With less than two months until the presidential election, the policy platforms for President Donald Trump and Vice President Kamala Harris are gradually forming. Through speeches and debates, each candidate is laying out what they stand for and how they would change existing policies. Investors often scrutinize taxes closely, and there are worries about how shifts in tax rates might affect both Wall Street and Main Street. As November 5 approaches, how can investors keep a balanced perspective?

It’s important to maintain perspective this election season.

Tax policy is a highly complex area, making it crucial to consult a trusted advisor. Moreover, the platforms of both candidates may change as election day approaches. While it’s not feasible to delve into all aspects here, the key distinctions in tax policies between the candidates and their parties largely hinge on the future of the Tax Cuts and Jobs Act (TCJA).

It’s essential to keep a balanced view on tax policy, as these topics can become politically charged. Taxes are deeply connected to politics, mirroring our divided political landscape. Regardless of our political leanings or personal preferences, maintaining objectivity is vital to focus on our financial objectives.

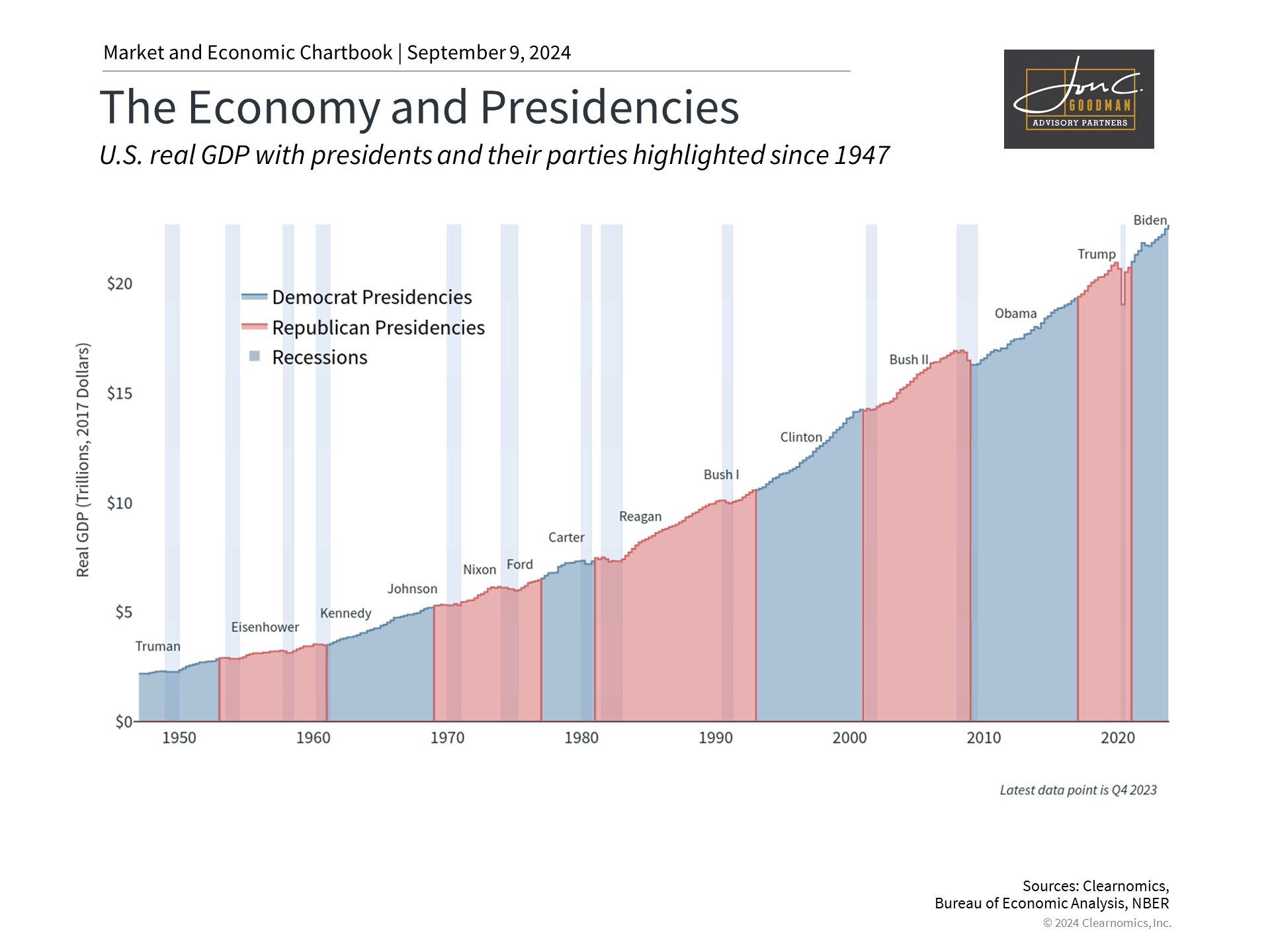

Taxes significantly affect households and businesses, yet their impact on the broader economy and stock market isn’t always direct. Taxes are just one of many factors that drive growth and returns. Numerous deductions, credits, and strategies can lower the effective tax rate, and changes in spending and investment often mitigate the effects of taxes. Thus, reduced taxes don’t guarantee economic growth, nor do increased taxes inevitably lead to a downturn.

Moreover, there is often a disparity between election rhetoric and actual policy implementation. Candidates may make promises aligned with their political ideologies that do not come to fruition once they assume office. Even after election, the enactment of new tax laws requires Congressional collaboration and consent. It is a historical trend for the president’s party to lose Congressional seats during a second term, which can lead to a decline in approval ratings. Such dynamics can modify or dilute the original policy proposals.

For instance, in the 2016 presidential campaign, President Trump pledged a comprehensive reform of the tax system. Although the Tax Cuts and Jobs Act introduced significant alterations, it preserved many pre-existing components. In a similar vein, President Biden, during the 2020 campaign, criticized the TCJA and proposed tax increases for high-income individuals and corporations. The Inflation Reduction Act of 2022 established a 15% minimum corporate tax rate, which represents a modest change compared to the extensive revisions proposed during his campaign.

The future of the Tax Cuts and Jobs Act and national debt is uncertain.

