The Federal Reserve’s decisions on interest rates continue to be a central concern for the markets. Although there is discussion about when and by how much rates should be cut, understanding why the central bank is reducing rates and the potential outcomes of the complete rate cut cycle is crucial. The effects are not as obvious as one might assume, and market expectations have changed significantly in the last year. Investors should be aware of the historical effects of rate cuts on the economy and the markets.

The rationale behind Fed rate cuts is important.

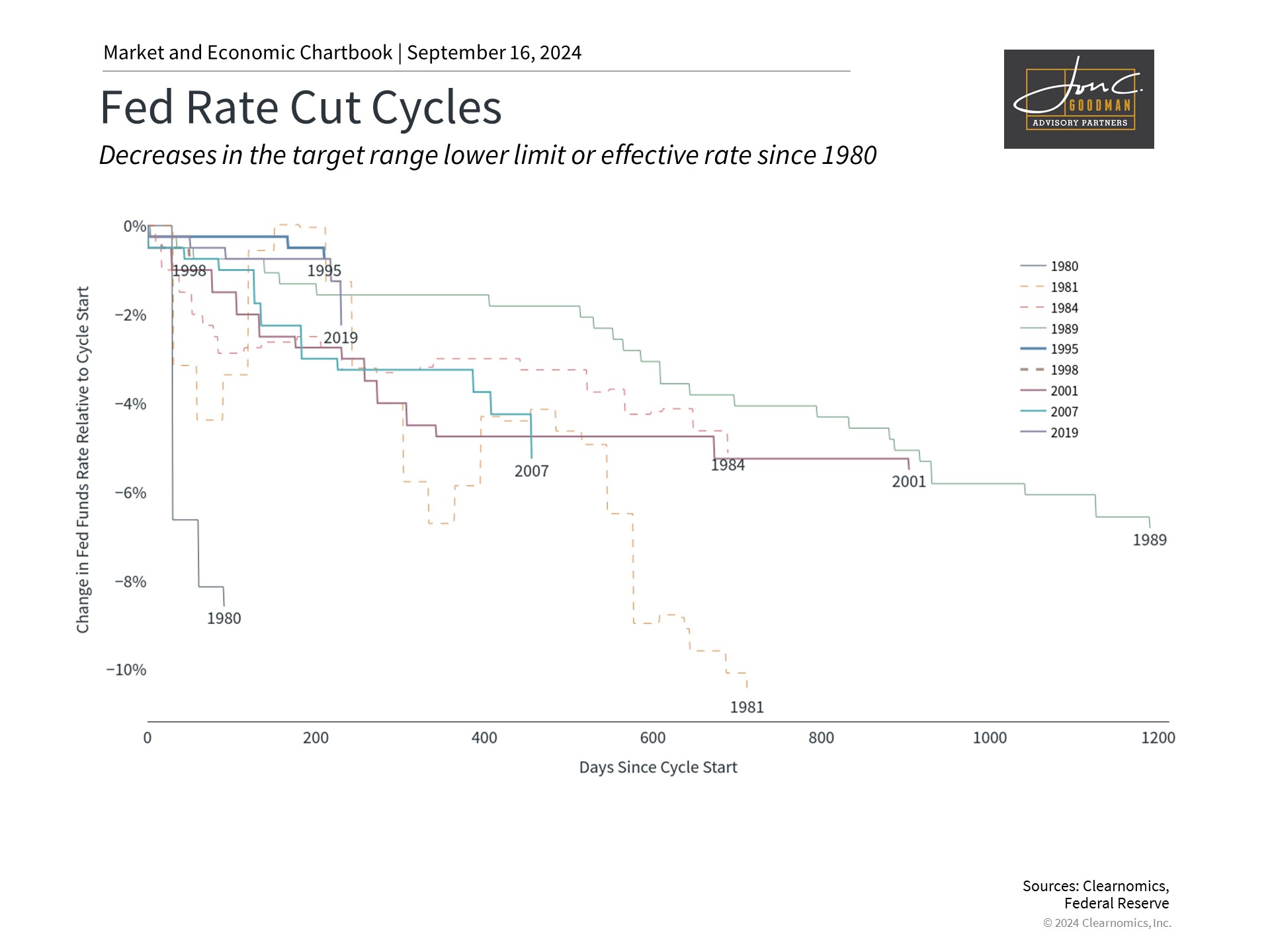

The Federal Reserve often reduces interest rates to stimulate a faltering economy, making borrowing more affordable for individuals and businesses, and encouraging spending over saving. This strategy is designed to foster growth and stabilize the financial system, particularly during recessions and crises. Historically, the Fed has enacted significant rate cuts during the dotcom crash in the early 2000s, the 2008 global financial crisis, and the 2020 pandemic.

