Interest rates have been going up lately, even though the Federal Reserve (the Fed) has been lowering them. This might seem confusing, but it’s happening because the economy is doing well and people are thinking about how the upcoming election might affect prices. These factors push long-term interest rates higher. Let’s look at what this means for you and your money.

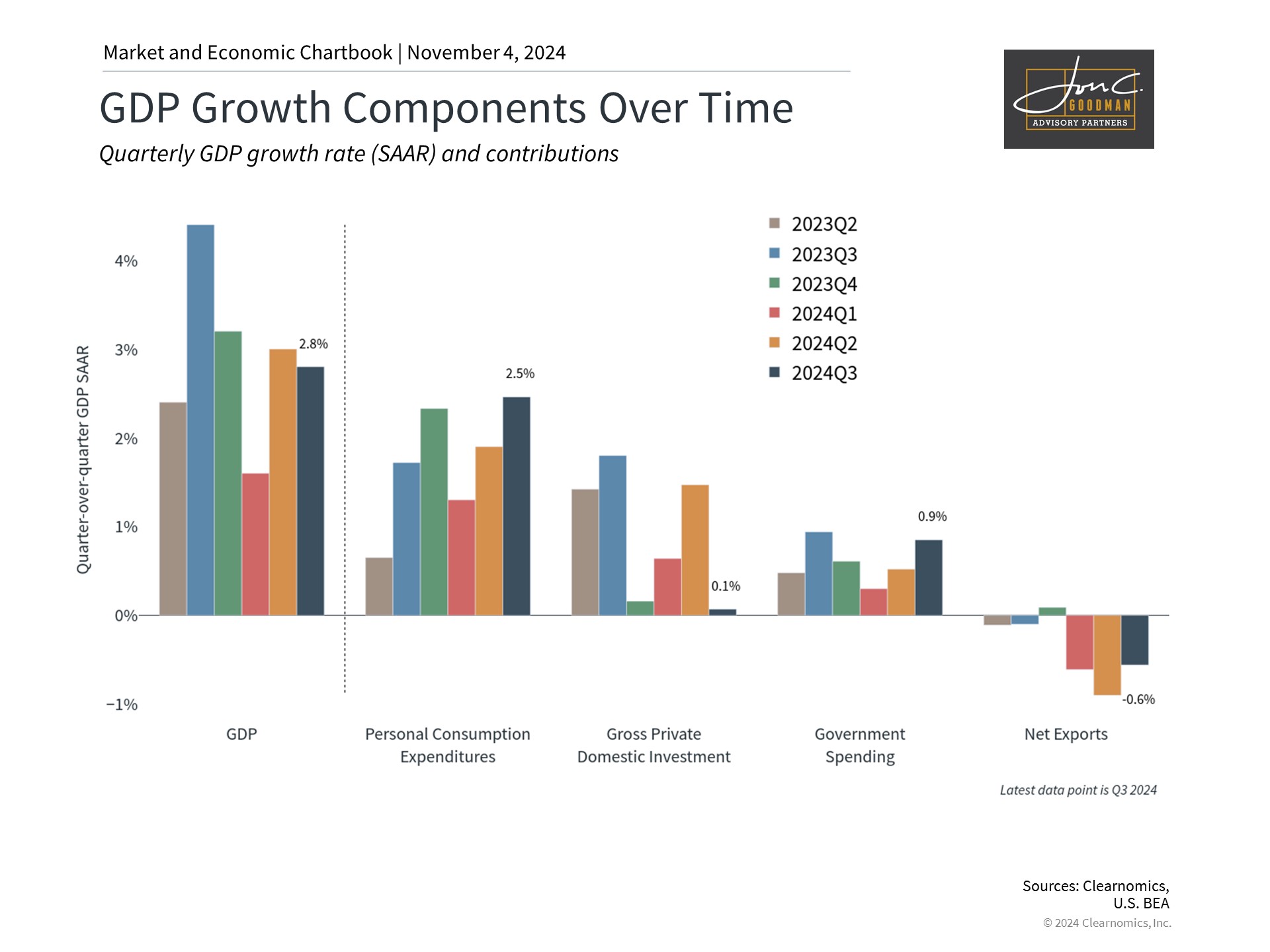

The economy is growing steadily.

Interest rates affect many parts of our lives. When rates go up, it becomes more expensive to borrow money for things like houses, cars, or credit cards. But higher rates can also be good news for savers, as you might earn more money on your savings accounts or bonds.

For businesses, higher interest rates can make it more expensive to borrow money, which might slow down their growth or hiring. This can affect the stock market and the value of bonds. As an investor, it’s important to understand how these changes might impact your investments.

So, why are rates going up now? The economy is doing pretty well. It grew by 2.8% in the last quarter, which is a good sign. People are still spending money, which keeps the economy moving. However, some experts worry that people might slow down their spending as they use up their savings and take on more debt.

