As the post-Labor Day period begins, it’s an opportune moment for investors to contemplate the markets and reassess their financial strategies for the year’s remainder. August witnessed the most significant market downturns in two years, yet major indices have recovered, with the S&P 500 nearing its historic peak. The Federal Reserve is anticipated to reduce rates at the September 18 meeting, a move that has led to the stabilization of interest rates lately. Inflation continues its decline, while the overall economy stays robust. Despite the onset of September bringing further market unpredictability, maintaining a balanced viewpoint is crucial for investors.

Markets have rebounded over the past month.

Investors should always brace for volatility, particularly with potential market-moving events on the horizon. Uncertainty persists regarding the Federal Reserve’s complete rate cut trajectory, the forthcoming presidential election, and continuous geopolitical tensions. Investors can glean lessons from recent months as they steer through these developments while keeping their long-term financial objectives in focus.

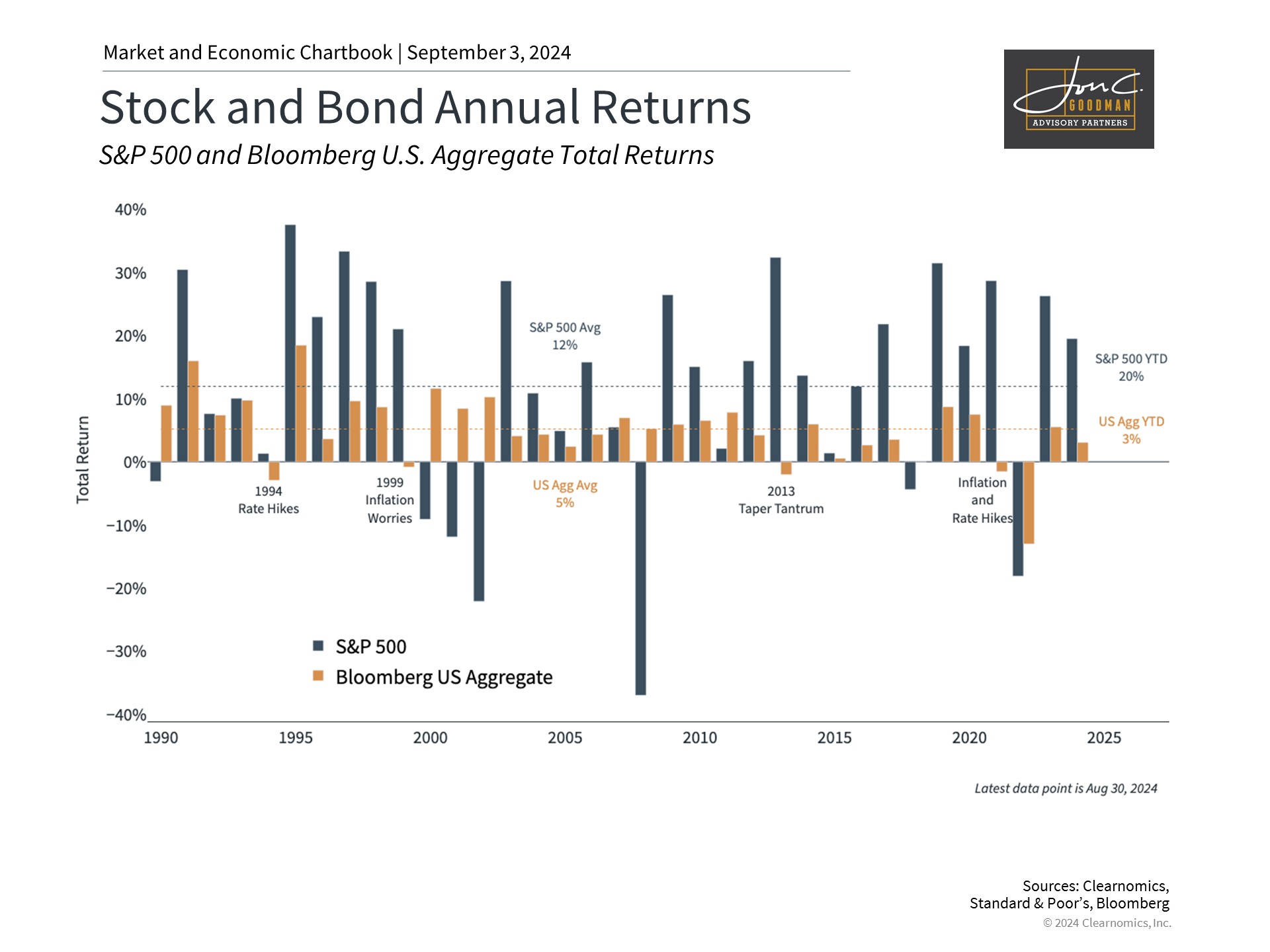

Despite fluctuations, the S&P 500, Nasdaq, and Dow have appreciated 19.5%, 18.6%, and 11.7% respectively, including dividends this year. The S&P 500 has only seen two significant pullbacks, with the steepest drop being 8%, which is under the historical norm. Bonds have faced challenges for much of the year due to persistently high rates, yet the prospect of Federal Reserve rate reductions has recently improved returns. Hence, while market volatility can be unsettling, it’s crucial not to react excessively to ephemeral occurrences.

The stock market’s recent stability has redirected investor attention to core factors, especially corporate earnings. This shift occurs as the stock market often reflects the direction of corporate profits, which typically grow with the economy. Projections for earnings are optimistic, forecasting a growth rate of 10% in 2024 and close to 14% in the following twelve months.

Bonds have outperformed recently, with the Bloomberg U.S. Aggregate Index posting a 3.1% gain year-to-date and a 6.7% increase since its April low, coinciding with the 10-year Treasury yield’s peak at approximately 4.7%. The high-yield bond index has climbed 6.3%, the corporate bond index 3.5%, and Treasuries 2.6%, propelled by a favorable period characterized by decreasing inflation and consistent economic growth. Additionally, bond prices saw a notable rise at the start of August, providing a counterbalance to fluctuations in the stock market. These developments highlight the significance of diversifying one’s portfolio, particularly in times of uncertainty.

The Fed is expected to cut rates in September.

