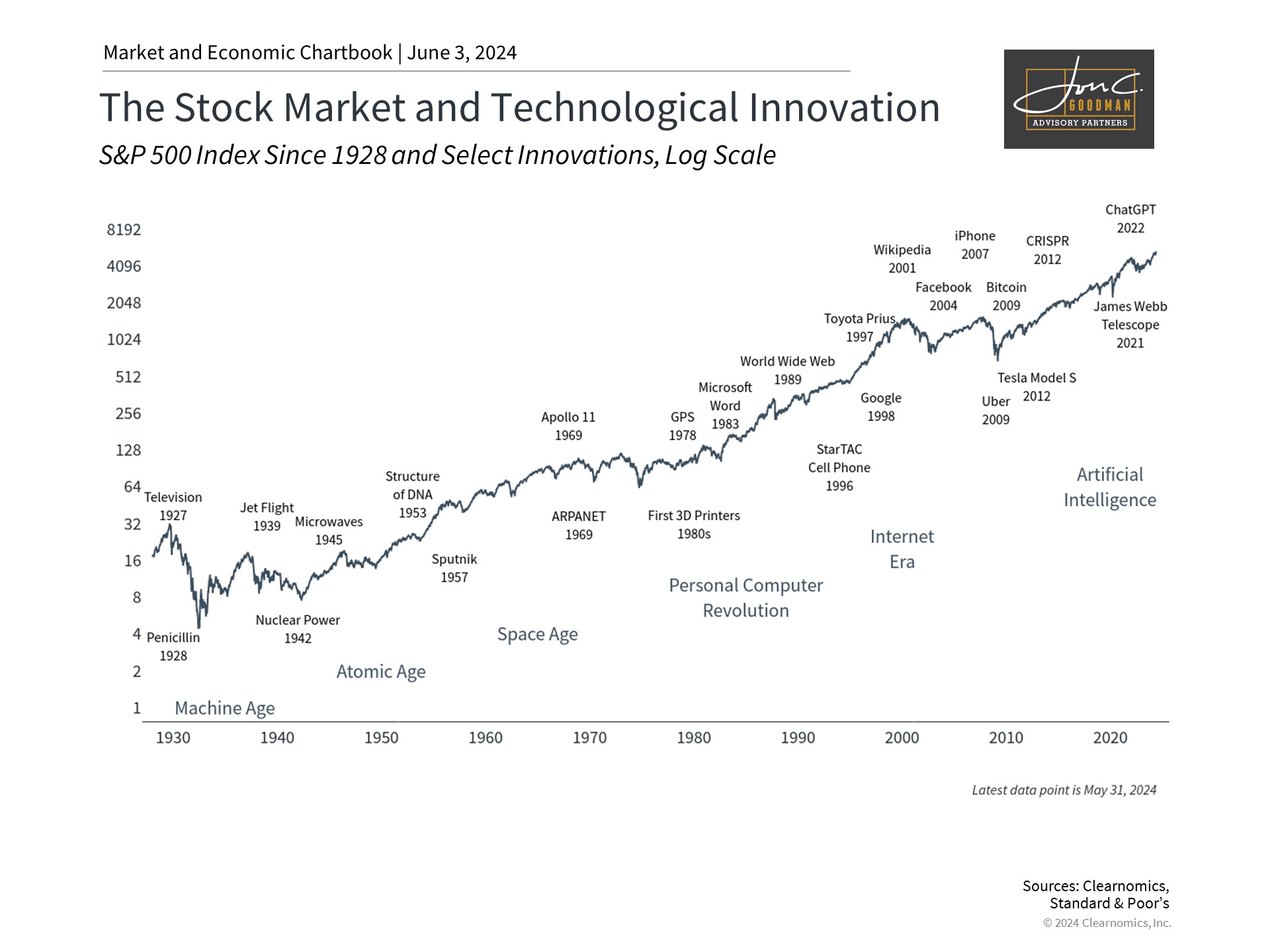

Investors and financial media often concentrate on macroeconomic issues like inflation, labor markets, and Federal Reserve policies. Although these are significant, historical data indicates that technological innovation and productivity improvements drive long-term economic and market growth. Consequently, the latest advancements in artificial intelligence have garnered significant interest from investors and economists. These developments have sparked debates over short-term investment prospects in technology stocks and, more critically, the long-term implications for the economy, productivity, and the labor market. How do new technologies typically affect markets and investor portfolios?