The typical behavior of the economy and markets during periods of rate cuts can be misinterpreted based on these events. Although rate reductions aim to encourage growth, implementing them amidst an economic downturn usually signals an impending recession and bear market that could persist for several quarters post the initial cut. Consequently, rate cuts are often associated with subpar market performance, despite being a reaction to, not a cause of, economic difficulties.

In contrast, rate hikes are generally perceived as dampening economic activity, yet they frequently coincide with periods of economic expansion and bull markets, as the Fed cautiously applies the brakes. Paradoxically, rate increases have historically aligned with robust market performance.

Currently, the Federal Reserve is not contending with an abrupt economic downturn or financial crisis. Instead, it is managing a phase of consistent but decelerating growth, with inflation improving and the labor market weakening, albeit remaining robust. This context differs markedly from times of emergency rate reductions. Hence, understanding the reasons behind rate cuts is crucial when assessing their potential effects on markets in the forthcoming months and years.

A comparable scenario might be the 1994-1996 rate cycle when the Fed increased rates to allay inflation concerns, only to reduce them again soon after. Such instances are often termed “soft landings,” as the Fed seemingly succeeded in tempering the economy without precipitating a recession. Despite a considerable disturbance to the bond market in 2022, markets ultimately reacted favorably to the rate decreases once the economy reached equilibrium.

The Fed’s task is to balance inflation and growth.

