As major stock market indices approach all-time highs, investor concerns about the economy persist. Positive trends in inflation and employment may position the Federal Reserve to lower interest rates later this year, yet apprehensions remain, particularly in the real estate sector. Real estate is not merely an asset class; it’s a significant segment of the economy affecting consumer net worth, inflation, financial stability, among others. Long-term investors should be aware of the current stresses in the real estate market.

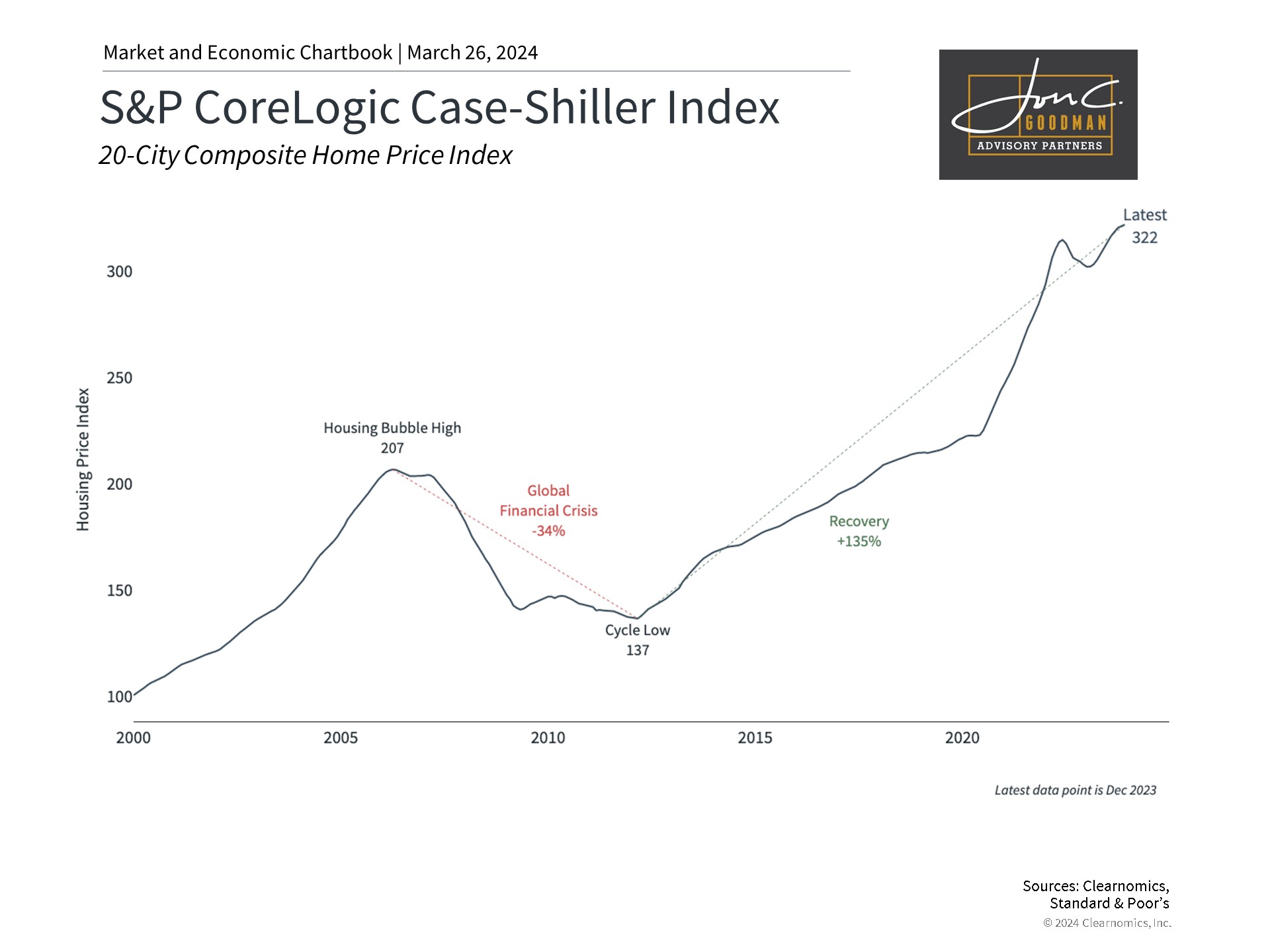

Housing prices have reached unprecedented heights.

