Recently, the Dow Jones Industrial Average hit the 40,000 mark for the first time, signaling a market recovery from an earlier 5% dip this year. Despite challenges such as inflation, elevated interest rates, and concerns over growth, the broader market has notched 23 new all-time highs. Concurrently, other asset categories like international stocks, commodities, and gold have also experienced a surge, buoyed by declining interest rate expectations.

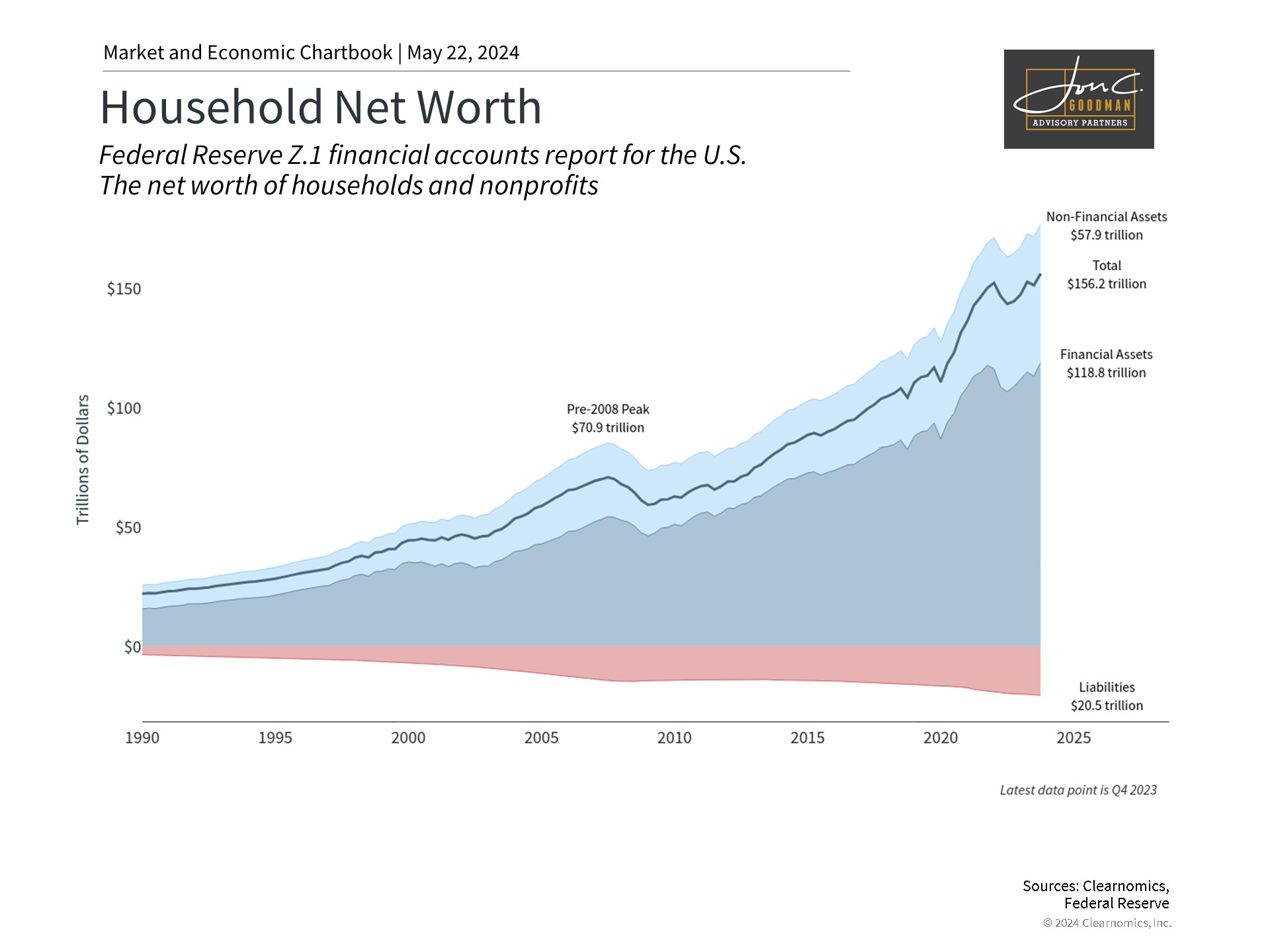

Household net worth is at an all-time high.

