As with many aspects of life, there’s a distinct difference between knowing what to do and actually doing it. This holds true for health, relationships, careers, and especially finances. In investing, it’s widely acknowledged that diversification and long-term commitment are key to achieving financial goals. Yet, this is often more easily said than done, particularly when faced with uncertain market and economic conditions that have persisted for years. Thankfully, strategies exist to manage the emotional responses to market volatility. Investors should be aware of how to adhere to an investment plan over the long haul.

Dollar-cost averaging and lump sum investing.

Understanding when and how to invest in the stock market can be daunting, particularly when one receives a substantial sum of money, such as from an annual bonus, business sale, inheritance, etc. Over time, proper investment can transform savings into significant wealth. However, in the short term, market fluctuations can unsettle even the most resolute investors.

Dollar-cost averaging serves as a strategy in this scenario. It involves investors consistently investing a predetermined amount according to a scheduled plan. This approach helps mitigate the urge to respond to every market fluctuation or attempt to time the market. If you’re already contributing regularly and automatically to your portfolio with each paycheck, for instance, through a 401(k) plan at work, you’re essentially practicing dollar-cost averaging. The frequency of these investments—monthly, quarterly, or yearly—is less critical than the commitment to adhere to a consistent investment strategy.

The alternative strategy, known as lump sum investing, involves deploying all available capital at once. The short-term performance of your portfolio is heavily influenced by market conditions immediately following the investment.

