During periods of market volatility, investors frequently turn to cash as a safe haven. This trend has persisted in recent years, with market fluctuations driven by the pandemic, geopolitical tensions, Federal Reserve rate increases, inflation, political stalemate in Washington, shifts in technology, and other factors. Lately, fears of higher-than-anticipated inflation and postponed Federal Reserve rate reductions have reignited investor worries. Concurrently, cash interest rates are at their highest in years, presenting seemingly attractive “risk-free” returns. Considering these factors, the question arises: what role does cash currently serve in investment portfolios?

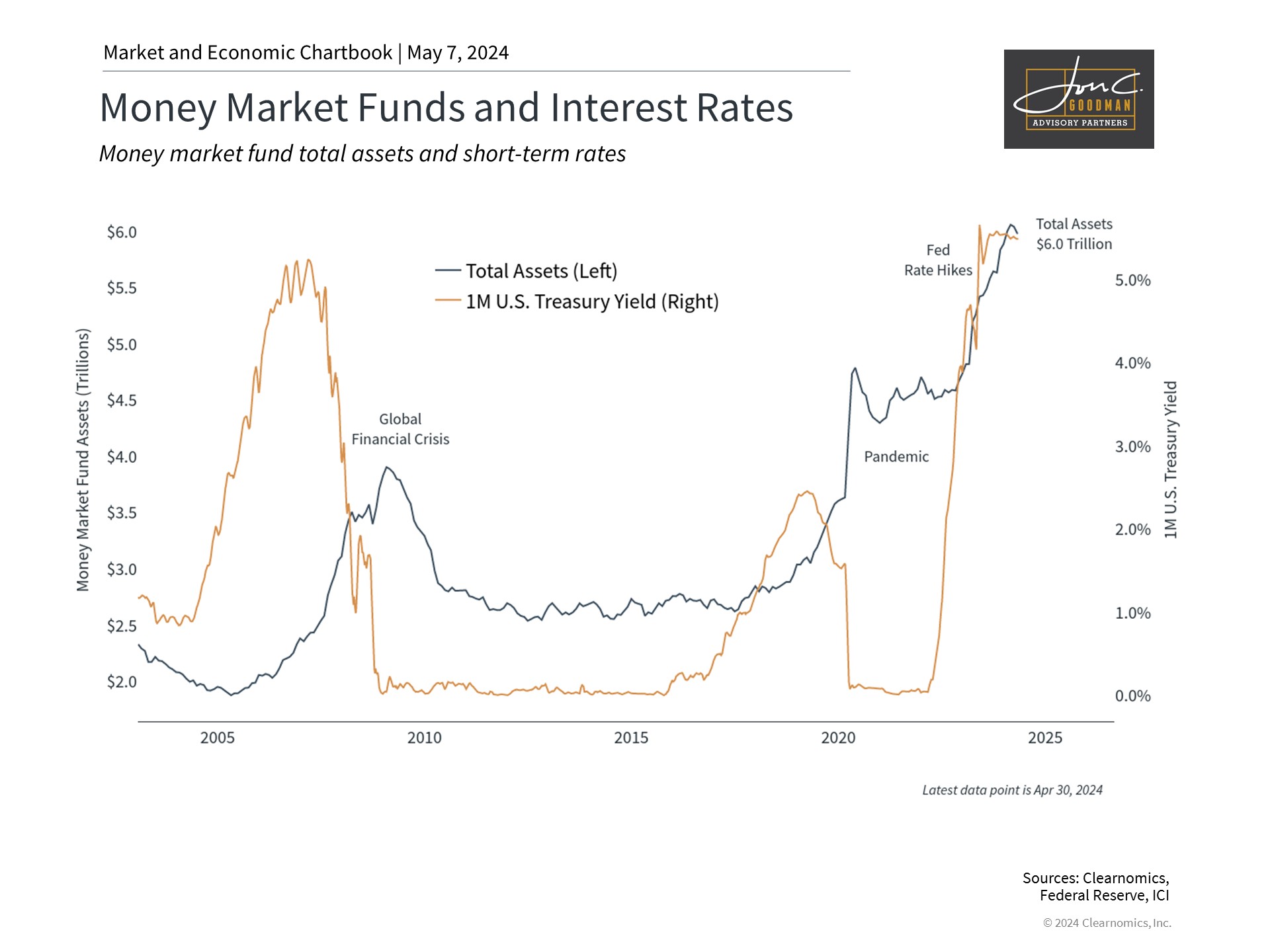

Money market funds have experienced significant inflows.