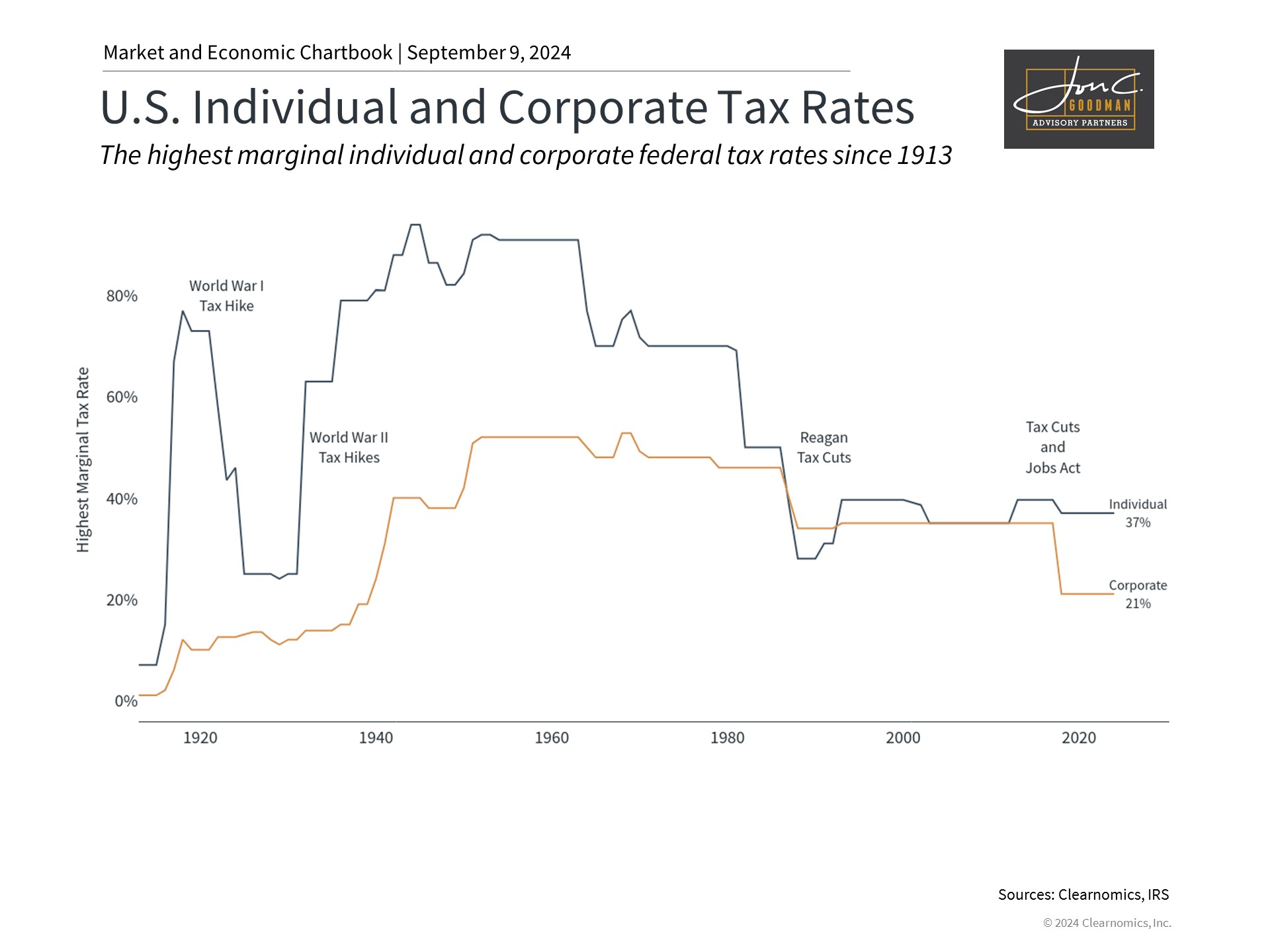

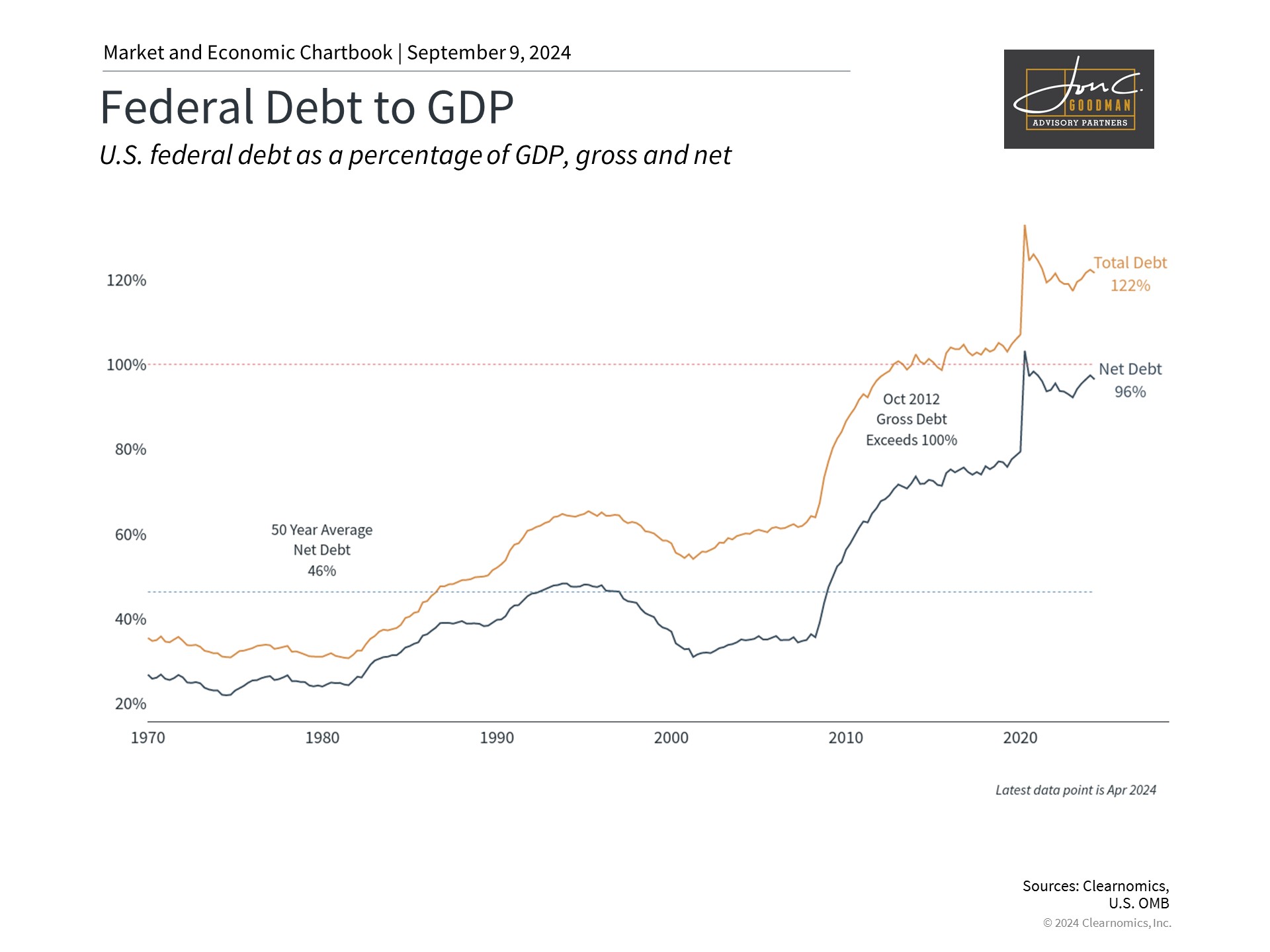

Historically, tax rates have been relatively low for decades. Despite this, the expanding federal debt has led many economists to speculate that taxes may need to increase in the future to mitigate the deficit, even if no changes occur in the next presidential term.

The Tax Cuts and Jobs Act (TCJA), which came into effect in 2018, included measures such as reducing the highest individual income tax rate from 39.6% to 37%, almost doubling the standard deduction, cutting the corporate tax rate from 35% to 21%, and transitioning to a territorial tax system for corporations. Additionally, the TCJA decreased estate taxes, removed personal exemptions, and made adjustments to various other deductions and credits.

Furthermore, the Inflation Reduction Act of 2022 established a 15% minimum tax on large corporations with annual profits exceeding $1 billion and introduced a 1% excise tax on stock buybacks by publicly traded companies.

If the President and Congress do not act, numerous provisions of the Tax Cuts and Jobs Act (TCJA) will expire by the 2026 tax season, leading to a “tax cliff.” This issue is particularly divisive in the current election season. The following are some provisions under discussion by the candidates:

- Trump proposes cutting corporate taxes further from 21% to 15% for some companies, including manufacturers who make their products domestically. Harris is in favor of increasing the corporate tax rate to 28%, in line with President Biden’s position.

- Trump has discussed extending the TCJA’s individual tax rates, but specifics are still unclear. Harris supports allowing the top marginal rate to revert to 39.6%.

Harris proposes raising the capital gains rate from 20% to 28%. Along with an increase in the “net investment income tax” introduced with the Affordable Care Act, the top capital gains rate would rise to 33%, the highest since 1978. - Both candidates propose new enhanced child tax credits and not taxing tips. Trump has discussed eliminating taxes on Social Security for seniors.

- Harris proposes expanding the startup expense deduction from $5,000 to $50,000 and $25,000 in support of first-time homebuyers making down payments.

- Harris proposes a new tax on unrealized capital gains for those worth $100 million or more. Such a tax would be historic. The recent Moore v. United States case in the Supreme Court loosely touched on this by allowing a provision in the TCJA that imposed a one-time tax on unrepatriated foreign earnings.

The economy has grown under both parties.

Regrettably, the annual budget deficit remains elevated, and the national debt is poised to increase irrespective of the presidential incumbent. Although studies on this issue vary and ought to be approached cautiously, several indicate that either candidate might contribute trillions to the debt over the next few years.

Nonetheless, historical data shows that the economy has expanded under the governance of both major political parties. It’s crucial to acknowledge that the president’s identity does not singularly dictate the economy and market outcomes, despite seeming paradoxical. Due to the checks and balances inherent in our political system, policy shifts usually occur incrementally. Notably, no candidate is advocating for a return to the peak pre-Reagan tax era, where the highest marginal rates soared to 94%.

Therefore, while taxes are a significant consideration in financial planning, they don’t necessarily affect investment portfolios and economic growth as one might presume. Investors are advised to persist in collaborating with a reliable advisor and concentrate on their long-term objectives during this election period. By keeping a level-headed view and steering clear of decisions influenced by political bias, investors may enhance their prospects for success amidst the changing political terrain.

The bottom line? As the election season heats up, it’s important for investors to maintain perspective amid heightened political rhetoric and divergent economic proposals from the candidates. While Trump and Harris may propose changes to the tax code, it’s important to maintain objectivity when crafting financial plans.

To schedule a 15 minute call, click here.