The economy’s health is a key factor in the current volatile yet robust market performance, largely attributed to strong consumer spending. Despite facing higher costs for daily goods and services, sector-specific layoffs, and lower savings rates, consumer financial health remains impressively resilient. Given that consumer spending accounts for more than two-thirds of the GDP, the condition of consumer balance sheets, wage growth, and overall sentiment play a pivotal role in driving corporate revenue and economic expansion. The question arises: what does the financial well-being of consumers in mid-2024 indicate for the wider economy?

To illustrate, current data indicates that household net worth has reached a record high, surpassing levels seen before the 2008 global financial crisis. This net worth increases with the rising value of assets like cash, stocks, bonds, and real estate, and decreases with liabilities such as credit card debt and car loans. Thanks to a robust economy and a thriving stock market, the total household net worth has more than doubled since 2007, weathering both the pandemic and the bear market of 2022.

An increase in household net worth can stimulate consumer spending, as people with more money often feel they can afford to spend more – this is known as the “wealth effect.” When individuals perceive their financial situation as positive, they are likely to spend more, which can lead to higher business profits, increased wages, and, consequently, a rise in stock prices. The wealth effect can also manifest when the value of illiquid assets, such as homes or retirement accounts, appreciates.

Despite the high inflation rates experienced in recent years, net worth has continued to grow. This underscores the importance for investors to maintain a diversified portfolio that can appreciate over time and surpass inflation, rather than solely holding cash. Historical data indicates that long-term wealth accumulation stems from investing in a balanced mix of stocks, bonds, and other asset classes.