After more than a decade of historically low interest rates, the recent rise in cash yields has been a positive turn for many investors. Interest rates have increased across various cash instruments, including savings accounts, certificates of deposit, and money market funds. The Federal Reserve’s rapid rate hikes from early 2022 to mid-2023, and maintaining the federal funds rate between 5.25% and 5.50% since the previous July, are the primary reasons. Following the latest Federal Reserve meeting, Chair Jerome Powell remarked that achieving greater confidence in the inflation trajectory will “take longer than previously expected,” suggesting that policy rates may remain elevated for an extended period.

These trends have prompted numerous investors to maintain higher cash reserves than before. For example, money market funds have seen significant inflows, with total assets surging to a record $6 trillion. This figure is over twice the amount held in these funds before the pandemic, a period when interest rates hovered near zero for almost ten years. As indicated by the related chart, assets in money market funds have generally increased during periods of economic turmoil or when interest rates were elevated.

Cash plays a vital role in both financial and investment strategies. In terms of financial planning, cash offers the liquidity necessary to manage expenses and significant life milestones. For example, the down payment for a forthcoming home acquisition should be kept primarily in cash or cash-equivalent assets. Additionally, maintaining a sufficient cash reserve is crucial for an emergency fund to address unforeseen personal circumstances like injuries or illnesses, as well as wider economic fluctuations. From an investment perspective, cash is instrumental in mitigating portfolio risk and enabling investors to capitalize on favorable market opportunities.