Real estate, perhaps more than any other industry, has felt the impact of rising interest rates in recent years. The sector faces added uncertainty due to recent events in both residential and commercial markets. The National Association of Realtors (NAR) settlement, in particular, challenges long-standing agent pricing practices. The plaintiffs contended that the standard 5 to 6% commission, shared between buyer’s and seller’s agents, is anti-competitive. Although the full impact of the NAR settlement will unfold over time, it could pave the way for innovative business models and more competitive pricing.

To put it simply, economic theory indicates that monopoly pricing in any industry limits activity. More competitive pricing would likely increase demand, in this case, for the services of real estate agents by buyers and sellers. This could lead to more transactions due to lower overall costs. In economic terms, this means a shift of some “producer surplus” to consumers and a reduction in “deadweight loss.” Ideally, a competitive market for real estate agent services benefits consumers and society by facilitating more transactions that are mutually advantageous, though it would require the industry to adapt.

This occurs as home prices return to record highs, as indicated in the chart above. Nevertheless, transaction numbers have stayed low, influenced by interest rates and supply levels. Housing starts have leveled off and are now slowly increasing, accompanied by a resurgence in existing home sales. Considering current prices and underlying demand, many economists believe that more flexible commissions may stimulate the housing market in the forthcoming years.

The impact on monetary policy is significant. “Shelter” costs, constituting more than a third of the Consumer Price Index basket, are partly why inflation progress has decelerated. Despite expectations from economists and the Federal Reserve for a reduction in rent and mortgage payment pressures, such relief has not been realized. Federal Reserve Chair Jay Powell, in his latest press conference, acknowledged this concern, stating, “there’s a bit of uncertainty about the timing of [shelter price improvements], but there’s a strong belief that they will manifest in due course.”

