Entering the second half of the year, it is crucial for long-term investors to keep in mind the significant events that have influenced the markets. Despite persistent economic uncertainties, the stock market has seen a robust rally, fueled by the anticipation of the Federal Reserve’s first rate cut and the continued surge in artificial intelligence stocks. In the first half of the year, the S&P 500 rose 15.3% including dividends, the Nasdaq climbed 18.6%, and the Dow Jones Industrial Average increased by 4.8%. The 10-year Treasury yield fell from its April high of 4.7% to 4.4%, resulting in a relatively stable bond market for the year. International stocks also saw improvements, with developed markets up by 5.7% and emerging markets by 7.7%.

The recent strong performance may have surprised some investors, while others might not have been well-positioned to capitalize on the upswing across various asset classes. This is due to the fact that market sentiment can quickly change, particularly with intense investor and media focus on short-term events. For instance, the recession predicted at the start of the year has not materialized, and there are indications that inflation, which was higher than expected for some time, is starting to ease.

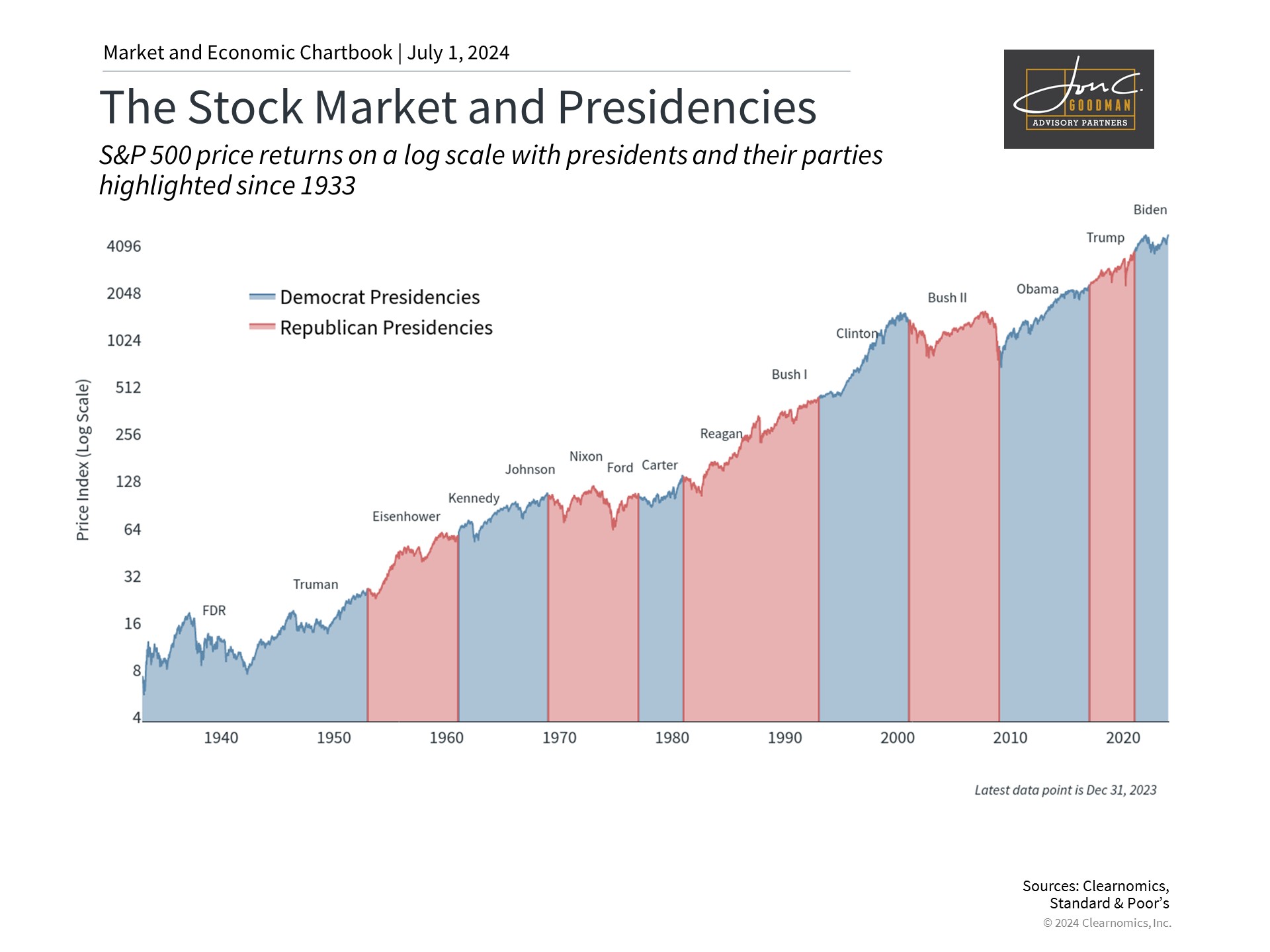

Naturally, the market will now turn its attention to significant events in the latter half of the year, with the presidential election being particularly noteworthy. As investors get ready to vote in November, they will also contemplate the implications of each political party on their investment portfolios and financial strategies. Additionally, investors will closely monitor the Federal Reserve’s rate cuts, as lower interest rates typically benefit both stocks and bonds.

Although these events are unpredictable and carry new risks, the first half of the year serves as a reminder that reacting impulsively to daily news at the cost of long-term trends can lead to suboptimal investment choices. History has demonstrated the importance of detaching personal political sentiments from financial decisions to remain invested, diversified, and methodical. Here are five essential facts that all investors should remember to maintain composure for the remainder of 2024 and beyond.