Innovation supports market and economic growth over time.

Investors naturally tend to concentrate on the financial aspects of markets and the economy, such as interest rates and Federal Reserve policies. The financial system’s role is to allocate capital to where it’s most valuable, funding real-world projects. Investors aim to earn substantial returns, increasing their capital for reinvestment in new ventures. Successfully achieving this can foster a beneficial cycle that promotes sustained economic growth.

However, the crucial factor is aligning these investments and returns with genuine innovation. The past century has witnessed relentless technological progress, from the inception of assembly lines to the lunar landing, culminating in a globally interconnected information network. The prevailing belief in the modern age is that technology should continuously improve, encompassing everything from smartphones to vehicles and home appliances. Consequently, the services they facilitate should enhance our life quality, be it through food delivery, on-demand entertainment, communication, healthcare, or investment choices. Nonetheless, outcomes may not always align with expectations, as evidenced by issues arising from social media usage.

The Information Age is distinct from previous historical periods due to the non-rivalrous nature of digital services; one person’s consumption doesn’t inhibit another’s. This characteristic is crucial as it enables knowledge workers to enhance productivity in a scalable manner, yielding benefits across diverse industries and scientific domains. Given the high costs and extensive time required to train knowledge workers, even minor improvements in productivity can have significant, compounding effects over time.

These factors contribute to the belief that AI represents the zenith of the Information Age. The current optimism surrounding AI is based on its potential to spur further technological breakthroughs and boost productivity. To date, AI’s contribution to productivity in the corporate sector has primarily manifested through content generation, task automation, and data analysis. Predicting AI’s ultimate impact is challenging, partly due to the rapid pace of its evolution and partly because forecasting the effects of novel technologies is inherently difficult. However, it is evident from historical data that stock market trajectories do not align perfectly with innovations, and the full effects of such advancements often unfold over extended periods.

