As the final quarter of the year commences, financial markets and the economy have surpassed many investors’ expectations. Instead of a recession, there has been consistent growth, though more gradual, and inflation rates have declined towards the Federal Reserve’s goal. Consequently, the macroeconomic climate has transitioned into a phase of monetary easing, driving the S&P 500 and Dow Jones Industrial Average to record highs and enhancing bond yields. The performance of the past three quarters serves as a testament to the importance of concentrating on long-term trends rather than past events.

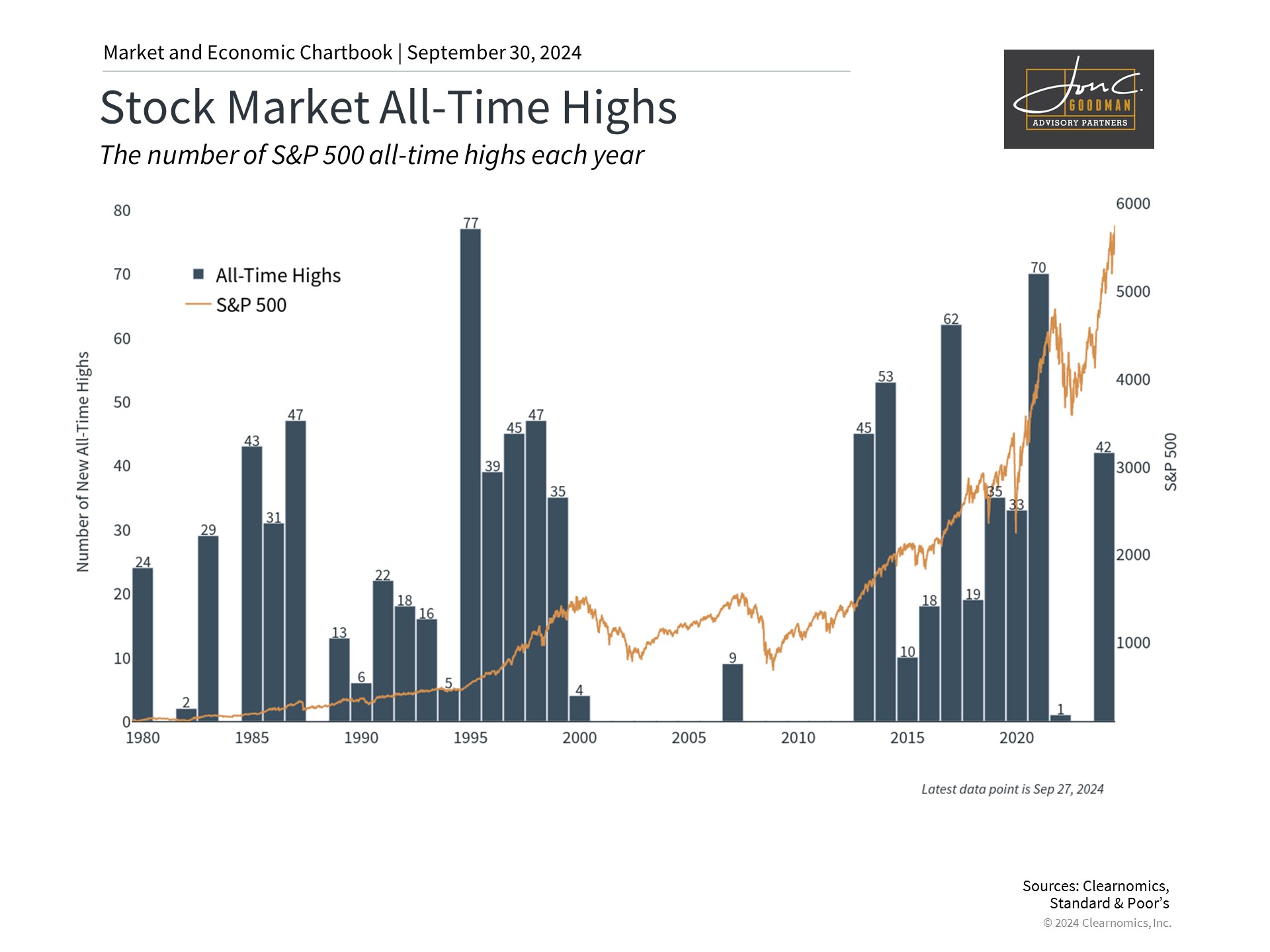

1. The market achieves many new all-time highs during bull markets.

Certainly, numerous risks loom in the coming months. The trajectory of Federal Reserve policy remains uncertain, sparking debates among investors about the magnitude of the next rate adjustment. The presidential election is tightly contested, carrying significant consequences for tax policies, regulations, trade, and more. Geopolitical tensions are escalating, potentially impacting global stability, supply chains, and oil prices. Moreover, market volatility is a constant possibility, particularly when valuations and earnings projections are elevated.

