Paraphrasing Ernest Hemingway, stock market shifts often happen “gradually, then suddenly.” In the last month, there has been a shift from large-cap technology stocks to small caps and other sectors. The recent jobs report triggered a sharp pullback in global stocks, fueled by concerns about the timing of Federal Reserve rate cuts, a weakening labor market, and underwhelming tech earnings, leaving financial markets tense as investors recalibrate for the evolving economic landscape.

The Nasdaq has entered correction territory, with a 10% drop from recent peaks. The S&P 500 has retracted 5.7% from its high three weeks ago, and the Dow has seen a more modest 3.5% fall. The VIX, the market’s “fear gauge,” has hit its highest point since early 2023. Meanwhile, the 10-year Treasury yield has dipped below 3.8%, down significantly from 4.7% just three months prior.

Ironically, the current macroeconomic scenario—2% inflation, slightly rising unemployment, decreasing interest rates, and substantial stock market growth—is what investors were aiming for at the year’s outset. In these times, investors require insight more than ever to steer through the markets and stay aligned with their financial objectives. Investors are contemplating how to interpret the recent fluctuations in the stock market as they plan for the upcoming months.

Investors need perspective in volatile markets.

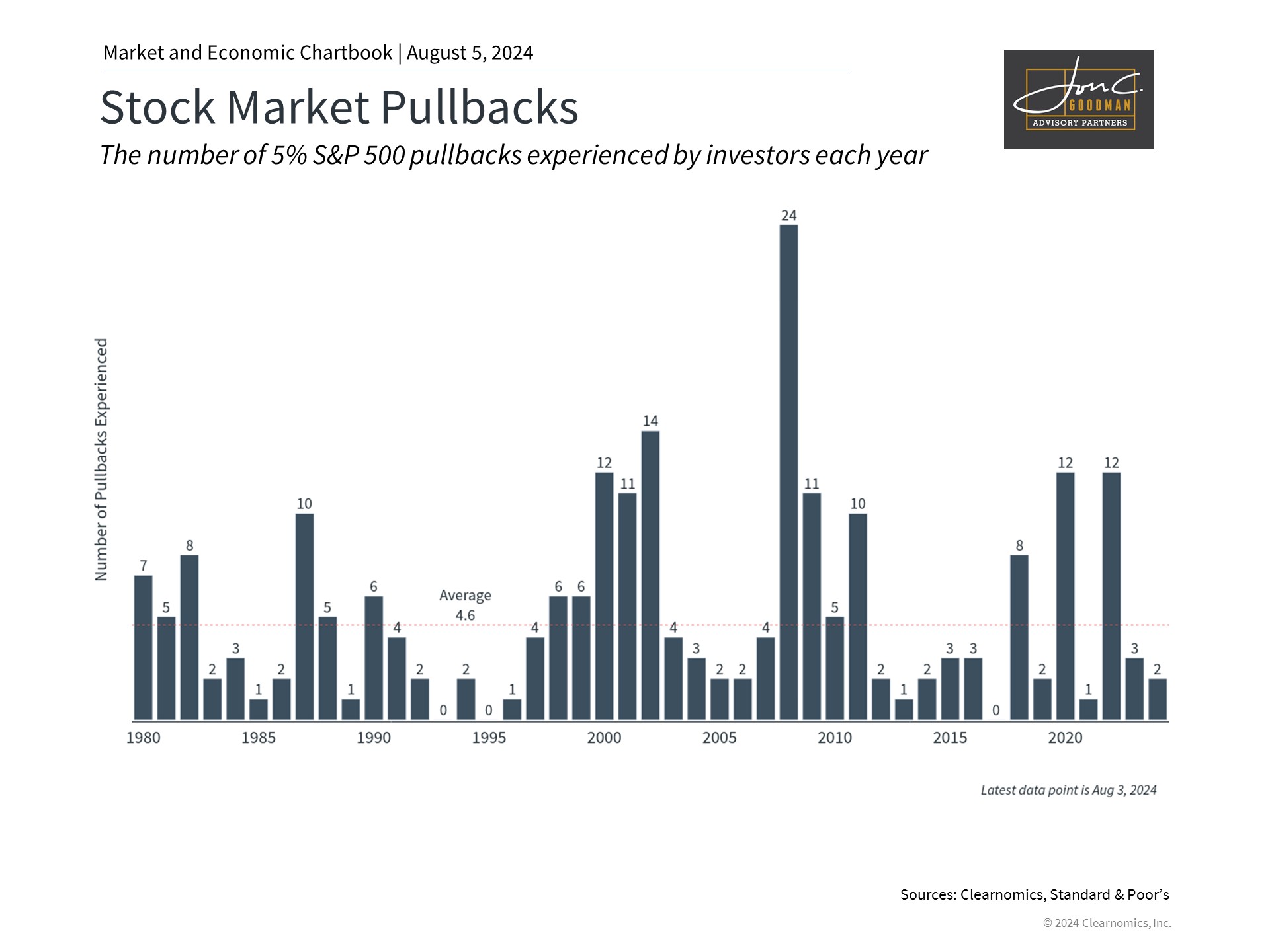

Investors who focus solely on recent performance might question whether the cycle has ended. However, it’s crucial to recognize that stock market fluctuations are not only normal but can also be beneficial, reflecting investors’ responses to new economic realities. This is particularly true when valuations become more attractive as prices realign and corporate profits continue to rise.

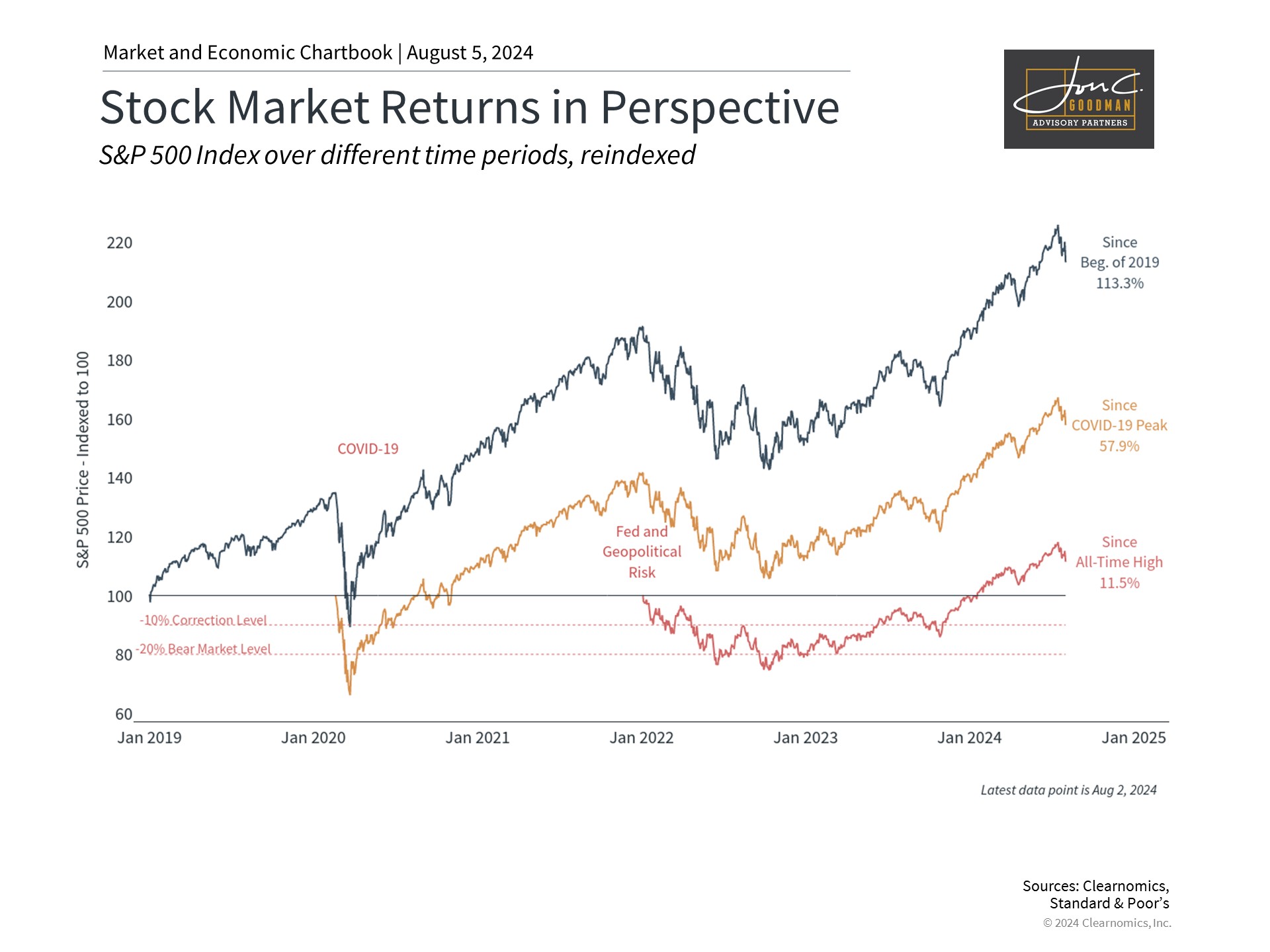

The market volatility experienced since 2020 may seem like a distant memory due to the consistent recovery over the past eighteen months. The S&P 500, as indicated by the chart, has risen 113% in the last five years, factoring in the pandemic downturn and the bear market of 2022. Although market downturns are always unwelcome, considering the market over such time frames provides context for the current downturn.

