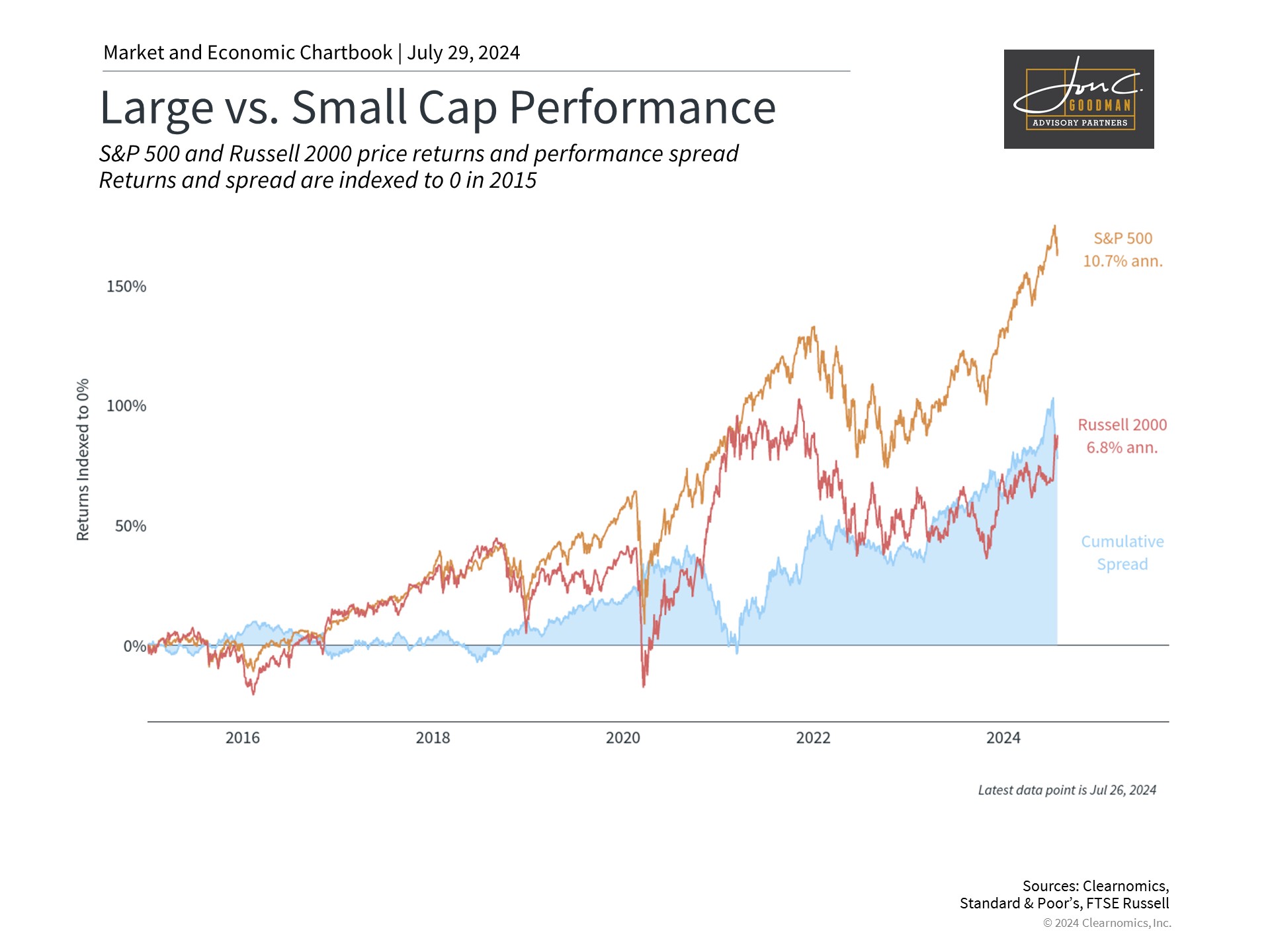

With the summer’s rise in temperatures, the stock market is also feeling the heat with increased volatility. Investors are shifting from large-cap technology stocks to a wider range of sectors and styles, notably small caps. Since reaching their peaks in mid-July, the Nasdaq Composite Index has seen a 7% decline, while the S&P 500 has dropped approximately 4%. In contrast, the Russell 2000 index, which tracks small-cap stocks, has surged over 11% since the beginning of July. The question arises: what is fueling this shift, and how can investors keep a balanced view of forthcoming market events?