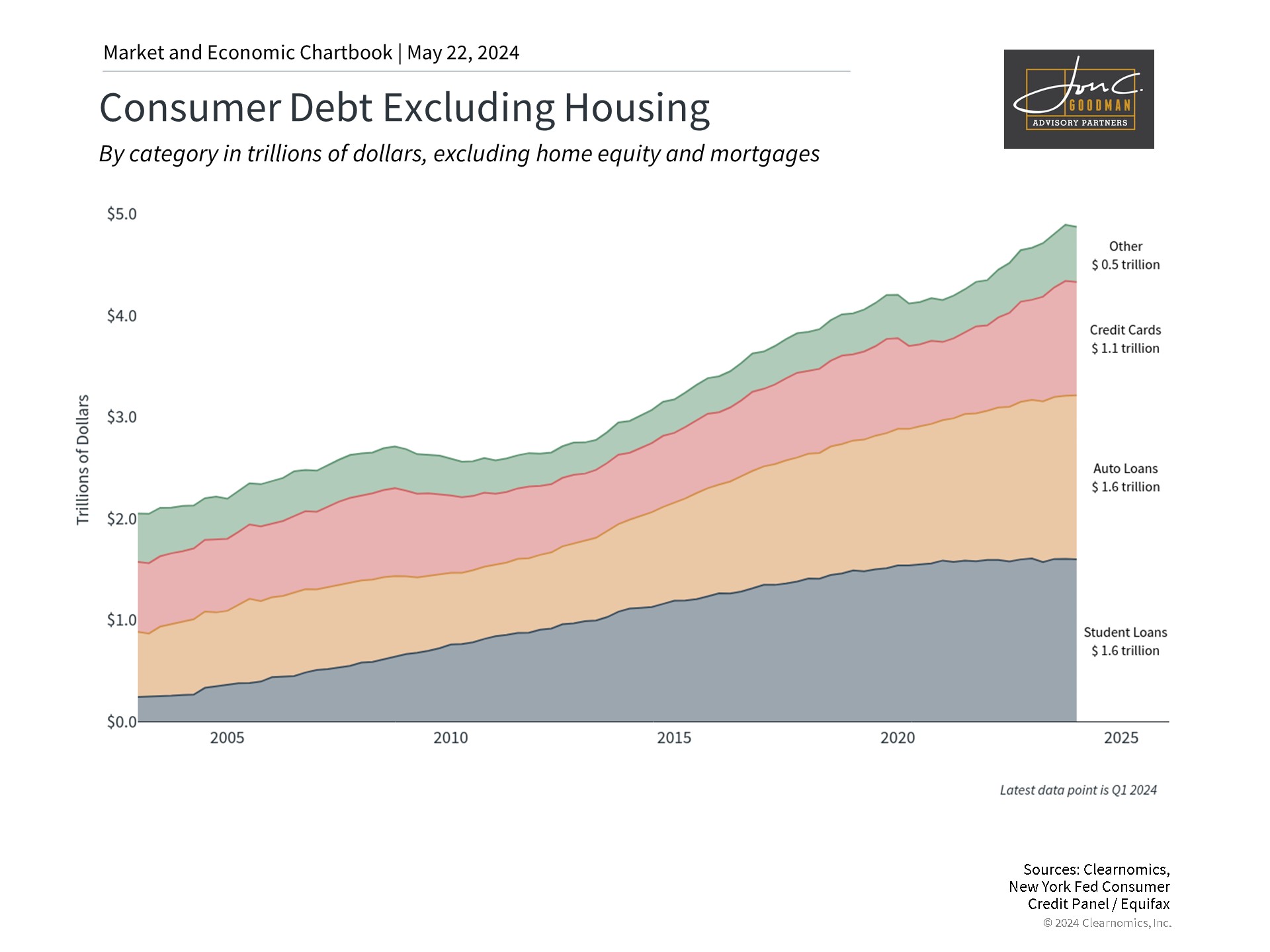

Consumer debts have grown but are still manageable.

Secondly, although consumer balance sheets have expanded overall, consumer debt levels are on the rise. Signs of distress are evident in some consumers due to the weight of monthly payments. The Federal Reserve Bank of New York’s most recent Household Debt and Credit report indicates that delinquency rates across all consumer debt categories have risen in the first quarter. Mortgage, student loan, and home equity loan delinquencies continue to follow recent trends, but credit card and auto loan delinquencies have seen a significant increase.

In particular, 8.9% of credit card balances have become delinquent over the last year, a substantial increase from the 10-year average of 5.9%. Although there was a slight decrease in credit card balances in the first quarter, they still amount to $1.1 trillion, which is 13.1% more than the previous year. Auto loan delinquencies have also risen to 7.9% of the total balances, with the overall auto loan debt increasing by 3.5% year-over-year to $1.6 trillion.

Higher interest rates can complicate the management of debt. Often, this is intentional as the Federal Reserve tightens monetary policy to curb economic growth and combat inflation. Since the Fed started increasing rates, new debt issuance has slowed, with the growth rate of non-mortgage debt balances dropping from 7.3% a year ago to 4.8% in the first quarter of 2024. Although monthly payments remain challenging for many, the slowdown in the accumulation of new debt is a positive sign.

