Following a robust beginning to the year, the markets have retreated by 2.5% at the onset of the second quarter. The rise in geopolitical tensions in the Middle East, inflation worries, corporate earnings, and other factors have contributed to this downturn, elevating the VIX index of stock market volatility to its peak in six months. During such periods of market stress, it is crucial for investors to keep a balanced view on essential matters and avoid reacting impulsively to headlines. Investors can navigate these times of market volatility by understanding the underlying issues.

Rising geopolitical tensions add to market uncertainty.

Tensions have risen in the Middle East following an unprecedented attack by Iran on Israel, marking the first direct assault between the two countries. The offensive consisted of a substantial number of drones and missiles fired from Iran, seemingly timed to provide Israel and its allies sufficient opportunity to activate defenses, thereby limiting the damage. The manner in which Israel will retaliate remains uncertain, but there is widespread hope for restraint from both sides to prevent a full-scale conflict.

These latest developments only add to geopolitical concerns around the world. Russia’s invasion of Ukraine and the October 7 attack on Israel by Hamas only a year and a half later have already destabilized Eastern Europe and the Middle East. Without diminishing the tragic loss of life and destruction from these conflicts, investors must weigh how such events might impact the global economy, markets, and their portfolios.

Geopolitical headlines can be unsettling for investors as they differ from the usual stream of business and market news. Analyzing these events is complex, and predicting their outcomes is difficult due to the intricate histories and motivations of the involved parties.

