With the onset of the presidential debate season, the contrasting tax strategies of the current and former presidents will come to the forefront. This contentious issue is driven by intense political beliefs regarding national priorities, government expenditure, entitlement programs, and the equitable distribution of tax burdens, among other factors. Although taxes influence every aspect of our financial existence, their effect on the stock market may be surprising to some. Amid escalating political discourse from both parties, investors may wonder how to remain composed and adhere to their long-term financial strategies.

Tax rates have fluctuated throughout history.

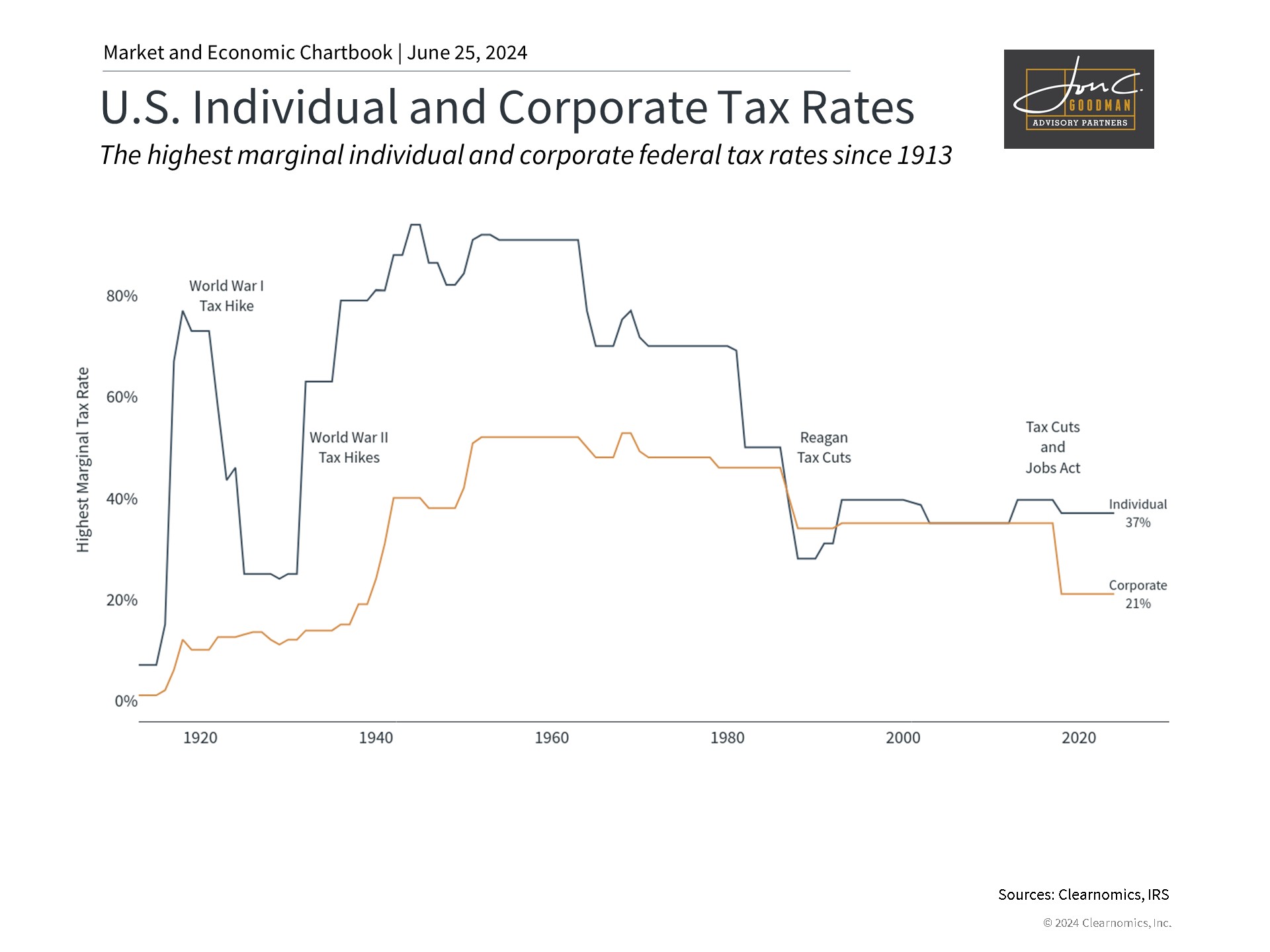

Investors often concentrate on corporate tax rates as they directly impact the profitability of large companies and, consequently, their stock prices. Tax rates, along with the nation’s tax philosophy, have varied throughout history. Historical data indicates that both corporate and individual tax rates were substantially higher for most of the 20th century, decreasing during the Reagan administration. The general belief is that Republicans prefer lower taxes, while Democrats advocate for higher rates, especially on corporate income. Naturally, the specific priorities and policies of each party have shifted over time, particularly concerning budget balance.

The 2017 Tax Cuts and Jobs Act, a key element of President Trump’s tax policy, lowered the corporate tax rate from 35% to 21%. Contextually, the U.S. had the highest corporate tax rate among OECD nations before this change, which brought it slightly below the OECD average. The corporate tax rate reached its zenith at 52.8% in the late 1960s. However, historical comparisons of corporate tax rates are complex due to evolving tax brackets. Moreover, the actual taxes paid by corporations can significantly deviate from the statutory rates.

The 2017 corporate tax cut, unlike individual tax rates, does not have an expiration date but can be altered by the ruling party. Although it’s early in the election cycle and candidates’ platforms are subject to change, President Biden has suggested increasing the corporate tax rate to 28% and the corporate alternative minimum tax rate (CAMT) from 15% to 21%. The CAMT, established by the Inflation Reduction Act of 2022, aims to ensure that large, profitable corporations pay a minimum tax amount. President Trump has not yet finalized his proposals, but he has indicated to business leaders a desire to reduce the corporate tax rate to 20%.

Corporate taxes have become less important over time.

Setting politics aside, there is no straightforward economic answer to how taxes affect growth and markets. An important concept is the “Laffer curve,” which suggests that tax revenue increases with tax rates only to a certain point. Ideally, tax policy should balance societal needs with economic growth.

Advocates for reducing corporate tax rates argue that lower taxes provide long-term incentives for companies to invest in productivity, enhancing global competitiveness. Theoretically, corporate taxes are ultimately levied on individuals, including shareholders, workers, and customers. Conversely, with the federal deficit and debt growing, supporters of higher corporate taxes see it as a vital method to generate necessary revenue.

