The stock market has sustained its historic surge, with the S&P 500 posting a 19% gain year-to-date, including reinvested dividends, culminating in a total return of 61% since the market’s nadir in 2022. Although large-cap technology stocks have propelled much of this growth over the last 18 months, there are indications that other market segments are now also seeing benefits. These developments underscore the vital principle that, despite the ebb and flow of investment trends, enduring investment strategies are key to expanding portfolios and realizing financial objectives over the long term. Investors should consider how diversification across different sectors and styles can benefit them in the coming quarters.

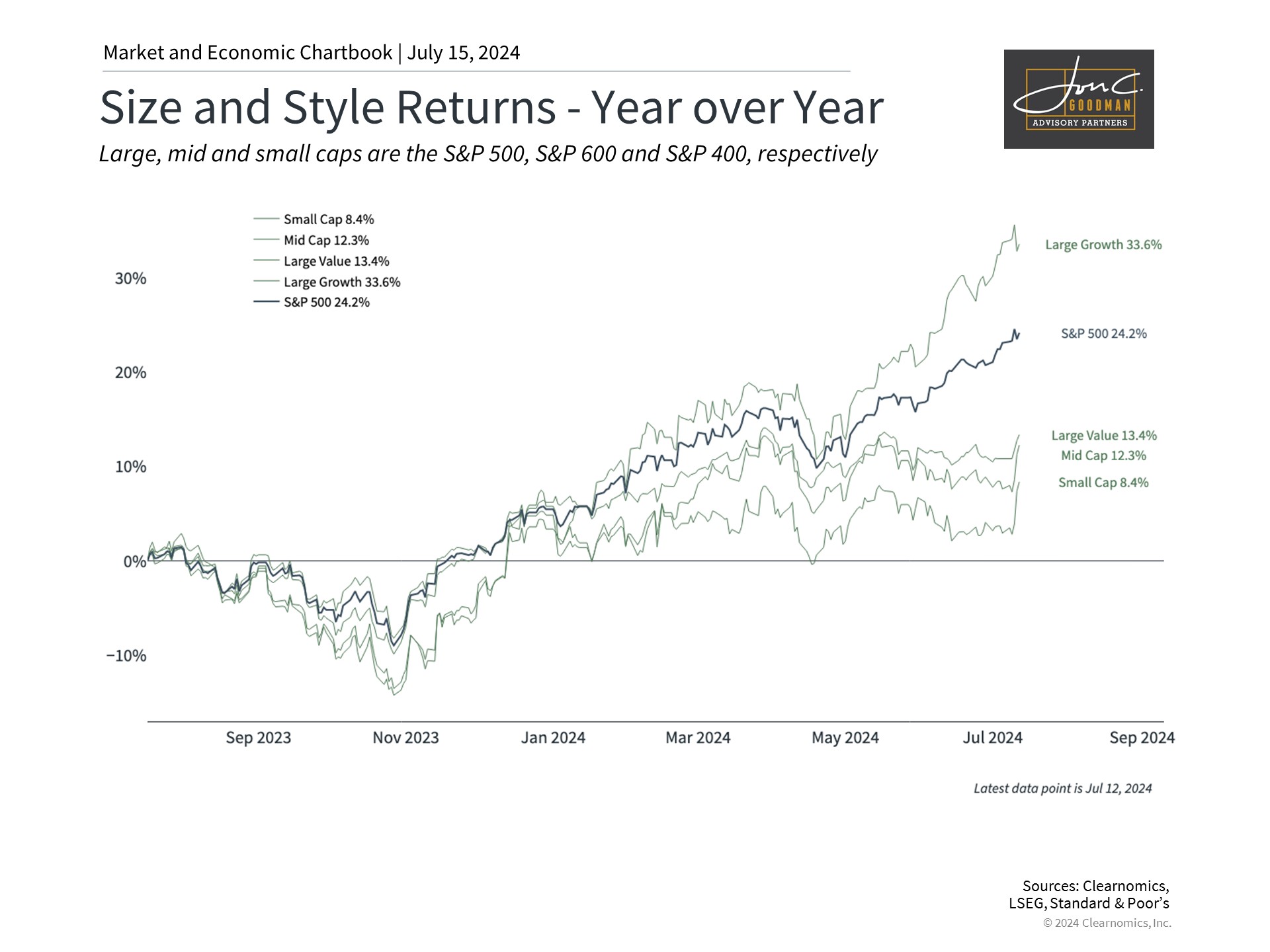

Performance is broadening beyond large cap growth.

Investors often focus on major market indices and the few sectors driving recent returns, but performance leadership tends to shift over time. Recently, large-cap tech stocks have dominated headlines, with the “Magnificent Seven” gaining 192% over the past year and a half. This surge is partly due to excitement over artificial intelligence breakthroughs and the positive impact of lower interest rates on growth stocks. This performance marks a reversal from the tech crash in 2022 when the Federal Reserve raised rates.

The accompanying chart indicates that other areas of the market are starting to show signs of participation, which has three key implications for investors.

First, recent economic reports confirm that inflation is improving, potentially leading the Federal Reserve to cut rates once or twice this year. This has boosted areas such as small-cap stocks and large-cap value. Small caps, in particular, are more sensitive to interest rates because they represent less mature companies with limited access to capital. Therefore, the prospect of lower rates can act as a catalyst for these stocks. Additionally, these companies tend to be more U.S.-focused, often outperforming when there is positive news on economic growth.