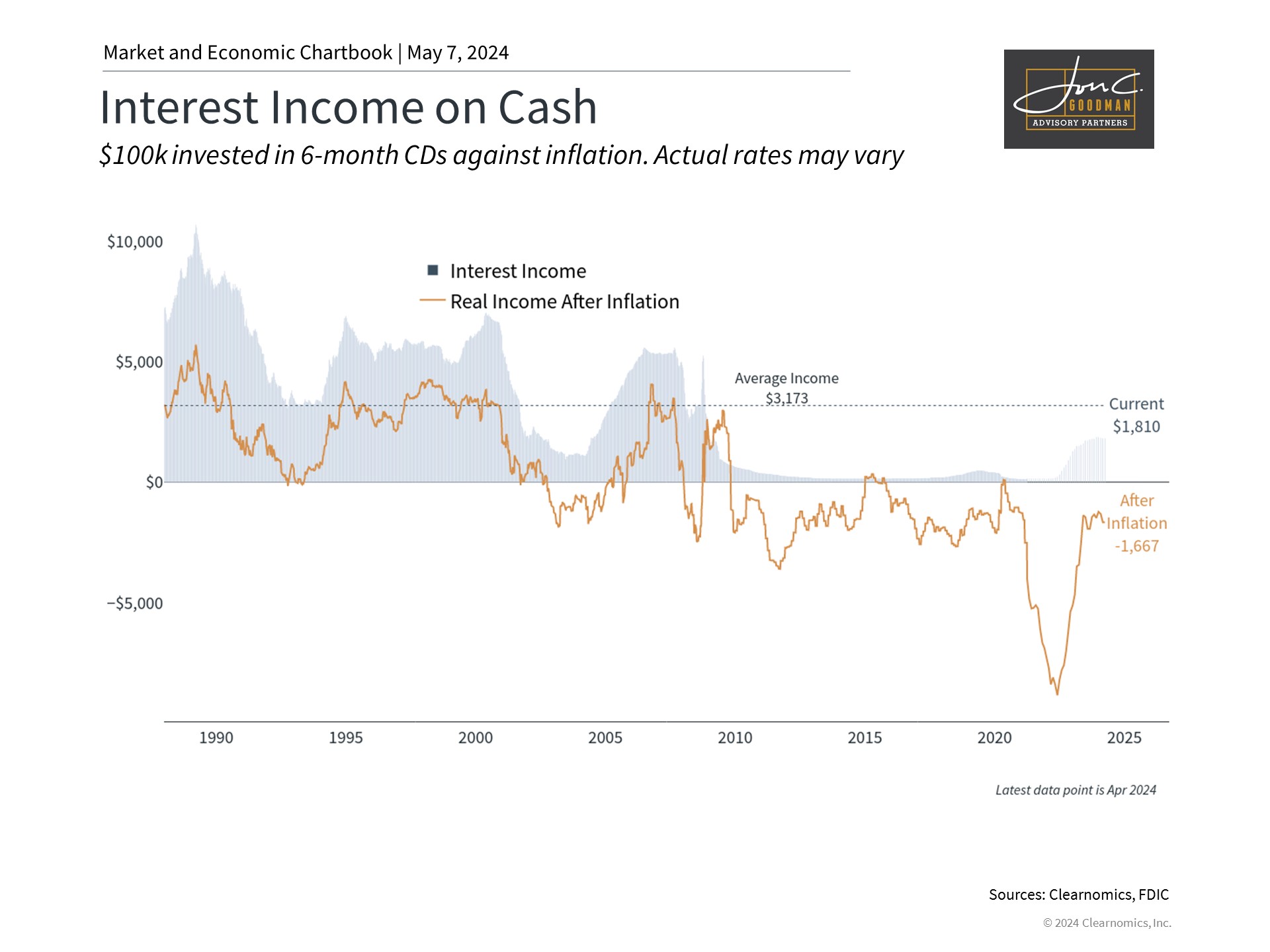

Inflation erodes the value of cash.

While cash is crucial, holding excessive amounts can be problematic for investors. Cash isn’t entirely risk-free, primarily for two reasons. Firstly, inflation can subtly reduce cash’s purchasing power over time. Therefore, even with high yields, the actual value of money may decrease. Historical data on average certificate of deposit rates indicate that inflation-adjusted income on cash has been consistently negative.

Numerous cash instruments may offer higher yields than these averages, but these rates are not guaranteed. Short-term rates are subject to frequent rollovers as instruments reach maturity, leading to ‘reinvestment risk’—the possibility that future rates won’t be as favorable. Consequently, investors must diligently manage these instruments to maintain expected yield levels.

The second challenge of holding excess cash lies in the opportunity cost of not investing in stocks or bonds. As interest rates for cash have increased, so have yields across various bond types. For example, the average yield on U.S. investment-grade corporate bonds is now 5.5%, significantly higher than the 3.7% average since 2009. These yields are long-term and could lead to price appreciation if rates fall.

In a similar vein, the stock market has seen robust performance despite numerous investor concerns in recent years. The S&P 500 has risen by 8% including dividends and has seen a 47% increase since the market’s low in 2022. Although past performance is not indicative of future results, these returns have significantly exceeded inflation and could have mitigated the diminishing purchasing power within a portfolio.

