Recently, financial markets have appeared more volatile, with investors expressing concerns about the economy, potential delays in interest rate cuts by the Fed, and lackluster tech earnings. Despite last week’s fluctuations, major indices remained mostly stable from Monday to Friday. Although they have retreated from their peak levels, amidst increased market uncertainty, the S&P 500, Nasdaq, and Dow have still recorded gains of 13%, 12%, and 6%, respectively, including dividends for the year. This serves as a reminder that despite the discomfort of market swings, maintaining a long-term perspective is crucial for investors to remain aligned with their objectives.

The unwinding of the Japanese carry trade.

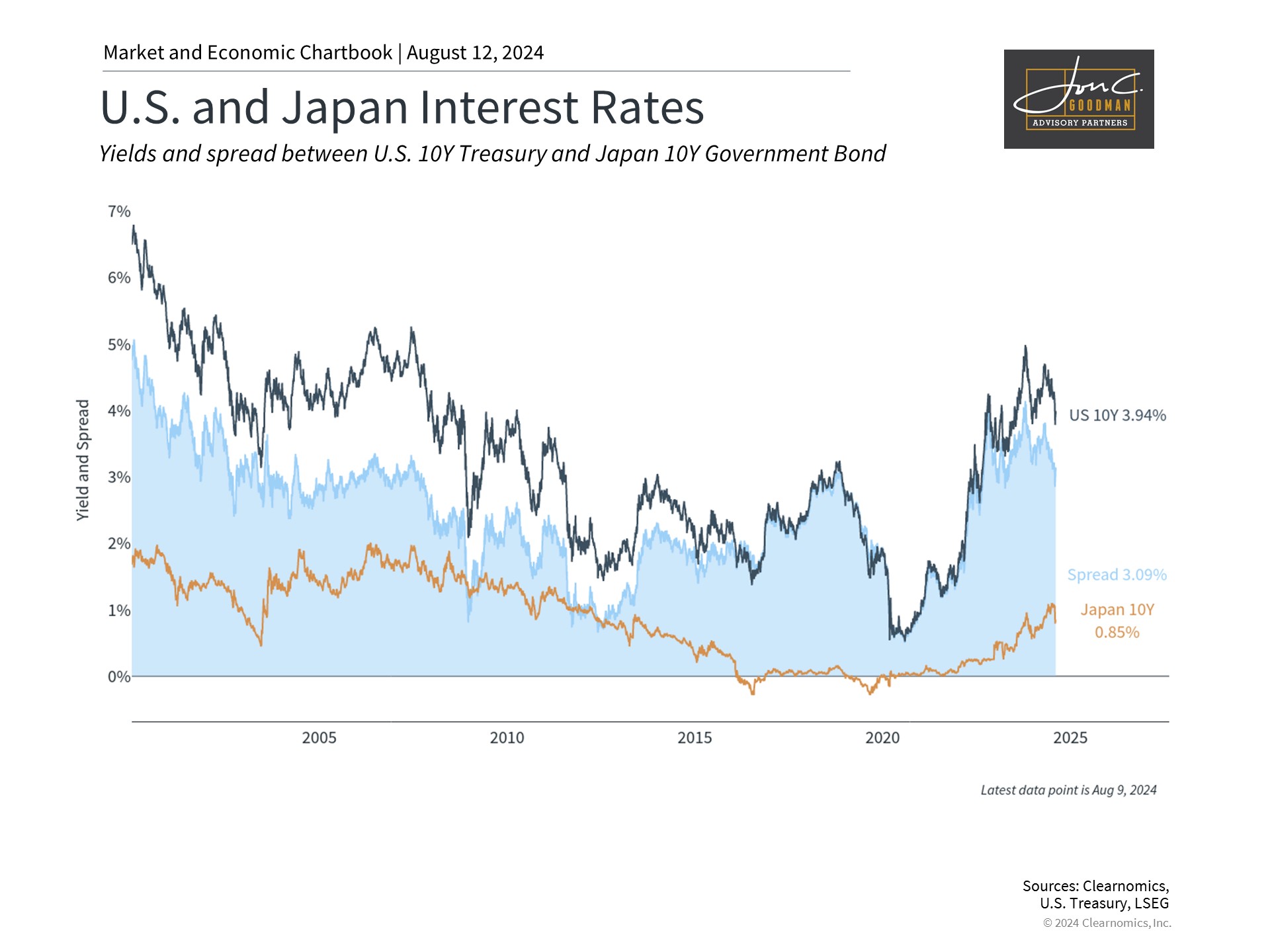

Market technicals, alongside economic and fundamental factors, may have exacerbated the recent market downturn, with a focus on the unwinding of the Japanese carry trade. This topic has been extensively covered in financial news, highlighting how technical factors can influence markets in the short term, even though fundamentals are the main drivers of returns over the long term. A carry trade, which is being implicated in the global stock market declines, involves borrowing money at low-interest rates and investing in higher-yielding assets, profiting from the interest rate differential. This strategy necessitates currency transactions, as investors typically engage in government bonds worldwide. Carry trades are particularly appealing when there is a significant disparity in interest rates and when currency values are stable.

