Investors commonly ask, “Why should I invest in an active fixed income fund with a 5.5% yield when I can opt for a money market fund offering nearly the same yield with no risk?”

Given that short-term yields are at their highest in years, cash has become a formidable competitor to active fixed income managers, surpassing other managers and even passive strategies. This viewpoint is valid, particularly if one anticipates rising rates. In such a case, the cash rate would likely increase steadily, making the duration of typical fixed income funds a source of discomfort.

If you accept the Federal Reserve’s stance that the barrier to raising rates is substantial and that a rate decrease is more probable, then opting for a cash strategy may result in significant foregone returns over time. Currently, investing in a money market fund yields a maximum of around 5%, and it’s unlikely to surpass this unless the Fed raises rates again.

While there’s no risk of loss, the return could fall below 5% depending on how quickly and significantly the Fed cuts rates. Should the Fed initiate cuts this year and bring rates down to about 4% within 12 months, the actual yield might average closer to 4.5% instead of 5%. More rapid or deeper cuts could reduce returns to around 4%. Although 5% is the highest possible return, with only potential downsides from there, even a slight decrease in rates could lead to high single-digit fixed income returns, as indicated by the Bloomberg Aggregate Index. A more substantial rate reduction could elevate total returns to the mid-teens, presenting a compelling case for favoring fixed income over cash.

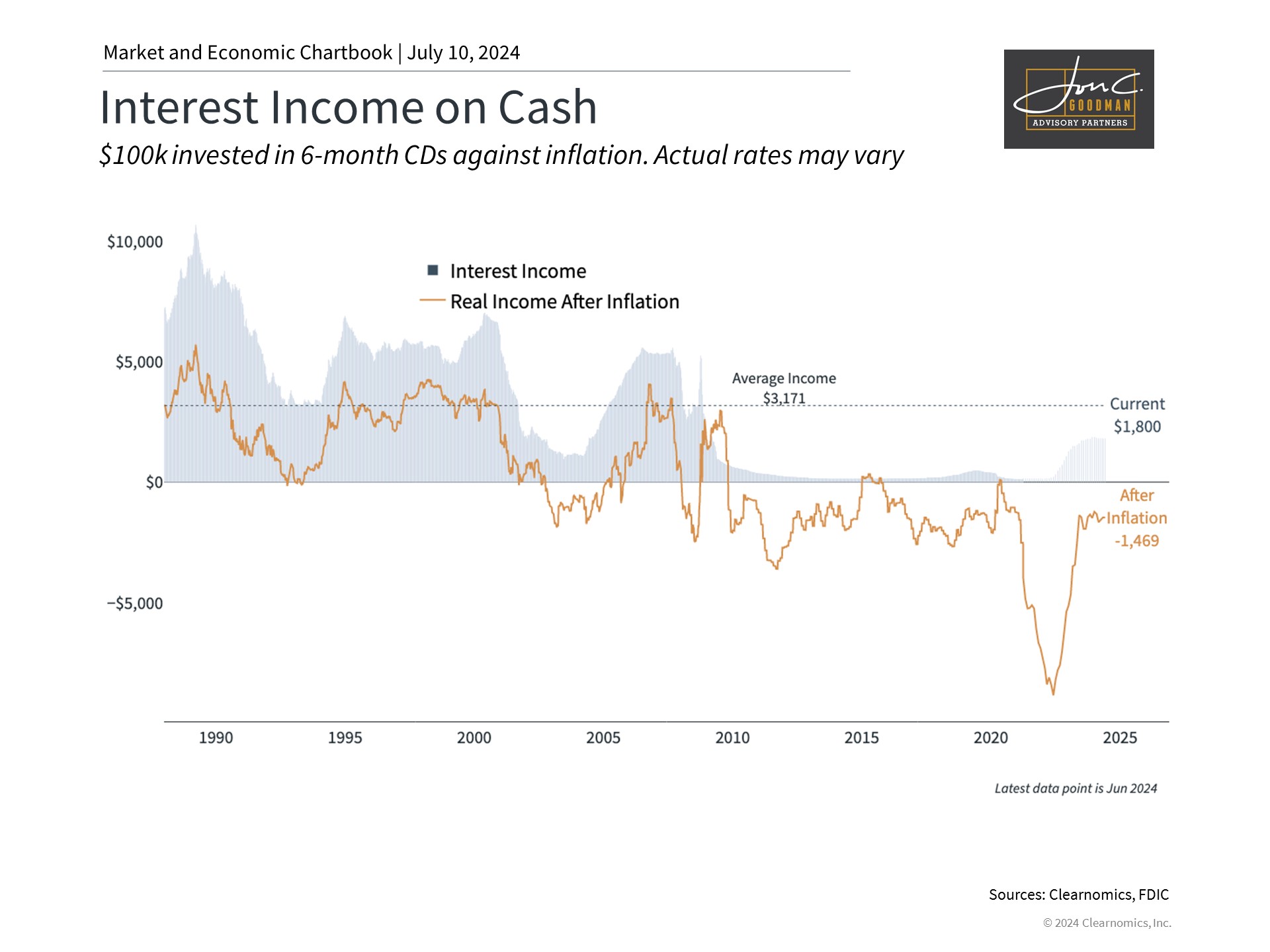

Generating income from safe investments has been challenging since the Global Financial Crisis (GFC).

