Financial markets have quickly turned their focus to policy implications, monetary decisions, and economic fundamentals following recent political developments. The market response has been notably positive, with major indices posting significant gains and digital assets reaching new highs. However, maintaining investment discipline and focusing on long-term fundamentals remains crucial despite short-term market enthusiasm.

In the days following the election, equity markets demonstrated strong performance across the board. Large cap indices gained between 3.7% and 4.2%, while small cap stocks surged over 6%. Digital assets also reached unprecedented levels above $80,000. While these gains benefit investors, it’s essential to maintain perspective and avoid being swayed by short-term market movements.

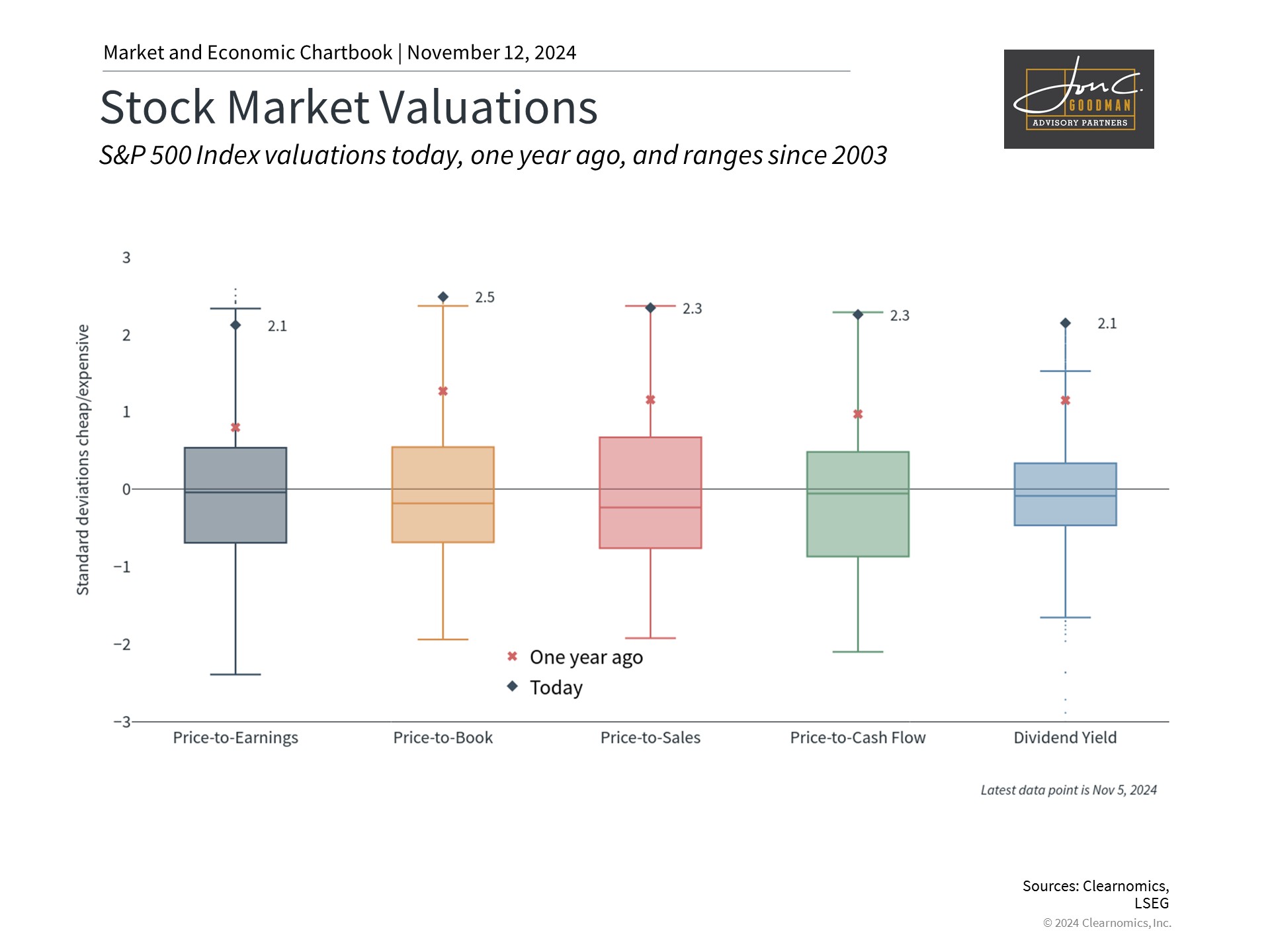

Market metrics suggest elevated price levels.

The incoming administration will likely benefit from positive economic momentum. The challenging inflation environment of recent years, driven by pandemic-related supply disruptions and stimulus measures, has largely subsided. With inflation approaching the 2% target, the Federal Reserve has begun implementing rate cuts to support economic growth.

However, the sustained market rally since late 2022 has pushed valuations across various assets significantly above historical norms, potentially limiting future return potential. Recent post-election gains have further elevated these metrics. The S&P 500’s price-to-earnings ratio is approaching levels last seen during the pandemic and is close to dot-com era peaks.

Market history demonstrates how sentiment can swing between extremes as investors react to events. This pattern was evident following the 2016 election, with markets rallying through 2017 before experiencing a correction in 2018. A subsequent recovery in 2019 was interrupted by the pandemic in early 2020. These cycles remind us that markets rarely advance without interruption, regardless of how positive conditions may appear.

Valuations serve as a reliable compass for investors during uncertain times. Long-term returns correlate most closely with whether markets are expensive or inexpensive relative to fundamental measures like earnings. While valuations don’t predict short-term movements, they help set appropriate long-term return expectations.