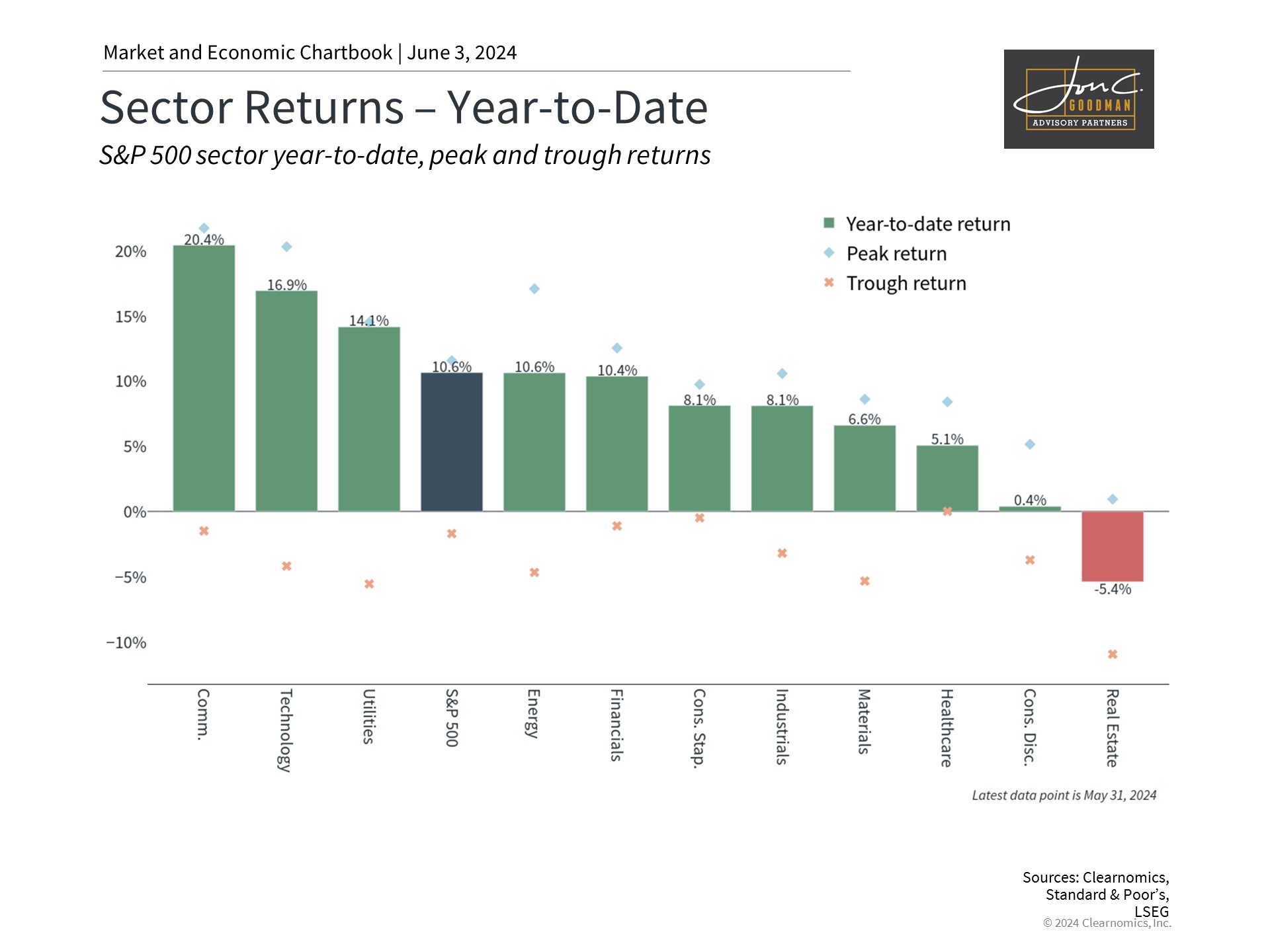

AI stocks have outperformed but other sectors are benefiting too.

Computer scientist Roy Amara observed that investors often overvalue the short-term impact of technology while undervaluing its long-term effects. Historical patterns, such as the dot-com bubble, illustrate this tendency. During the late 1990s and early 2000s, companies eagerly adopted .com and .net in their names to align with the internet craze, reminiscent of the “tronics boom” of the 1960s when electronics were the rage.

Although these trends yielded substantial returns for a time, the resulting bubbles inevitably burst, revealing a misallocation of investor capital. Identifying such bubbles remains a challenge. Presently, companies are adopting AI branding, reminiscent of past trends, with major stocks being driven by a select few tech and AI firms. For example, Nvidia, once known mainly for video game graphics cards, has now become a widely recognized name.

Today’s market differs significantly from the dot-com bubble, notably because many of the large cap companies benefiting from current trends are highly profitable. Leveraging a market trend or a long-term investment theme is not inherently problematic. The issue arises when investors attempt to time the market or make concentrated bets that do not align with their portfolio’s risk profile. The provided chart illustrates that while sectors like Communication Services and Information Technology have excelled, other sectors have also performed well this year. Overemphasis on AI trends to the detriment of portfolio diversification can pose challenges for investors pursuing their long-term objectives.

