The trajectory of interest rates has been unpredictable in recent years, influenced by factors such as inflation, economic growth, and Federal Reserve policies. For example, the 10-year U.S. Treasury yield surged from 3.8% at the close of the previous year to a peak of 4.7% in April, before recently stabilizing at approximately 4.2%. This rise in rates has confounded investors and economists alike, presenting a difficult scenario for the bond market as increasing rates typically lead to falling bond prices. Nevertheless, with signs of inflation easing, there is a widespread expectation that the Federal Reserve will start to reduce rates by this year’s end. Diversified investors need to consider what strategies will help them remain stable during the upcoming months.

Improving inflation is supporting the bond market.

Recent economic reports indicate potential improvements in inflation. Following higher-than-anticipated figures earlier in the year, the most recent Consumer Price Index data revealed no change in overall prices in May, marking the first instance in nearly two years. The Core CPI increased by 0.2% in May, or 3.4% on an annual basis, signaling a significant slowdown from the previous month’s 3.6% rate. Although housing costs remain high, excluding them yields a core inflation rate of just 1.9% for the last year. Additionally, other indicators like the Producer Price Index have displayed signs of deflation, having previously reported higher than expected numbers.

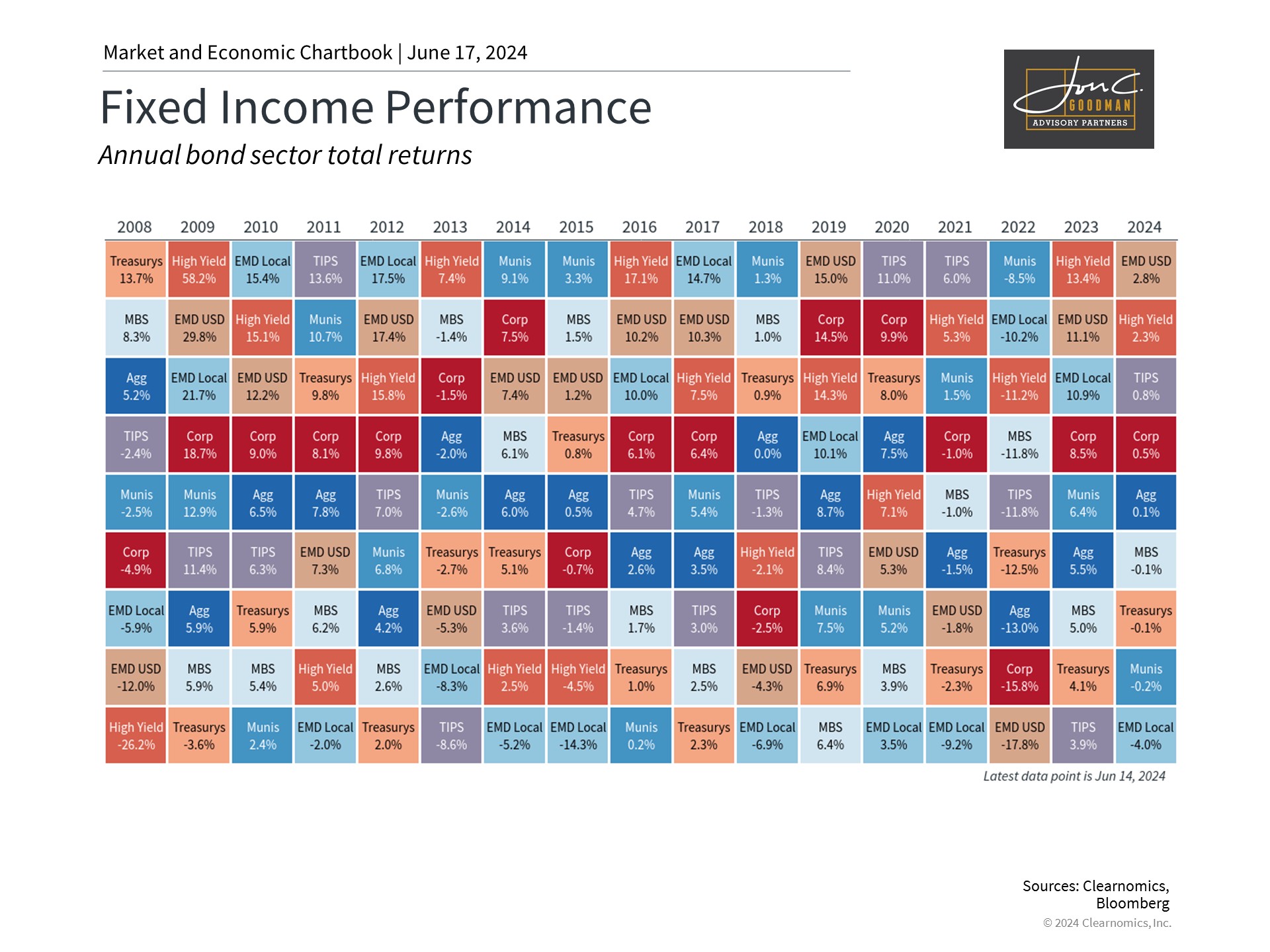

Recent developments and new Federal Reserve guidance have led to a decrease in rates, bolstering bond prices. The Bloomberg U.S. Aggregate Bond Index, which represents the total bond market, has leveled out this year after a 4% drop in April. Both investment-grade and high-yield bonds have shown positive returns for the year. This marks a stark contrast to 2022, when bonds entered a bear market amid a historic surge in interest rates, only to stabilize and recover in 2023.

With the decline in interest rates, bond prices generally increase as the yields on existing bonds grow more appealing. For example, the yield on the investment-grade bond index is currently around 5.3%, significantly higher than the 15-year average of 3.7%. High-yield and mortgage-backed securities are yielding 7.9% and 5.1%, respectively.

The significance of these yield levels cannot be overstated. In the decade following the 2008 financial crisis, investors questioned whether yields would ever rise as policy rates hovered near zero or dipped into negative territory globally. Investors dependent on their portfolios for income had to take greater risks to achieve adequate returns, such as purchasing riskier bonds or opting for dividend-paying stocks. Now, despite increased price volatility, retirees and long-term investors can take advantage of the most favorable yields seen in years.

The Fed is still expected to cut rates later this year.