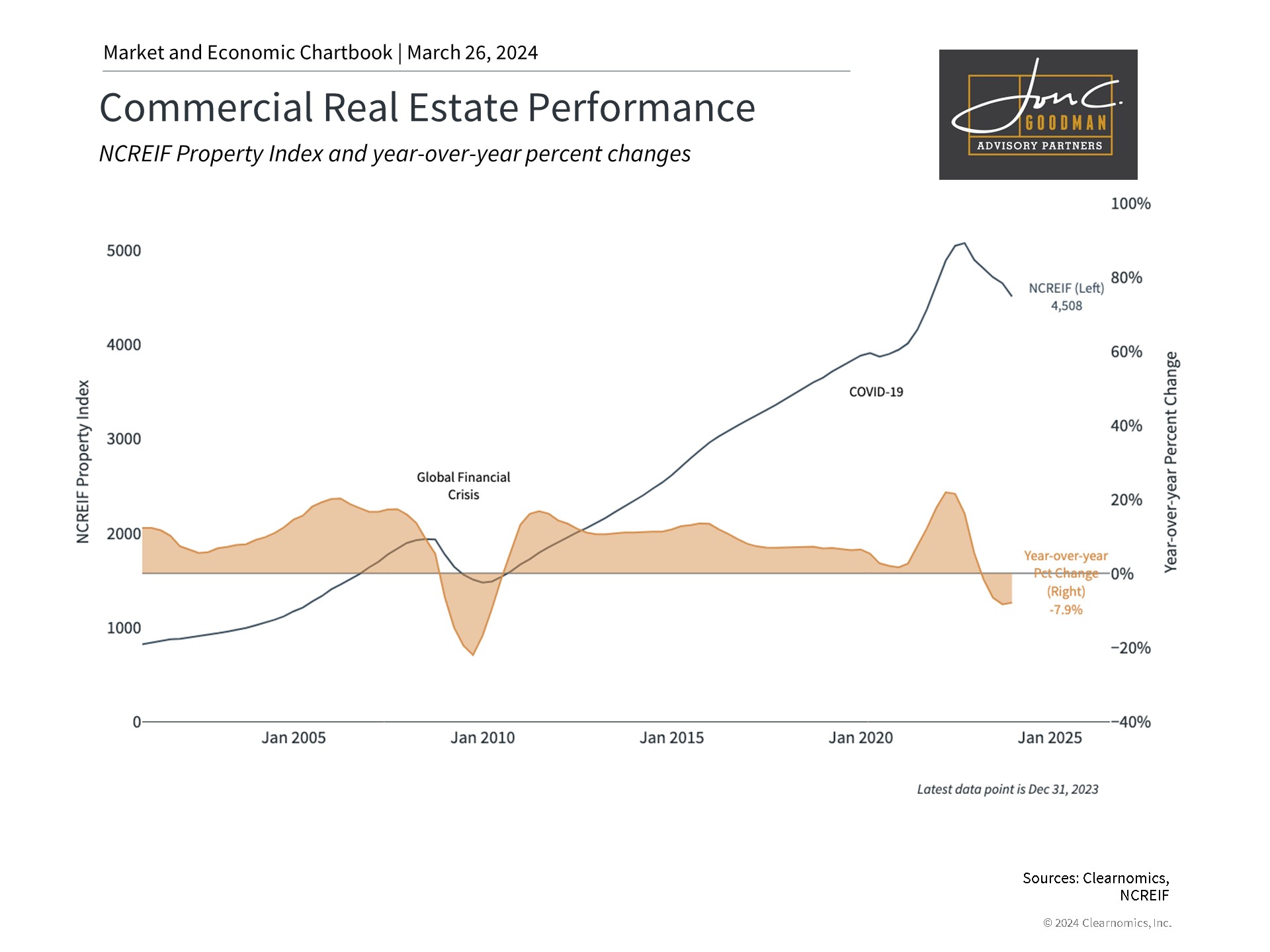

Commercial real estate prices are showing signs of stabilization.

Recent events in commercial real estate, such as the rescue of New York Community Bank (NYCB) by private investors, have heightened market concerns. Although the banking sector has stabilized since the previous year, commercial real estate, particularly in the office and multifamily segments, remains challenged. These segments represent a substantial part of NYCB’s loan portfolio, largely acquired from Signature Bank. Moreover, this acquisition elevated NYCB’s assets beyond $100 billion, subjecting it to more stringent capital and liquidity requirements.

Therefore, the challenges confronting NYCB can be seen as an extension of the difficulties experienced by Signature Bank, stemming from rising interest rates and a decelerating economy, rather than signaling a new, widespread systemic problem. This suggests that the issues may be specific to individual banks rather than indicative of broader financial system distress. Historically, Federal Reserve rate increases have affected banks, as seen in the savings and loan crises of the 1980s and 1990s. Ideally, these strains should diminish as the Federal Reserve eases monetary policy in the forthcoming months.