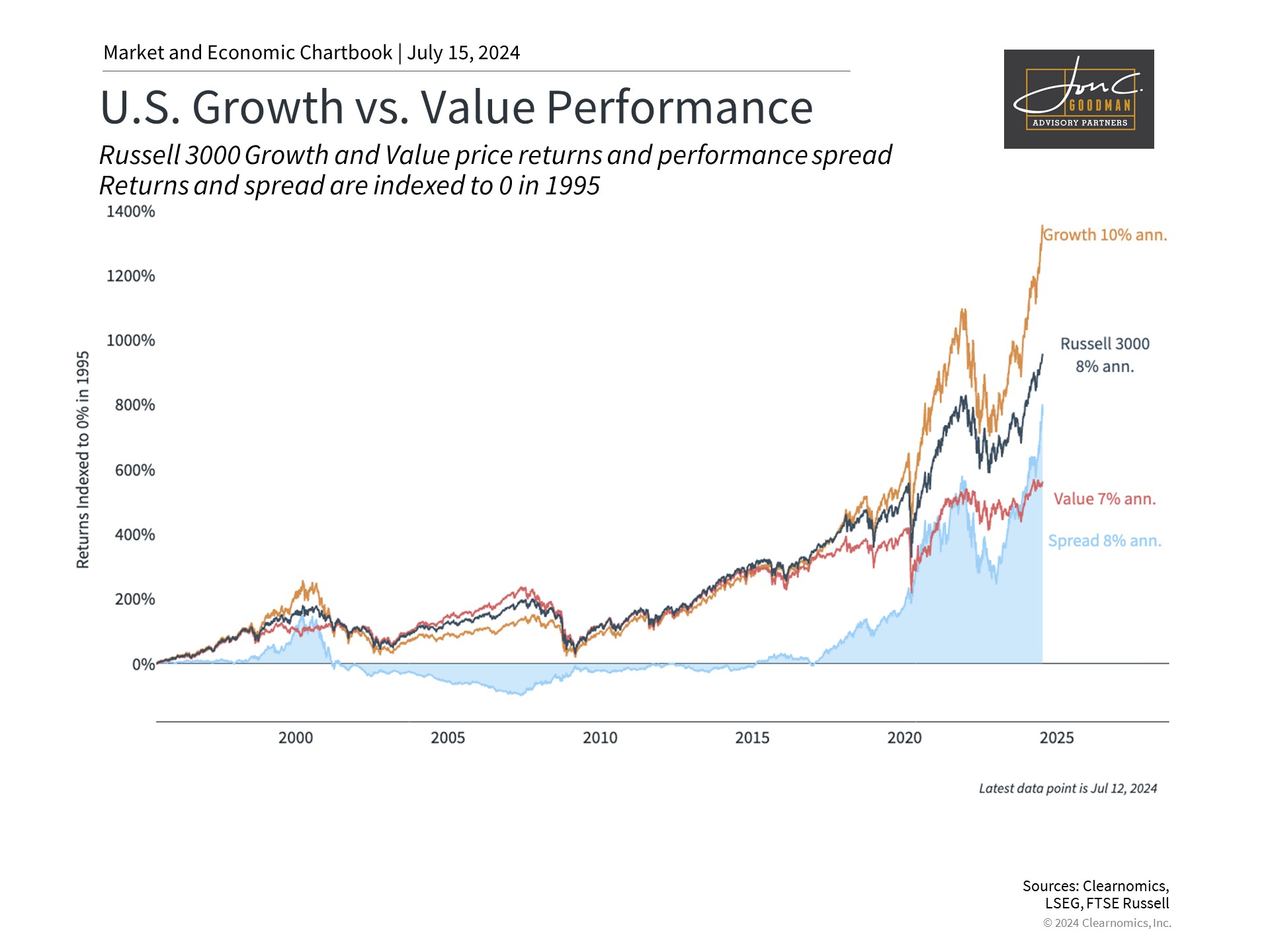

Growth and value can each outperform over long periods.

Value stocks have recently outperformed due to various factors, but this hasn’t necessarily come at the expense of growth stocks. Instead, value stocks might be starting to catch up after underperforming for the past 18 months.

Value and growth stocks are often distinguished by their valuation levels. Stocks with lower valuations are typically considered “value” stocks, while those with higher valuations are classified as “growth” stocks. Value investors look for stocks that are undervalued based on fundamentals like earnings, hoping their prices will rise to reflect their true worth. Growth investors, on the other hand, focus on companies expected to grow significantly, paying less attention to current valuation levels or share prices.

The chart above provides a historical perspective on the fluctuations between value and growth stocks over time. During the late 1990s and early 2000s, growth stocks outperformed significantly during the dot-com boom. This was followed by a strong outperformance of value stocks throughout much of the 2000s. This cyclical rotation between growth and value has been a recurring pattern, fueling much academic research on the value premium. While growth stocks have recently outperformed, history indicates that shifts in market leadership are not uncommon.