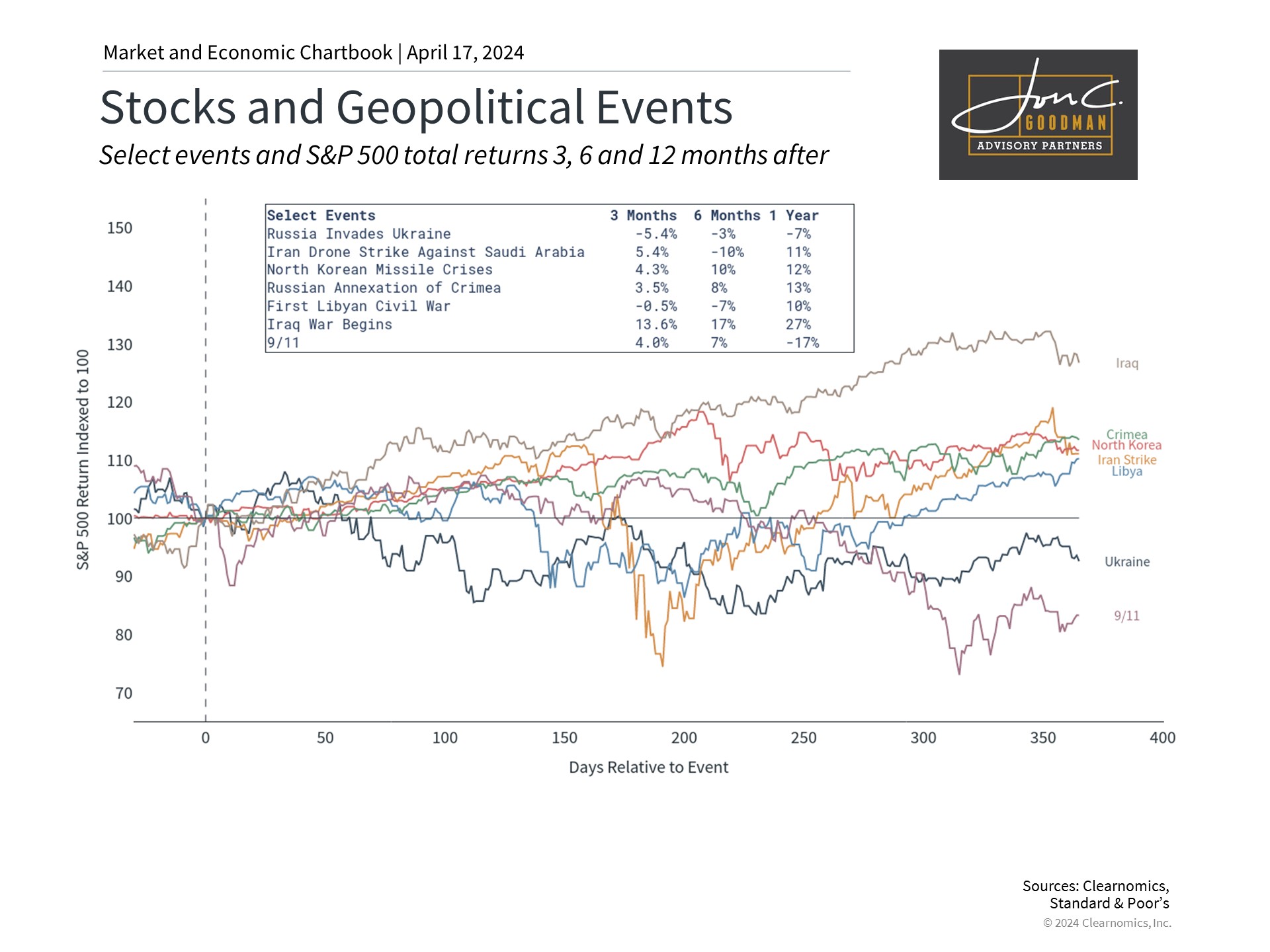

History indicates that although geopolitical incidents can affect markets, their impact is often transient. The provided chart illustrates market responses to significant geopolitical events of this century. Some occurrences, like 9/11, altered the global landscape and had enduring consequences, despite the dot-com crash being the main driver of market downturns. Other incidents, such as the conflict in Ukraine, led to increased oil prices, influencing inflation and monetary policies. However, most events did not sustain long-term market effects once conditions stabilized.

While current conflicts will be under scrutiny, it’s wise for investors to refrain from making hasty decisions with their portfolios. Over the long term, markets generally rebound and perform robustly, mainly because business cycles play a more significant role over years and decades, regardless of the events that unfold over weeks and months.

Stubborn inflation has markets rethinking the number of rate cuts.

