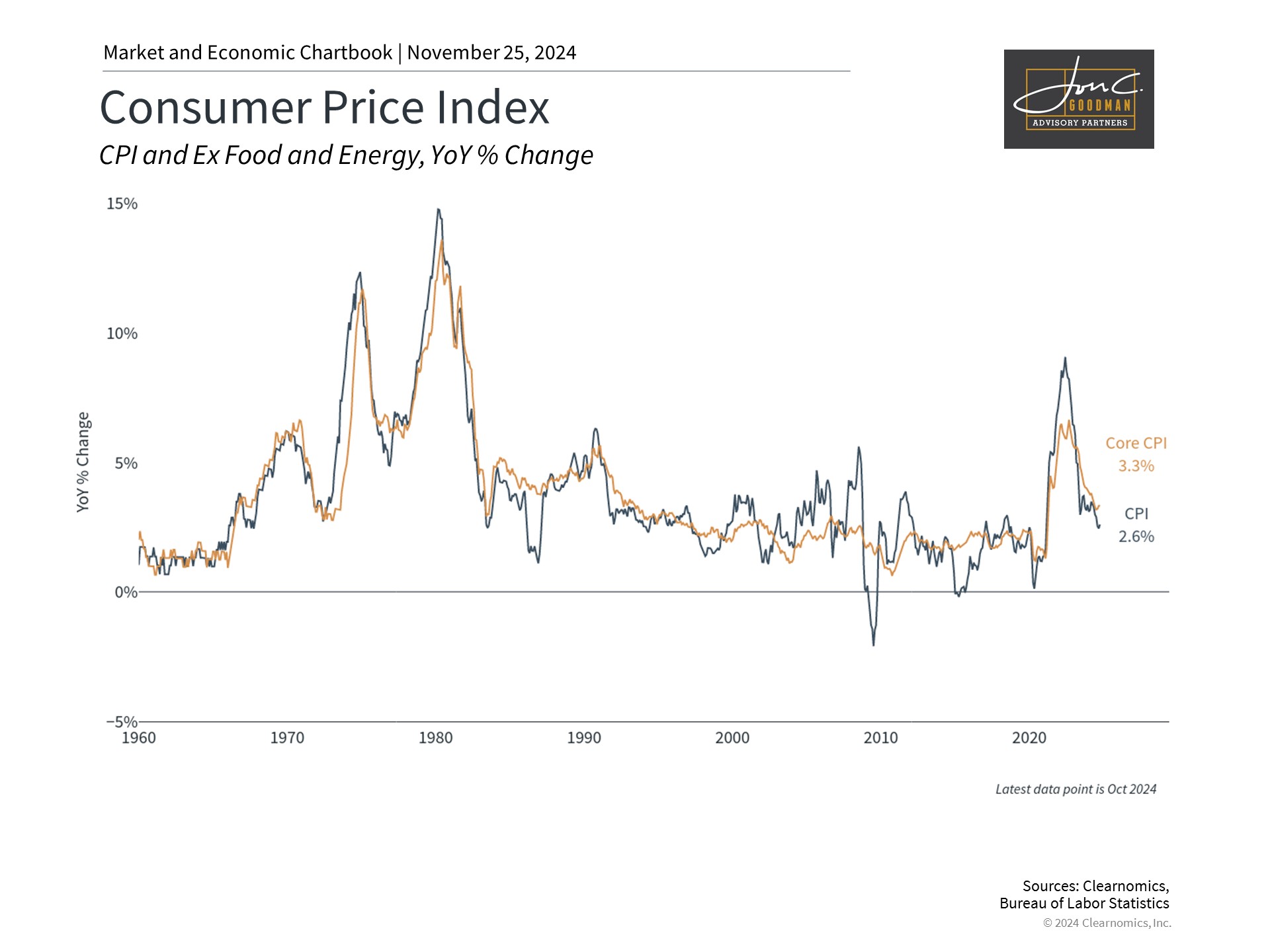

The second positive development is the return of inflation to pre-pandemic ranges. While consumers still face higher prices for essentials like food and housing, the broader trend is encouraging. This is particularly relevant for investment portfolios, which are highly sensitive to interest rate movements that correlate with inflation trends.

The moderation in inflation has enabled the Federal Reserve to consider reducing policy rates for the first time since early 2022. Much of this year’s market volatility stemmed from speculation about the timing and magnitude of these potential rate adjustments.

Ultimately, understanding the broader trajectory of lower short-term rates proved more valuable than precise timing predictions. For long-term investors, building portfolios based on these fundamental factors, rather than recent market trends, remains paramount.

Labor market conditions continue to support economic growth.

