In recent weeks, financial markets have shown remarkable resilience, nearly rebounding from the fluctuations seen at the start of August. Major stock indices are nearing record highs again, with the S&P 500 up 19.2% for the year, including dividends, just shy of its peak by less than half a percent. Fed Chair Powell’s latest speech, hinting at a possible rate cut in September, has contributed to this positive momentum. The volatility observed over the past month serves as a reminder that such fluctuations are a normal part of the market. It’s often wiser to focus on long-term trends rather than daily market movements when making investment decisions.

Corporate earnings drive market returns in the long run.

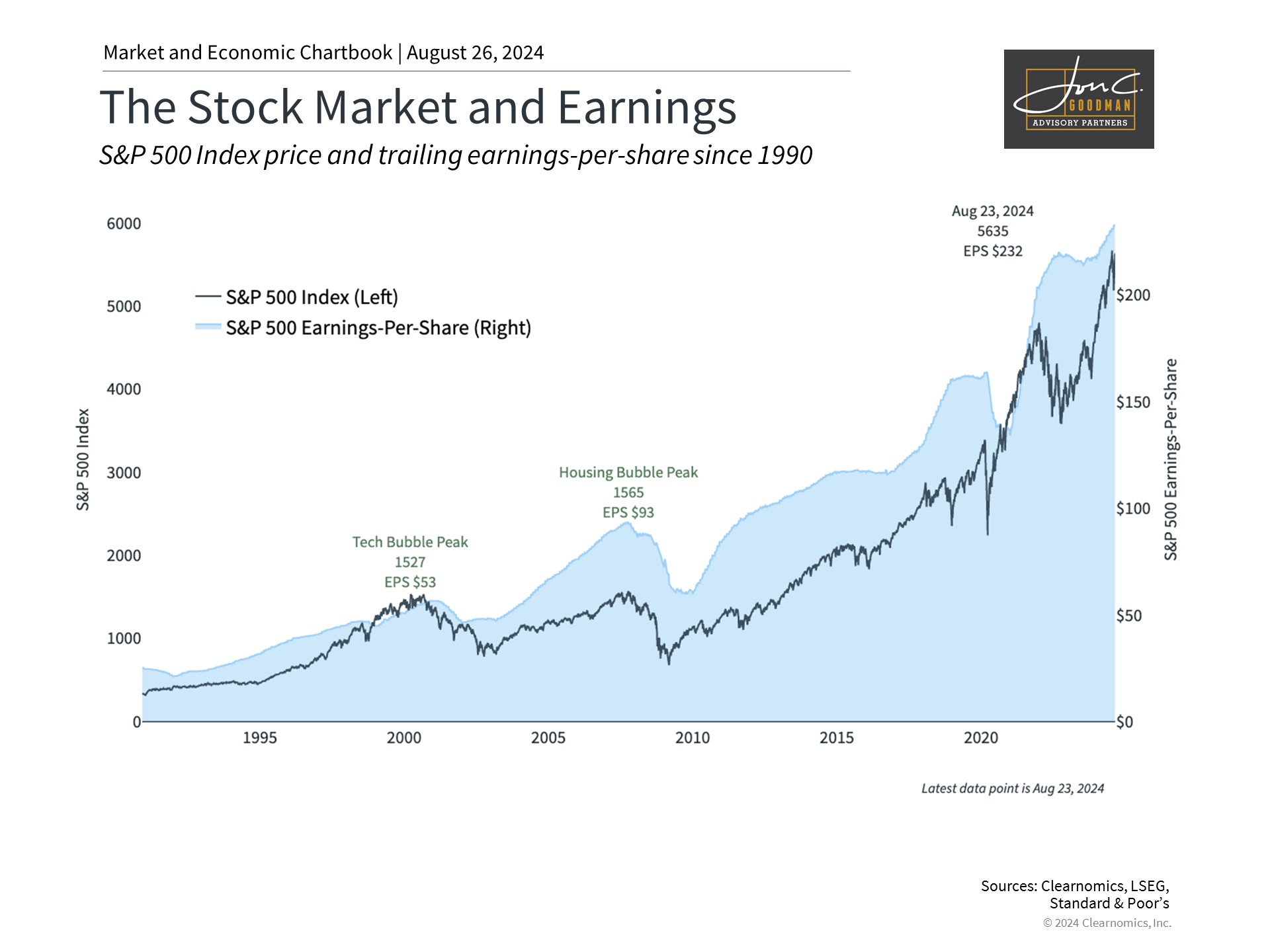

As market volatility diminishes, investors are refocusing on fundamental indicators like corporate earnings. Historically, the stock market reflects the pattern of corporate profits, climbing as the economy expands, since stock shares represent a stake in a company’s earnings. Despite occasional market fluctuations, a consistently growing economy and increasing corporate profits have traditionally propelled the stock market.

The relationship between market movements and earnings, while not perfectly synchronous, exhibits parallel trends. This is evident in the accompanying chart. The discrepancy between them contributes to stock market valuations, such as the price-to-earnings ratio, indicating how much investors are willing to pay for each dollar of earnings. Given the high valuations in recent years, market corrections can be beneficial, prompting investors to recalibrate their expectations.

In the last year, S&P 500 earnings have climbed to $232 per share, marking a robust growth rate of 7.4%. This growth accelerated in the second quarter, with S&P 500 earnings expanding at a blended rate of 10.9%, per FactSet data. Should these figures hold, it would signify the quickest growth since late 2021. The rebound in earnings started over a year ago, following a period of struggle in 2022 and early 2023 amid recession worries.

It’s encouraging that 79% of S&P 500 companies have reported earnings above expectations, yet the margin by which they’ve exceeded estimates is only 3.5% on average. This is in part due to S&P 500 revenue growth falling short of the 5-year average of 5.2%. Sales trajectories in upcoming quarters will largely hinge on the spending behaviors of consumers and businesses, whether they choose to increase spending or adopt a more frugal approach.

Companies are concerned about consumer spending.

Companies are increasingly concerned about consumer financial health, particularly due to the economic fluctuations and rapid inflation in recent years. The sustained high costs of essentials like food and housing are well-known. In their most recent earnings discussions, numerous firms expressed concern over consumers becoming more frugal in their spending on dining, travel, entertainment, etc., a sentiment shared by leaders from Marriott, McDonald’s, Disney, among others.