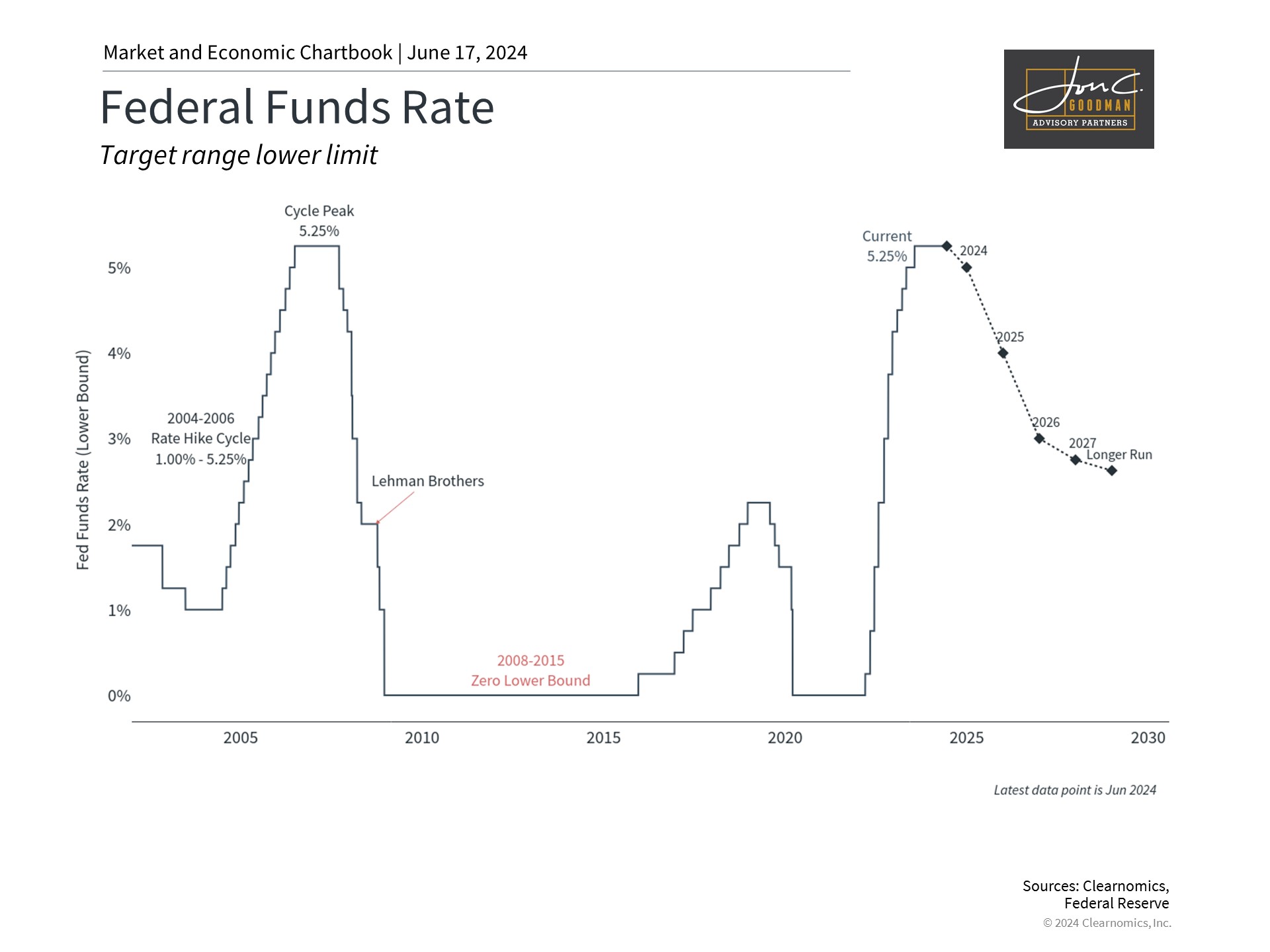

Performance numbers are always variable, but they currently suggest the potential for rate cuts later this year and stabilizing inflation rates. This is significant as the market’s expectations for Federal Reserve rate cuts have varied greatly this year, leading to fluctuations in longer-term rates. In January, fed funds futures indicated multiple rate cuts by the Fed due to a potential recession. However, as the economy remained robust and inflation persisted, those expectations shifted.

Inflation rates are above the Federal Reserve’s preference, yet recent trends align with what policymakers aim to achieve. Elevated policy rates are designed to constrict economic activity, reduce spending, and control inflation. Following the Consumer Price Index report, the Federal Reserve acknowledged “modest further progress toward the Committee’s 2 percent inflation objective.”

During his press conference, Federal Reserve Chair Jerome Powell highlighted the Fed’s awareness of the “two-sided risks” associated with maintaining higher fed funds rates over an extended period. High policy rates are intended to address inflation but may also undesirably decelerate the economy. For example, last year’s banking crisis was partly attributed to the effects of increasing rates on banks with exposure to rate-sensitive assets like long-term bonds, commercial real estate, cryptocurrencies, and others.

The Federal Reserve’s recent projections indicate a single rate cut later this year, a decrease from the previously projected three, with the additional cuts deferred to the following year. Although this demonstrates the Fed’s cautious approach, these forecasts are subject to frequent revisions and should be considered cautiously. The timing of the announcement was close to the release of the latest positive Consumer Price Index data. Despite this, market indicators still point to the possibility of two rate cuts this year, potentially in September or November.

Bonds can still provide portfolio balance.

Should rates eventually decrease, the historical function of bonds as portfolio diversifiers might be enhanced. Bonds have traditionally served to balance portfolios, often moving inversely to stocks. For example, when the economy and stock market falter, interest rates usually drop, bolstering bond prices.