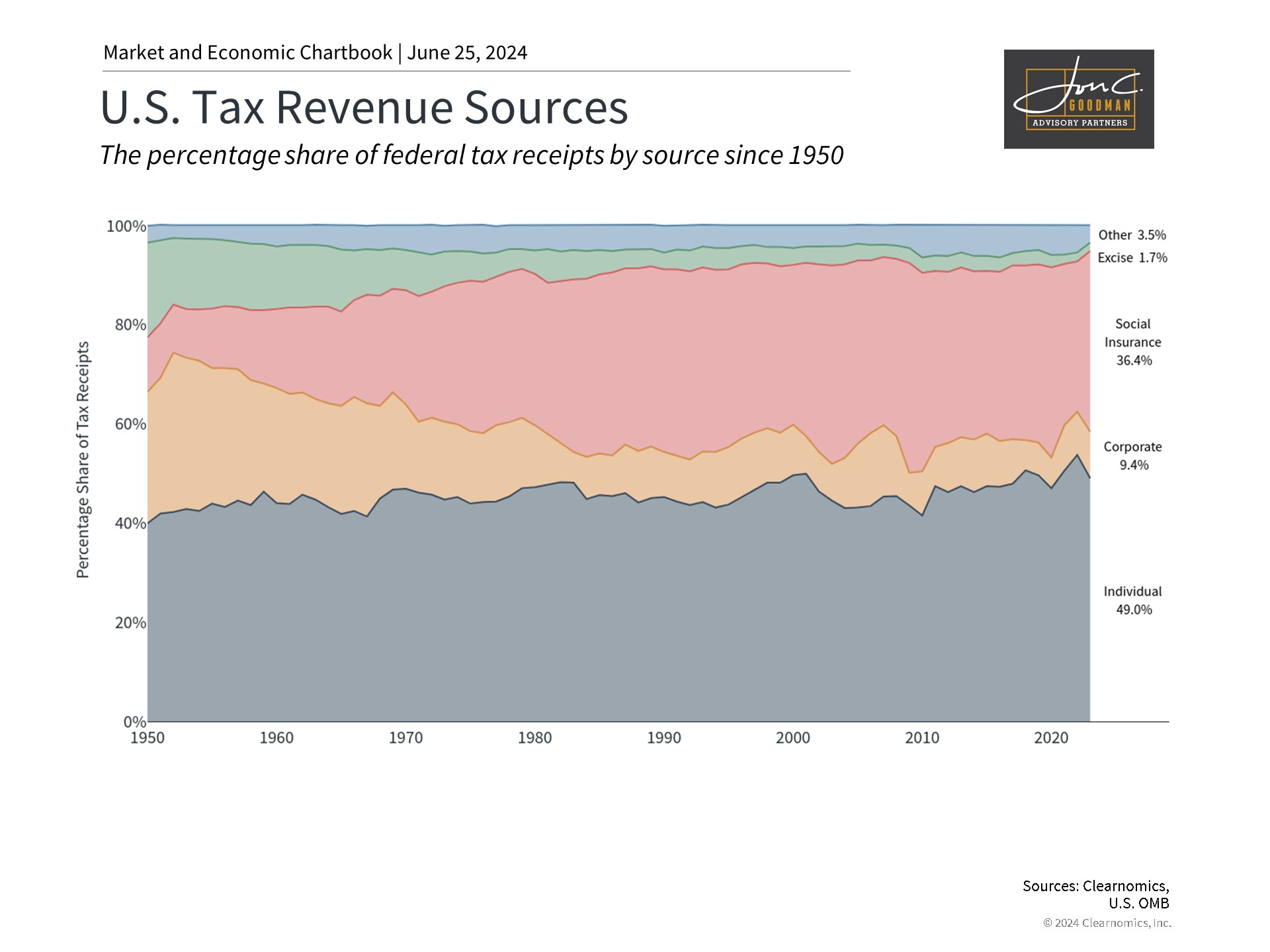

The accompanying chart illustrates that the proportion of revenue from corporate taxes has plummeted from 27% in 1950 to just 9.4% today. Meanwhile, individual income taxes have continued to be a significant portion of government income, increasing from 40% to 49% over the same timeframe. The rise in social insurance and retirement receipts, from 11.0% to 36.4%, has offset the decline, while other taxes, such as excise taxes, have diminished in significance as a source of government funds.

Although corporate taxes are a focal point for investors, they currently represent only a small segment of total tax revenues. Contrary to what one might expect, the stock market has thrived under various tax conditions. This resilience is partly due to corporations’ ability to swiftly adjust to new tax regulations and reduce their tax liabilities through diverse strategies. Additionally, recent presidents have generally preserved existing tax policies to prevent increasing tax burdens.

However, government spending is the flip side of the tax coin. Presently, there’s no apparent strategy to cut spending to reduce the debt and deficit. In fact, the Congressional Budget Office has updated their projections to reflect this trend.