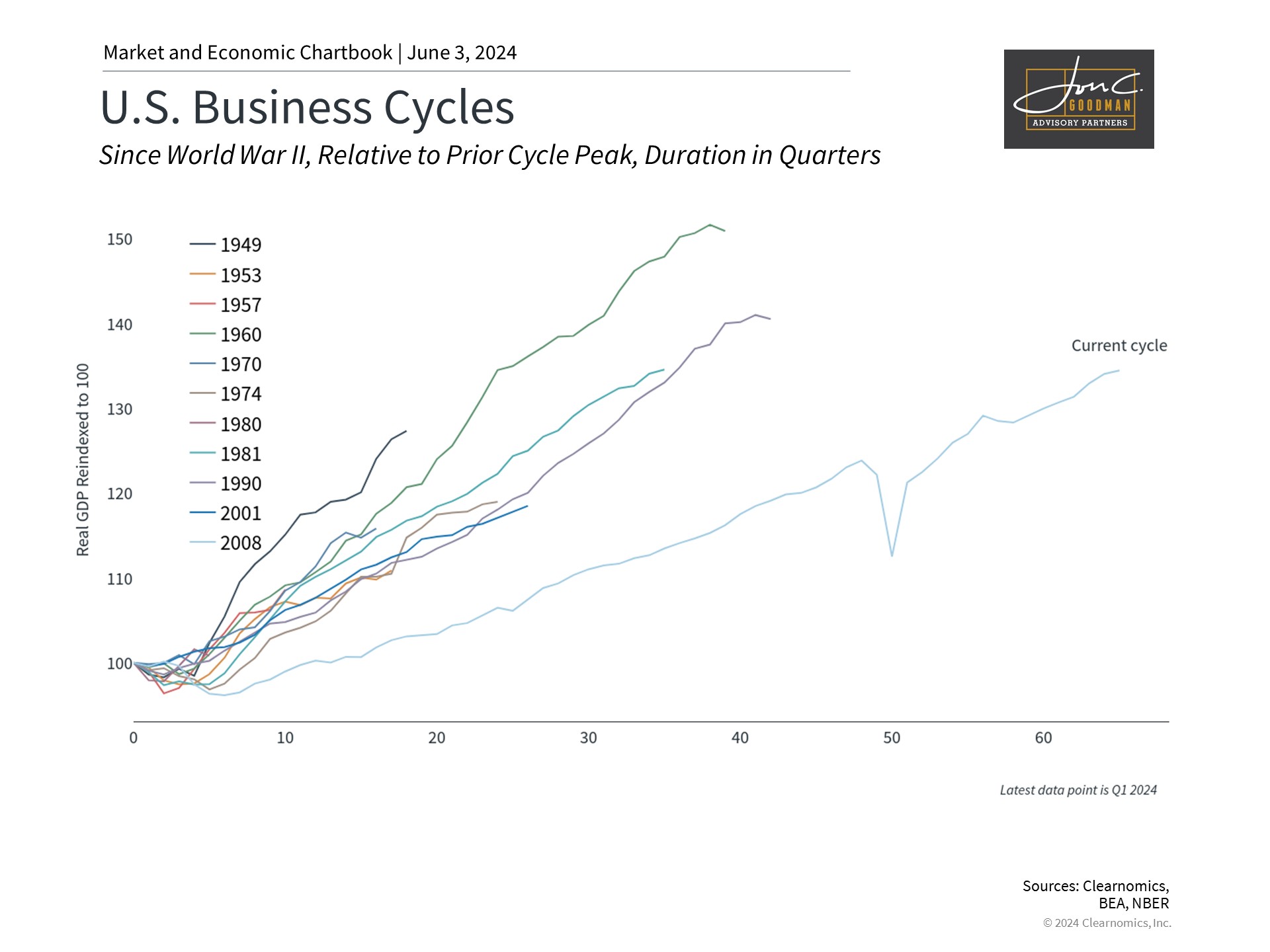

Productivity is what drives long run economic growth.

Having a short-term perspective is also problematic because the benefits of past technological innovations were much broader than a few stocks over a year or two. For instance, the benefit of the information technology revolution driven by the rise of personal computers and the growth of internet adoption was not, in hindsight, just concentrated in a few dot-com stocks in the 1990s. Instead, the benefits were broad across industries as all companies adopted new technologies that improved their productivity. In fact, the true impact of these technologies took decades to come to fruition and are still affecting markets today.

Productivity is crucial because it enables us to achieve more using fewer resources. However, its impact can be challenging to quantify and may not always be reflected in macroeconomic data as anticipated. During the advent of personal computers and the internet, productivity experienced a period of stagnation. For instance, in the 1980s, the average annual productivity increase was a mere 1.5%, which was lower than in the preceding three decades. This phenomenon, dubbed the “productivity paradox,” was highlighted by economist Robert Solow in 1987 when he remarked, “you can see the computer age everywhere but in the productivity statistics.”

The surge in productivity growth commenced in the early 1990s and persisted into the early 2000s, coinciding with significant shifts in business operations and product and service delivery. Predicting the pace at which AI will drive similar transformations in industries and societies is complex, leading to debates among AI experts and economists. MIT economist Daron Acemoglu recently posited that AI’s most substantial impact would stem from creating new, higher-value tasks for workers. However, he cautioned that such benefits are not guaranteed and may not be as extensive as some projections suggest.

While recent advancements in AI are indeed impressive, enhancing worker productivity through AI applications may take time. On one hand, we might be approaching the threshold of artificial general intelligence (AGI), which has the potential to replace human labor entirely. On the other hand, AI’s value could hinge on proper application and widespread adoption. Meanwhile, the market will attempt to assess the value of these prospects. For long-term investors, it’s crucial to keep a broad perspective and avoid getting swept up in short-term excitement.

The bottom line is that history indicates the importance of maintaining a diversified portfolio during periods of market enthusiasm. This approach enables investors to capitalize on the latest AI innovations while also preparing their portfolios for sustained growth.

To schedule a 15 minute call, click here.