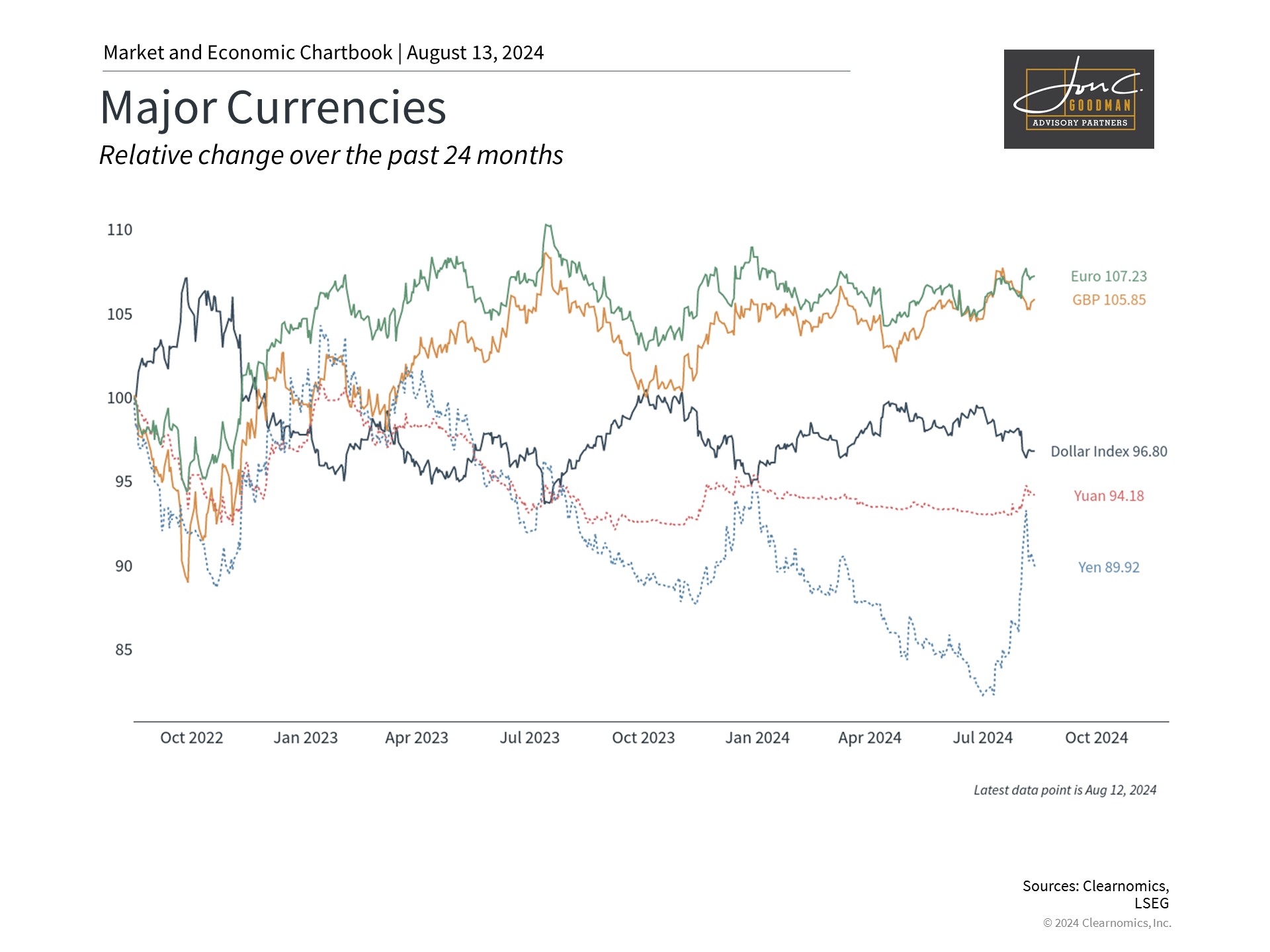

The Japanese yen has been a favored currency for carry trades for many years due to Japan’s historically low-interest rates. The Bank of Japan’s policy rate has been negative since 2016 and did not exceed 0.1% after 2008, reaching a peak of 0.5% this century. Japan’s low-interest rates stem from various factors, including deflation risks, stagnant growth, and unfavorable demographic patterns, leading to what is often referred to as Japan’s “lost decades.”

This all changed recently due to rising inflation and the Bank of Japan raising rates to 0.25%, all while the Fed is expected to cut rates. Not only does this decrease the interest rate differential between the U.S. and Japan, but the Japanese yen has also strengthened over the past month and jumped overnight when market volatility hit. These market moves work against the typical carry trade since the difference in rates shrinks and the borrowing currency becomes more expensive. Note that the way the yen is typically quoted–the number of Japanese yen per U.S. dollar–a higher number represents a weaker yen.

Recent volatility has been worsened by financial leverage.

Individually, the reversal of a single trade typically doesn’t raise global alarm. However, carry trades, which rely on borrowing, can magnify effects due to financial leverage. This mechanism has intensified market crises historically, including the 2008 global financial crisis, the 1997 Asian currency crisis, the collapse of Long-Term Capital Management, and the Crash of 1929.

Economist Hyman Minsky noted, “The longer stability lasts, the more unstable things will be when the crisis hits.” Carry trades, with their long-standing history, are predicated on economic patterns enduring for decades. The success of a trade over time emboldens investors to increase their stakes, similar to a gambler’s behavior during a winning streak. This can lead to a “Minsky Moment,” where the trade’s unwinding is exacerbated by leverage. Investors typically shun the trade after such an event, only to eventually re-engage, restarting the cycle.

For investors, understanding this concept is vital as it underscores the need to watch financial stability and the dangers of excessive optimism and risk-taking in financial markets. A recent example is the 2021 “everything rally” post-pandemic, marked by optimism disconnected from market and economic realities.