Nonetheless, encountering risks is an inherent part of investing and future planning. The way investors respond to these risks is what ultimately shapes their financial and investment outcomes. Instead of attempting to time the market to sidestep these risks, maintaining a robust portfolio designed to endure various market conditions is advisable. In the following, we offer insights into five key factors influencing the market and their potential implications for investors in the upcoming months.

Initially, the market has seen numerous new all-time highs this year, including in the last quarter. Although this trend is promising, it can also lead to anxiety among investors concerned about a potential pullback.

In bull markets, it’s common for stock indices to achieve multiple new all-time highs, which is indicative of consistent earnings, economic expansion, and rising investor confidence. These highs are not dependable indicators of imminent market downturns, as the actual market and economic conditions are what truly matter. Market timing based on index levels alone is often unproductive.

Market volatility is an inherent aspect of investing, and downturns are bound to happen eventually. Predicting when these downturns will occur is extremely difficult, and historically, markets have tended to reach new peaks and higher troughs. The recoveries after the April and August downturns this year serve as examples that markets can rebound more quickly than expected by many. Although history doesn’t guarantee future outcomes, staying invested is typically more advantageous than attempting to time market entries and exits.

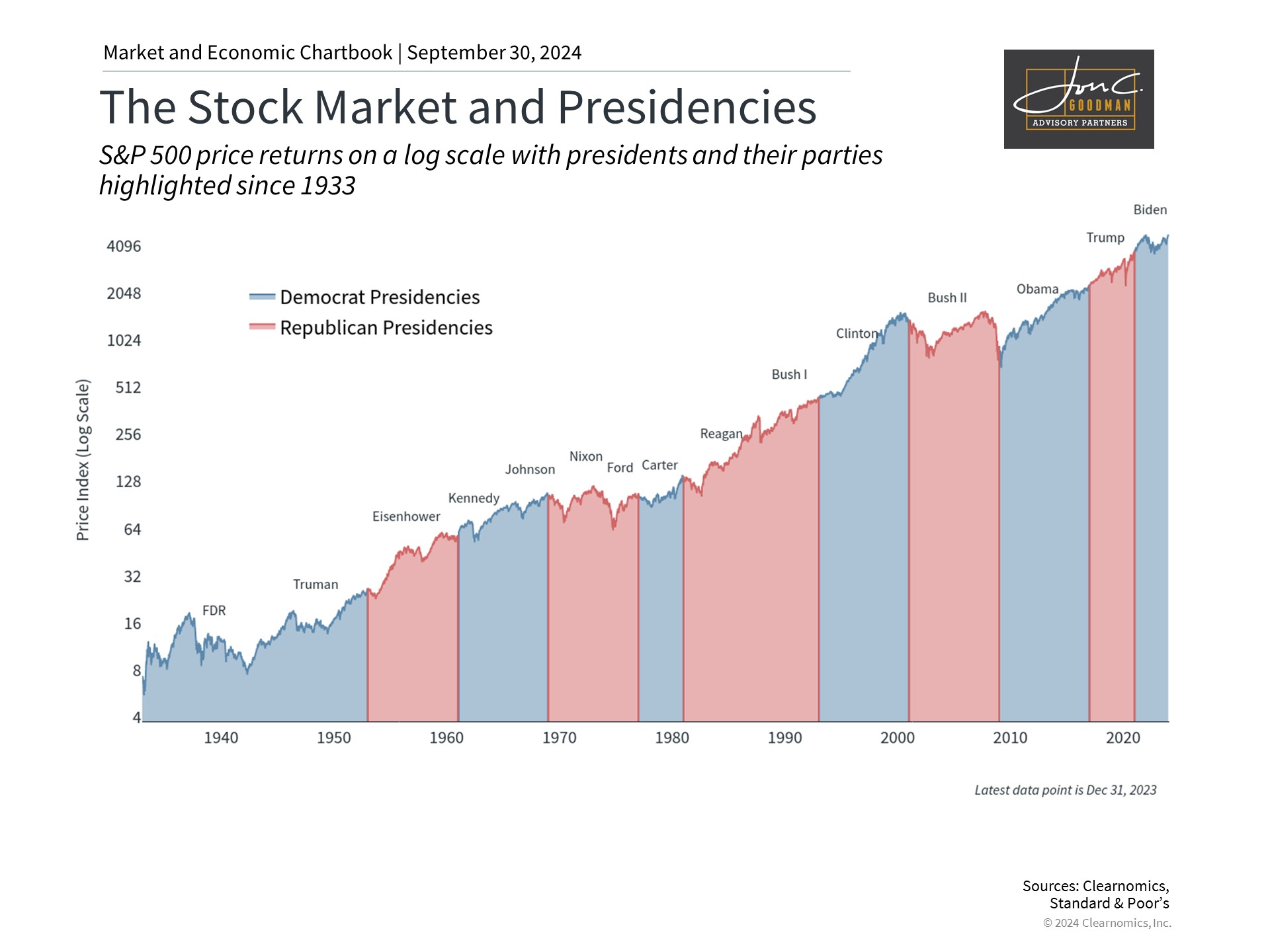

2. The market has performed well under both political parties.

Secondly, the potential impact of the presidential election on the economy is a significant concern for many investors. Polling data from the Pew Research Center indicates that eight out of ten registered voters consider the economy very important to their vote in the presidential election. As the race heats up, it’s vital to remember that while elections are significant for the country and its citizens, we should not let them dictate our investment decisions and savings.

Historical data reveals that the stock market has grown over the long term under both major political parties, as illustrated in the provided chart. The market or economy does not necessarily crash when a particular political party takes office. This is because the primary drivers of market performance, such as economic cycles, earnings, and valuations, hold more weight than the political leader in the White House.

It’s true that policies can influence taxes, trade, industrial policy, regulatory frameworks, among other areas. Nonetheless, policy changes tend to happen slowly, and their timing and effects are often overestimated. Politicians’ promises frequently differ from the legislation that gets passed. Therefore, investors should concentrate on long-term economic and market trends instead of the fluctuating daily poll numbers. Those worried about how specific policies might affect their financial strategies should consult a trusted financial advisor.