Technology stocks, especially those in the artificial intelligence sector, have significantly driven market gains. The Magnificent Seven, a collection of stocks including Nvidia that have capitalized on recent trends, have surged an impressive 162% since early 2023 and 362% since the beginning of 2020.

The recent rotation and subsequent pullback in these stocks stem from investor concerns about the extent of the rally and the earnings of major tech companies. The ability of AI and large language models to fulfill their ambitious promises remains to be seen, and understandably, investors are becoming impatient for returns on the billions invested in these technologies by large firms.

Market fundamentals, however, seem to remain robust despite short-term stock movements. Profit projections are still optimistic, with S&P 500 earnings predicted to increase by 13% in the next year. Earnings in over half of the S&P 500 sectors are expected to see double-digit growth, and positive growth is anticipated across all 11 sectors. Ultimately, it is earnings that propel stock market returns, making the overall economic health more significant than short-term fluctuations in stocks and specific market sectors.

Concerns are growing that the Fed has made a policy mistake.

These shifts have redirected the Federal Reserve’s attention to the labor market, with an acknowledgment of being “attentive to the risks to both sides of its dual mandate.” The latest employment report revealed the economy added 114,000 new jobs in July, falling short of the anticipated 175,000. Contrary to expectations of a steady 4.1% unemployment rate, it increased to 4.3%. Although still low by historical standards, this is the highest unemployment rate observed since the pandemic and since mid-2017.