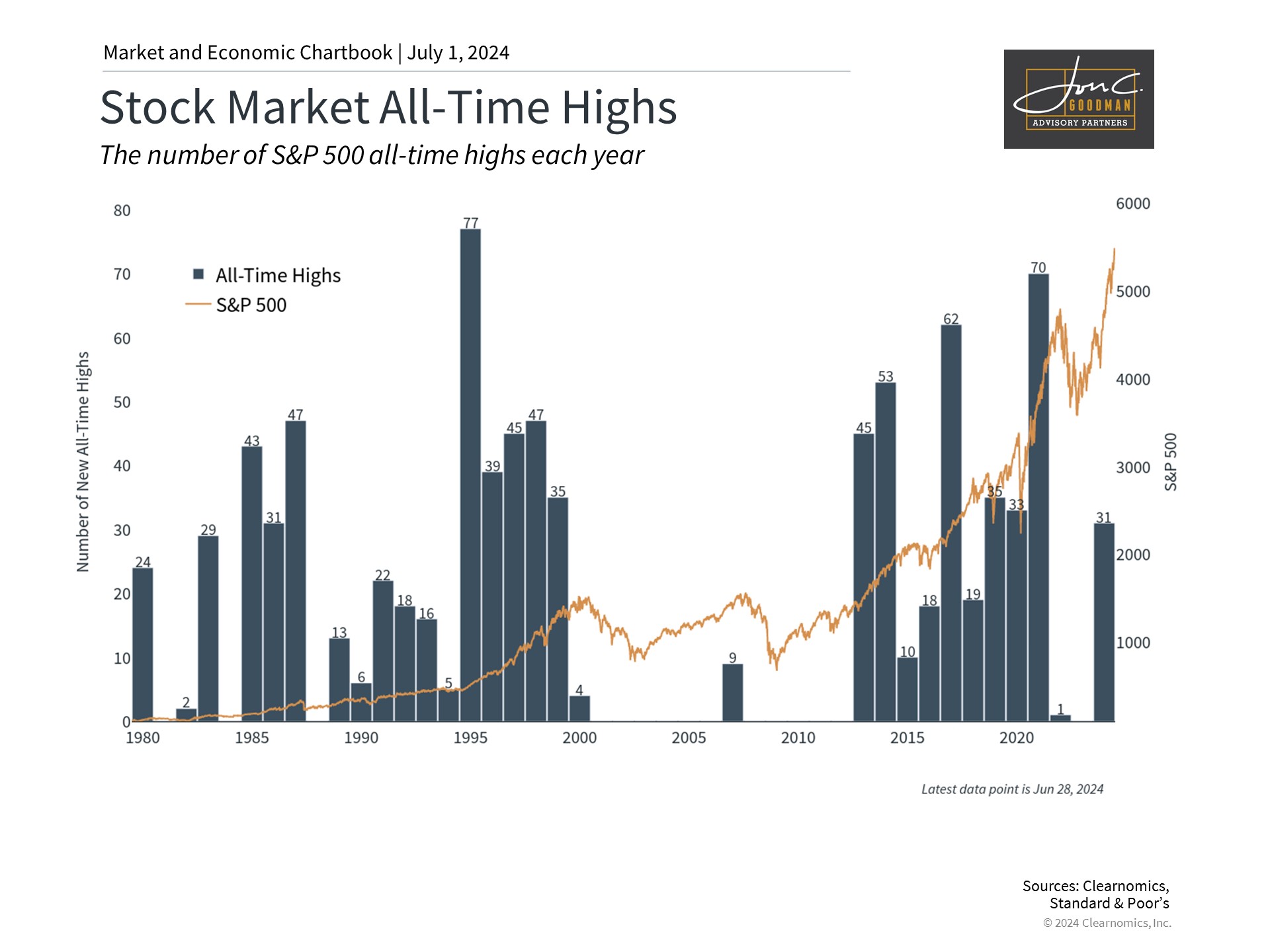

1. The market continues to reach new all-time highs.

In the first half of the year, the S&P 500 has notched over 30 new all-time highs on its way to a 15.3% gain. While this growth is generally seen as positive, it can also cause anxiety among investors. It’s common to fear a pullback when the market reaches uncharted heights.

The truth is, market fluctuations are an inherent aspect of investing, and a market retreat is inevitable at some point. Predicting the exact timing of these downturns is challenging, if not impossible. Moreover, during bull markets, it’s normal for major stock market indices to spend considerable time at or near peak levels, as indicated in the accompanying chart. For this reason, attempting to time the market is often unproductive.

Artificial intelligence stocks, especially Nvidia, have significantly boosted market returns this year, with the Information Technology and Communication Services sectors up 28.2% and 26.7%, respectively. Other sectors, including Energy, Financials, Utilities, and Consumer Staples, have also started to rally, each gaining about 10%. Overall, 10 out of the 11 sectors have posted positive returns for the year. Although the future direction of large-cap technology stocks remains uncertain, maintaining a diversified portfolio allows investors to capitalize on the growth of various sectors.