Secondly, even with increasing rates, the income from cash assets, such as CDs and savings accounts, has not kept pace with inflation. When adjusted for inflation, most savers are experiencing a loss in purchasing power by holding onto cash.

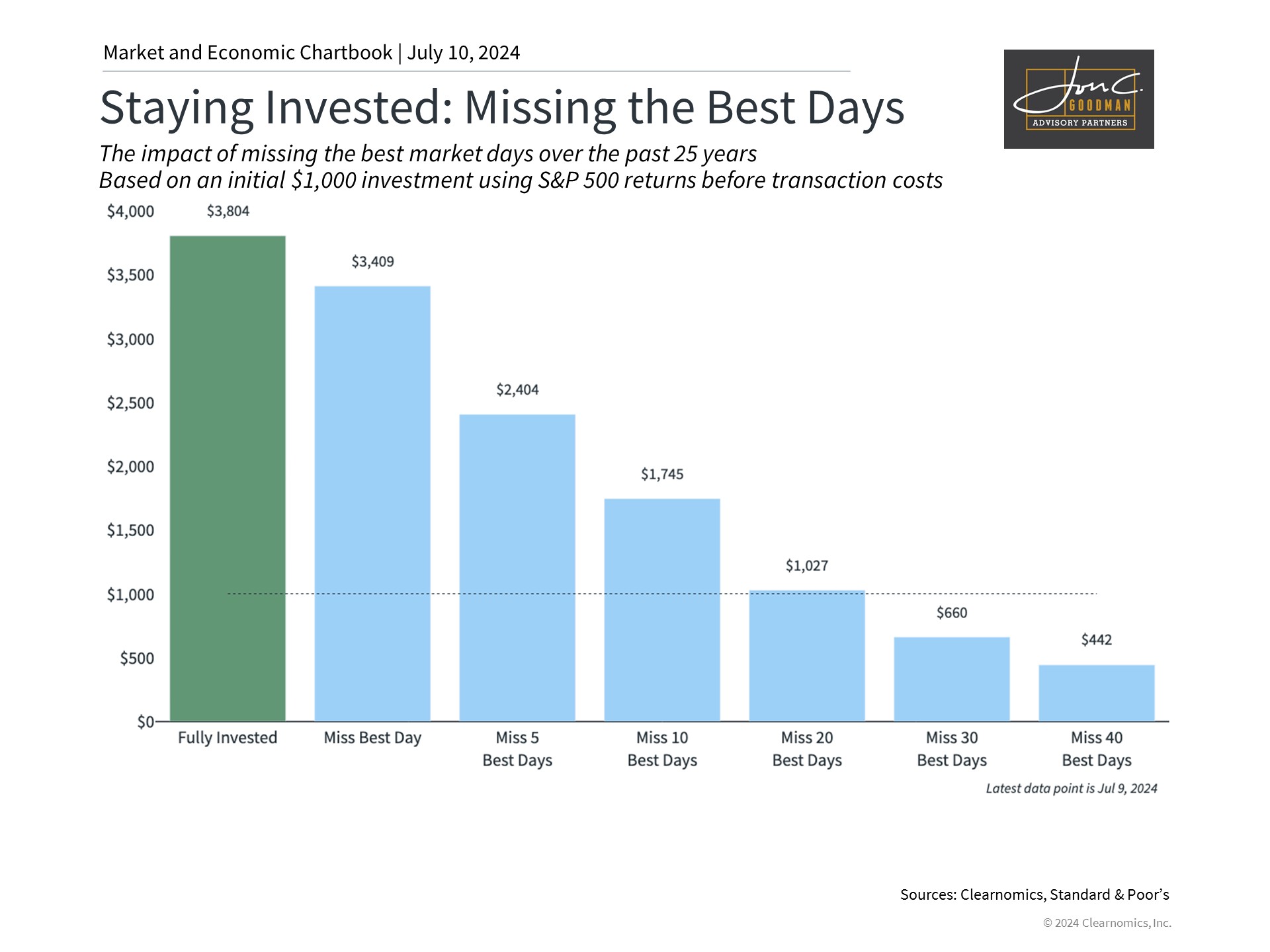

Timing the market is more challenging than it appears, as it requires being correct on two occasions.

Lastly, investors who prefer to hold cash often say, “I’ll reinvest in the fixed income market when the cycle turns, so I won’t miss out on the upside.” However, while many claim they will do this, in reality, very few manage to execute it successfully when the opportunity arises.

Market downturns can occur for various reasons, often when the cycle shifts, leading to unattractive markets with falling prices and low liquidity. This can cause panic, resulting in inaction despite intentions to buy. In some cases, individuals may want to purchase but are hindered by their investment committee, client, or risk manager, or they may be delayed by lengthy approval processes, causing them to miss the opportunity.

In challenging markets, a common feature is the scarcity of buyers, indicating that many are unable to execute their intended purchases. Holding cash poses a significant risk of not re-entering the market swiftly. However, if the funds are already invested, there’s no immediate action required. Instead, we adapt the strategy exposures, increase risk judiciously, and make purchases as needed. This is part of our role, adding value and enabling our clients to benefit from the market’s recovery.

To schedule a 15 minute call, click here.