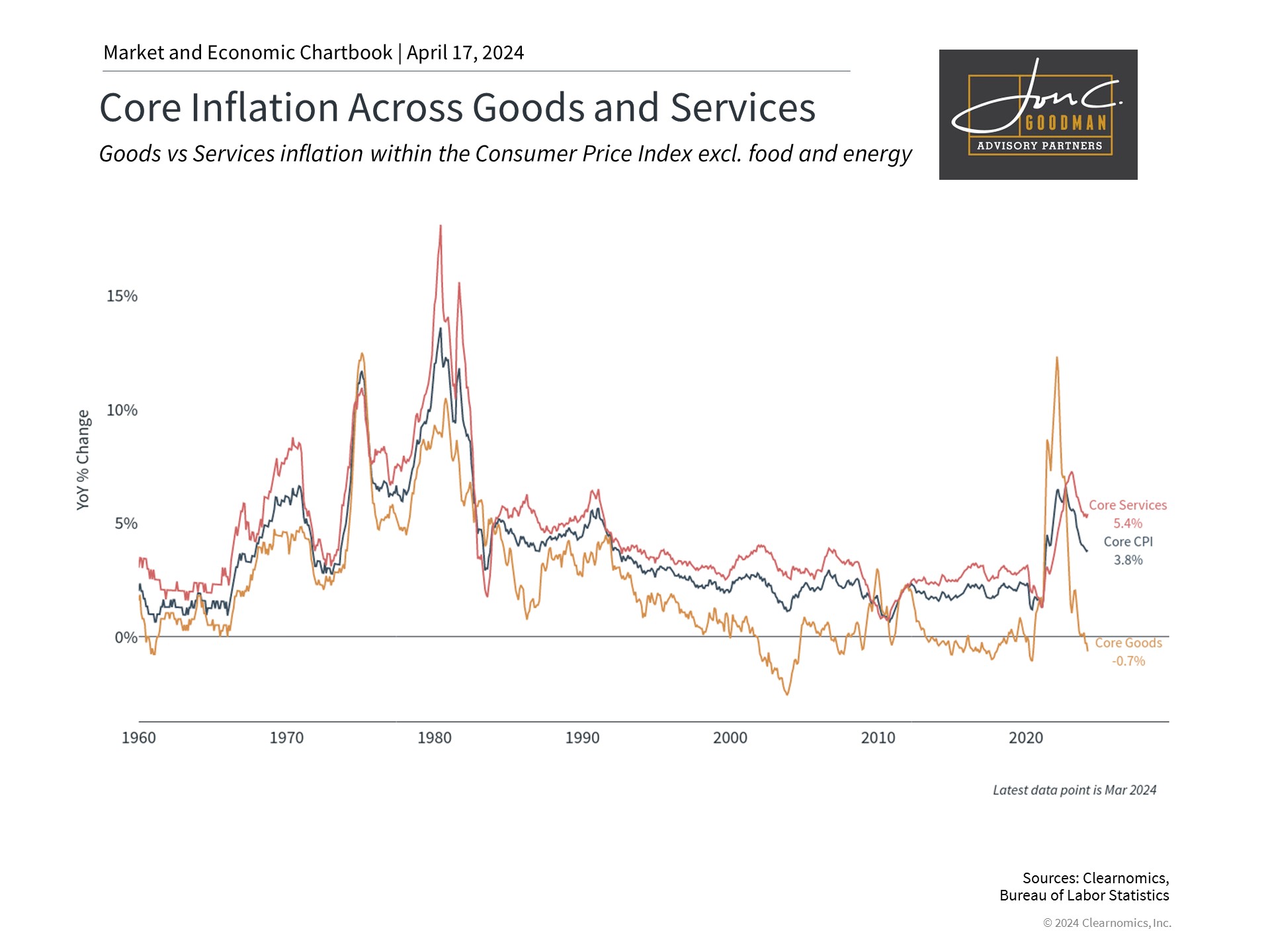

Secondly, various measures of inflation have been more persistent than economists had anticipated. The most recent Consumer Price Index (CPI) report for March indicated that headline inflation persisted at a higher-than-expected rate of 3.5% year-over-year, while core inflation, which omits food and energy prices, climbed to 3.8%. The escalating costs of shelter, namely the expenses associated with renting and homeownership, are a significant factor in the slower-than-expected reduction in inflation.

In light of recent job market data that surpassed expectations, numerous investors now predict that the Federal Reserve may decelerate the pace of rate cuts this year, or possibly refrain from cutting rates altogether. The Federal Reserve’s economic forecasts have consistently indicated the possibility of three rate cuts this year. However, market expectations have dramatically shifted since the beginning of the year, when there was some speculation that the Fed might start reducing rates as early as March. Currently, the market anticipates only two or three rate cuts in 2024.

It remains crucial for investors to maintain a balanced view of these expectations. For long-term investment strategies, the overall direction of policy is more significant than the precise timing or extent of rate cuts. The Federal Reserve’s projections and monthly inflation figures still carry risks, particularly if oil prices escalate further due to geopolitical tensions. Nevertheless, even in such scenarios, inflation is now considerably more controllable and does not necessitate an urgent monetary intervention.

Investors should always be prepared for market volatility.