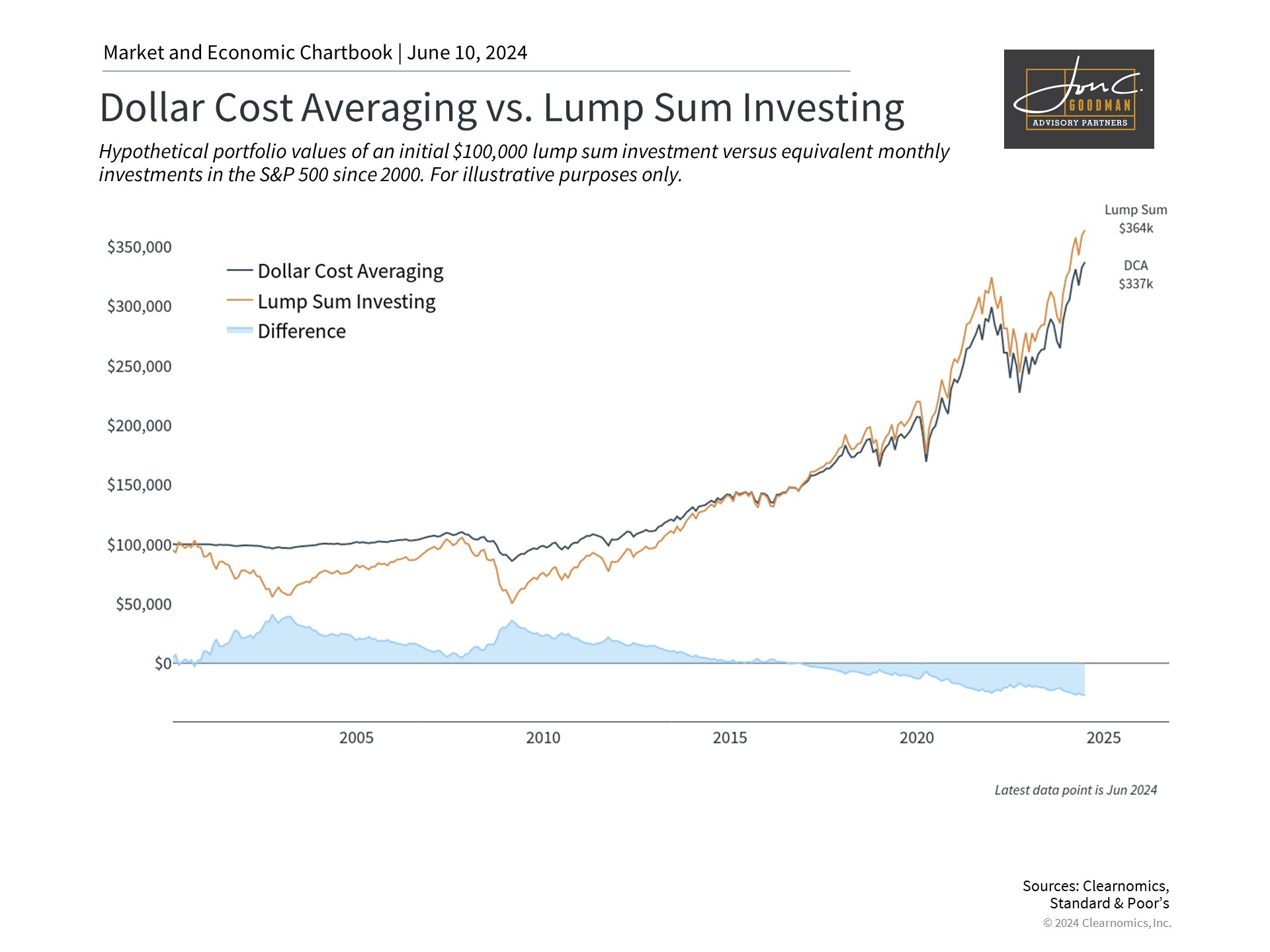

As illustrated in the chart referenced, the hypothetical outcomes of these two strategies since 2000 are quite distinct. An investment of $100,000 in the S&P 500 would have depreciated shortly after due to the dot-com bust. However, it would have regained value over the following years until the housing market crash. The investment’s value would have eventually rebounded in 2013 when the S&P 500 reached new all-time highs, subsequently profiting from the extended bull market.

The chart also illustrates the hypothetical returns from a dollar-cost averaging strategy, where the investor divides $100,000 into monthly investments throughout the entire period. Although this is an extreme case due to the length of the timeframe, it effectively underscores several key points.

Employing dollar-cost averaging on a monthly basis would have circumvented the early market downturns, with the portfolio largely in cash and thus remaining stable until the mid-2010s. Following this period, there’s a turning point where the lump sum investment begins to outperform, benefiting from the robust bull market. Hence, each approach had its moments of advantage throughout the last two and a half decades.

Dollar-cost averaging can make it psychologically easier to invest.

The key point here is not merely to maximize returns, but to remain invested over the long term. Dollar-cost averaging can mitigate risk in scenarios where markets sharply decline, particularly in the early stages. However, lump sum investing often surpasses dollar-cost averaging over extended periods since markets have historically trended upwards over time.

This can be likened to the difference between a portfolio composed entirely of stocks and one that is well-diversified with a mix of stocks, bonds, and other assets. A 100% stock portfolio may yield higher returns over lengthy periods, particularly in robust bull markets like the current one, but it is also prone to more significant downturns. In contrast, a diversified portfolio tends to grow more steadily and suffer less dramatic drops, which helps investors maintain their composure.

This consideration is particularly pertinent now, with the market approaching record highs. Markets are perpetually fraught with uncertainty. Factors such as the forthcoming presidential election, international disputes, or shifts in interest rates and the economy can lead investors to fear a market downturn immediately after they invest.