Investors are rotating away from large cap technology stocks.

Stock market fluctuations are always unsettling, and discerning whether they stem from ephemeral shifts or enduring trends is challenging. With the presidential election on the horizon, investors are pondering its potential impact on economic policies and their investment portfolios. Meanwhile, geopolitical unrest is intensifying, particularly in the Middle East. Despite these concerns, corporate profits remain strong, consumer expenditure is steadfast, and GDP growth is solid. Amidst these developments, the Federal Reserve is anticipated to start reducing interest rates in the coming months.

Theoretically, reduced rates ought to benefit most market segments. However, instead of an extension of the broad-based “everything rally” witnessed intermittently over the last ten years, a “market rotation” is occurring.

Although it’s crucial not to hastily react to market changes that unfold over days or weeks, it’s apparent that investors are reevaluating the surge in artificial intelligence stocks. For example, the group known as the Magnificent 7 has seen an extraordinary bull run, soaring nearly 170% since early 2023 and significantly outperforming the wider market indices. Market rallies, by their nature, are unsustainable indefinitely, and a retraction was bound to happen at some point—the difficulty lies in pinpointing when.

There are increasing inquiries regarding the billions of dollars that major corporations are pouring into AI, and whether these investments will yield adequate returns. This highlights the reality that not all promising ideas translate into profitable investments, as the latter hinges on paying a reasonable price.

Moreover, small caps have shown strong performance due to their higher sensitivity to interest rates and economic growth. Smaller companies, having less flexible financing than their larger counterparts, benefit more from falling rates. They are also typically less diversified globally, making them more responsive to domestic economic trends, which recent data suggests are robust.

This has led to a sector rotation rather than a widespread market rally. Nevertheless, there is cause for optimism in the overall market. Historically, bull markets are propelled by earnings growth, and corporate earnings among large companies have been robust. FactSet reports that with 41% of companies having reported, approximately 78% have surpassed expectations, pointing to an estimated S&P 500 earnings growth rate of 9.8%. This is not only historically significant but also marks the continuation of the earnings rebound that started a year prior.