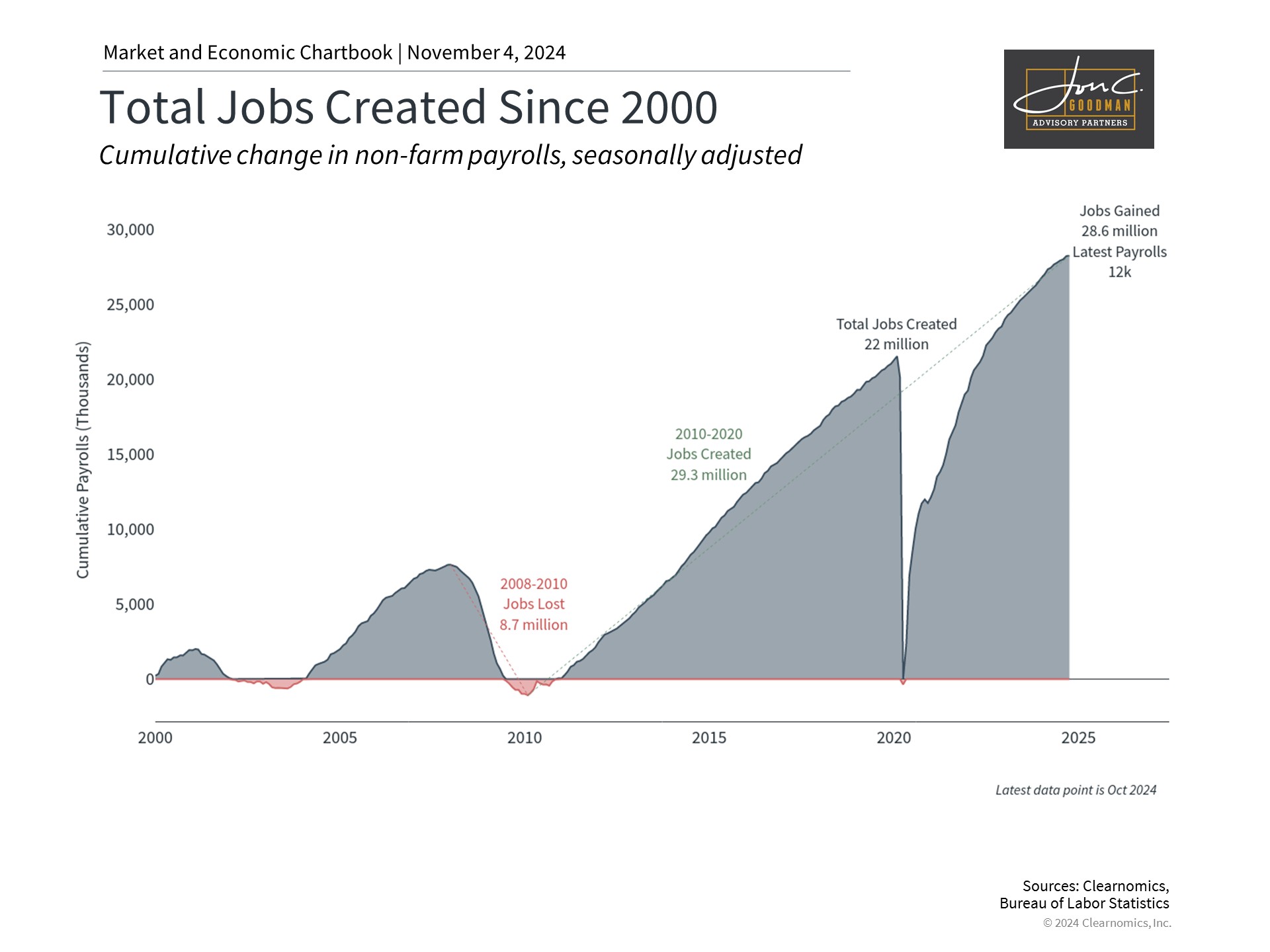

The job market has been strong too. In September, 223,000 new jobs were created. This is good news for workers, but it might mean the Fed doesn’t need to lower interest rates as quickly as some people thought. The Fed tries to balance keeping prices stable (controlling inflation) with making sure there are enough jobs for people.

Job growth has slowed down, but is still positive.

The latest job report for October showed only 12,000 new jobs were added. This is much lower than usual, but it might be because of some temporary factors like strikes and hurricanes. Even with this slow month, the job market is still quite strong overall. In the past year, 2.2 million new jobs were created, and only 4.1% of people who want to work can’t find jobs (this is called the unemployment rate).

The Fed pays close attention to these job numbers when deciding what to do with interest rates. They want to make sure there are enough jobs for people while also keeping prices from rising too fast (inflation).

It’s normal for long-term interest rates (like for 10-year loans) to go up when the economy is doing well, even if the Fed is lowering short-term rates. This is called a “steepening yield curve” and often happens when the economy is starting to grow after a slow period.

