As the presidential election approaches in two and a half months, the economic policy platforms of the candidates are just starting to emerge. This delay has led to investor worries regarding the potential effects of these policies on the economy and financial markets. With every election, the stakes seem high, and recent years have seen an increase in political polarization, heightening emotions. Investors, in such a volatile climate, must stay informed about what to watch for in the coming months to ensure that their political anxieties do not adversely impact their financial strategies.

The economy is in the spotlight leading up to the election.

Political issues play a crucial role in our everyday lives, affecting aspects from tax bills to industry regulations. This underscores the significance of elections, as they enable us to voice our choices for various social and economic policies. Nevertheless, it’s vital for investors to cast their votes at the polls rather than through their portfolios. Historical evidence underlines the necessity of detaching personal beliefs from investment and financial decisions.

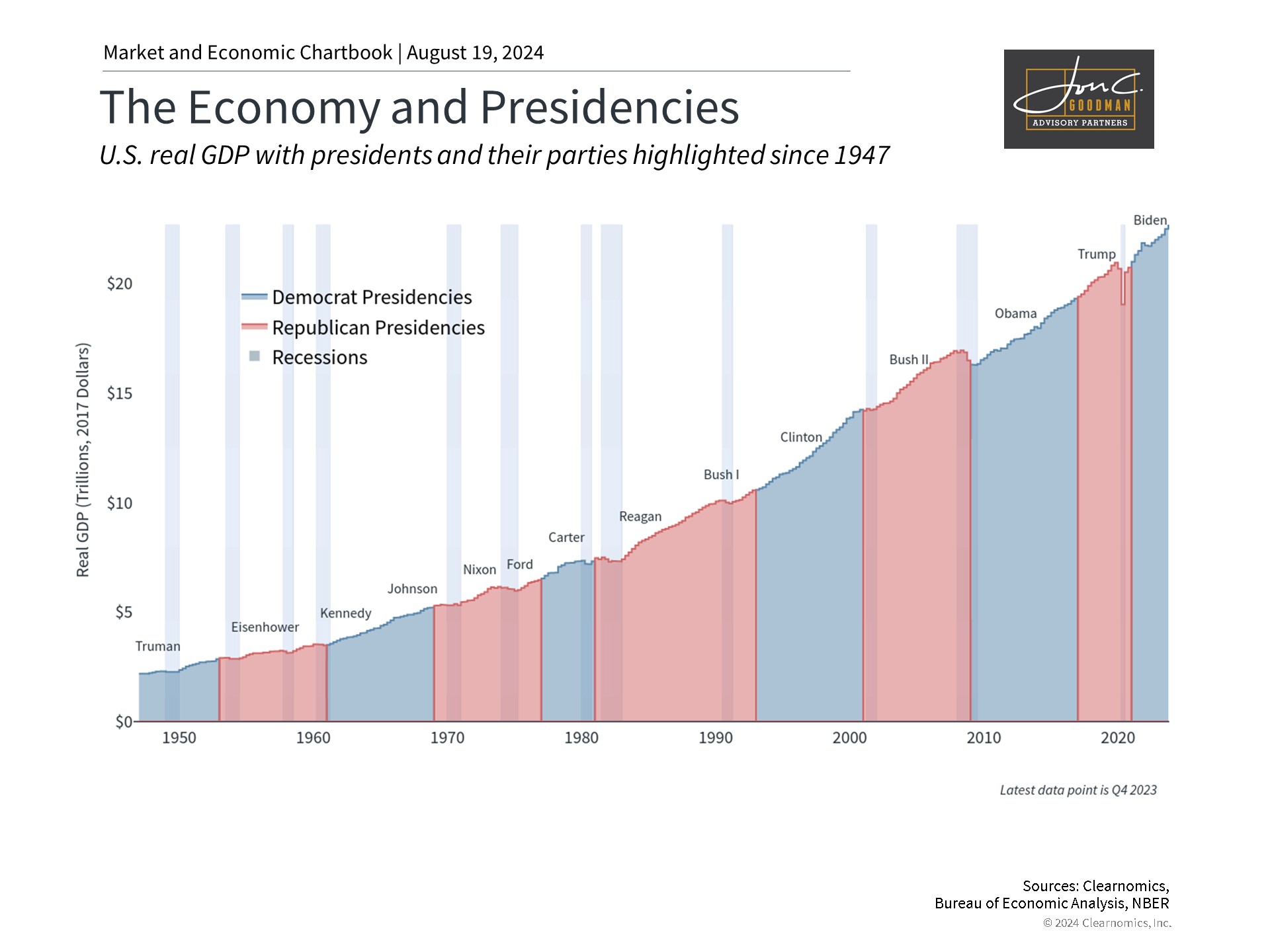

From a long-term investment perspective, presidents are often over-credited or overly blamed for economic states. The real determinants of sustained economic growth are the foundational business cycle trends, which outlast and outweigh any individual administration’s policies. Over time, it is these business cycles that propel investment returns and the generation of wealth.

The importance of this is illustrated by a chart showing the country’s gross domestic product (GDP) levels, an indicator of economic size, since World War II. During this span, there have been numerous business cycles and recessions, including the recent pandemic downturn, the 2008 global financial crisis, and the 2000 dot-com collapse.

The economic outcomes were influenced by both external shocks and trends that were largely independent of the White House’s control. The globalization, the revolution in information technology, and the expansion of financial markets during these years had a more significant impact. The consistent trend is evident: over the past eight decades, the economy has experienced steady growth under the stewardship of both political parties.

Consumers are the central focus this election season.

As candidates’ policy platforms emerge, particularly during the Democratic National Convention, grasping the broader context becomes crucial. This does not imply that economic policies are unimportant, but rather that investors should avoid overreacting to the outcomes of any single election or specific policy.

Indeed, it is frequently the economy that influences elections rather than the reverse. This is particularly evident as the platforms of the two candidates tend to reflect on the experiences of households in the preceding years. For example, a recent The Economist/YouGov poll indicates that 24% of Americans consider “inflation/prices” the most pressing issue, with “jobs and the economy” coming in second at 13%. These concerns align with the recent fluctuations in the market and economy, which have been affected by inflation, interest rates, and Federal Reserve policies.

