The recent escalation in the conflict between Israel and Hezbollah heightens the possibility of a full-scale war, adding to the ongoing instability in the Middle East. This situation is occurring amidst global uncertainty, with the Russia-Ukraine war, China-Taiwan tensions, South China Sea unrest, Red Sea disruptions, and continuous threats from North Korea and Iran. These complex events are leading to severe humanitarian crises and, regrettably, lack straightforward resolutions.

The impact of geopolitical risk depends on broader trends.

While acknowledging the significant real-world consequences of conflicts, investors may question their potential effects on financial markets and the economy. Historical data indicates that geopolitical events may cause market uncertainty and volatility, but typically, this impact on investment portfolios is transient. As situations progress and stabilize, market conditions often normalize, with broader economic cycle trends resuming their role as primary performance drivers. Therefore, investors are advised to avoid making reactive decisions based on headlines, focusing instead on their long-term financial objectives.

Geopolitical risk is an inescapable element for long-term investors. News of regional and global conflicts can be particularly jarring as they involve violence and loss of life, standing in stark contrast to the usual business and market news concerning earnings, valuations, and mergers and acquisitions. The complexity of these events makes them hard to analyze, and forecasting their outcomes is notoriously difficult. Hence, it is crucial for investors to distinguish their personal sentiments and political views from their investment strategies.