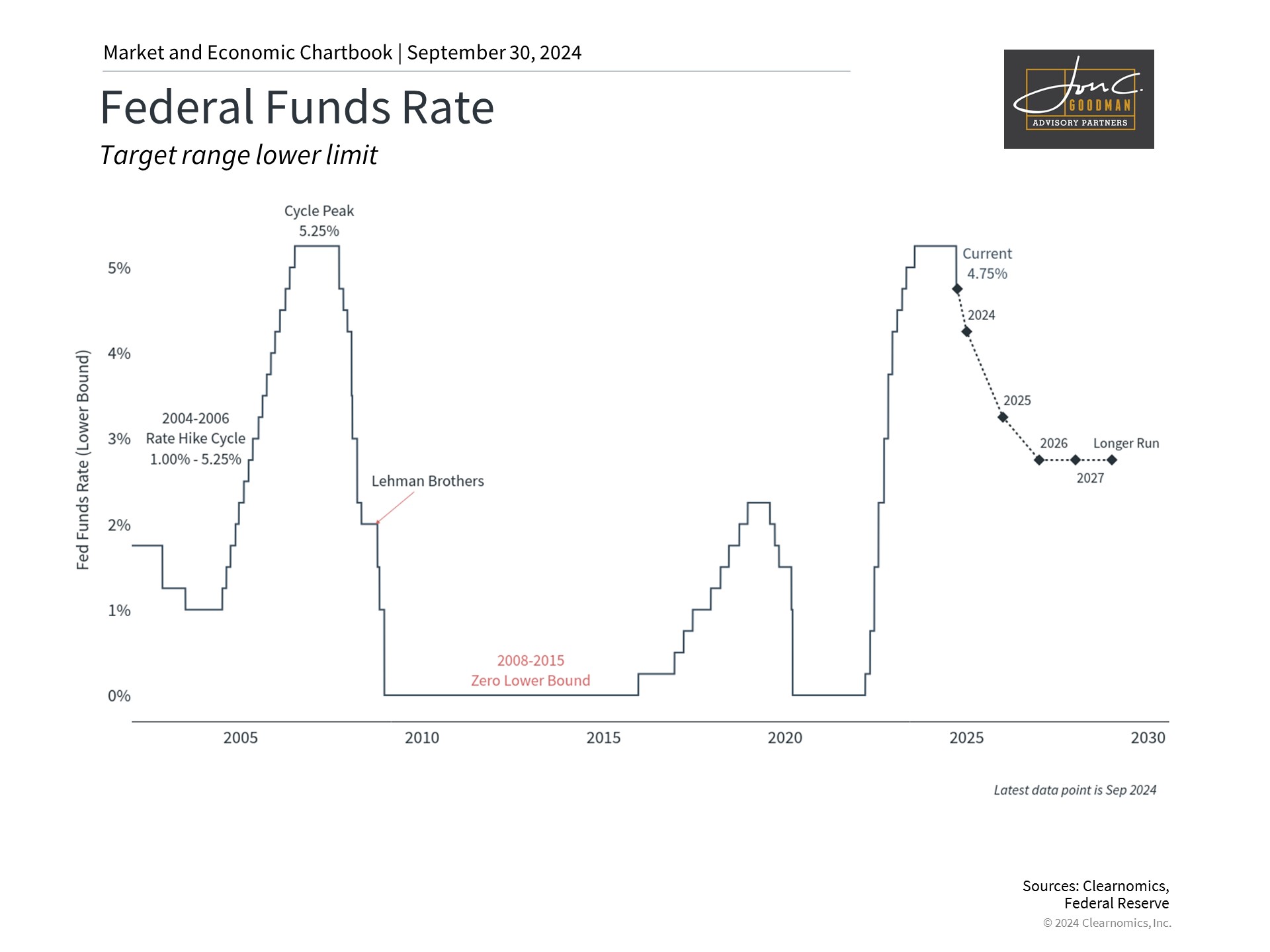

3. The Fed is expected to cut rates further.

Thirdly, inflation is showing signs of moderation, with the latest data indicating the PCE price index— the Fed’s preferred inflation gauge—rising only 2.2% from the previous year, nearing the Fed’s target rate of 2%. Concurrently, the labor market continues to exhibit a slowdown, with unemployment at 4.2%, which remains low by historical standards.

These economic indicators have prepared the ground for the Fed’s initial 50 basis point cut in interest rates in September, with further reductions anticipated throughout the remainder of the year and into 2025. The market, having predicted cuts of varying magnitudes throughout the year, responded positively in the aftermath of the announcement.

Analyzing historical rate cuts is challenging because the reasons behind the Fed’s rate reductions are more significant than the timing or magnitude. Typically, the Fed has lowered rates in response to economic and financial crises, as seen in 2008 or 2020, periods when prolonged economic and market challenges are expected.

In contrast, the present circumstances aim for equilibrium or a “soft landing,” akin to the Fed’s strategy in the mid-1990s. After the swift rate increases in 1994, the Fed implemented cuts in 1995 as inflation concerns waned, setting the stage for an extended period of economic growth and a bull market. Although this is a singular instance, it underscores the importance of drawing appropriate historical comparisons in understanding Fed policy.