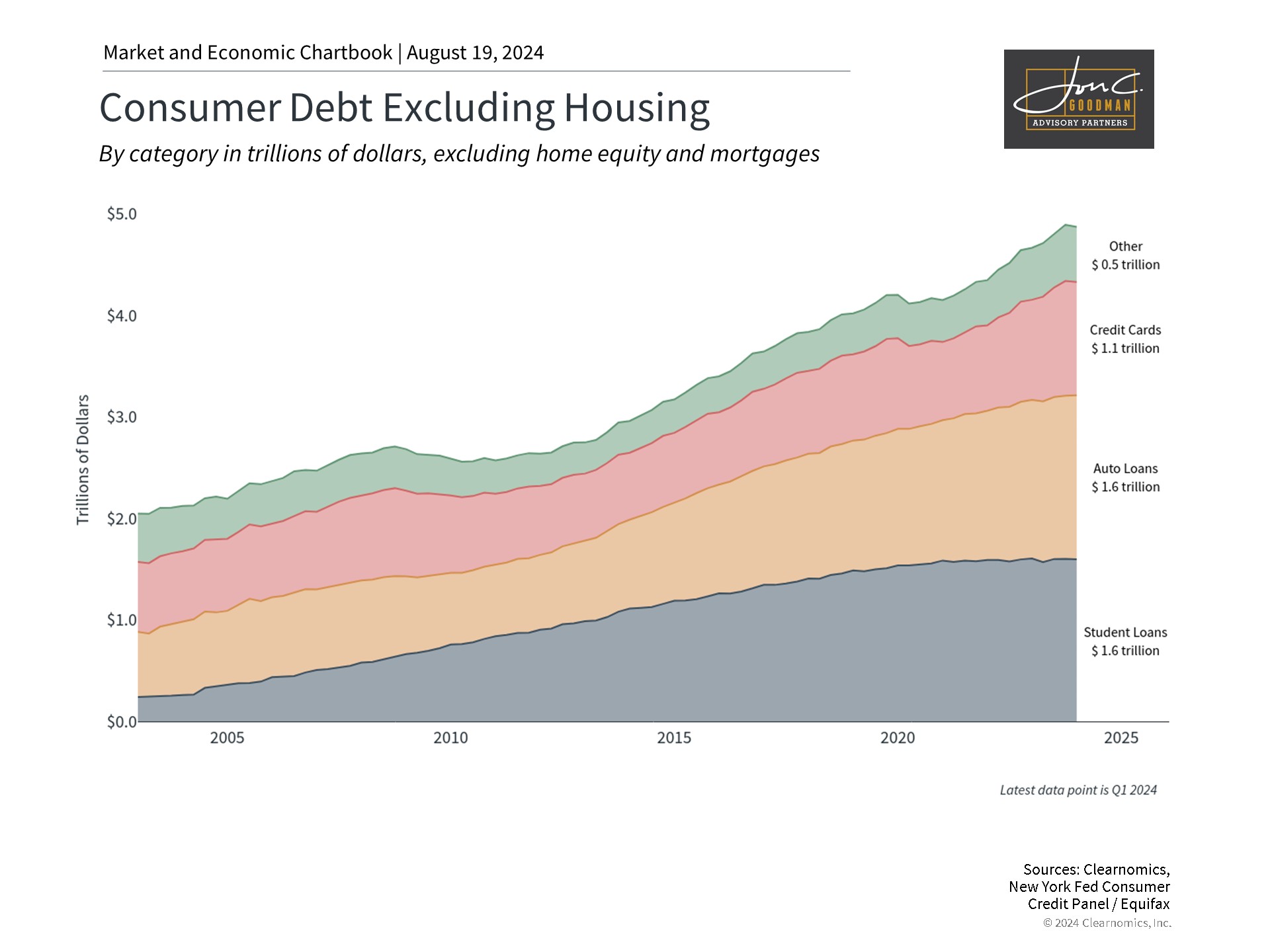

Despite significant easing of inflation pressures and various indicators of a strong economy, consumer confidence in the economy and personal financial situations remains low. This is largely attributed to a dramatic increase in consumer debt, as indicated by the accompanying chart. Over the past two decades, total non-mortgage consumer debt has more than doubled, under both Democratic and Republican administrations. Credit card debt has reached an all-time high, while student loan and auto loan balances have surged at their quickest pace since 2003.

Consequently, President Trump and Vice President Harris have centered their economic platforms on consumer issues. Despite their social policy differences, their economic proposals share common ground, particularly concerning the cost of living, which includes grocery items like bacon, bread, and ground beef, as well as prescription medications and housing costs. Recently, both candidates have concurred on proposals to expand child tax credits and to exempt tips from taxation. This bipartisan focus on economic relief reflects a political strategy to connect with those feeling economically marginalized in recent turbulent times.

Taxes and the deficit are also in focus.