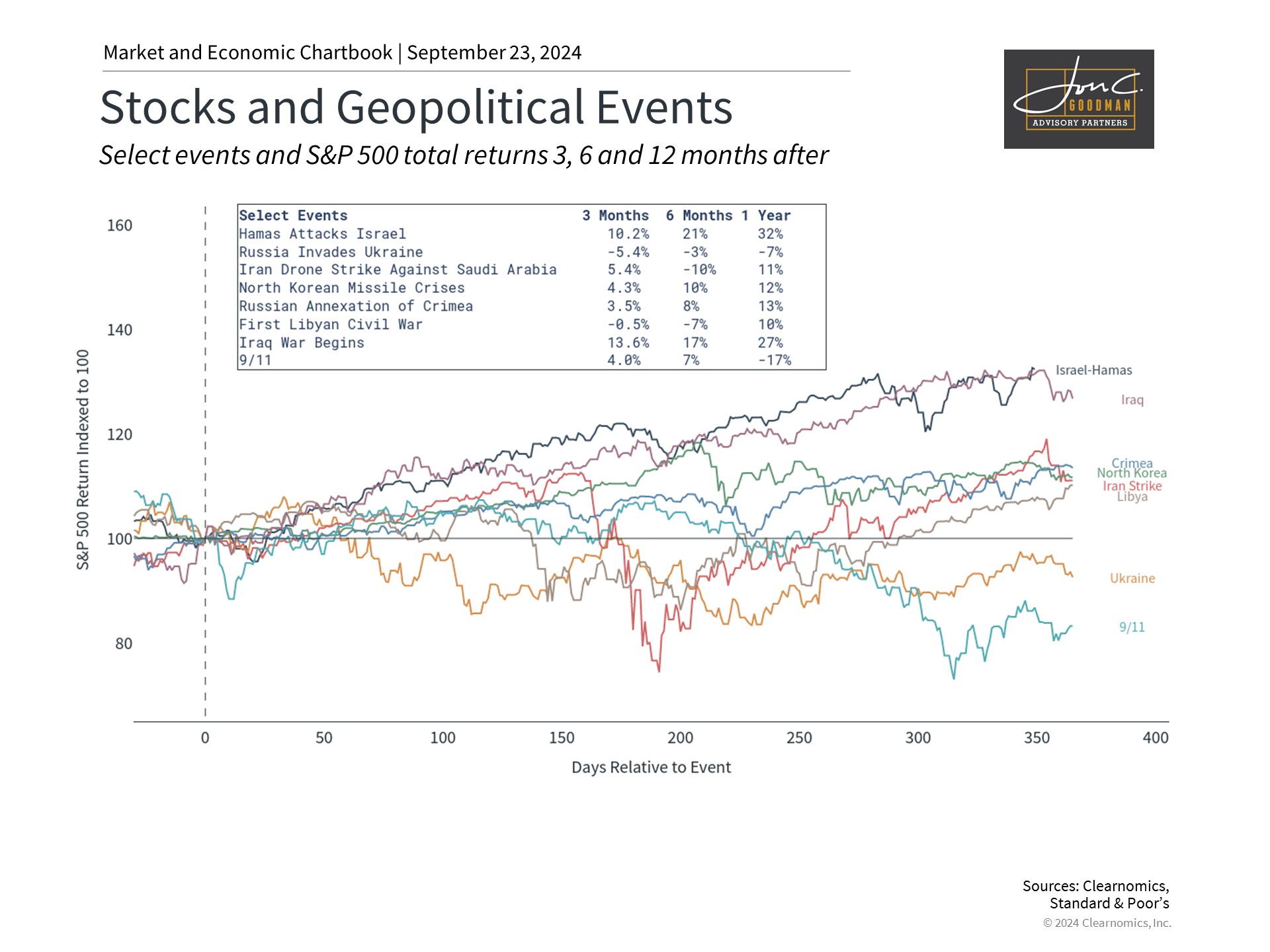

Historical evidence suggests that the influence of regional conflicts on markets is often more contingent on the prevailing economic environment than on the specifics of the conflicts themselves. This pattern is evident in a chart that documents the most significant geopolitical events of recent decades. Often, markets have rebounded within days or weeks, if affected at all.

Market struggles have often been attributed to broader economic conditions, such as the dot-com bust coinciding with 9/11, or the rapid Federal Reserve rate hikes in 2022 during Russia’s invasion of Ukraine. In contrast, many conflicts since the 2010s, including Middle Eastern wars, Russia’s annexation of Crimea, and nuclear tensions in North Korea and Iran, occurred amidst an expansionary economic cycle, which seemed to drive markets forward despite heightened uncertainty.

Similarly, the 20th century saw robust bull markets in the face of significant global events like World War II, the Vietnam War, Middle Eastern conflicts, and the pervasive Cold War. This suggests that basing investment decisions purely on geopolitical events does not align with historical outcomes.

Oil prices can affect the global economy.