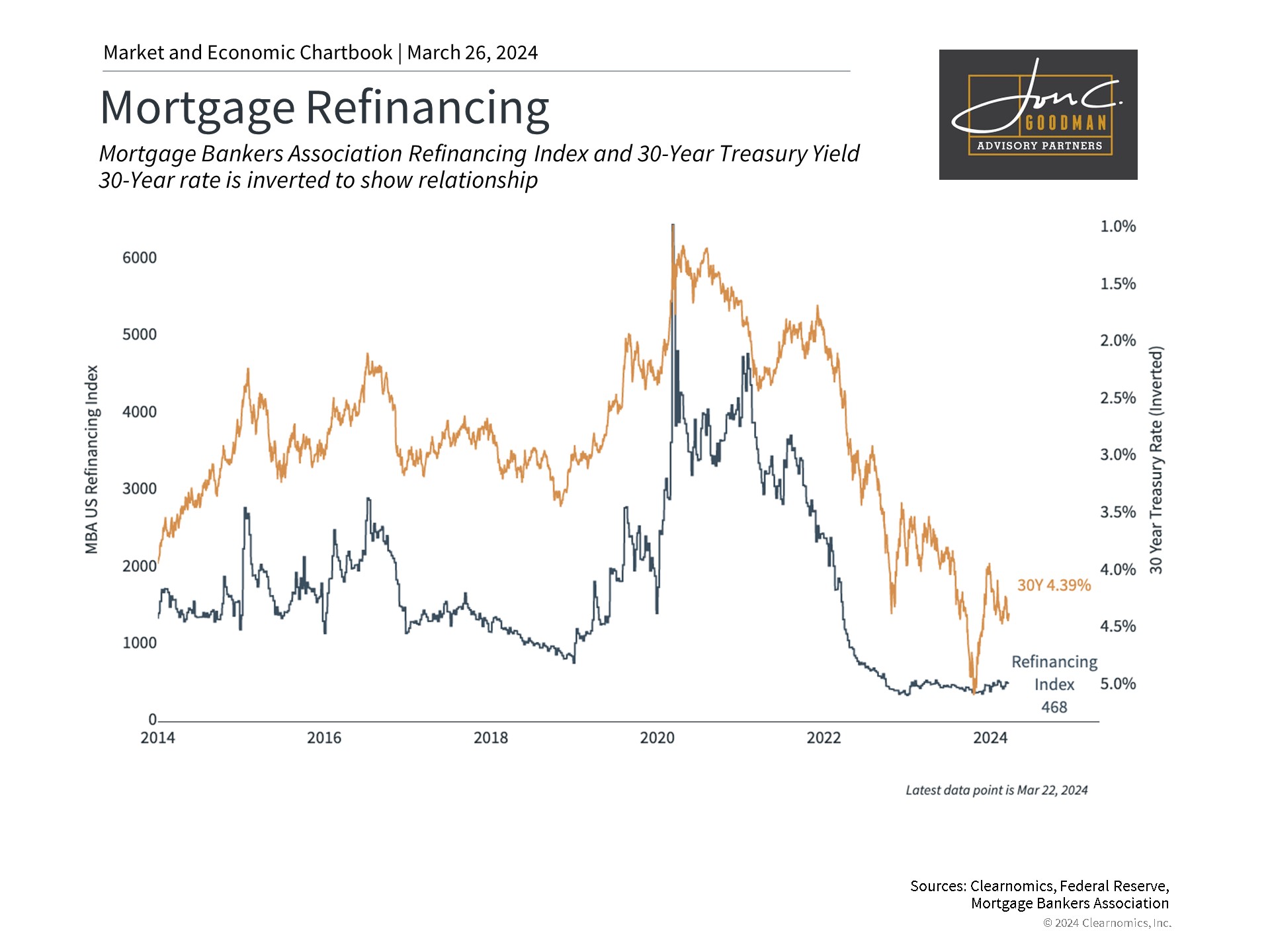

Refinancing activity has slowed down as a result of rising interest rates.

Consequently, numerous factors are influencing the real estate market, such as elevated interest rates, commission settlements, persistent challenges with commercial real estate loans, among others. Although interest rates are just one of these elements, we can expect transaction volumes to rise and financial strains to diminish as the rates start to stabilize. Given that the circumstances leading to the current situation may shift rapidly, investors would be wise to concentrate on long-term economic and market trends instead of past events.

In summary, despite the challenges in both residential and commercial real estate sectors, there are encouraging signs that may stimulate activity, particularly with the Federal Reserve’s move to lower interest rates. Investors would be wise to maintain their focus on long-term trends and ensure diversification in their portfolios.