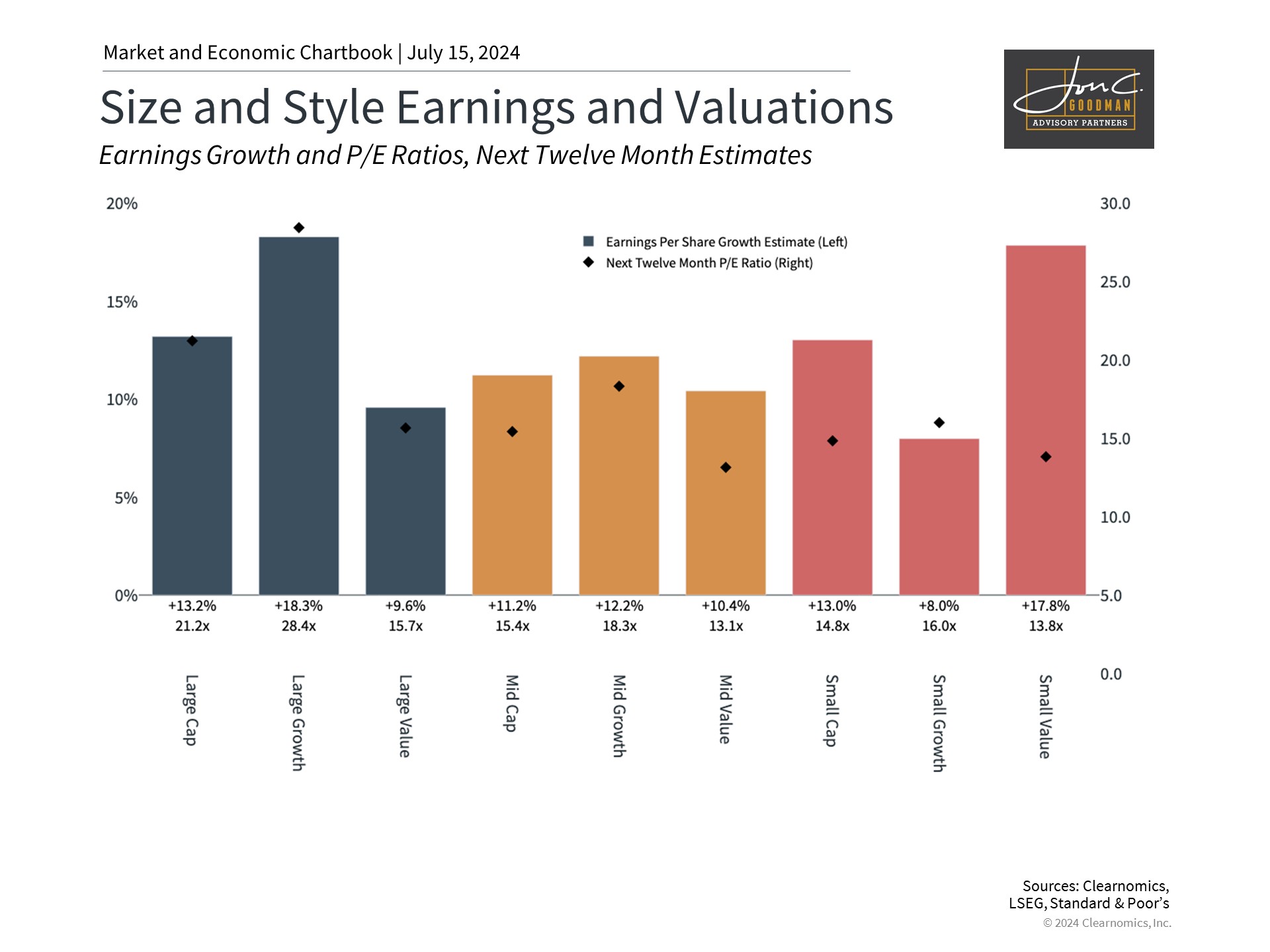

Diversifying across styles helps to reduce portfolio risk.

The recent outperformance of growth stocks doesn’t diminish the importance of diversification. In fact, diversifying across different styles helps investors capitalize on market trends while safeguarding their portfolios from potential risks.

The third chart, for instance, illustrates that the segments of the market with strong performance also have high valuations. The price-to-earnings (P/E) ratio for large-cap growth stocks is currently 28.4, pushing the overall S&P 500 index P/E to 21.2. In contrast, large-cap value stocks have a P/E of 15.7, and small-cap value stocks are even more affordable with a P/E of 13.8. This is notable because small-cap value stocks are projected to have earnings growth rates comparable to large-cap growth stocks over the next twelve months.

With ten out of eleven S&P 500 sectors showing positive returns, it highlights the importance of diversification. While tech stocks often grab the headlines, it’s encouraging to see gains in financials, utilities, consumer discretionary, industrials, consumer staples, healthcare, and energy sectors as well.

Bottomline, diversifying across different styles and sectors can help investors capture opportunities and manage risks more effectively. Market leadership can shift quickly, so staying diversified is key to achieving smoother, more consistent progress toward financial goals. As ever, how you approach diversification in your own investments matters.

To schedule a 15 minute call, click here.