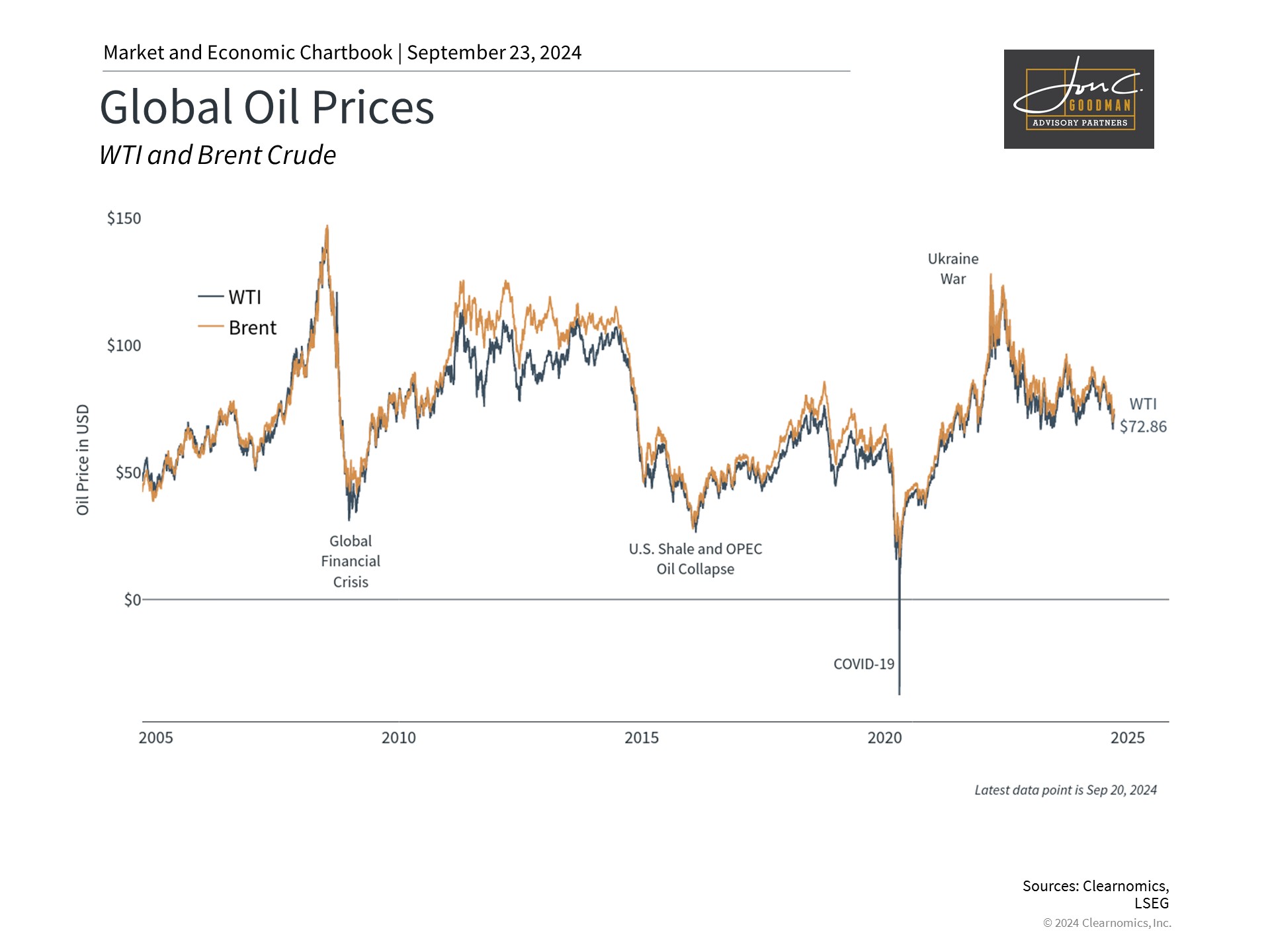

Short-term disruptions in global markets often stem from rising oil prices or supply chain issues. Oil supply problems can drive up energy prices, affecting inflation and economic growth worldwide. A recent example was Russia’s invasion of Ukraine in 2022, which exacerbated global inflation.

Currently, tensions in the Middle East have caused a modest increase in oil prices, with Brent crude going from $69 to about $75 per barrel since early September. This rise is small compared to the spikes during other geopolitical crises. For instance, in 2022, oil prices surged to nearly $128 per barrel, pushing U.S. gasoline prices above $5 per gallon before they declined again.

Today, the United States stands as the world’s top producer of oil and gas, with domestic production surpassing 13.3 million barrels per day, outdoing Saudi Arabia, Russia, and OPEC+ members. This level of energy independence theoretically shields the U.S. more from global events, despite still relying on imported oil for various reasons.

The macroeconomic climate may have been more reactive to oil prices earlier in the year, as investors and the Federal Reserve assessed the trajectory of inflation. During that period, monthly shifts in oil prices had the potential to influence inflation rates, thereby impacting monetary policy direction. However, with the recent significant slowdown in inflation and the Federal Reserve’s initiation of rate cuts, the markets might now be less responsive to brief variations in oil prices.

Markets are resilient but investors should always prepare for uncertainty.