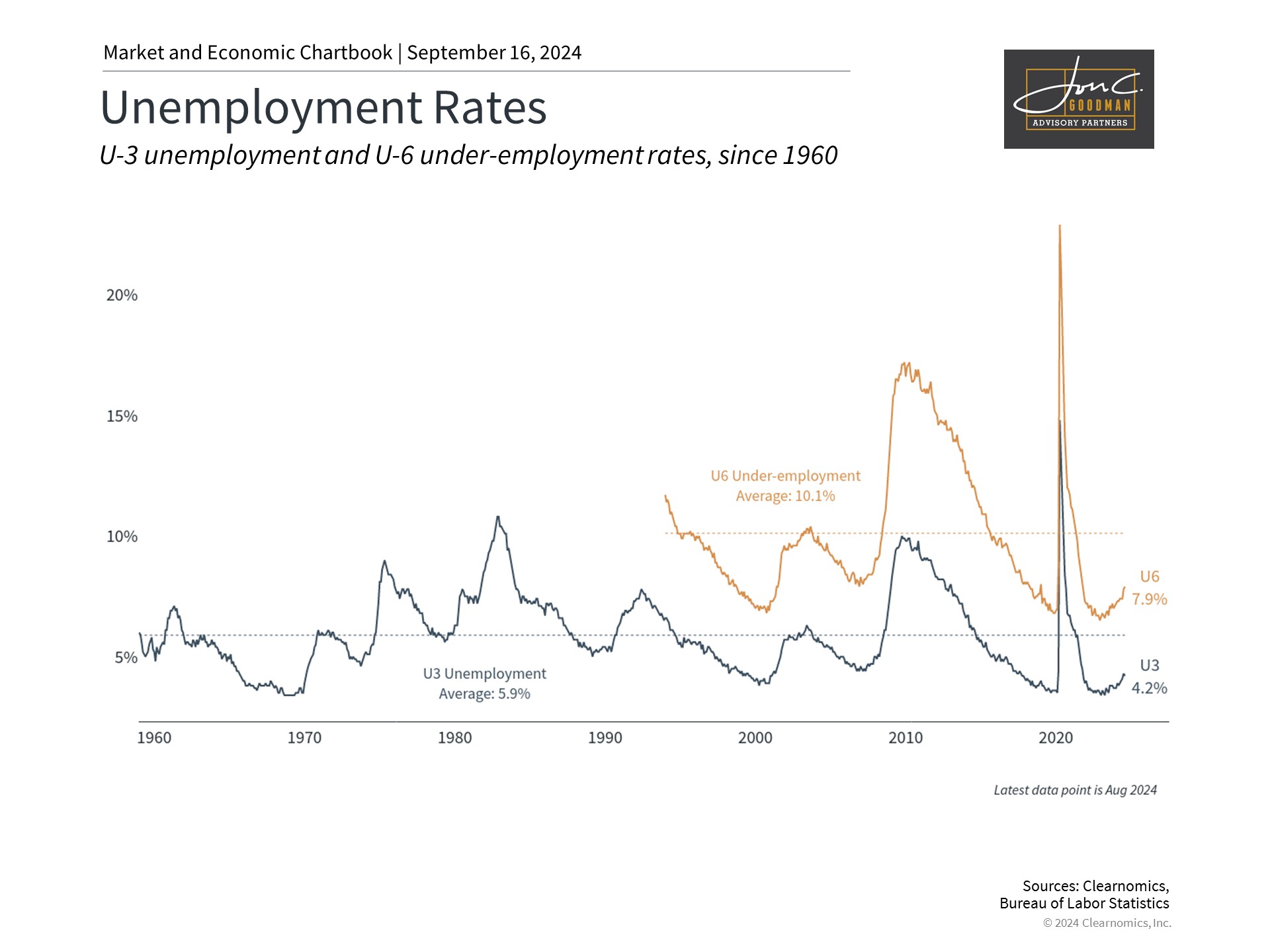

The Federal Reserve’s dual mandate, outlined in the 1977 Federal Reserve Act, aims to “promote maximum employment and stable prices.” Currently, this translates to bringing inflation back to 2% while fostering steady economic growth.

These goals can conflict, as theoretically, quicker growth could lead to increased inflation. Between 2009 and early 2020, inflation was almost non-existent, which allowed the Fed to maintain very low interest rates, contributing to one of the strongest job markets in history. However, recent years’ inflation has forced the Fed to balance price stability with employment.

Inflation has shown signs of improvement since its 2022 peak. The most recent Consumer Price Index report indicated a continued slow decline in prices for August, with the headline index up just 2.5% from the previous year. Yet, the Fed remains cautious in claiming success because the core CPI, which omits the volatile food and energy sectors to better represent the underlying trend, saw a minor increase to 3.2%. This is largely attributed to persistent high housing prices, which remain a concern for economists.

It is often stated that monetary policy operates with “long and variable lags.” This means that if the Federal Reserve waits for inflation to return to 2%, it might be too late. Such a delay could lead to an excessive tightening of the job market, resulting in tangible adverse effects on households and businesses. Therefore, the recent weakening in employment data further justifies a reduction in interest rates.