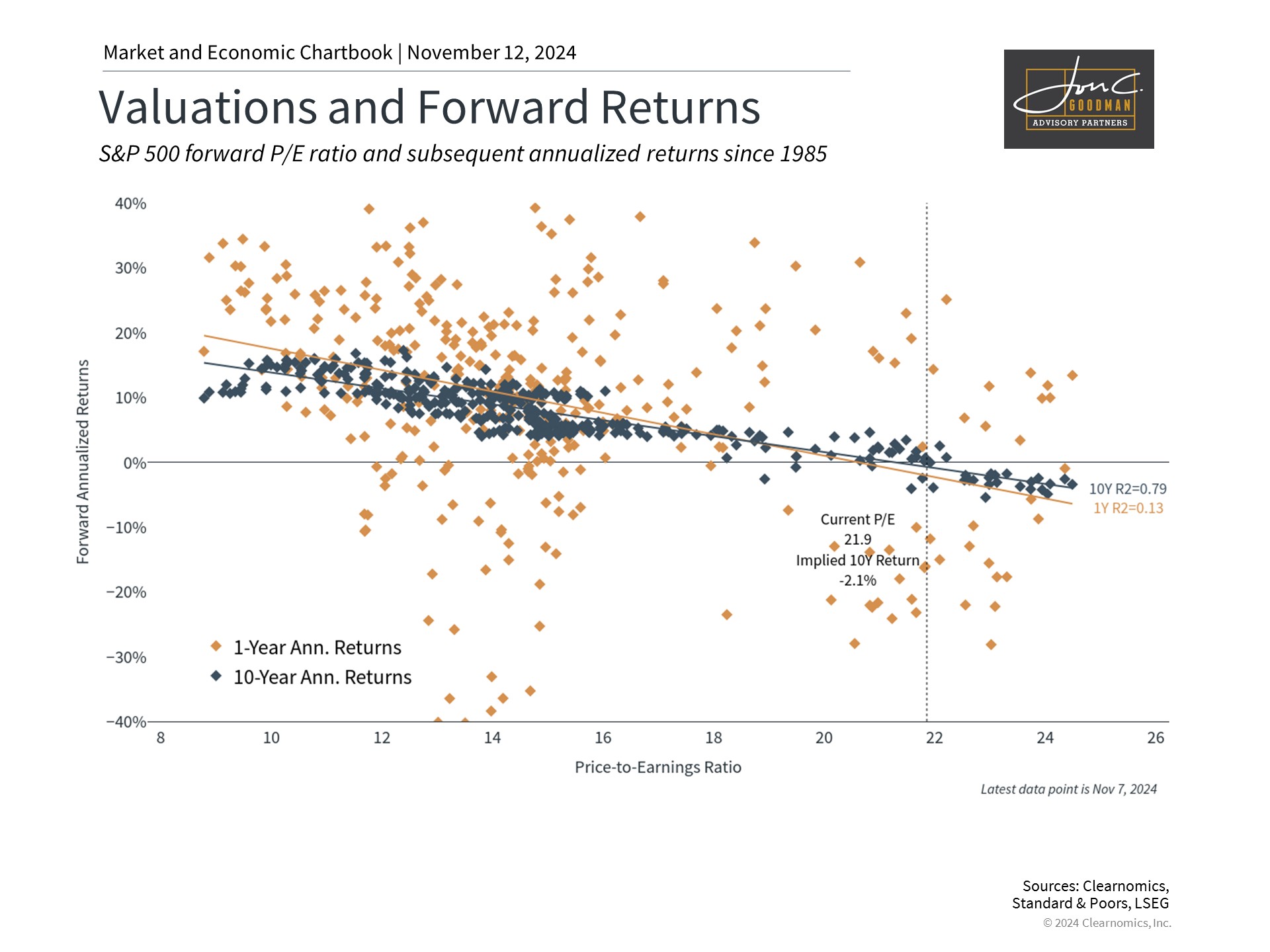

Historical data shows inverse relationship between valuations and future returns.

Current market optimism reflects anticipated policy changes, including potential tax reforms, trade policies, regulatory adjustments, and infrastructure spending. Similar enthusiasm drove markets after the 2016 election as investors anticipated pro-growth initiatives.

Benjamin Graham’s observation that “in the short run, the market is a voting machine but in the long run, it is a weighing machine” is particularly relevant today. Many investments with stretched valuations, particularly in technology and digital assets, are susceptible to significant price swings. While strong performance may make fundamental analysis seem unnecessary, it’s precisely these periods when valuation discipline becomes most important.

The data illustrates that high valuations often precede periods of lower or negative returns, particularly when occurring late in economic cycles. While optimists hope for continued steady growth, even in favorable scenarios, recent market gains may represent future returns being realized earlier than expected.