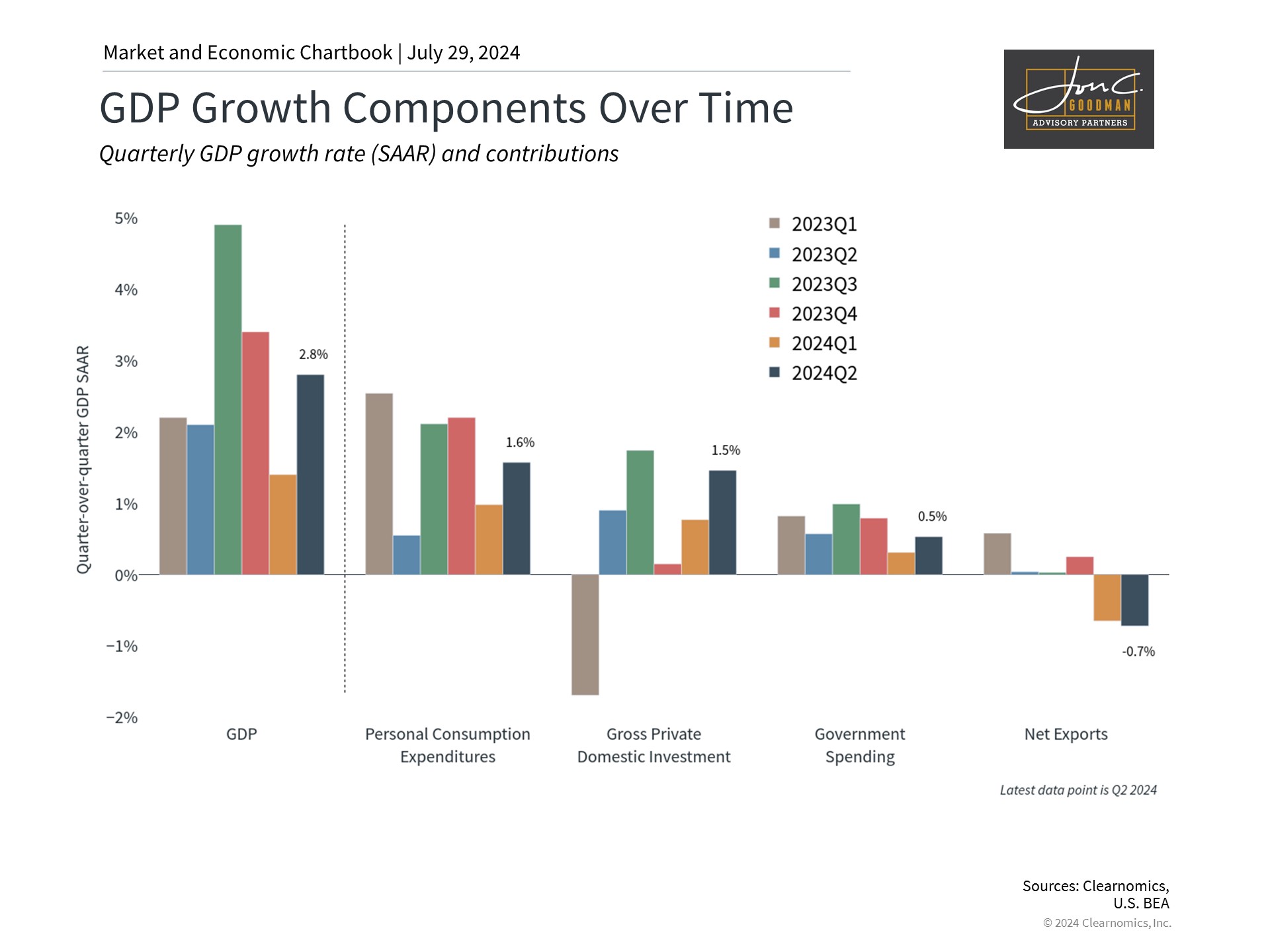

Economic growth is healthy.

Market rallies, often driven by robust earnings, are in turn supported by a strong economy. The latest GDP report indicates that the economy expanded at a 2.8% rate in the second quarter, surpassing the anticipated 2.0%. This marks a notable increase from the 1.4% growth seen in the first quarter. The growth was propelled by surges in consumer spending, business investment, and government expenditure, although slightly offset by trade. Despite concerns over high interest rates and a potential economic slowdown, consumer spending remained strong, contributing 1.6 percentage points to the total GDP growth.

Supporting data also reinforce this perspective. The Personal Consumption Expenditures index, the Fed’s preferred inflation gauge, suggests easing price pressures. In June, overall prices edged up by only 0.1%, or 2.5% on an annual basis, showing a modest slowdown from the previous month, while core inflation rose by just 2.6%. Various inflation indicators, including consumer and producer prices, provide strong evidence that inflation may be aligning back towards the 2% target over time.

The economy’s resilience is a positive indicator for the prospect of a “soft landing.” Consequently, the market anticipates the Fed will lower interest rates in September and again later in the year. Recent statements from Federal Reserve governors appear to support this outlook, with several advocating for imminent rate reductions.

