The year 2024 opened with intense debates on whether the Federal Reserve would manage a “soft” or “hard” landing to stabilize the economy, alongside discussions on the durability of the previous year’s market surge. However, just three months in, the focus has shifted to a more serene outlook as inflation wanes and the Fed considers cutting interest rates. Consequently, there’s been a robust market upswing, with the S&P 500, Dow Jones Industrial Average, and Nasdaq climbing 10.2%, 5.6%, and 9.1% respectively, since the year’s start.

Investors have been caught off guard by the economic landscape as inflation’s decline persists. The Personal Consumption Expenditures index, the Fed’s inflation gauge of choice, has seen a year-over-year increase of 2.5% across the board and 2.8% when food and energy are excluded—marked reductions from their highs a year and a half prior. Despite ongoing issues in certain inflation sectors like housing and energy, the trend is gradually aligning with the Fed’s long-term goal of a 2% inflation rate.

Even with unemployment remaining below 4% amidst tech sector layoffs, interest rates have stabilized, with the 10-year Treasury yield at approximately 4.2%. Additionally, stock market returns have diversified beyond just artificial intelligence stocks. However, the approaching presidential election and the forthcoming Federal Reserve policy phase are causing some investor apprehension. These concerns are intensified by the market’s proximity to all-time highs.

In volatile market conditions, maintaining a long-term investment perspective becomes increasingly crucial. Here are three essential insights to help investors comprehend forthcoming events and their historical impact on investment strategies.

Steady economic growth has driven markets to new all-time highs.