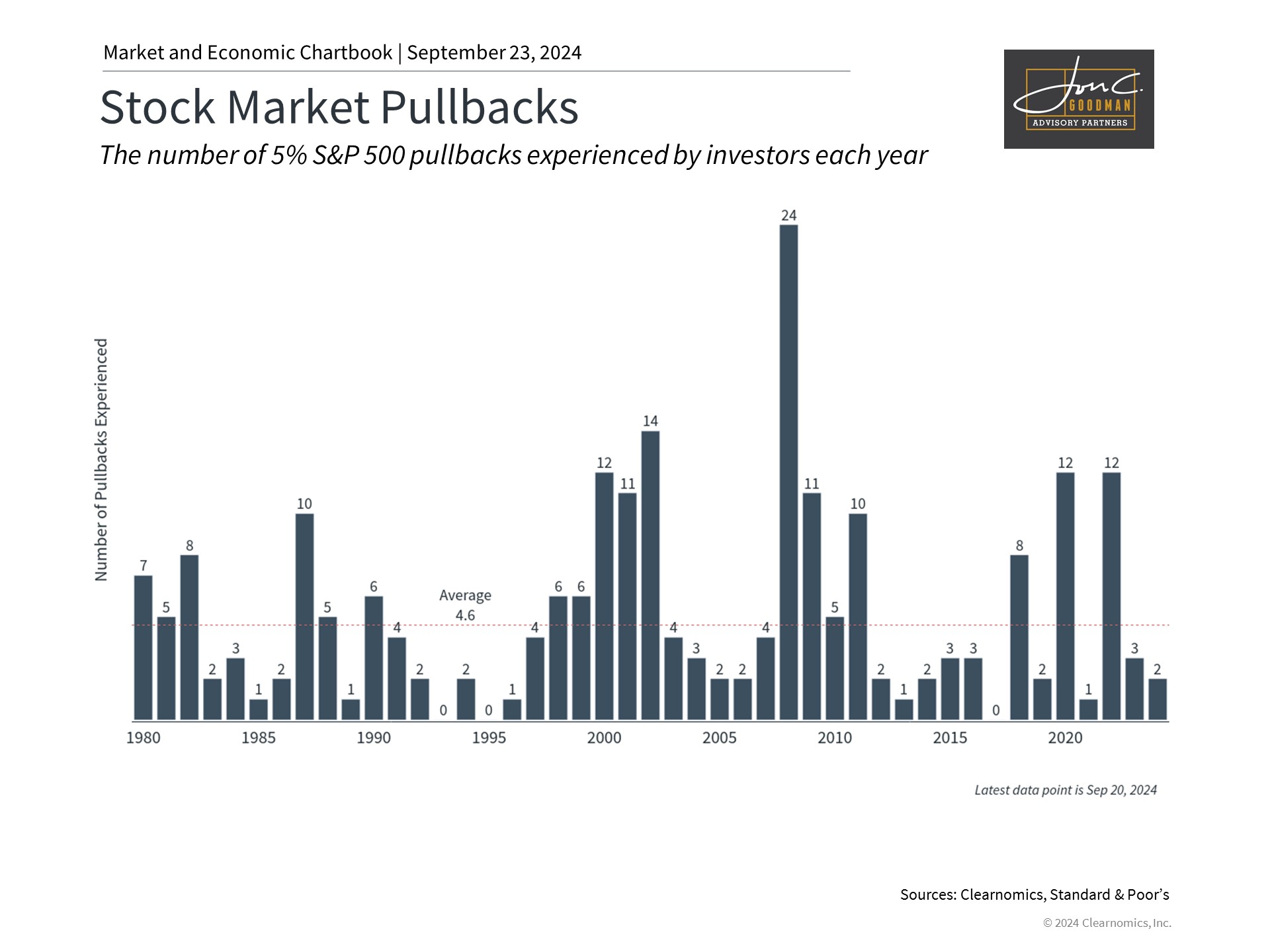

Investors might perceive significant market uncertainty this year; however, the stock market has only seen two pullbacks of 5% or more. These took place in April and August, sparked by concerns over the Federal Reserve and economic growth, yet they remain below the historical average. Meanwhile, the S&P 500 has produced a 20.8% total return year-to-date. This underscores the value of remaining invested without overreacting to news, while also being ready for market volatility.

In terms of geopolitics, it’s crucial to acknowledge that although markets rely on global stability, the rule of law, and business/consumer confidence, they are largely influenced by broader market and business cycle trends. Therefore, while regional conflicts may raise the “risk premium” on financial assets due to heightened uncertainty, dramatic portfolio adjustments in response to geopolitical crises can be ill-advised.

Ultimately, despite the gravity of the situation in the Middle East, investors should keep a balanced view regarding their portfolios. Working with a reliable advisor to develop a portfolio based on long-term financial goals, capable of withstanding uncertain times, is essential.

To schedule a 15 minute call, click here.