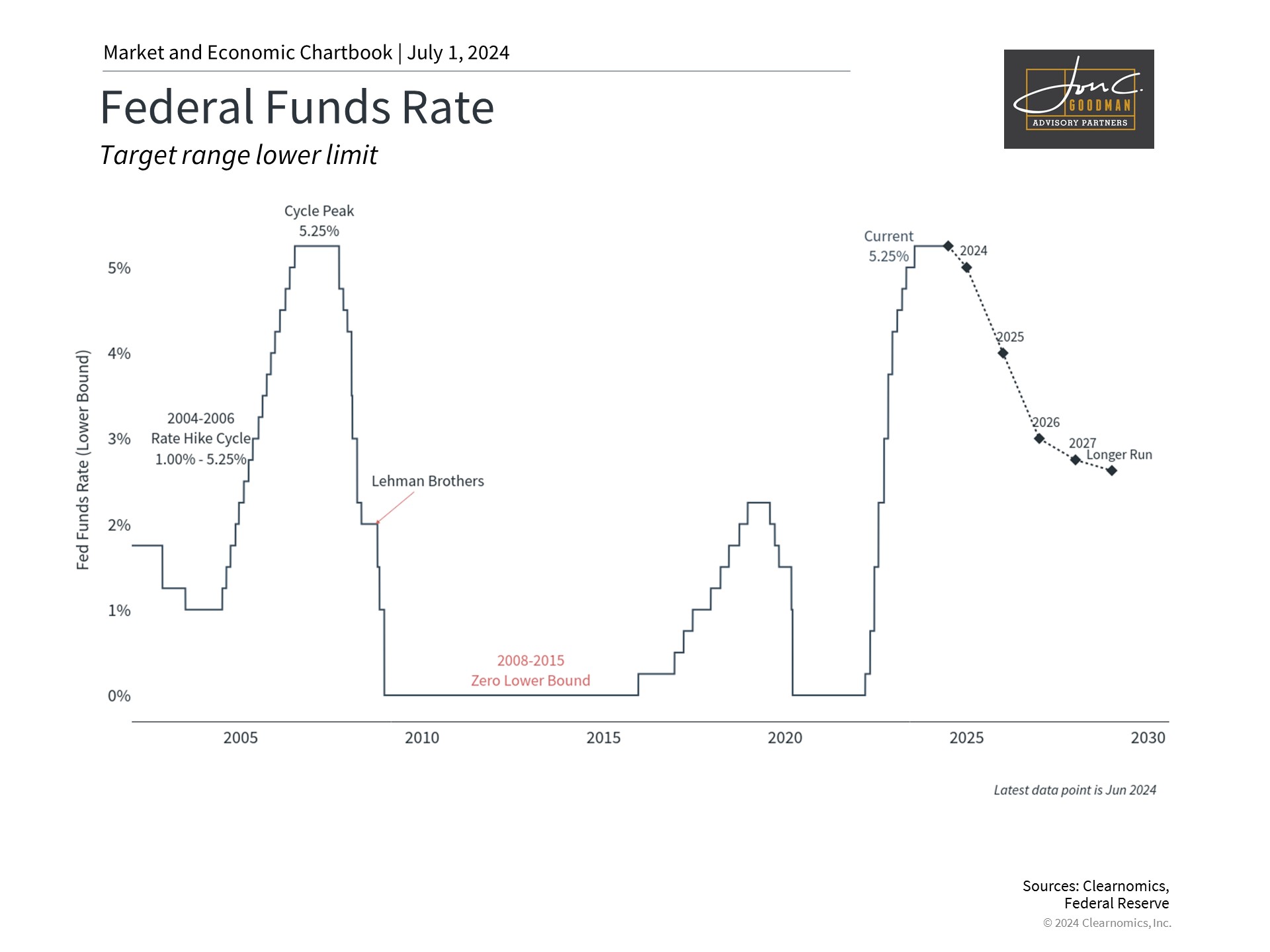

2. With inflation cooling, the Fed is on track to cut rates later this year.

Investors have been anticipating the cycle’s first rate cut since the year’s start. This anticipation has not only fueled returns but also caused significant market fluctuations whenever new economic data shifted expectations.

The chart accompanying this text illustrates the potential trajectory of the federal funds rate according to the Fed’s most recent projections. In its previous meeting, the Fed acknowledged robust job growth and low unemployment as signs of strong economic activity but also noted that “inflation has moderated over the past year yet remains high.” Encouragingly, the latest inflation figures for May indicated a substantial slowdown, keeping the prospect of a rate cut this year alive.

The additional rate reductions investors had anticipated are now expected next year, contingent on economic data in the forthcoming six months. Regardless of when and how the Fed rate cuts occur, these forecasts mark a shift from the emergency monetary policy measures initiated in early 2022.