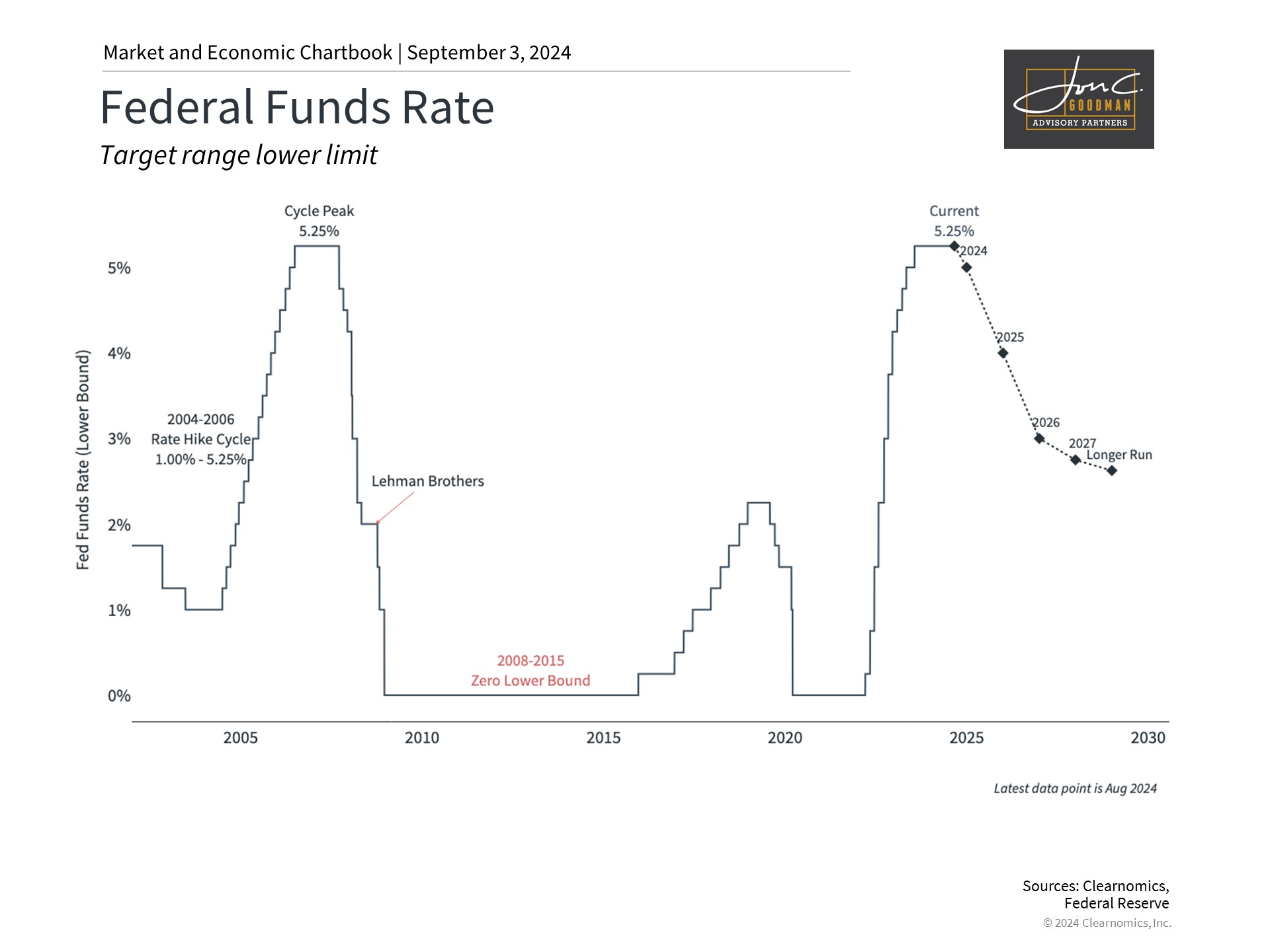

Secondly, the Federal Reserve is anticipated to start reducing rates later this month following a swift cycle of rate increases from early 2022 to mid-2023. This is largely due to the ongoing improvement in inflation. The Fed’s preferred gauge of inflation, the Personal Consumption Expenditures Price Index, has slowed to an overall 2.5% and 2.6% when food and energy are excluded. In a similar vein, the headline Consumer Price Index has dropped to just 2.9% year-over-year, with the core index falling to 3.2%. Although consumer prices remain significantly higher than before the pandemic, these developments are sufficient for the Fed to consider a change in monetary policy.

The market volatility seen this year largely stems from shifting expectations regarding the Federal Reserve. The year started with investors predicting several rate decreases due to a potential “hard landing.” However, when inflation was higher than expected in the first quarter, it led investors to think there would be no rate cuts this year. Presently, the Fed is projected to lower rates by approximately one percentage point by year’s end. Each pivot has prompted market adjustments. This serves as another reminder that markets can sometimes be overly anticipatory, and focusing on fundamental trends is often more prudent.

Moreover, recent employment data indicate that while the labor market remains robust, signs of weakening are emerging. For example, the latest job report showed that only 114,000 new jobs were created in July, which is significantly lower than the anticipated 175,000. The unemployment rate increased from 4.1% to 4.3%, surpassing expectations and hitting a post-pandemic peak, although it is not considered high by historical standards. In his latest address, Federal Reserve Chair Powell highlighted the potential risks to employment, stating, “We do not seek or welcome further cooling in labor market conditions.” While the Federal Reserve’s main concern had been to control soaring inflation, its attention is now turning towards the employment sector.

Interest rates are adjusting to a shift in Fed policy.