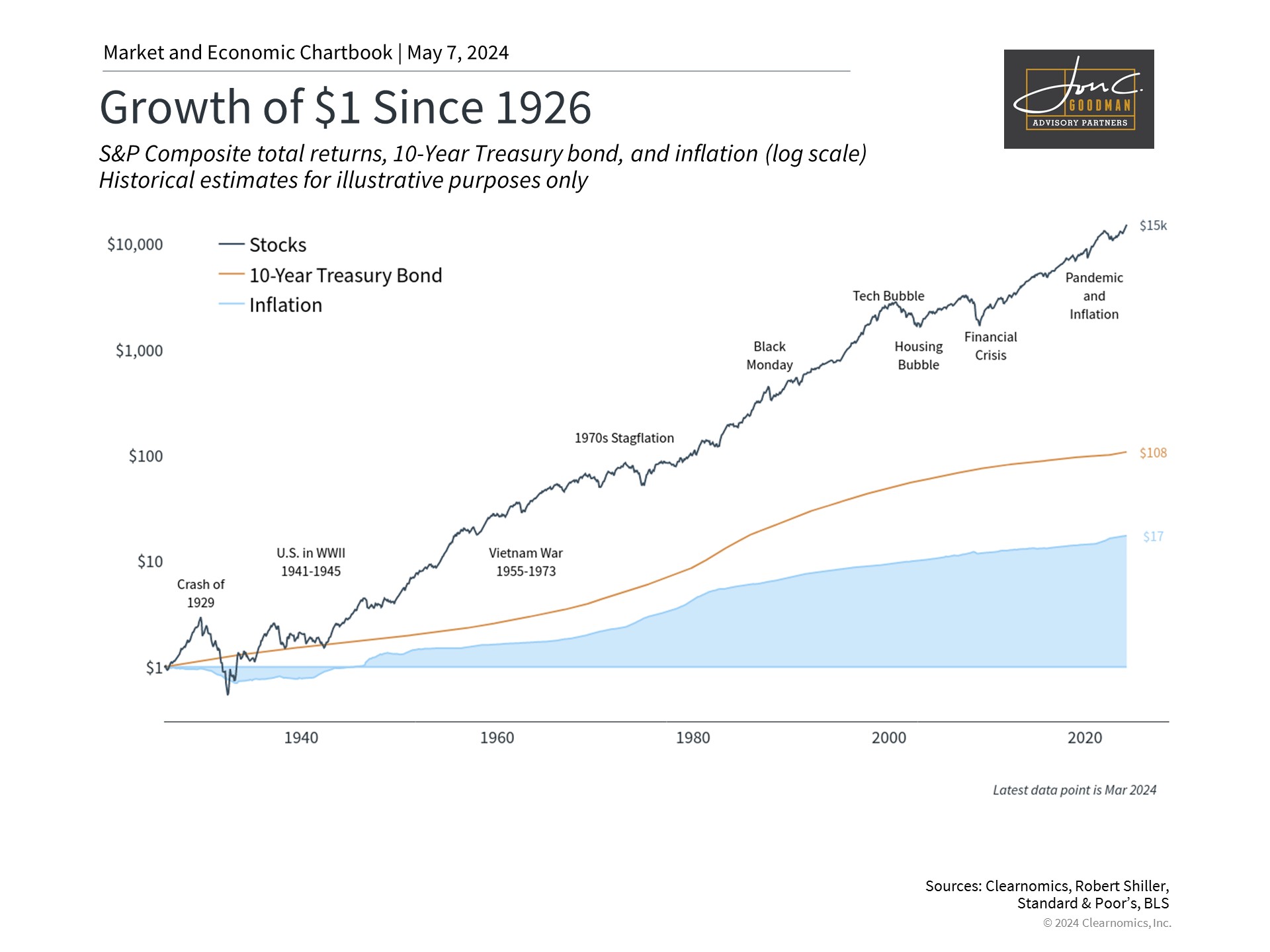

Stocks and bonds have outpaced inflation over history.

If the Federal Reserve starts to lower interest rates later this year, the outlook for cash holdings could deteriorate. Investors might have to reinvest their cash at reduced interest rates or opt for stocks and bonds, which are likely to have already increased in price. The anticipation of declining rates has been a key factor propelling the stock market and is expected to persist.

The provided chart illustrates the opportunity cost vividly. Inflation has driven the cost of what was one dollar in 1926 up to $17 today. Yet, the stock market has greatly exceeded inflation over the long term. An initial investment of one dollar in the stock market in 1926 would now be valued at over $13,000. In comparison, the same amount invested in long-term bonds would have grown to $106, surpassing inflation as well.

While short-term investments have their place in financial strategies and portfolios, it’s crucial in the current market climate to avoid retaining cash for the wrong reasons. Market apprehension and elevated short-term rates have prompted substantial movements into cash and similar instruments. Although these might be sensible for brief durations, historical evidence suggests they do not constitute the cornerstone of enduring financial prosperity.

In essence, as the stock market advances and the Federal Reserve gears up to reduce rates, investors ought to reassess their cash positions. Over time, maintaining an appropriate mix of stocks and bonds remains the optimal approach to fulfilling financial aspirations.

To schedule a 15 minute call, click here.