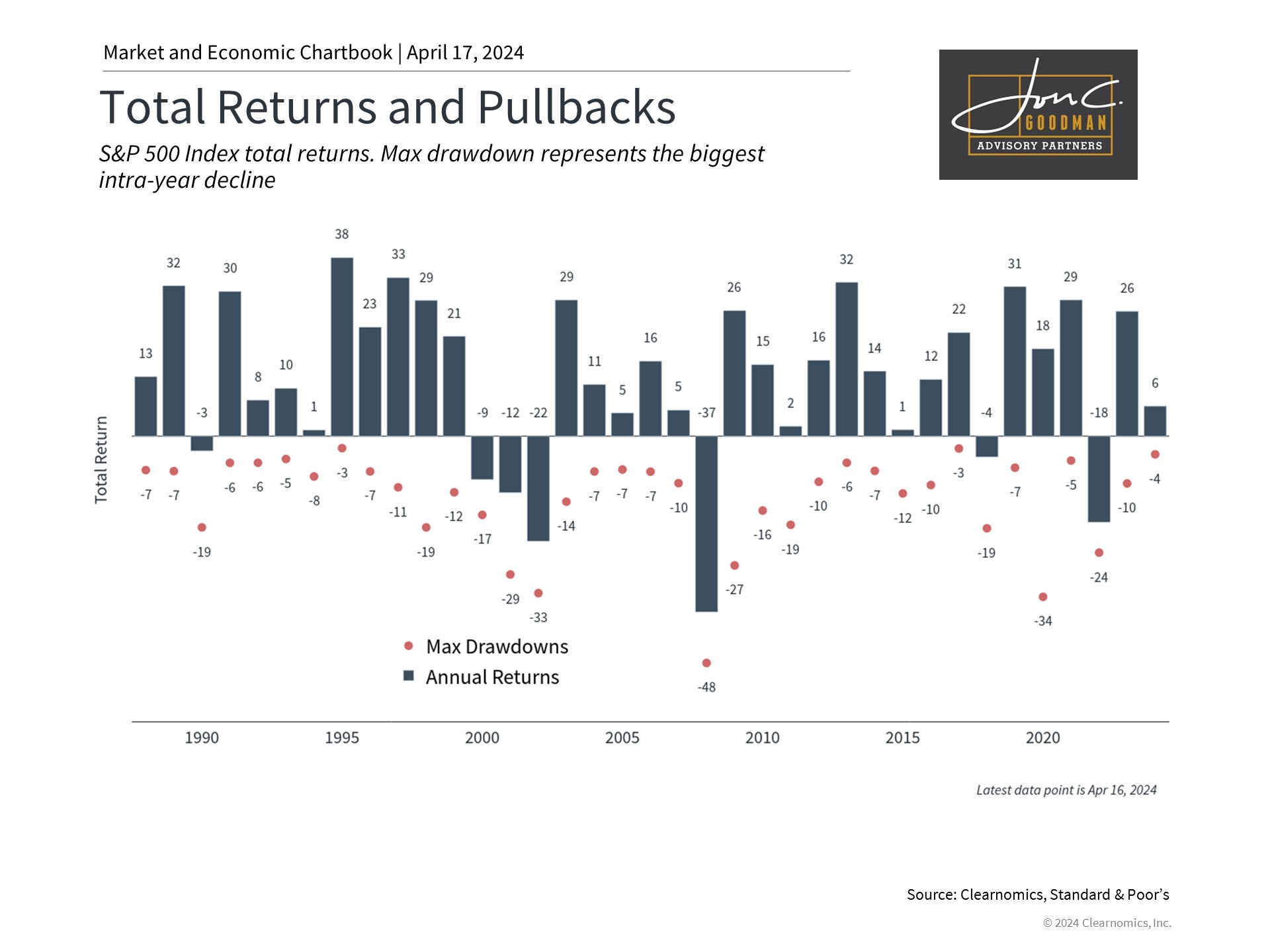

Investors should also maintain perspective on market volatility levels. Although the recent market downturn of 2.5% is the most significant since the year’s beginning, it comes after a 10.6% total return in the first quarter. Since the market rally began last October, the S&P 500 has seen a 28% increase, including dividends. Furthermore, since the bear market low in 2022, the market has risen over 50%.

The provided chart illustrates that significant pullbacks are common within an average year, and this year’s pullback has been relatively minor in comparison. Despite these temporary setbacks, markets generally rebound and often conclude the year positively. This underscores the importance of a diversified portfolio, which can help mitigate short-term risks and enhance the likelihood of long-term financial success, irrespective of market volatility stemming from economic conditions, Federal Reserve policies, geopolitical events, or other factors.

In summary, markets have faced challenges at the onset of the second quarter, influenced by shifting expectations regarding the Federal Reserve and rising geopolitical tensions. Maintaining composure and viewing these events within a broader context remain the most effective strategies for realizing long-term financial objectives.

To schedule a 15 minute call, click here.