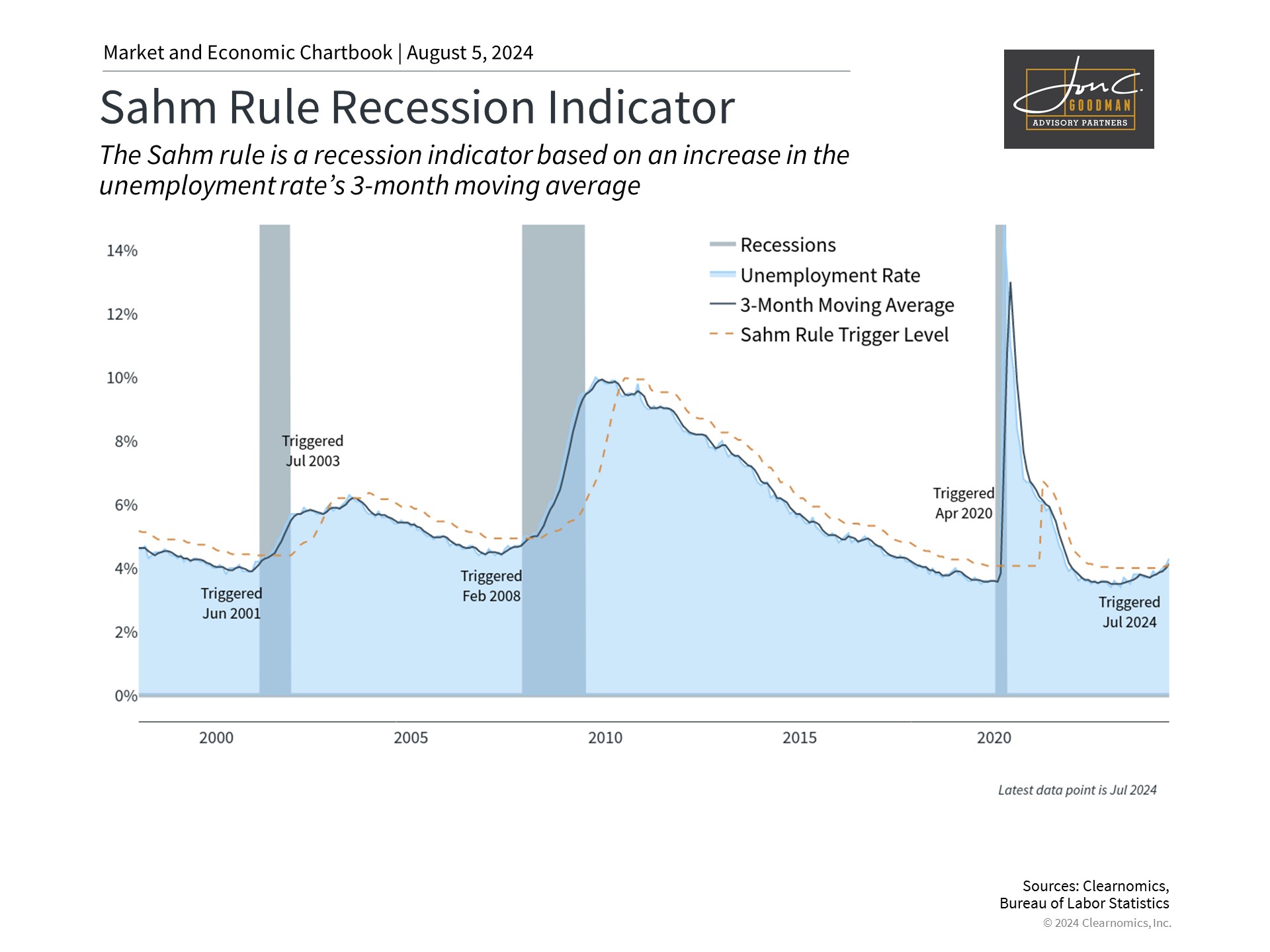

Economists’ concerns about the rising unemployment rate stem from an economic indicator known as the Sahm rule, depicted in the associated chart. Named after a past Federal Reserve economist, the Sahm rule forecasts the start of recessions by examining unemployment trends. It is based on the observation that a sharp increase in unemployment rates often signals economic downturns, as the definition of a recession is closely tied to job market conditions.

The July job report has activated the Sahm rule, indicating that the present unemployment rate aligns with the historical onset of recessions. Nonetheless, it is crucial to consider that factors such as immigration and increased labor force participation, which are generally positive, have contributed to the uptick in unemployment. Furthermore, Sahm has noted that her rule represents a “historical regularity” rather than an absolute law. Hence, while the rise in unemployment to 4.3% warrants close monitoring, it does not automatically signal an impending recession.

Both aspects of the Federal Reserve’s mandate—maximum employment and stable prices—are currently indicating a strong likelihood of a rate cut in September. Investors are concerned that the Federal Reserve may have delayed rate cuts for too long.

It remains to be seen whether this concern is warranted. Historically, there have been several instances referred to as “soft landings.” One of the most significant occurred between 1994 and 1995 under the leadership of Fed Chair Alan Greenspan, when the federal funds rate was increased from 3% to 6%. Despite this, inflation was kept in check and the economy continued to expand without entering a recession.

Although this period was stressful for investors, resulting in one of the worst bear markets for bonds at that time, the long-term outcome was beneficial, setting the stage for prolonged bull markets in both stocks and bonds.

Historically, hard landings have often resulted from policy errors rather than merely suboptimal timing. For example, the Great Depression was exacerbated by the Federal Reserve’s tightening of monetary policy when expansion was necessary. Likewise, the high inflation of the 1970s was due to the Fed’s excessively lenient stance during a period of rapidly rising prices. In both cases, the Fed’s actions were contrary to what the economic conditions demanded, highlighting the gravity of policy blunders.

As for the current stance of the Fed, few contend that the Federal Reserve has made incorrect decisions—rather, the critique is that the timing has not been ideal. Although many might have preferred a rate cut at the last meeting, it appears likely that the Fed will implement one in the near future.

Investing is about both returns and managing risk.

Investment is never guaranteed. Burton Malkiel, in his seminal work “A Random Walk Down Wall Street,” suggests that “the stock market resembles a casino where the odds favor the players.” The risks associated with stock market investment can be mitigated through strategic portfolio management and a long-term perspective. Historical data indicates that, despite market fluctuations, remaining invested is the most effective strategy for wealth accumulation and achieving financial objectives over several decades.

Stock prices do not consistently rise in a linear fashion; therefore, our response to market volatility is arguably more critical than the volatility itself. This year, the S&P 500 has undergone its second decline of 5% or more. This frequency is less than the typical 4 to 5 annual declines, and significantly lower than those observed during bear markets.

Moreover, the current market apprehensions, influenced by technology stocks, the Federal Reserve, and the job market, also present opportunities. The economy remains robust, corporate profits continue to increase, and a sustained decrease in interest rates could advantage various market segments. Similar to previous periods of volatility, looking beyond immediate market fluctuations and headlines is essential to capitalize on the long-term upward trend.

In summary, recent economic indicators have raised concerns that the Federal Reserve may have delayed rate cuts. Additionally, a decline in tech stocks has occurred as investors express apprehension over valuations and earnings. During times of market volatility, it is crucial for investors to remain composed and focused on their long-term objectives.