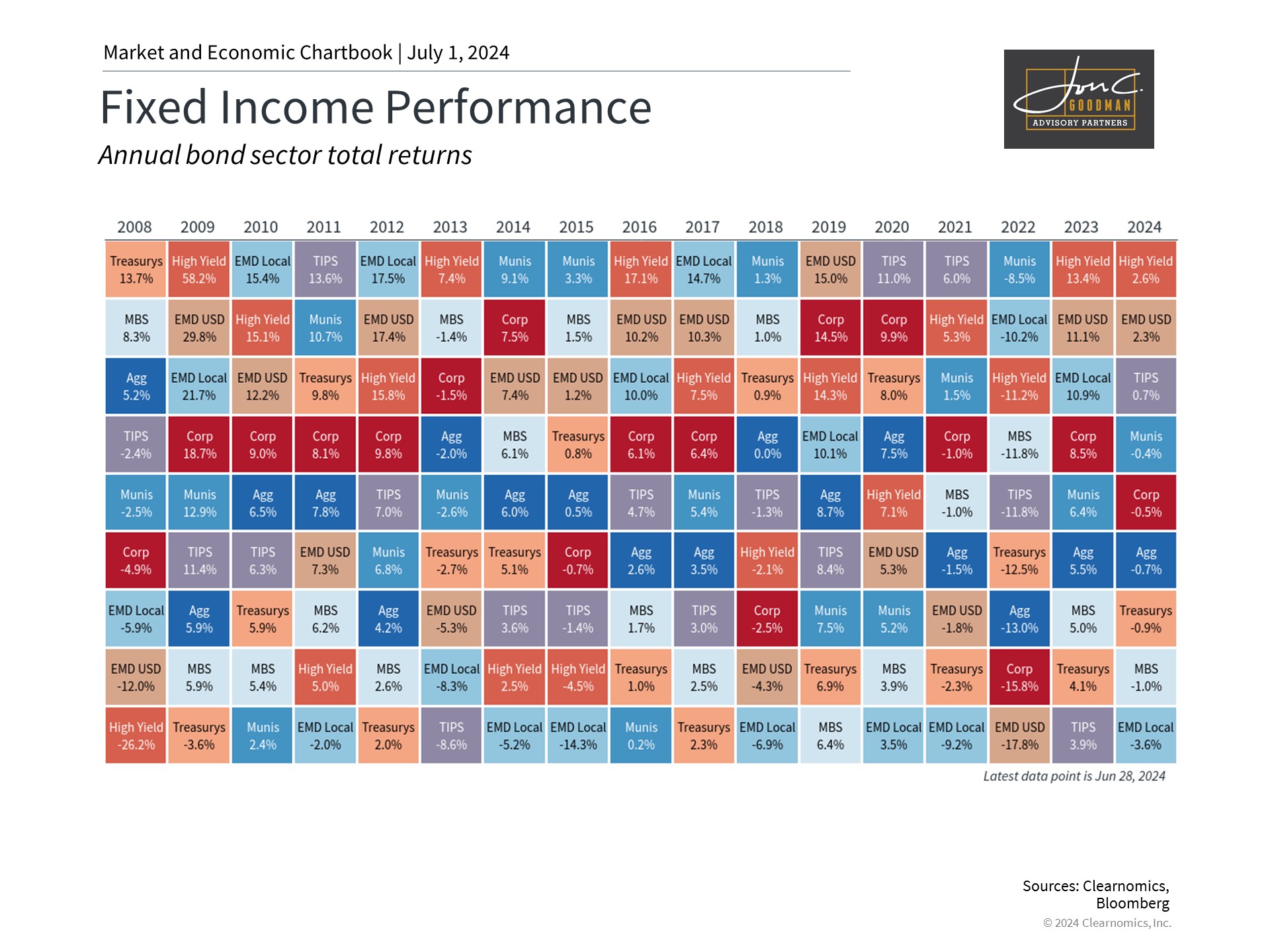

3. Steadier rates support the bond market.

The trajectory of interest rates has been highly unpredictable in recent years, influenced by factors such as inflation, economic growth, and Federal Reserve policies. This unpredictability has led to higher-than-anticipated rates, posing challenges for the bond market as increasing rates typically depress bond prices.

Following unexpectedly high readings earlier in the year, the most recent Consumer Price Index data indicated no overall price change in May, marking the first occurrence in nearly two years. The core CPI increased by 0.2% in May, or 3.4% on an annual basis, signaling a significant slowdown from the 3.6% rate seen the previous month. Similar trends have been observed in other indicators like the Personal Consumption Expenditures index, preferred by the Fed, and the Producer Price Index.

Recent developments and updated Federal Reserve guidance have contributed to a decrease in rates, which has been beneficial for bond prices. The Bloomberg U.S. Aggregate Bond Index, which represents the total bond market, has almost recovered to its starting point for the year after a 4% drop in April. This stands in stark contrast to 2022, when the bond market entered a bear market amid a historic surge in interest rates, only to stabilize and recover in 2023.