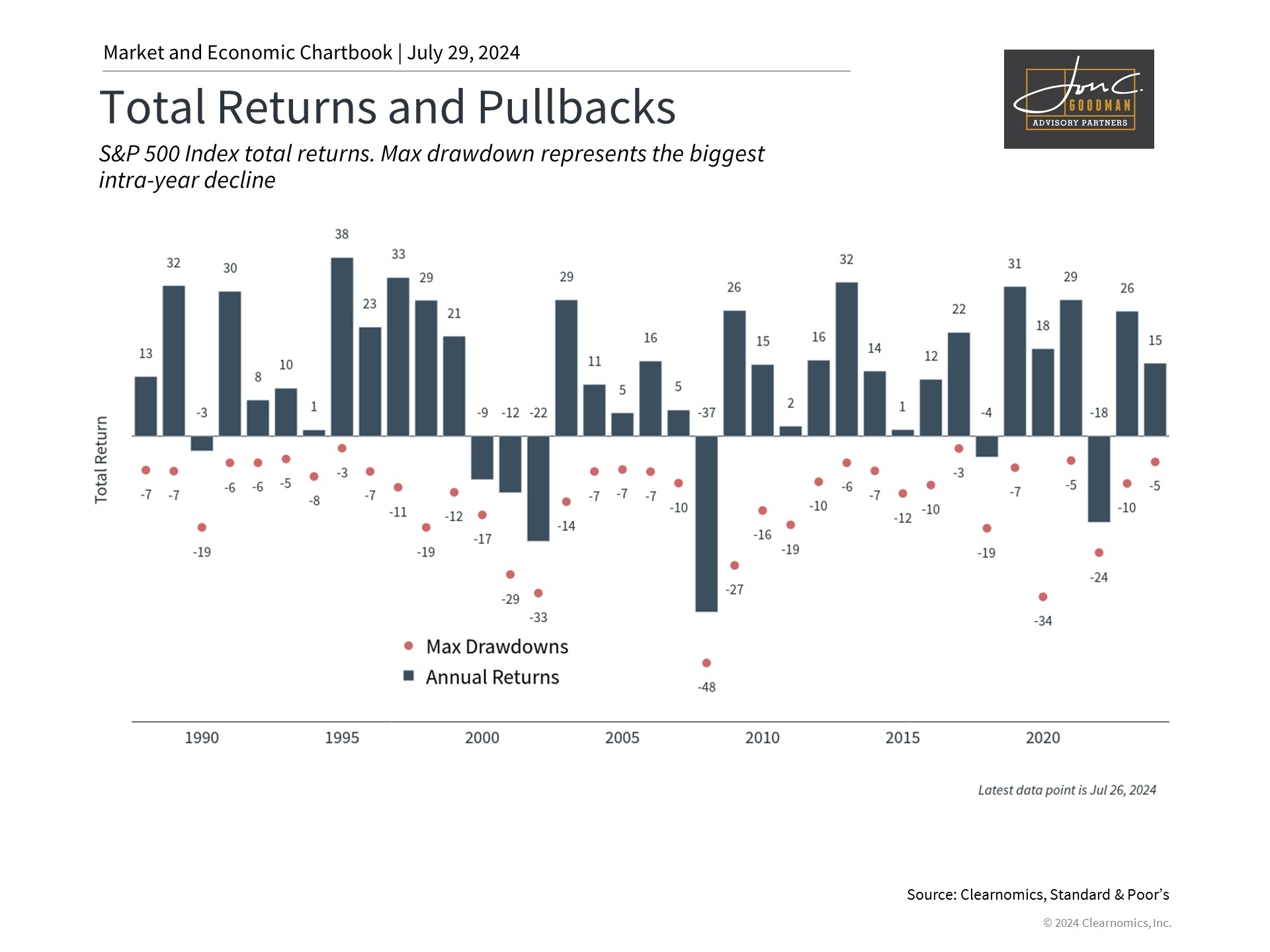

It’s important to maintain a level head during volatile periods.

Maintaining a long-term perspective is always crucial for investors, particularly during periods of market volatility. This is even more pertinent in light of the current economic conditions, which are expected to bolster the market. Short-term downturns and shifts in the market are typical and anticipated as investors assimilate new information and data.

For instance, the largest drop this year was merely 5%, which is modest compared to historical standards and when juxtaposed with the robust gains of the S&P 500 (15%) and Nasdaq (16%). It’s common for most years to witness more substantial intra-year declines, yet they often conclude with positive outcomes.

This underscores the necessity of being equipped for stock market fluctuations. Market pullbacks are inevitable, particularly considering the increased event risk in the upcoming months. The manner in which investors respond to these risks is usually more critical than the risks themselves. The ongoing market shift also serves as a reminder for investors to diversify their portfolios across various market segments, rather than concentrating solely on the current top performers. Adhering to these enduring principles remains the optimal strategy for investors to fulfill their long-term objectives.

The key takeaway is that the shift from large-cap stocks, particularly in technology and artificial intelligence, to sectors like small caps, has heightened market volatility. Investors are advised to avoid knee-jerk reactions to these fluctuations and should continue to adhere to a long-term investment strategy and concentrate on their strategic asset allocations.

To schedule a 15 minute call, click here.