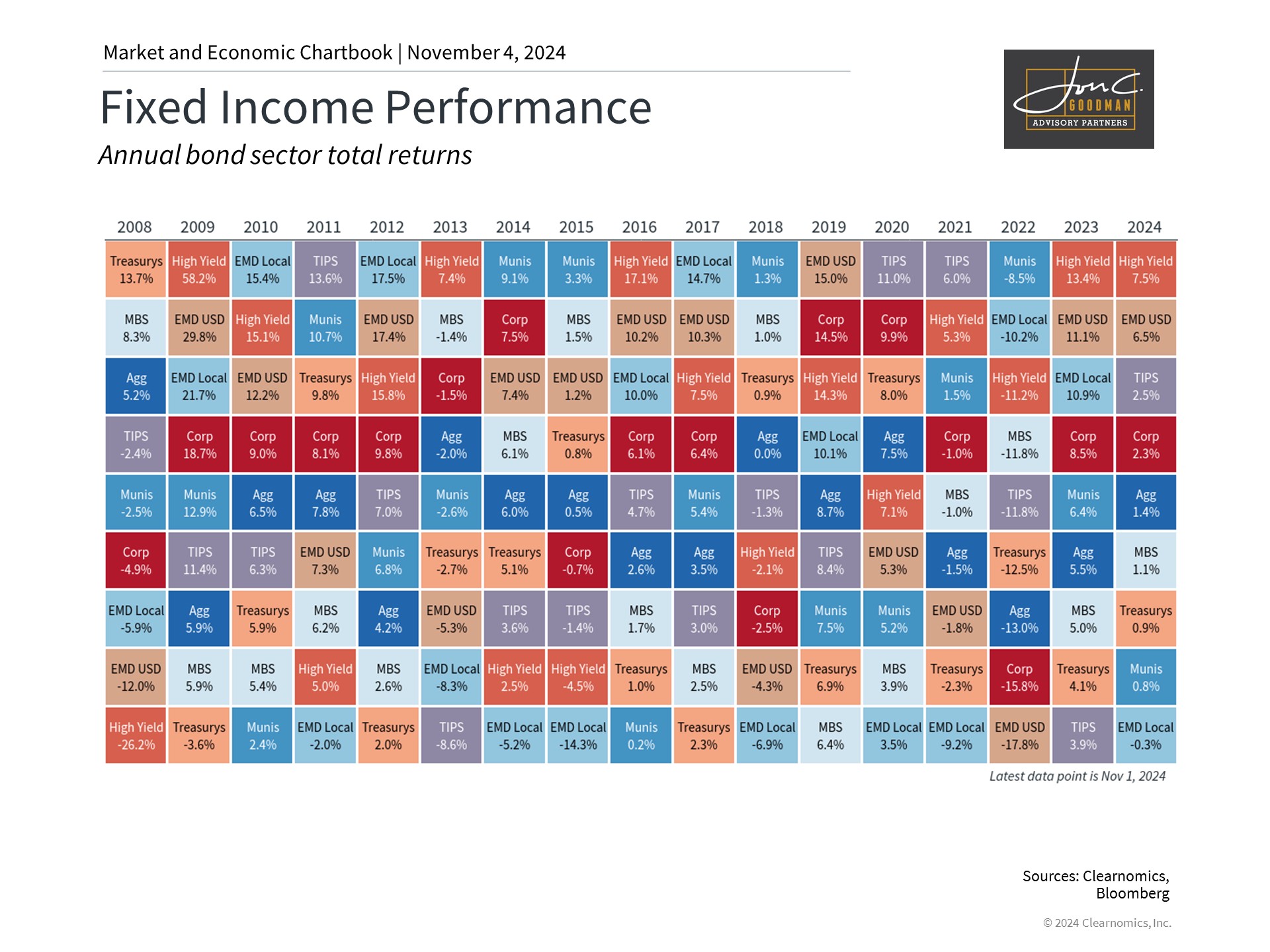

Bonds can still be a good investment even when interest rates are changing.

When interest rates change, it affects the value of bonds. This year, bonds haven’t gained much value overall. Different types of bonds have had different results–some have done well, while others haven’t gained much.

Even though bond prices can go up and down, many bonds are now paying more interest than they have in a long time. For example, U.S. government bonds (called Treasury bonds) are paying about 4.3% interest, which is much higher than the 2% average since 2009.

Bonds are still important for investors because they can help balance out the risks in your investment portfolio. They can provide steady income and can help protect your money when the stock market is unstable. It’s a good idea to have different types of bonds in your investment mix to help handle changes in the market.

The bottom line? Recent economic news, including slower job growth, might affect how the Fed changes interest rates. Try not to make quick decisions based on just one piece of news. Instead, keep a mix of different investments and think about your long-term financial goals.

To schedule a 15 minute call, click here.

.