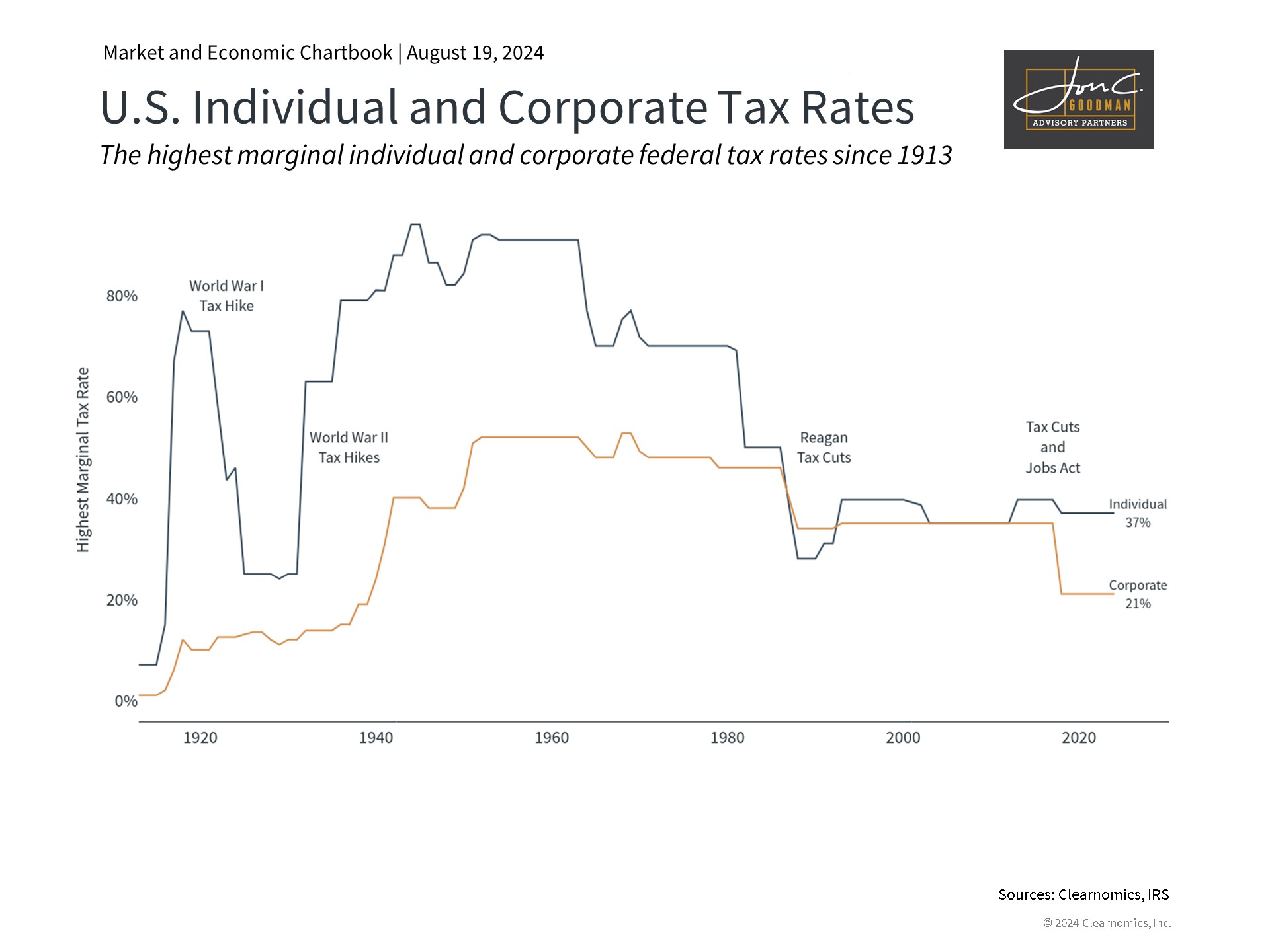

As anticipated, key differences emerge in areas such as taxation and the policy instruments each candidate prefers. For example, Trump advocates for the extension of his administration’s tax reductions and the potential decrease of corporate tax rates. Conversely, Harris emphasizes tax credits for middle- and lower-income citizens and has reaffirmed the Biden administration’s commitment to not increase taxes for individuals earning less than $400,000 annually. Without legislative intervention, several elements of the Tax Cuts and Jobs Act, including lowered individual tax rates, augmented standard deductions, and broadened child tax credits, are set to revert to their pre-2018 status by 2025.

Despite apparent disparities between the parties, many policies remain unchanged during power shifts, with alterations usually being gradual. This characteristic of the political system requires widespread consensus to implement new policies, even with the president’s party in control of Congress. For example, the tax cuts from the Reagan era have largely persisted for decades, and many tariffs introduced by the Trump administration, despite initial controversy, have continued under the Biden administration.

Of course, tax cuts and credits need to be paid for somehow – either through lower spending in other parts of the federal budget, greater tax receipts, or rising debt levels. These receipts can either occur through higher tax rates in the future or through faster economic growth.

Unfortunately, since government spending tends to only rise, recent history shows that the likely result will be higher government debt. Higher tax rates are also a concern among many investors, especially because individual tax rates are still quite low by historical standards. This emphasizes the importance of proper tax planning, ideally with the help of a trusted advisor, as investors look toward retirement.

The bottom line? While many investors are nervous about the impact of the presidential election on the economy and markets, history shows that presidents often receive too much credit and blame for long-term economic outcomes. Investors should vote at the ballot box and not with their portfolios in the coming months.

To schedule a 15 minute call, click here.