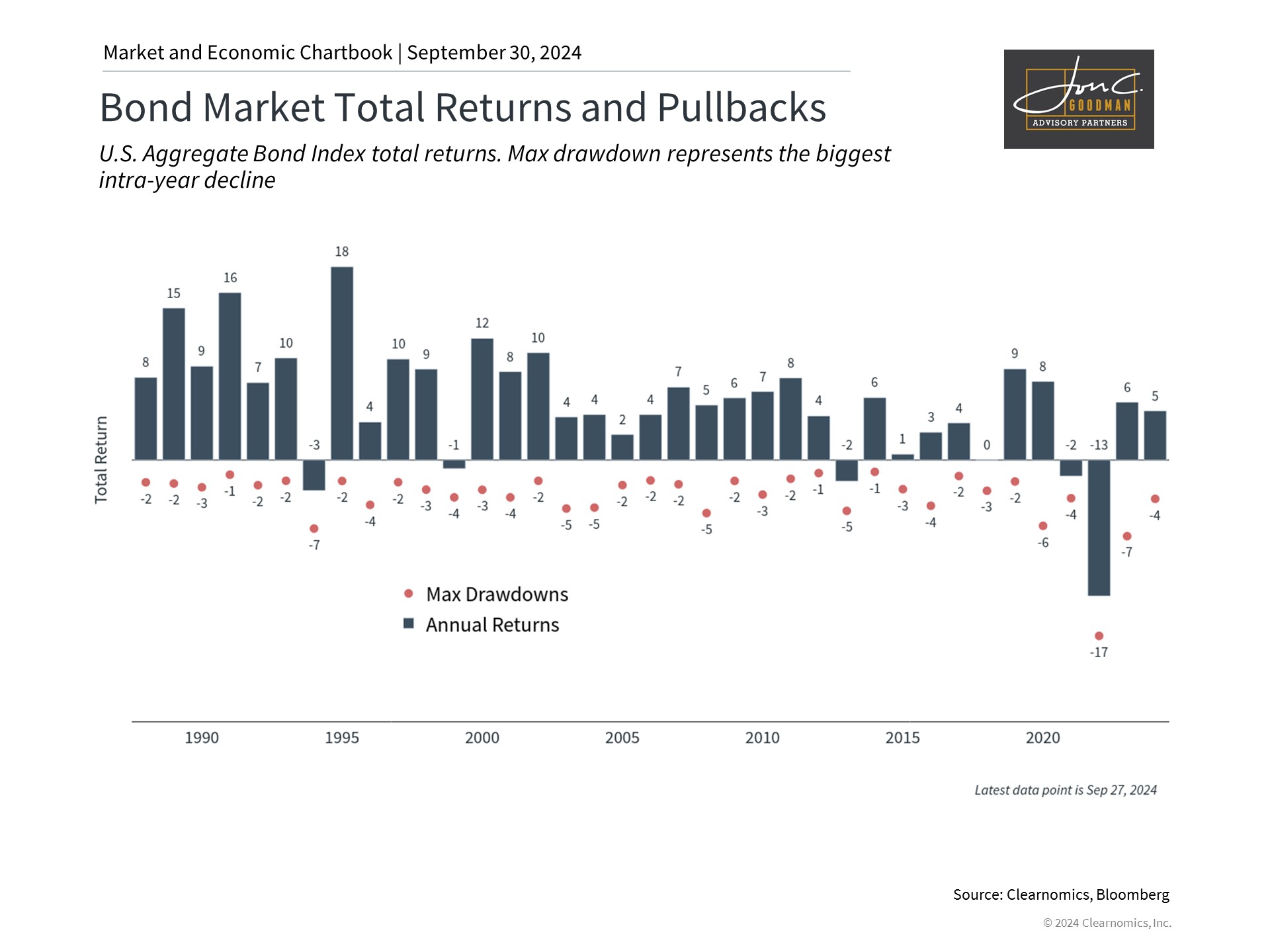

4. The fixed income landscape is shifting.

Federal Reserve rate cuts have led to reduced interest rates across various maturities and a reversal of the yield curve, often called a “bull steepener,” which can benefit bond markets. This marks a shift from the rising rates and bear bond market of 2022.

As interest rates decrease, bond prices typically rise since bonds issued at higher rates become more attractive. Today’s bondholders not only enjoy yields above the average but may also see their bond values increase if the downward rate trend persists.

Economically, lower rates decrease borrowing costs for both businesses and individuals, which may encourage economic growth and investment. This can lead to improved corporate earnings and fundamentals. Therefore, despite recent difficulties, maintaining a diversified asset portfolio remains crucial.