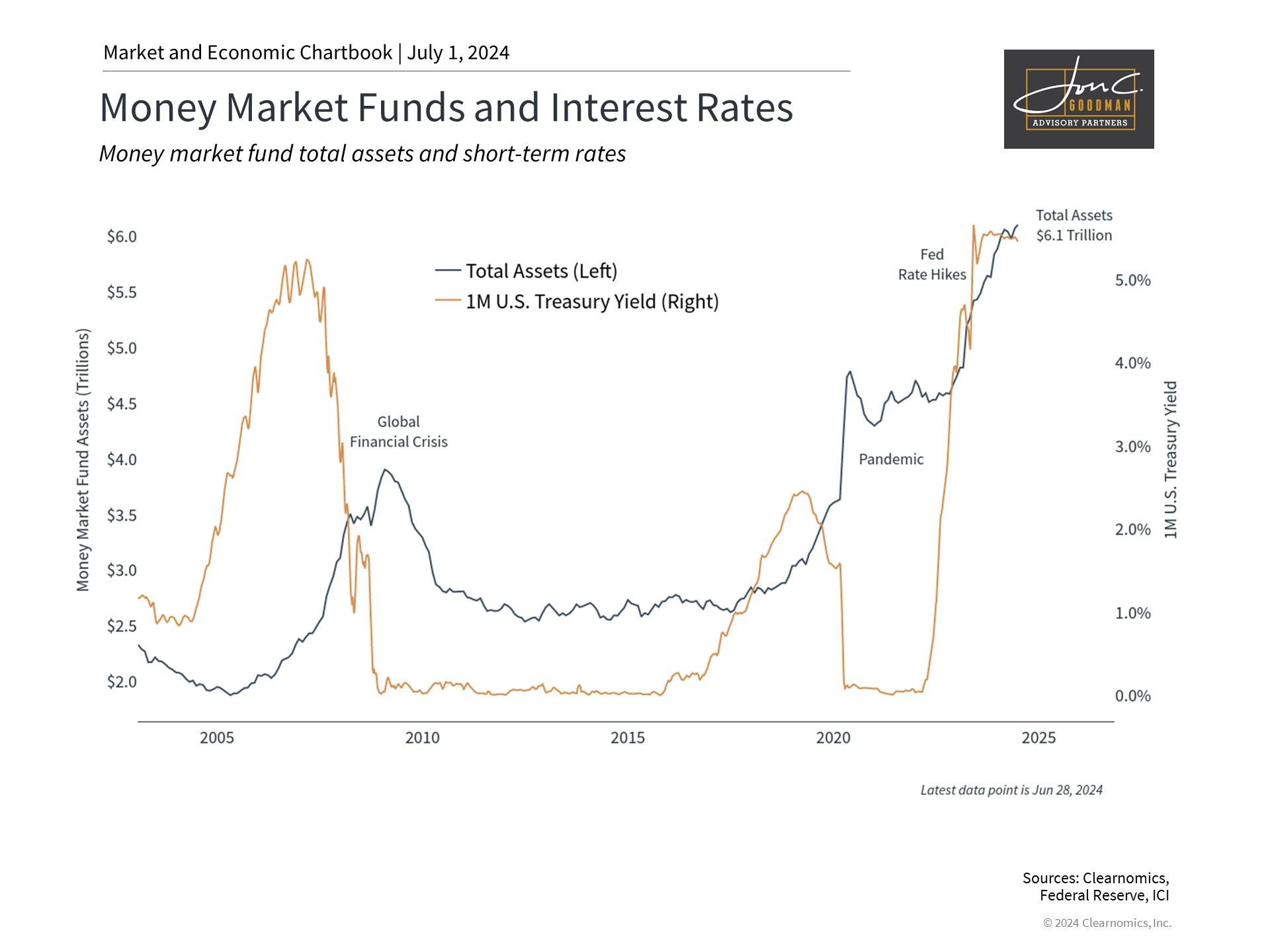

4. Many investors remain on the sidelines in cash.

During periods of market volatility, investors often turn to cash as a safe haven. This trend has persisted in recent years, with market fluctuations driven by the pandemic, geopolitical conflicts, Federal Reserve rate increases, inflation, political stalemate in Washington, shifts in technology, and other factors. Moreover, cash interest rates are currently at their highest in decades, presenting seemingly attractive “risk-free” returns.

However, holding excessive cash can be problematic. Cash is not genuinely risk-free for two key reasons. Firstly, inflation gradually diminishes the purchasing power of cash. Therefore, despite high yields, the actual value of money may decrease.

Secondly, the outlook for cash could deteriorate if the Federal Reserve starts to lower rates. Investors might then have to reinvest their cash at reduced interest rates or opt for stocks and bonds, which are likely to have appreciated in price already.

5. The presidential election is heating up.

Coverage of the presidential election is heating up. While elections are an essential way for Americans to help shape the direction of the country as citizens, voters and taxpayers, it’s important to vote at the ballot box and not with investment portfolios.

Historical data indicates that market performance is resilient under both major political parties. The provided chart illustrates that, over the years, economic and stock market growth has occurred irrespective of the presidential administration. The primary influences during these times have been the business cycle’s fluctuations.

While politics can indeed affect aspects such as taxes, trade, industrial activities, and regulations, policy shifts are generally gradual, and their precise timing and impact are often overvalued. Therefore, it is more beneficial to concentrate on long-term economic and market trends rather than the transient nature of election polls. Investors worried about how specific policies may affect their financial plans are advised to consult with a reliable financial advisor.

In conclusion, investors ought to consider these five key factors as summer approaches. Maintaining a long-term outlook is crucial for achieving investment objectives. Collaborating with a reliable financial advisor can assist in steering through the uncertainties ahead and staying prepared for economic and stock market shifts throughout the remainder of 2024.

To schedule a 15 minute call, click here.