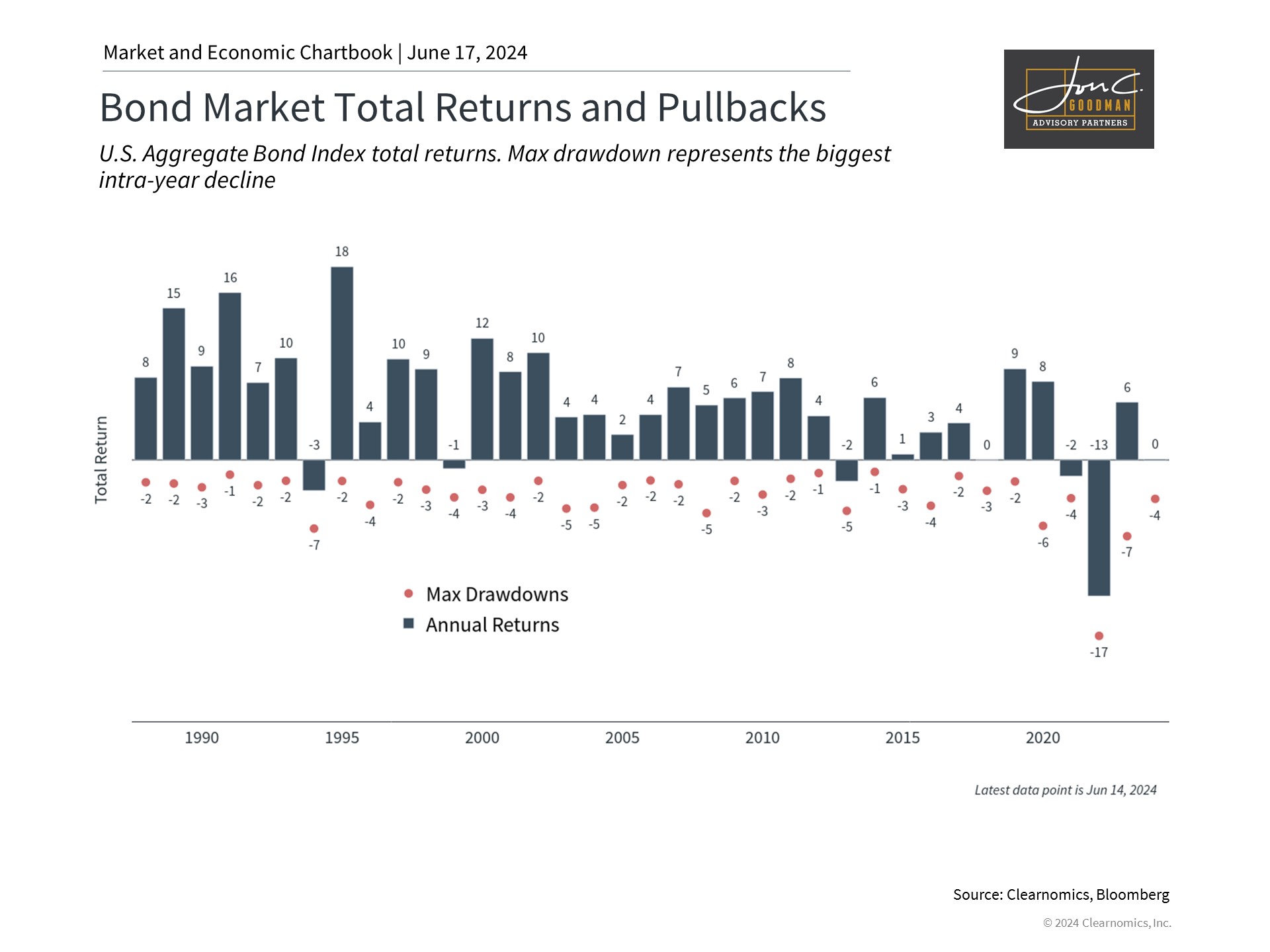

This trend became more pronounced starting in the mid-1980s, as a consistent decline in interest rates led to an increase in bond prices over the next four decades. This situation facilitated a strong bull market for both stocks and bonds, with bond prices remaining stable or increasing further during stock market downturns. However, in 2022, both asset classes declined due to unforeseen inflation, challenging the conventional role of bonds as stabilizers and reliable sources of yield and returns.

The future interplay between stocks and bonds hinges on inflation trends and the Federal Reserve’s rate decisions. If inflation eases and the Fed reduces rates, we may see a return to traditional patterns. The chart referenced illustrates the historical behavior of bond returns. Periods of inflation concern and monetary tightening, such as those in 1994, 1999, and 2013, have led to weak bond returns. Yet, historically, after these periods, investors have often gravitated back to bonds for yield and portfolio diversification.

Despite the challenges diversified investors have faced over the past two years, the prospect of more stable rates suggests that bonds may become more appealing. It remains crucial to maintain diversification across various asset classes as the Federal Reserve approaches its initial rate cut and as economic price pressures ease.

Bottomline, bonds retain their significance within a diversified portfolio. Although the future is unpredictable, diminishing inflation and potential Federal Reserve rate reductions could bode well for the bond market moving forward.

To schedule a 15 minute call, click here.