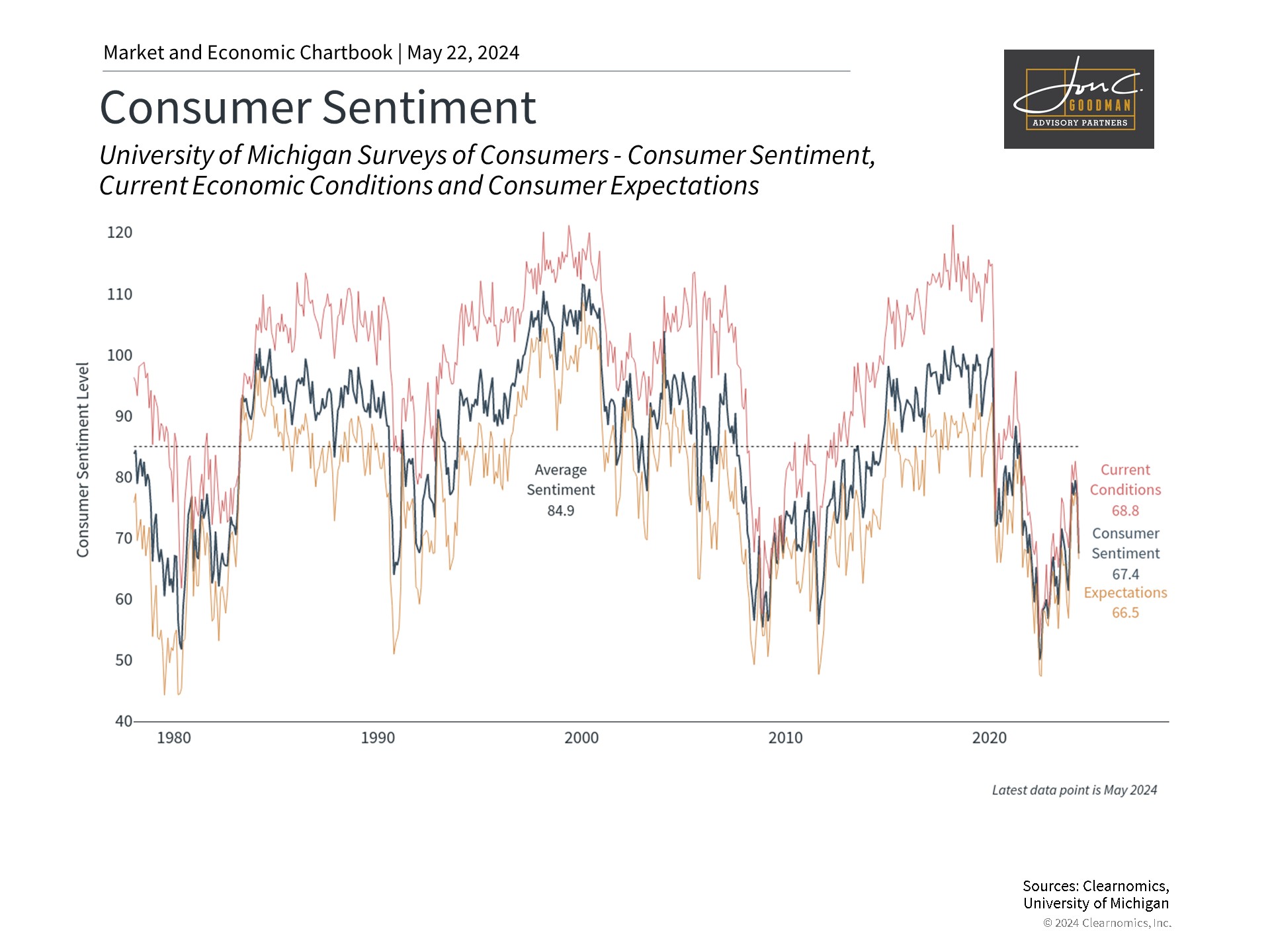

Consumer sentiment has been volatile.

Consumer sentiment has been volatile due to market fluctuations and the uncertain inflationary environment. Sentiment generally improves with slowing inflation and a robust job market, as seen last year. Currently, ongoing inflation is affecting consumers’ economic outlook, despite historically low unemployment rates.

The trends are slowly shifting positively. The most recent Consumer Price Index report indicated a slowdown in inflation, with headline and core inflation at 3.4% and 3.6%, the lowest since 2021. Although these rates exceed the Federal Reserve’s target of 2 to 2.5%, they have led markets to anticipate two Federal Reserve rate cuts this year, highlighting that economic data can vary monthly.

In summary, despite challenges from inflation, higher interest rates, and increasing debt, the average U.S. consumer remains financially stable. This stability is supported by rising asset prices as markets bounce back. Conversely, the wealth effect stimulates consumer spending, which boosts corporate profits and, consequently, stock prices. Ultimately, consumer and economic health significantly influence market performance beyond immediate news.

The key takeaway is that robust consumer spending is a driving factor behind the markets reaching new all-time highs this year. Investors would be wise to concentrate on these economic trends instead of getting swayed by short-term headlines or isolated economic reports.

To schedule a 15 minute call, click here.