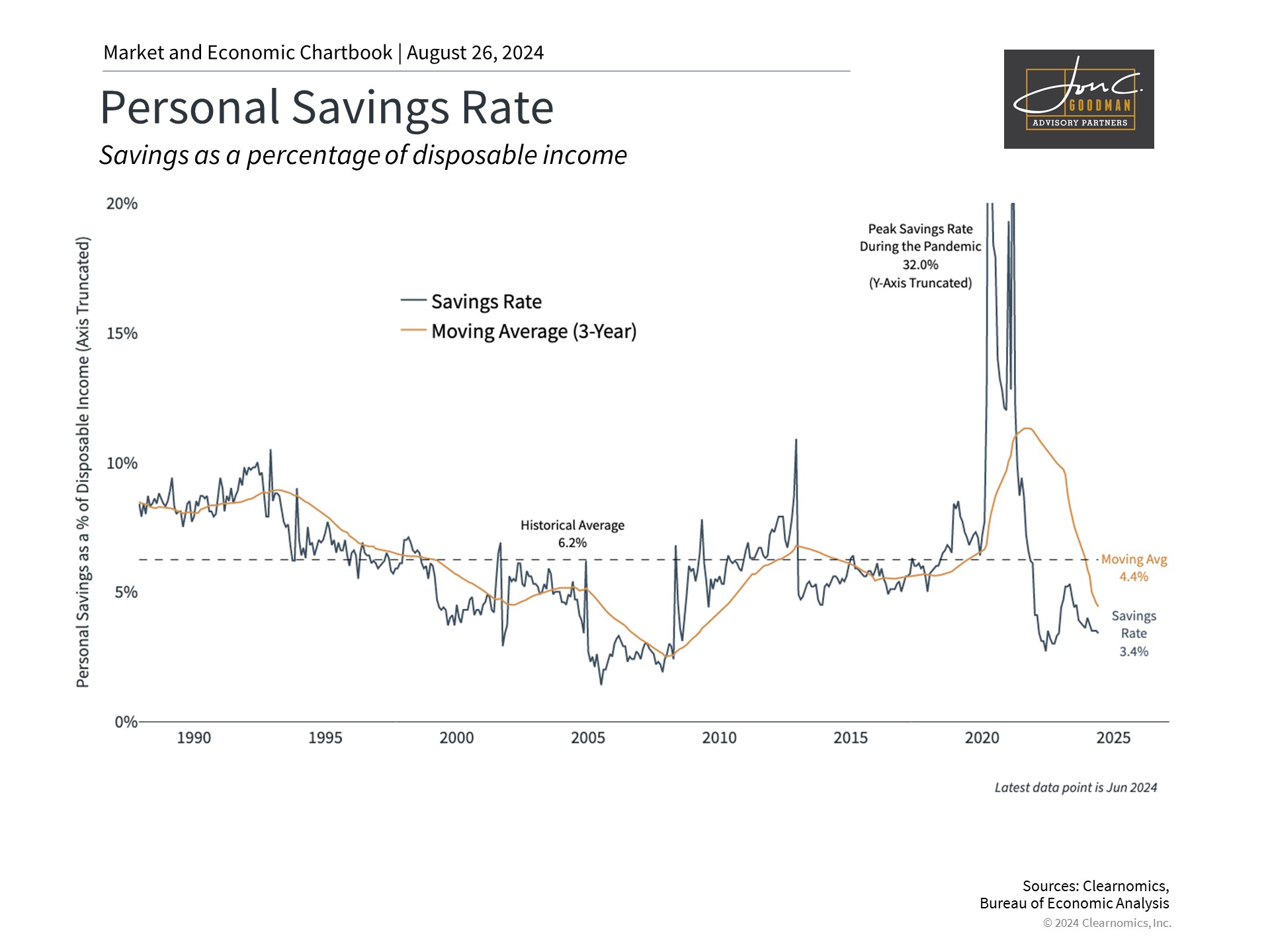

On one side, recent consumer spending data surpassed expectations, revealing a 1% month-to-month increase in retail sales, against the anticipated 0.3%. Conversely, savings rates have dipped since the pandemic highs, which could hinder future expenditures. The referenced chart illustrates that the additional savings from paychecks during 2020 and 2021 have largely been depleted. Although this hasn’t significantly impacted consumer spending to date, it remains an important consideration for investors and economists.

Consumer sentiment remains subdued due to the elevated prices experienced in recent years. The University of Michigan’s Consumer Sentiment Index continues to register below the average. Deloitte’s recently released financial well-being index presents a divided sentiment. High-income earners exhibit a positive outlook, with 74% reporting financial improvements over the past year. In contrast, only 61% of middle-income and 50% of lower-income earners report similar progress.