5. Geopolitical conflicts are worrisome but do not directly impact markets.

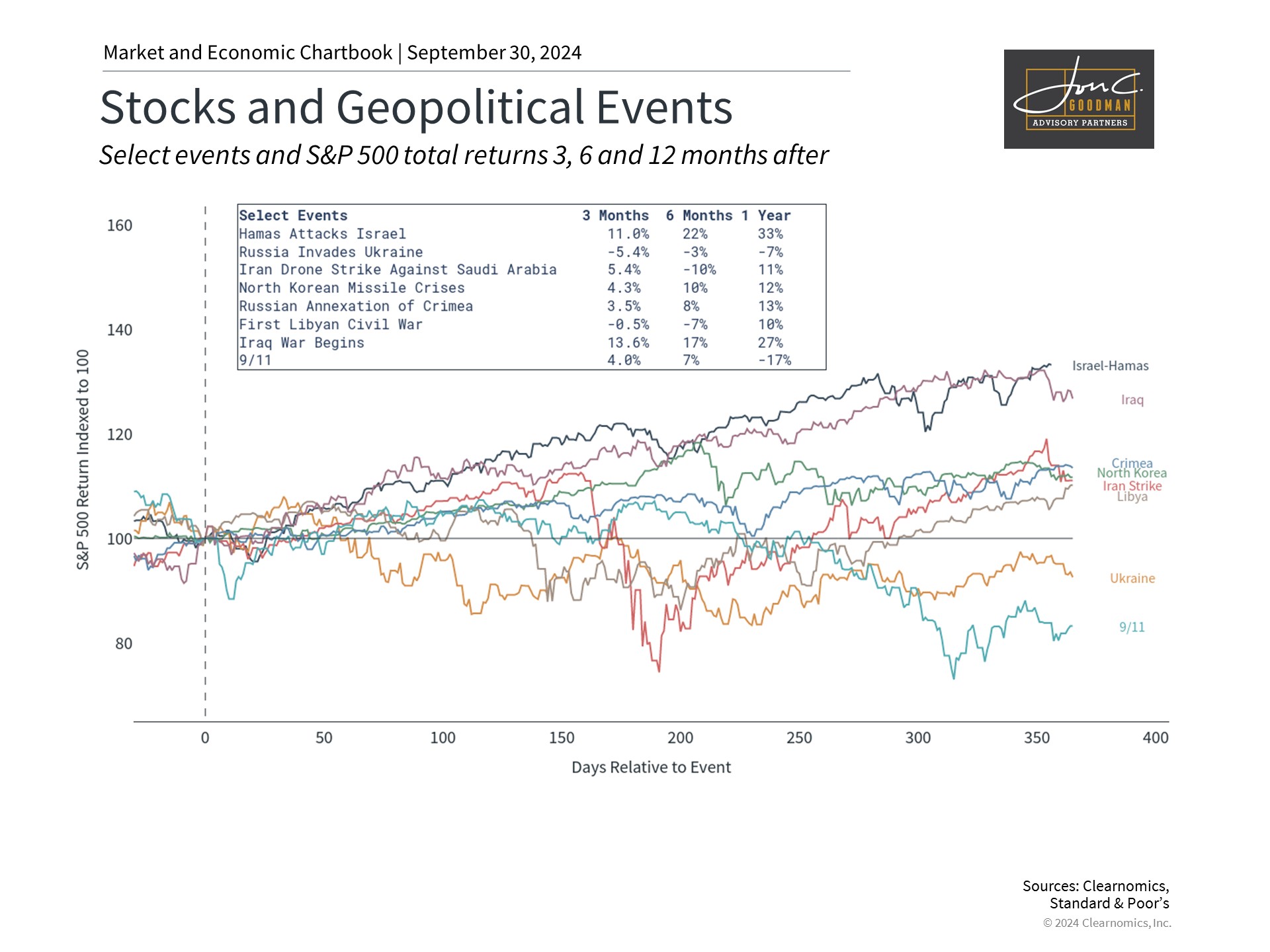

Tensions have escalated in the Middle East with the intensifying conflict between Israel and Hezbollah, contributing to global geopolitical strains, including the ongoing Russia-Ukraine war. Although these events have significant real-world consequences, their impact on the economy and stock market is ambiguous, with investor portfolio effects usually transient. Historical data indicates that extended market downturns often align with significant events like the dot-com bubble burst or the 2022 rate hikes.

Regional conflicts can affect the broader economy through oil prices. The Middle East’s turmoil has slightly increased oil prices, yet the rise is minor relative to past crises, and the U.S.’s status as a leading oil and gas producer might offer some buffer against global incidents.

Despite geopolitical volatility, the stock market has seen only two pullbacks of 5% or more this year, underscoring the value of maintaining investments and concentrating on general market trends over immediate news.

In short, with the Federal Reserve reducing rates, an upcoming election, and markets approaching record highs, prioritizing long-term financial objectives over ephemeral events is crucial.

To schedule a 15 minute call, click here.