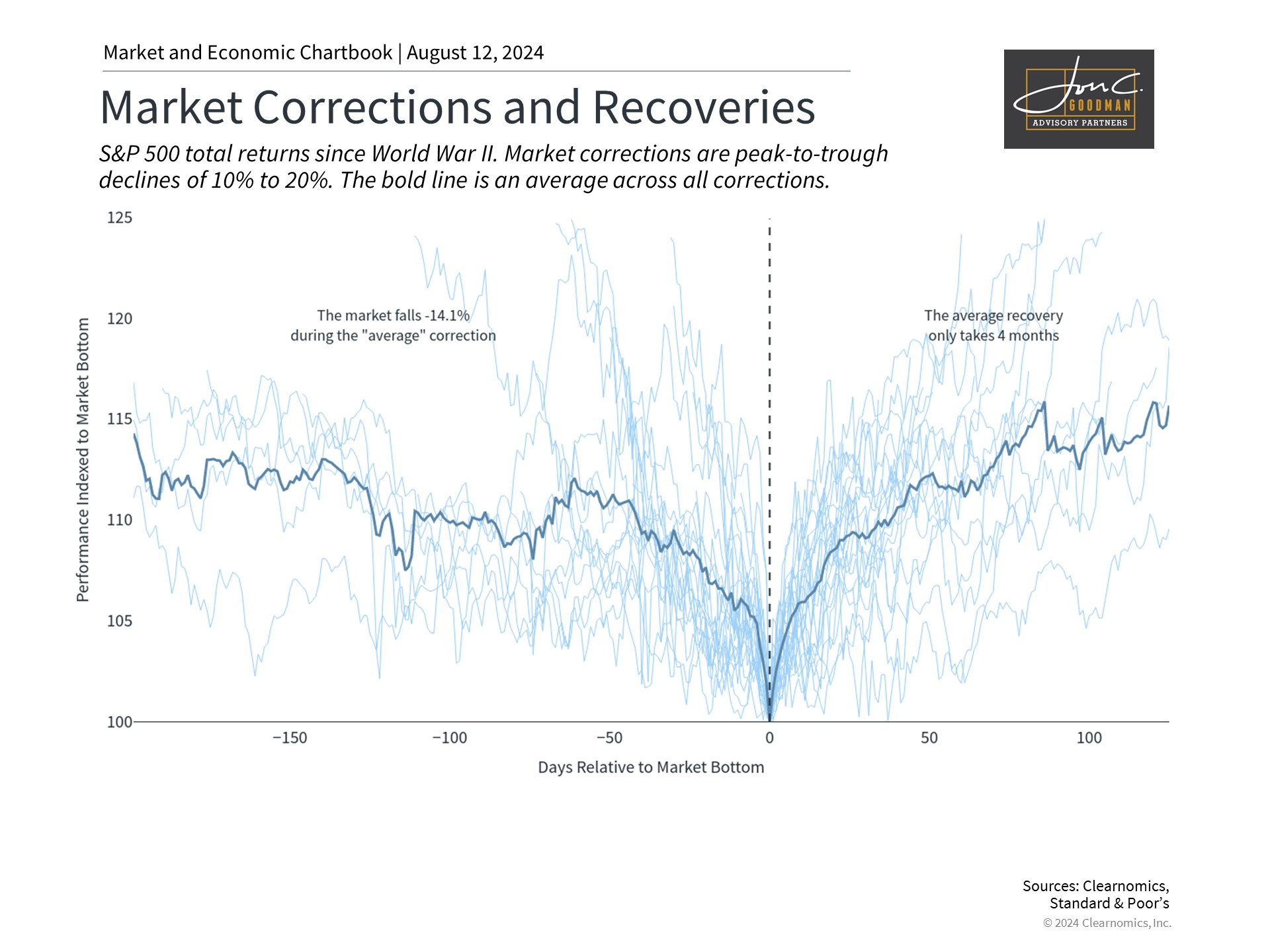

It’s important to remember that market shocks are not uncommon, and not all potential vulnerabilities lead to significant volatility. Economic cycles often go through expansion and contraction phases without precipitating a crisis like those seen in 2008 or 2020. The banking crisis last year serves as a recent instance of a grave situation that was ultimately contained. Therefore, while caution is essential, investors should also keep a balanced view, acknowledging that markets have a track record of recovering from difficulties.

Market pullbacks are normal and expected.

Major stock market indices remain below their recent peaks, and investor unease may persist. The Nasdaq is in correction territory with a 10% drop from its peak, while the S&P 500 is halfway there. However, history indicates that market pullbacks and corrections are typical and can be beneficial as they reflect adjustments to new economic, market, and company data. A typical correction sees an average decline of 14%, recovering within four months, often starting unexpectedly.

Day-to-day market fluctuations can unsettle investors, but the longer-term trends are crucial. The unwinding of the Japanese carry trade has sent shockwaves through global markets, yet there are indications of stabilization. By concentrating on the business cycle, corporate earnings, and fundamental market factors, investors can look beyond short-term volatility.

In essence, markets have been volatile due to economic worries and technical issues like the Japanese carry trade. Instead of fixating on short-term fluctuations, investors are advised to concentrate on long-term trends to achieve their financial objectives.

To schedule a 15 minute call, click here.