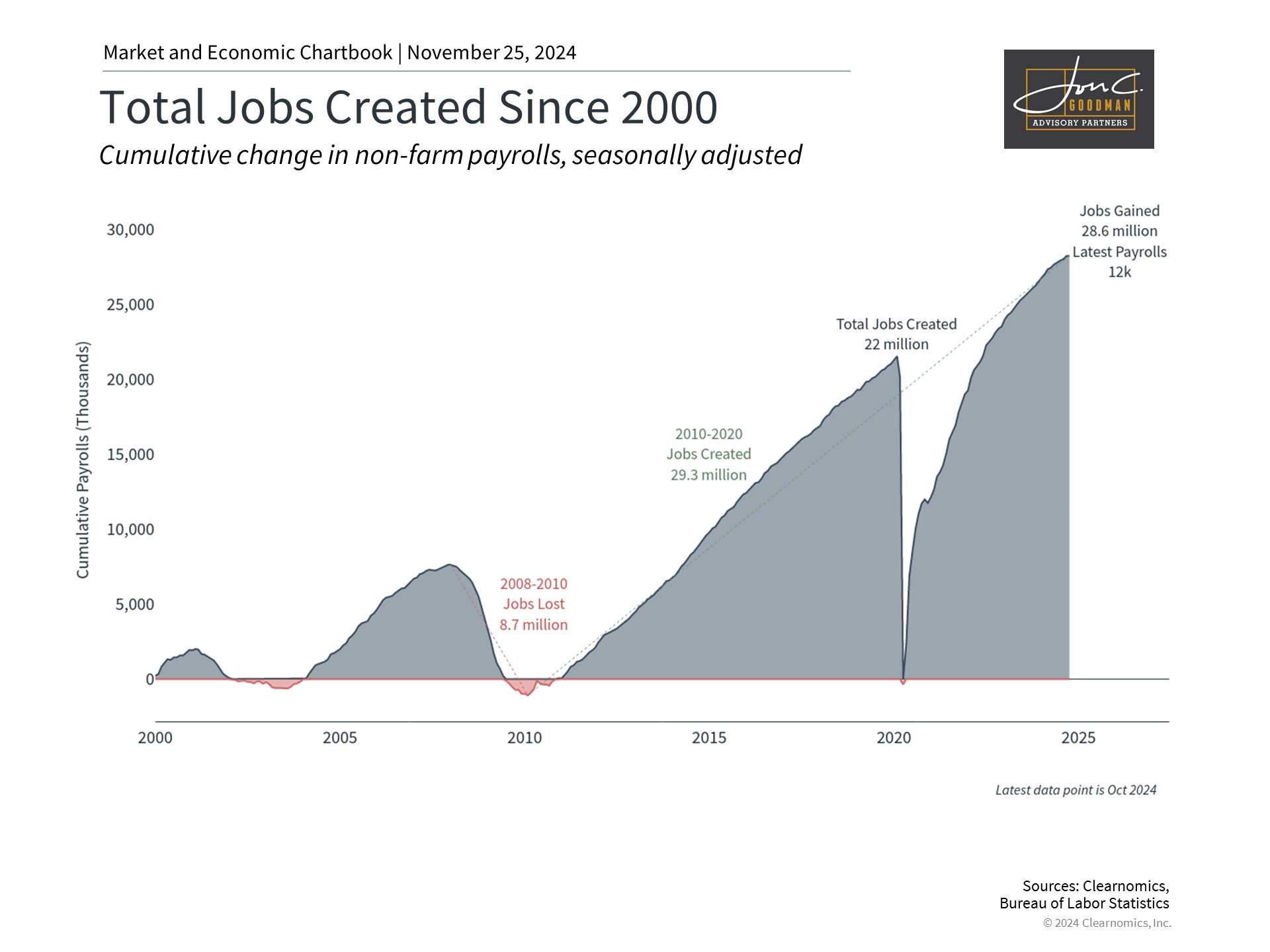

The third significant development is the continued strength of employment conditions, which directly impacts individual economic well-being. Earlier concerns about a “hard landing”–where inflation control would trigger widespread job losses–have not materialized.

Unemployment remains near historic lows with consistent job creation. While wage growth hasn’t fully matched inflation, it has been positive. The chart demonstrates remarkable post-pandemic job creation, with 28.6 million new positions exceeding previous levels. Despite sector variations, this broadly indicates healthy consumer financial positions.

The broader economic picture shows continued resilience, with real GDP expanding at a 2.8% annualized rate in the latest quarter. Consumer spending has been a key driver, though challenges lie ahead as pandemic savings diminish and debt levels rise. The hope is that lower interest rates, tax policy clarity, and increased business investment will sustain economic momentum.

The bottom line? While market progress isn’t linear, 2024 has delivered exceptional returns despite occasional turbulence. This season provides an opportunity to appreciate these positive developments while ensuring portfolio alignment with long-term objectives.

To schedule a 15 minute call, click here.