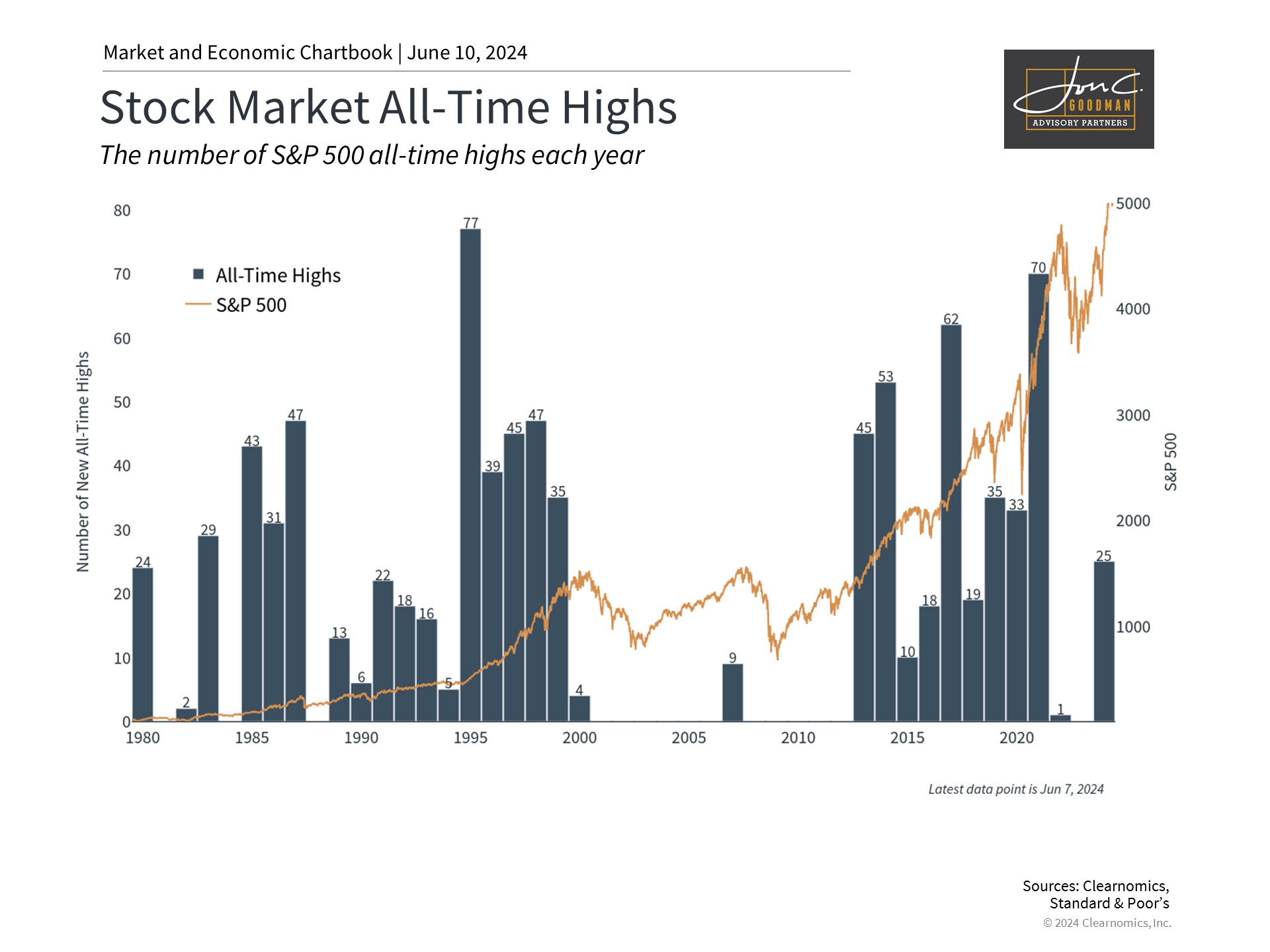

It’s crucial to remember that a market nearing its peak does not necessarily indicate an impending pullback. Markets often reach new all-time highs during bull markets. Despite the considerable uncertainty this year from interest rates, inflation, and Federal Reserve policies, the S&P 500 has marked 24 new all-time highs, including a strong rally in May following an April downturn.

Investing can be psychologically challenging both when the market is climbing and when it’s declining, due to fears of investing at the peak or concerns about further declines. Therefore, the choice between dollar-cost averaging and lump-sum investing largely depends on the individual investor’s risk tolerance and investment time frame.

Getting invested sooner is better than waiting for the right timing.