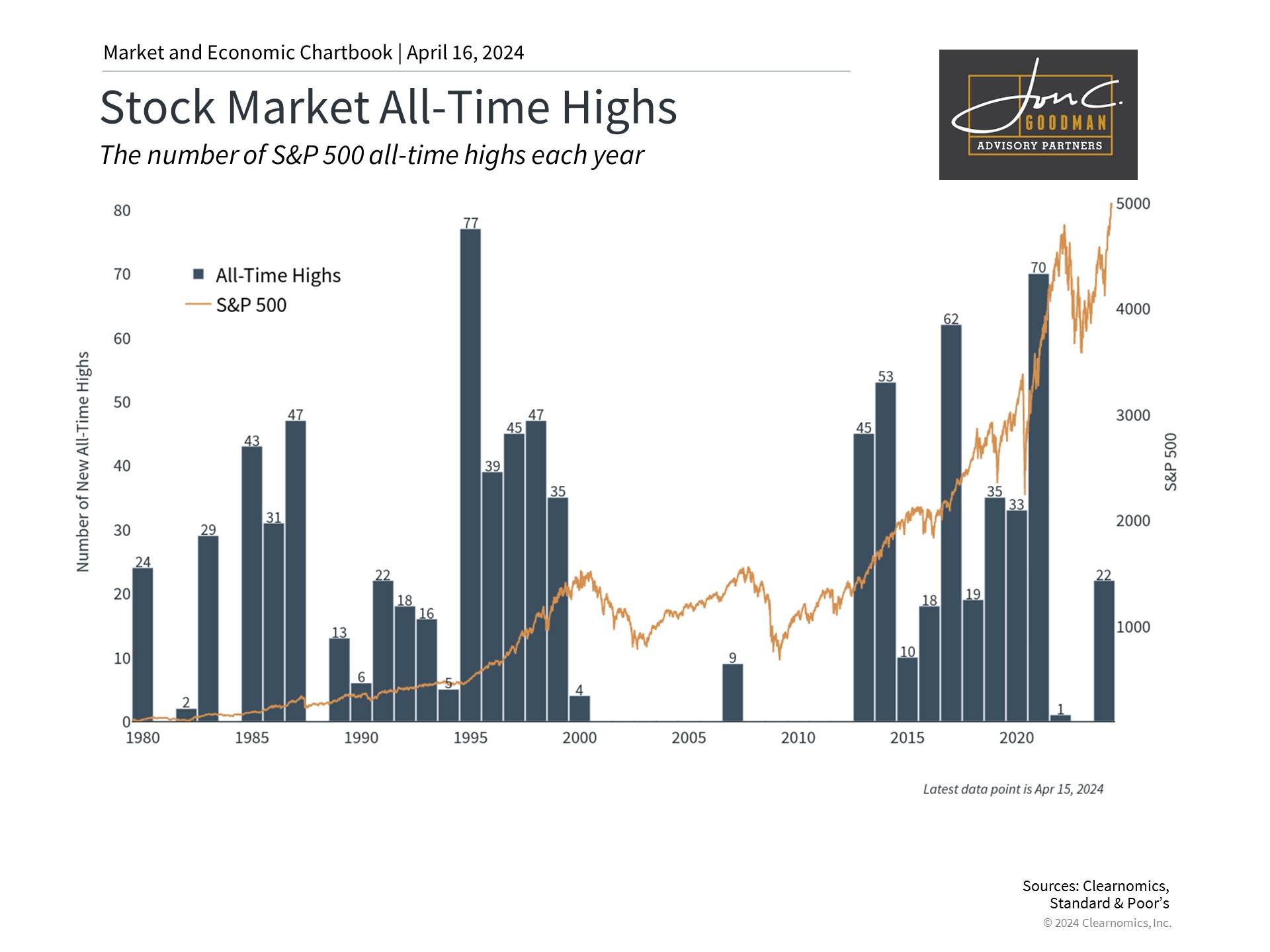

Despite a brief market downturn in the first two weeks, the S&P 500 has reached 20 new all-time highs this year. While this is encouraging for investors, concerns about the sustainability of continued market growth are understandable. However, new all-time highs do not necessarily signal an impending pullback.

Price fluctuations are a normal aspect of investing, and while markets do experience downturns, they generally trend upwards over extended periods. In a bull market, it’s common for major indices to frequently approach or hit record levels. For example, in 2021, the market closed at new all-time highs on 70 occasions, contributing to the numerous highs since 2013.

Adopting a long-term investment strategy can help investors capitalize on these trends without the constant concern of a potential pullback. A well-diversified portfolio enables investors to endure market downturns without undue emphasis on the market’s current position.

Markets have rallied through both Democratic and Republican presidencies.

The anticipation for the presidential election is intensifying as the November rematch between President Biden and Trump approaches. Elections are a crucial means for Americans to influence the nation’s trajectory as citizens, voters, and taxpayers. However, it’s vital to cast votes at the polls rather than through investment portfolios.

Historical evidence suggests that markets can thrive under both Democratic and Republican administrations. As indicated by the chart, the economy and stock market have expanded over the years, irrespective of the party in power. The business cycle’s fluctuations have had a more significant impact during these times. For example, the Clinton administration greatly benefited from the prolonged growth of the 1990s, while the George W. Bush administration coincided with the dot-com bust and the 2008 financial crisis. These business and market cycles were the defining factors of their terms in office.

Politics certainly affect aspects like taxes, trade, industrial activities, and regulations. Yet, policy changes are often gradual, and their precise timing and consequences are frequently overvalued. Therefore, it’s more prudent to concentrate on long-term economic and market trends rather than the fluctuating results of election polls. Investors worried about how specific policies might affect their financial plans are advised to consult with a reliable financial advisor.

The Fed is expected to cut rates as inflation stabilizes.

The market rally has expanded beyond the large technology companies in the first quarter. The equal-weight S&P 500, which is an alternative to the standard market cap-weighted index, reached a new record high in early March, indicating that a broader array of stocks is performing well. The optimistic economic forecast and the potential for rate cuts have increased confidence throughout various market segments.

In light of this situation, the Federal Reserve is anticipated to lower interest rates later in the year, though the exact timing is still unknown. The chart that was provided illustrates the potential trajectory of the federal funds rate according to the Fed’s most recent predictions, which include three reductions this year. In its previous session, the Fed pointed to robust employment growth and low unemployment as signs of a strong economy but stressed that “the Committee does not anticipate it will be appropriate to lower [interest rates] until it is more certain that inflation is consistently approaching 2 percent.”

Regardless of the precise timing and course of the Federal Reserve’s rate decreases, these forecasts mark a shift from the emergency monetary policy measures initiated in early 2022. It is crucial for investors to adjust to this evolving landscape and not concentrate exclusively on the events of the recent past.

In summary, with the markets close to peak levels, an impending presidential election, and anticipated Federal Reserve rate reductions later in the year, it is advisable for investors to adhere to their financial strategies and remain invested throughout the second quarter. Historical data indicates that this approach continues to be the most effective for realizing long-term financial objectives.

To schedule a 15 minute call, click here.