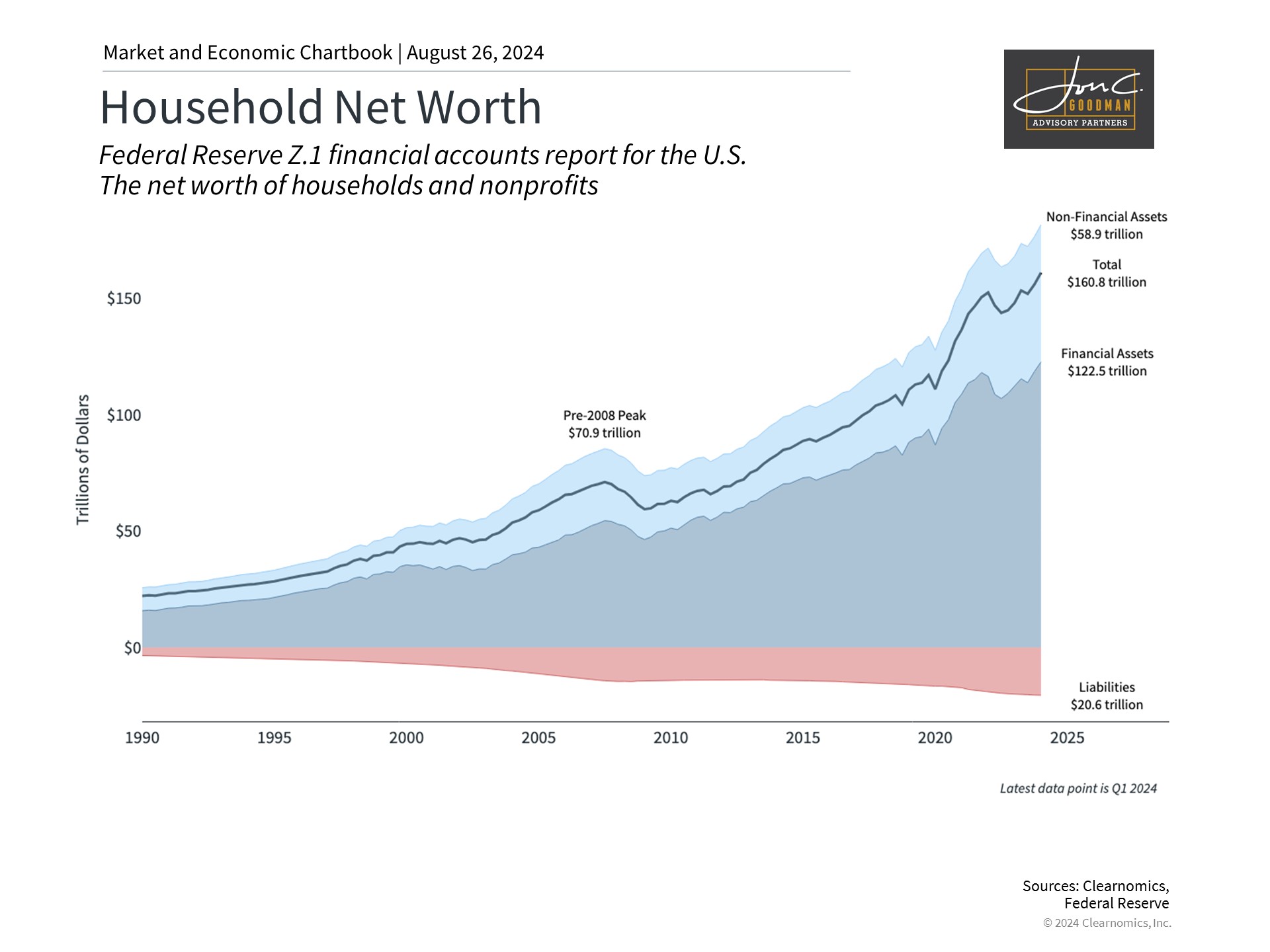

Consumer net worth is at record levels.

Simultaneously, there are indications that consumer sentiment regarding inflation is becoming more positive. The Federal Reserve Bank of New York’s recent Survey of Consumer Expectations showed a marked decrease in the inflation outlook over the next three years, with expectations falling to a historic low of 2.3% since the survey began in 2013. Similarly, the University of Michigan’s survey indicated that consumers expect inflation to be only 2.9% over the next year and 3% over the next five years, marking a notable improvement recently.

As inflation trends closer to 2%, with the Federal Reserve ready to lower interest rates, and as markets recover, household net worth has soared to unprecedented levels. The increasing value of financial assets over time is likely to bolster consumer spending and confidence. This phenomenon, known as the “wealth effect,” typically fosters further growth during the expansion phases of business cycles.

In summary, markets are bouncing back from the volatility seen a few weeks prior. Corporate profits are rising steadily, underpinning market strength over the long term. Investors are advised to keep an eye on these larger patterns rather than ephemeral market fluctuations.

To schedule a 15 minute call, click here.