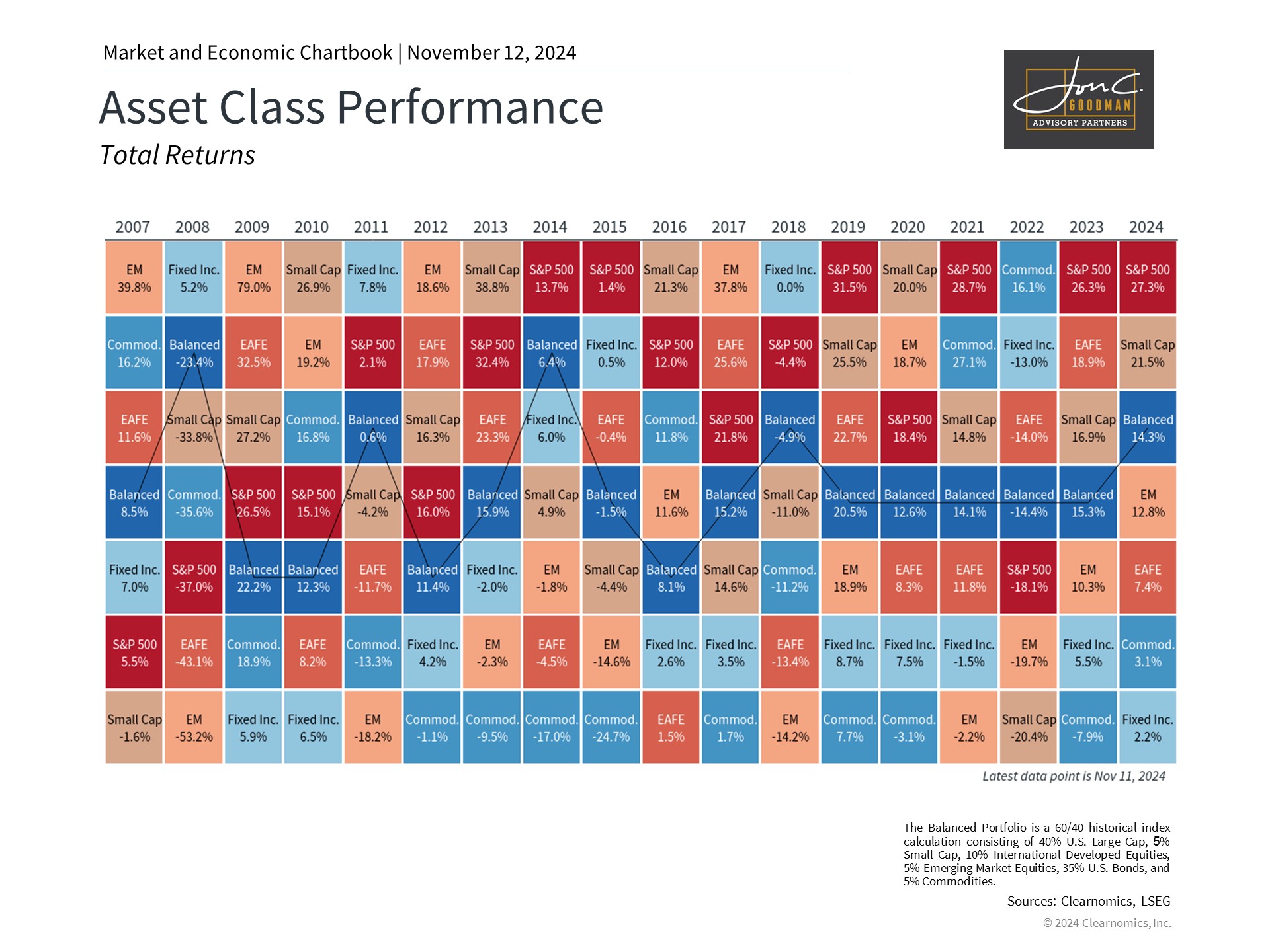

Diversification benefits evident across global markets.

Rather than avoiding equities entirely, elevated valuations suggest the importance of thoughtful portfolio construction and risk management through diversification. While U.S. stocks have performed well, various other asset classes have also delivered positive results this year.

International equities currently offer more attractive valuations compared to U.S. markets. Fixed income, despite recent challenges from rising rates, continues to provide important portfolio benefits through income generation and diversification, particularly during volatile periods.

Underlying economic fundamentals remain encouraging. Corporate earnings show consistent growth and economic output has exceeded expectations. The Federal Reserve’s recent 25 basis point rate reduction to 4.5%-4.75% represents the second cut in this cycle.

The Fed’s communications reflect evolving labor market conditions, noting general easing while unemployment remains historically low. They acknowledged significant progress on inflation while maintaining economic strength, though labor conditions have normalized from pre-pandemic levels.

The Fed Chairman’s balanced assessment emphasized both progress and continued vigilance – an approach that should be mirrored in portfolio management.

The bottom line? Long-term investment success depends more on fundamental economic trends than short-term market reactions. The period from 2016 to 2020 demonstrates why portfolios should be positioned to capture upside while maintaining protection against uncertainty.

Until next time,

To schedule a 15 minute call, click here.

.