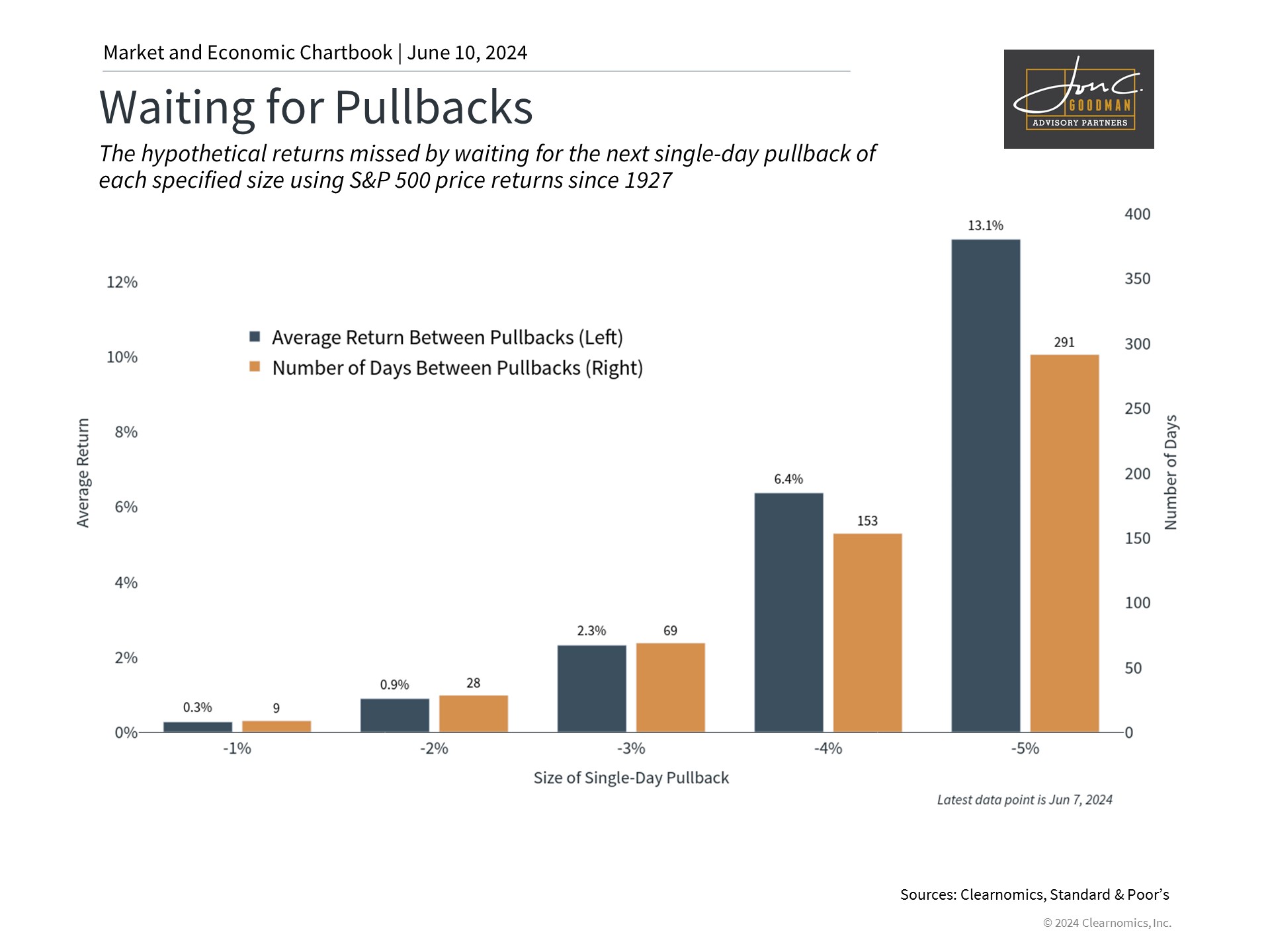

Choosing to dollar-cost average or invest in a lump sum, entering the market early typically outperforms waiting for a market dip. Historical data suggests that attempts to time the market for a better entry point often fail. The market’s general upward trend and unpredictable rebounds mean that even suboptimal timing usually beats not investing at all.

For instance, investors aiming for a 5% market pullback before investing have historically faced an average wait of 291 days. Despite regular market dips, the upward trajectory means each new low is often higher than the last. During such waiting periods, the market has historically risen by an impressive 13%, including the downturn.

Diversifying a portfolio can mitigate risk and volatility, similar to how dollar-cost averaging smooths investment over time. While not the most mathematically optimal strategy, as lump sum investments have historically performed better, dollar-cost averaging helps investors concentrate on long-term goals without fretting over each market fluctuation or attempting perfect market timing. Consulting a reliable financial advisor is always recommended to tailor an investment strategy to your unique objectives.

In essence, both dollar-cost averaging and lump-sum investing are strategies for investing cash. Historically, entering the market sooner rather than later has proven to be the most effective approach for reaching long-term financial objectives.

To schedule a 15 minute call, click here.