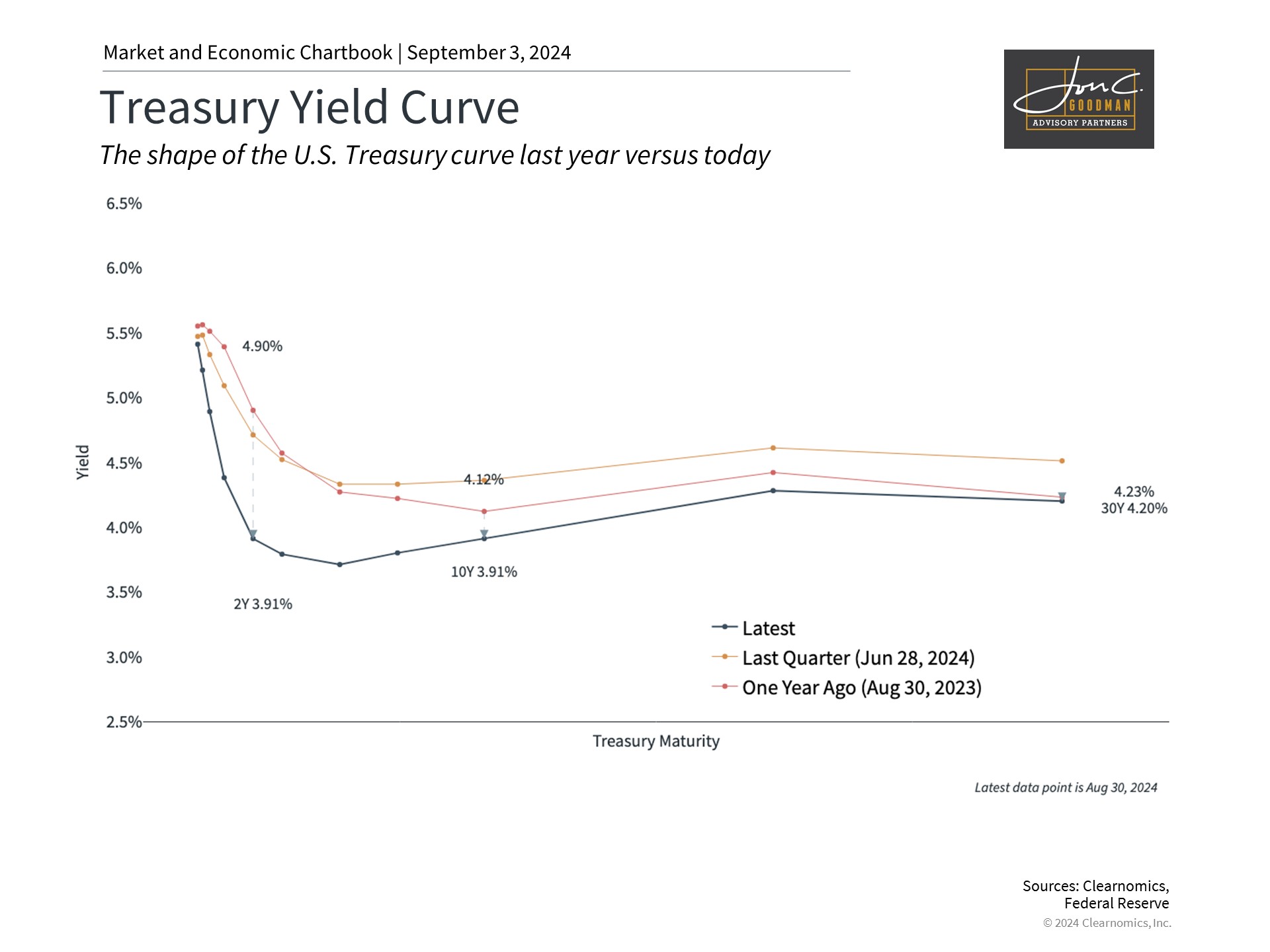

With the approach of Federal Reserve rate cuts, market-based interest rates have also adjusted. The accompanying chart illustrates that yields have decreased, particularly at the short end of the curve, and the yield curve is no longer inverted. The spread between the 10-year and 2-year Treasury yields has recently flattened due to the anticipated rate trajectory.

Should these trends persist, they may have various implications for the economy and markets. The sharp inversion of the yield curve since the 1980s, which some investors believed signaled a 2024 recession, typically precedes recessions and occurs when the Federal Reserve tightens late in the business cycle. Although a recession is possible, the current situation may differ as the higher short-term yields are a response to inflationary pressures.

While outcomes remain uncertain, reduced rates might foster economic growth, particularly in sectors sensitive to interest rates like real estate, technology, and small caps. Bonds, too, have gained from the rate improvements, reclaiming part of their role as portfolio stabilizers.

Ultimately, our response to stock market fluctuations may be more crucial than the fluctuations themselves. The uncertainty investors faced over the summer serves as a reminder to maintain a long-term perspective while pursuing financial objectives.

To schedule a 15 minute call, click here.