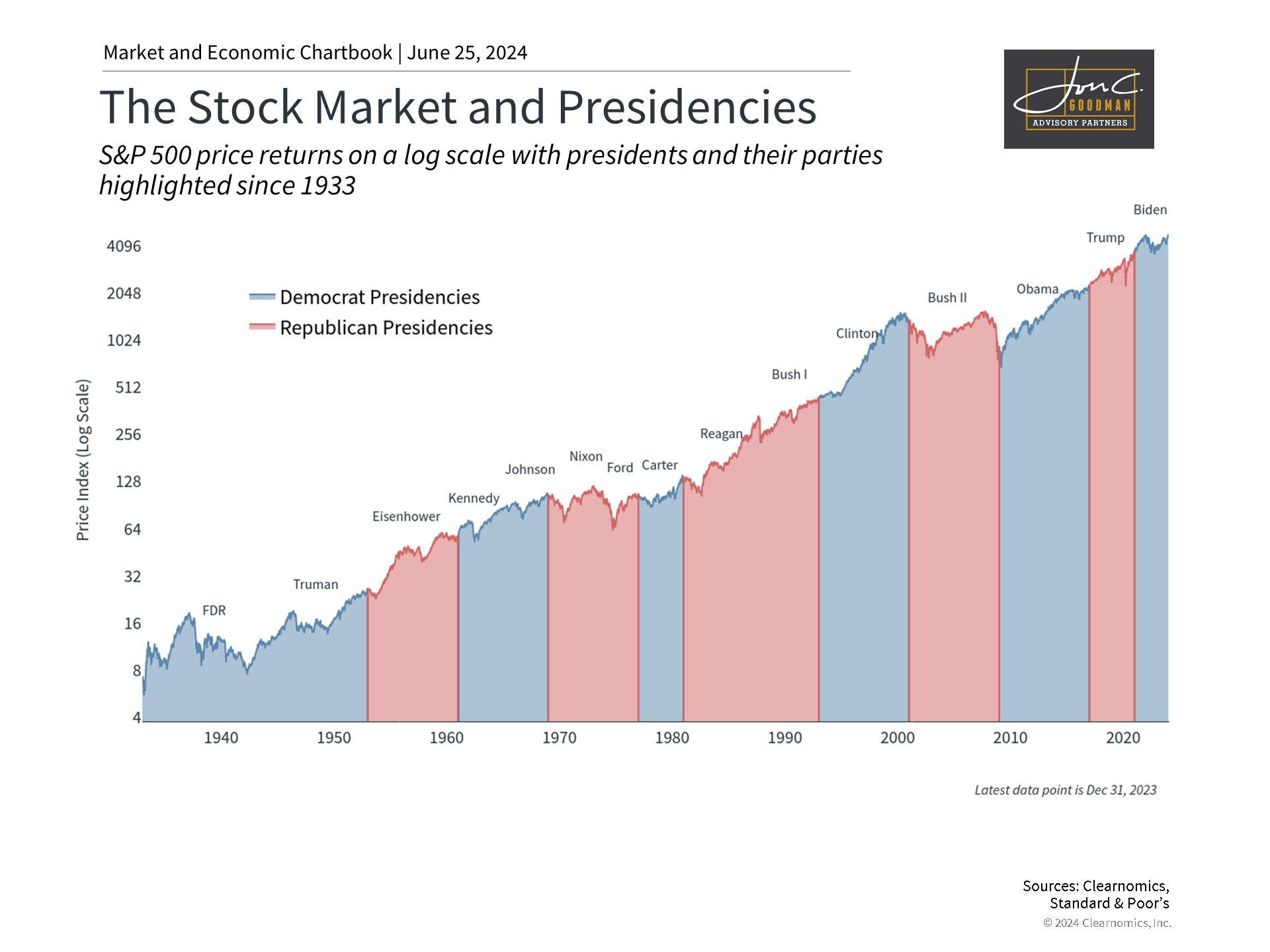

Growth happens under both parties.

In terms of market performance, investors should avoid overreacting to sweeping tax policy changes or political events. Historical data indicates that the stock market has thrived under various administrations and tax structures. This resilience is largely due to market returns being more influenced by business cycles, which span years or even decades, rather than by short-term policy shifts. The notion that markets will plummet solely due to an election result or tax policy alteration lacks historical precedent.

Achieving financial objectives involves more than just market performance; personal financial planning, including tax and estate considerations, is crucial. Investors worried about the effects of particular tax policies should consult a trusted financial advisor for guidance.

In summary, although tax policies are a focal point of the forthcoming election, investors are advised to adopt a wider view. Remaining invested is the most effective strategy for reaching financial targets, regardless of political changes.