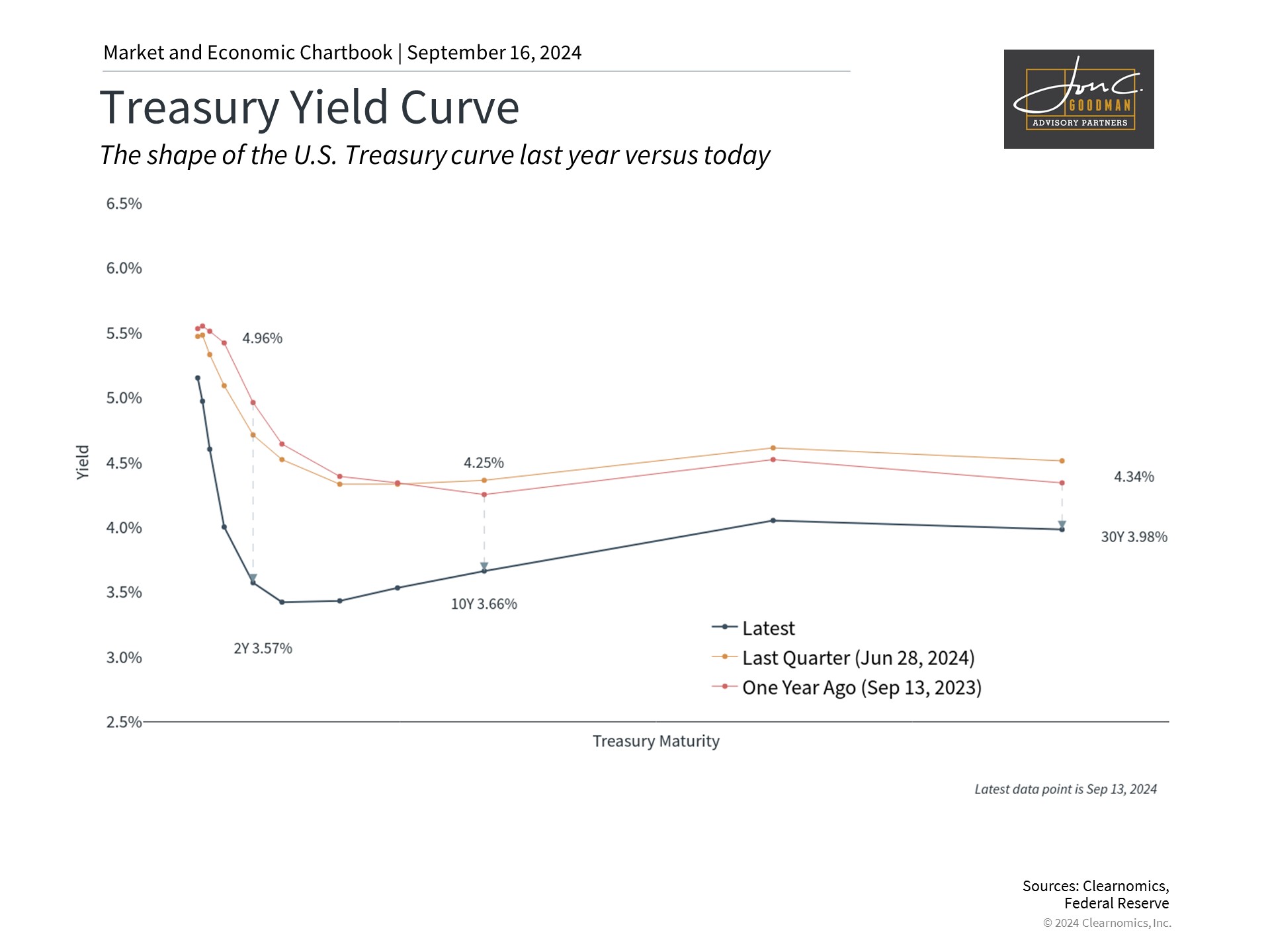

Bond yields are adjusting to rate cuts.

In light of these economic trends, many economists and investors anticipate that the Federal Reserve will lower interest rates several times this year and into 2025. The bond yields have reacted by “disinverting” the yield curve for the first time since the rate hike cycle started in 2022. This shift is due to the decrease in short-term interest rates, which are influenced by Fed policy, while long-term rates, linked to economic growth, have not fallen as sharply. An “upward-sloping” yield curve, which has emerged as a result, is typically viewed as a positive sign for the economy.

Historically, lower rates have been beneficial for both stocks and bonds, although past performance is not indicative of future results. Specifically, bond prices tend to rise when bond yields fall, explaining the recent recovery in many bond indices.

For the stock market, reduced interest rates translate to lower-cost financing for businesses to invest and grow. In terms of company valuation, lower rates lead to a smaller discount on future cash flows, potentially making current valuations more appealing. However, it’s important to remember that markets do not always advance linearly, and investors should expect periods of volatility as the financial system adapts to changes in Federal Reserve policies.

As monetary policy enters a new stage, economists will pay close attention to various indicators, especially those concerning employment and economic growth. The Federal Reserve’s task is to fine-tune its policy to bolster the economy while avoiding the rekindling of inflation or the creation of market imbalances.

The key takeaway is that grasping the reasons behind the Federal Reserve’s rate cuts is as crucial as the policy actions themselves. Instead of concentrating on singular rate adjustments, investors ought to keep a long-term outlook to remain aligned with their financial objectives.

To schedule a 15 minute call, click here.